- The risky appetite of speculators for BTC improved with bids from long -term holders.

- But Bulls could only confirm the market advantage if they recovered $ 91.5k.

Speculative interest in Bitcoin [BTC] Slightly recovered and it pushed to $ 88k, but a strong, persistent recovery path was not yet clear, at least at the time of press, by analysts.

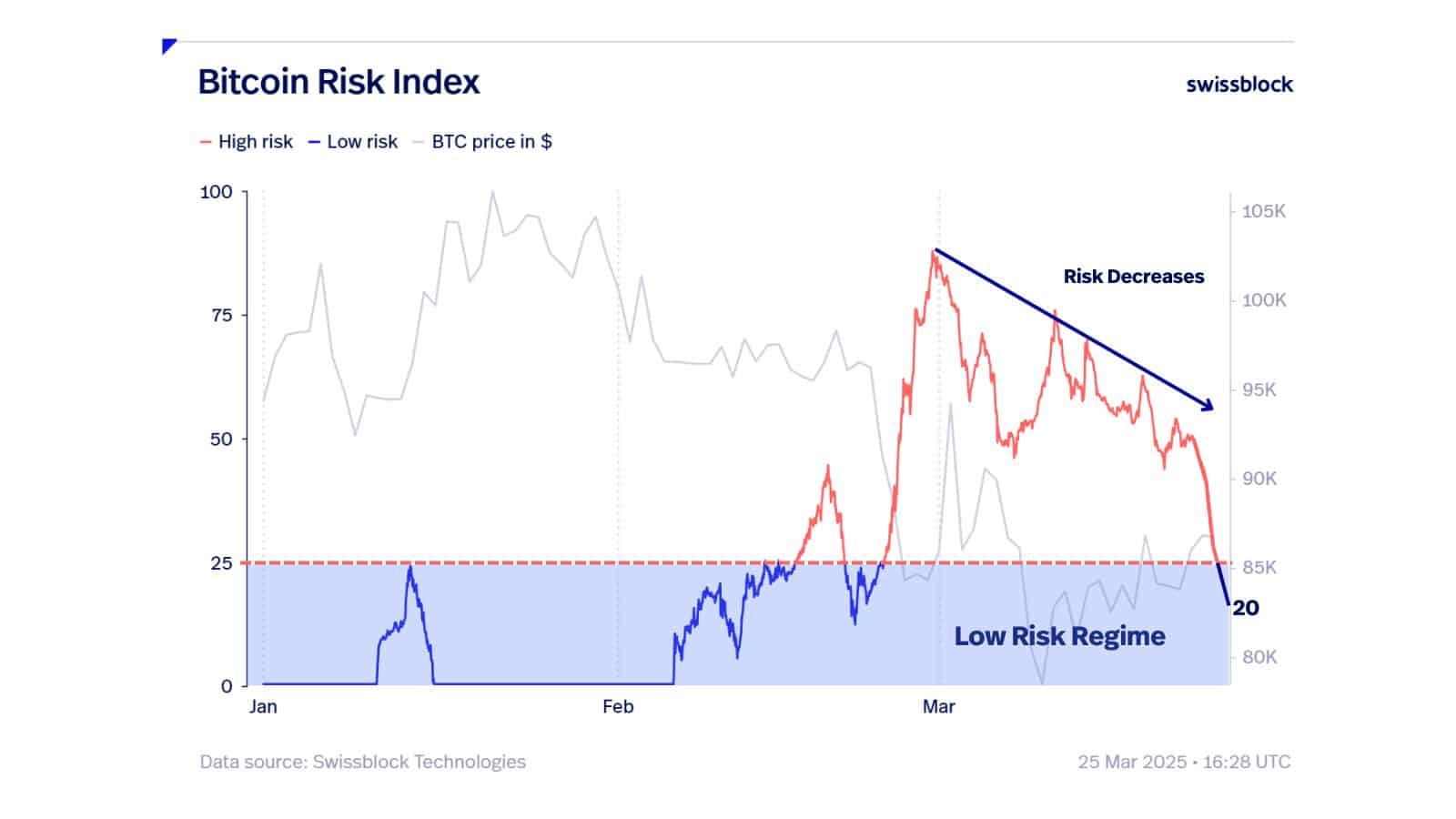

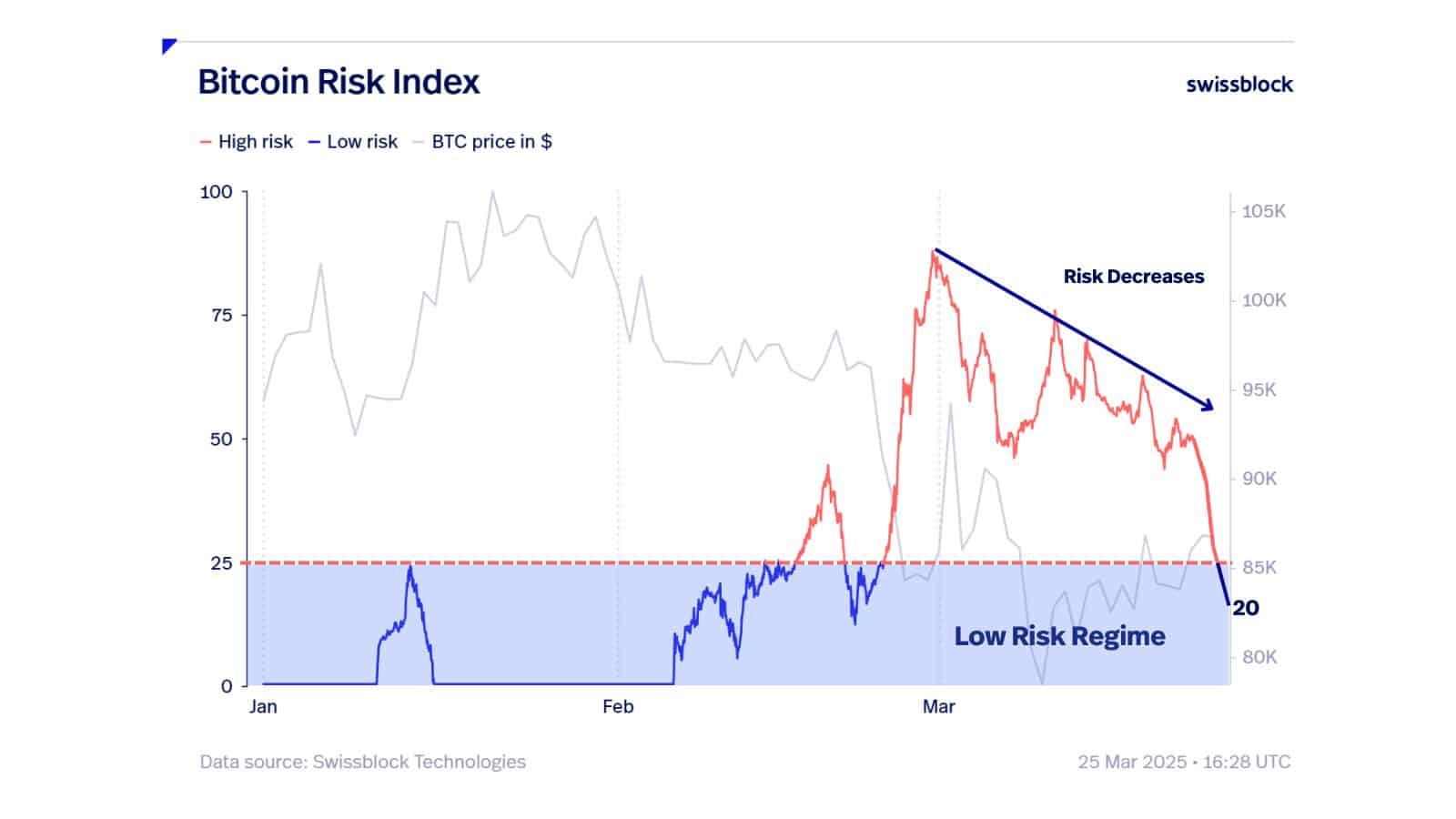

According to Swissblock, an analysis company from Glassnode -founders, Risk Aversion addicted A bit but no breakout guaranteed.

“Rishable risks … now under the 25 threshold, which gives a shift in a low risk regime. An important step in the soil process. Reduces the chance of a sharp fall but does not guarantee an outbreak.”

Source: Swissblock

Bitcoin breakout prospects

The prospects were confirmed by the Crypto fear and greed index, which increased from an extreme fear from 10 to a neutral level of 47 at the time of writing.

But the company added that the regime with a low risk could attract new question and liquidity that are needed for a possible outbreak.

In addition, Swissblock stated That the breakout could only be confirmed if BTC would reclaim $ 90k.

Renowned BTC trader and analyst Cryyp Nuevo repeated a similar sentiment. He said”

“Very good reaction from the 1W50ema, our purchase zone and probably at the bottom of this correction. Once we will be out of the forest/once we can turn $ 91.5k, what the previous range was.”

Source: X

Despite the caution, investors seemed optimistic, as illustrated by the BTC of $ 420 million withdrawn van fairs in the past week. In fact, on March 24, $ 220 million BTC was moved from stock markets and an accumulation repeated.

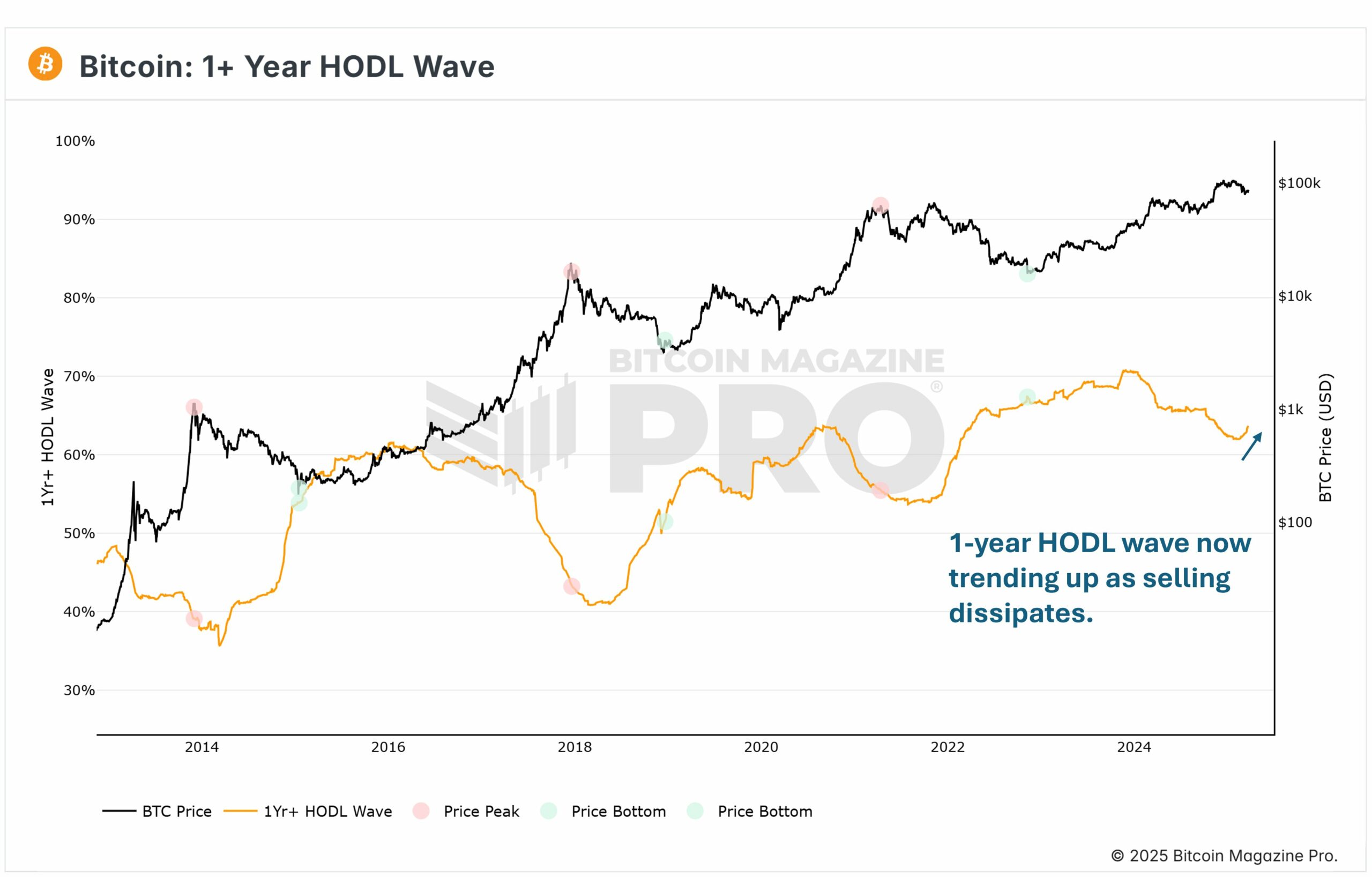

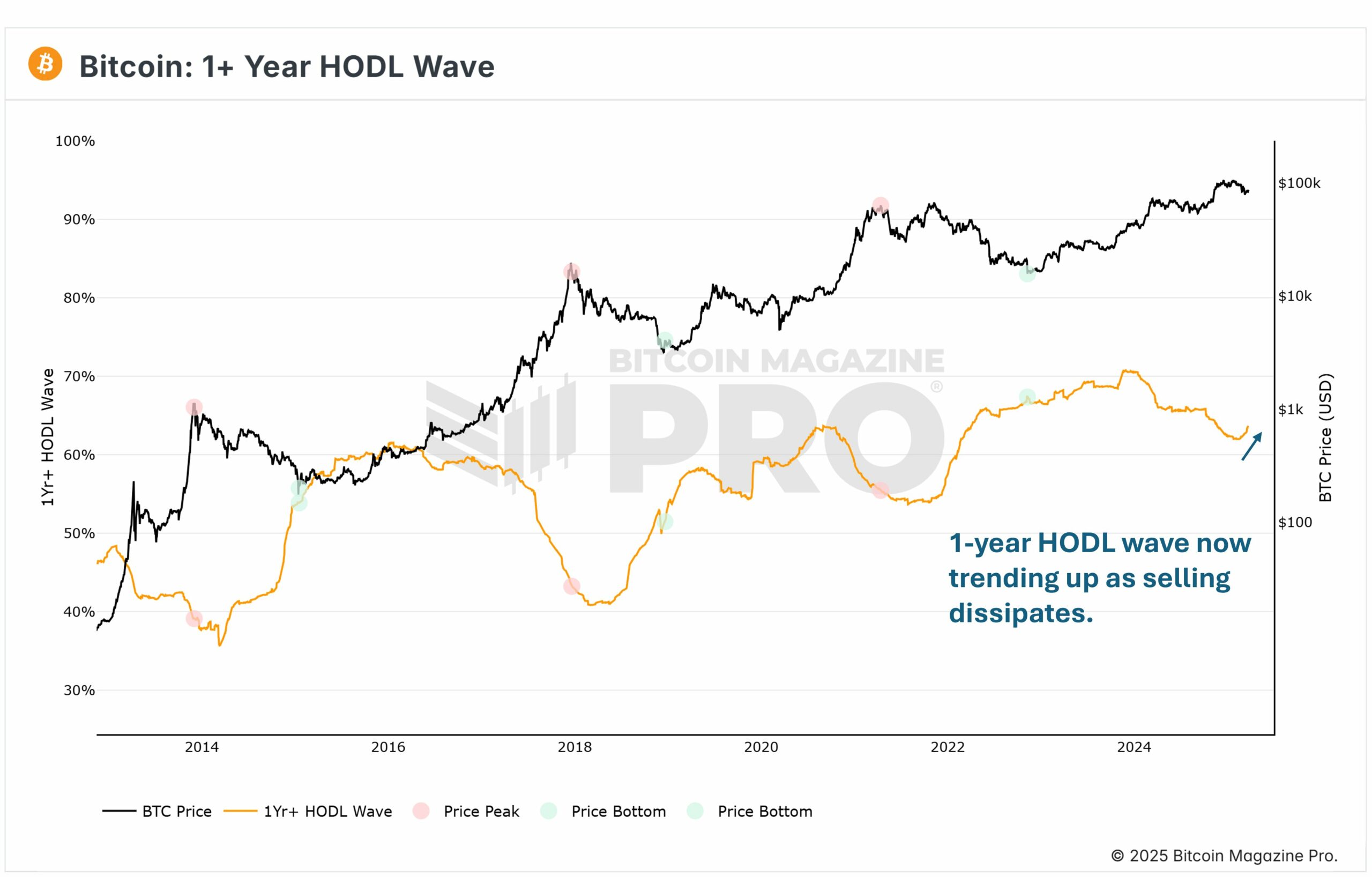

Renewed interest of long-term holders further confirmed the silent demand, as illustrated by 1-year-old Hodl waves. After selling during the ‘Trump Pump’, analyst Philip Swift noted They offered again.

“Long-term BTC holders have stopped selling their BTC around $ 100k. +1 years of Hodl Wave is now back on trending. Expect this to trend again if we are comfortable above $ 100k.”

Source: BM Pro

According to the graph, it usually offers HODL cohort during market anxiety and dumps and then sells during price rallies.

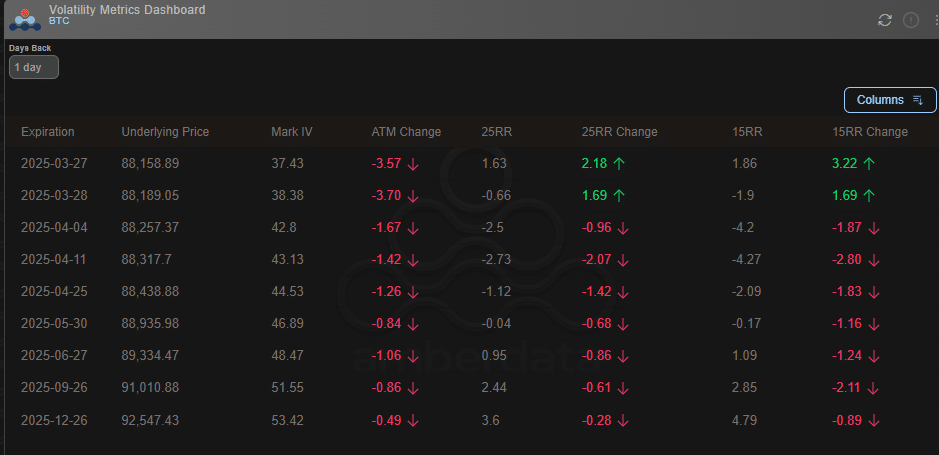

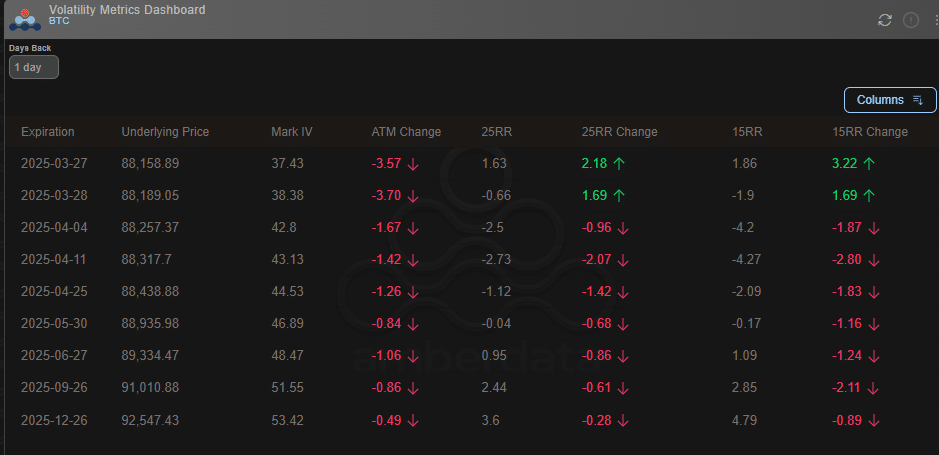

However, the option market seemed somewhat careful, because PUT options were traded with a light premium (there was more demand for security protection of downward descent).

This was illustrated by 25RR (25 -Delta Risk Reversal) before March 28, which has an expiration date at -0.66.

In addition, the beginning of the beginning of April had a 25RR of -2.5 and -2.73, which further strengthens the caution of the traders in the first half of next month.

Source: Ambdata