Reaching $100,000 for Bitcoin remains a very attainable target, especially considering the cryptocurrency’s price hit a new all-time high of $73.00 prior to the halving. In preparation for the explosive move expected to follow the halving, Bitcoin whales are doing everything they can to fill their wallets with BTC.

Big Bitcoin whales are buying more BTC

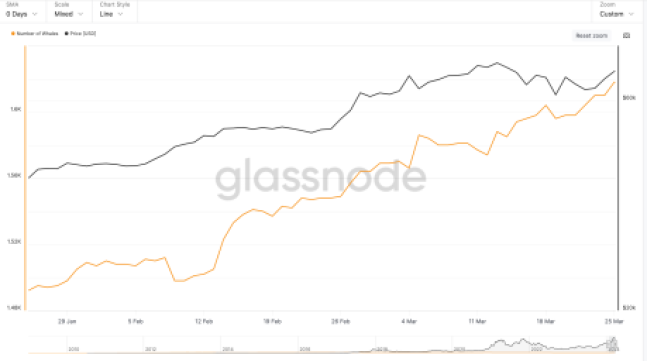

Now that the Bitcoin price has retreated from its surge, big Bitcoin whales are taking advantage of the dip to buy more coins at cheap prices. These whales, who own at least 1,000 BTC – meaning they are at the low end of $70 million – have been buying up a large tranche of coins over the past three months.

There has been one since January steady climb in the number of wallets that can hold at least 1,000, as interest continues to grow. Much of this interest is driven by institutional investors pouring billions of dollars into Spot Bitcoin ETFs. Now that issuers must own the BTC they sell to customers, these institutions have bought up a large portion of the supply.

The number of addresses with at least 1,000 BTC was less than 1,500 at the beginning of this year. But by March, as institutions ramped up their purchases, this number had risen to 1,617. This is an 8% increase in the number of these large whales in the last three months.

Source: Glassnode

To put this increase in perspective, the last time this many whales held this much BTC was in 2021, at the height of the bull market. So if this number rises again, it means that these large investors are expecting the price to rise and are trying to maximize their profits as a result.

Spot ETF Inflows See 2,600% Peak

After a week of consistent outflows, inflows into the Spot Bitcoin ETFs are starting to increase again. For the first day of the week: inflow climbed to $14.5 million, a welcome change from the nearly $900 million outflow recorded the week before.

This change in tide appears to have sparked renewed interest among investors, as inflows increased as much as 2,600% on Tuesday. A total of $418 million went into Spot BTC ETFs on Tuesday, one of the highest inflows since the ETFs were approved.

This change in price is also clearly visible in the Bitcoin price, which has recovered from last week’s low of $60,000. The price has since risen back above $70,000, with a 10% increase in the past week. This also confirms the whales’ attempts to acquire more Bitcoin, making the vast majority of their holdings profitable.

As we have seen in the past, a return of high inflows into the Spot ETFs has always been bullish for the price. So if the inflows were to continue this week, Bitcoin’s price could hit a brand new all-time high before the halving.

BTC bulls push price toward $72,000 | Source: BTCUSD on Tradingview.com

Featured image from India Today, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.