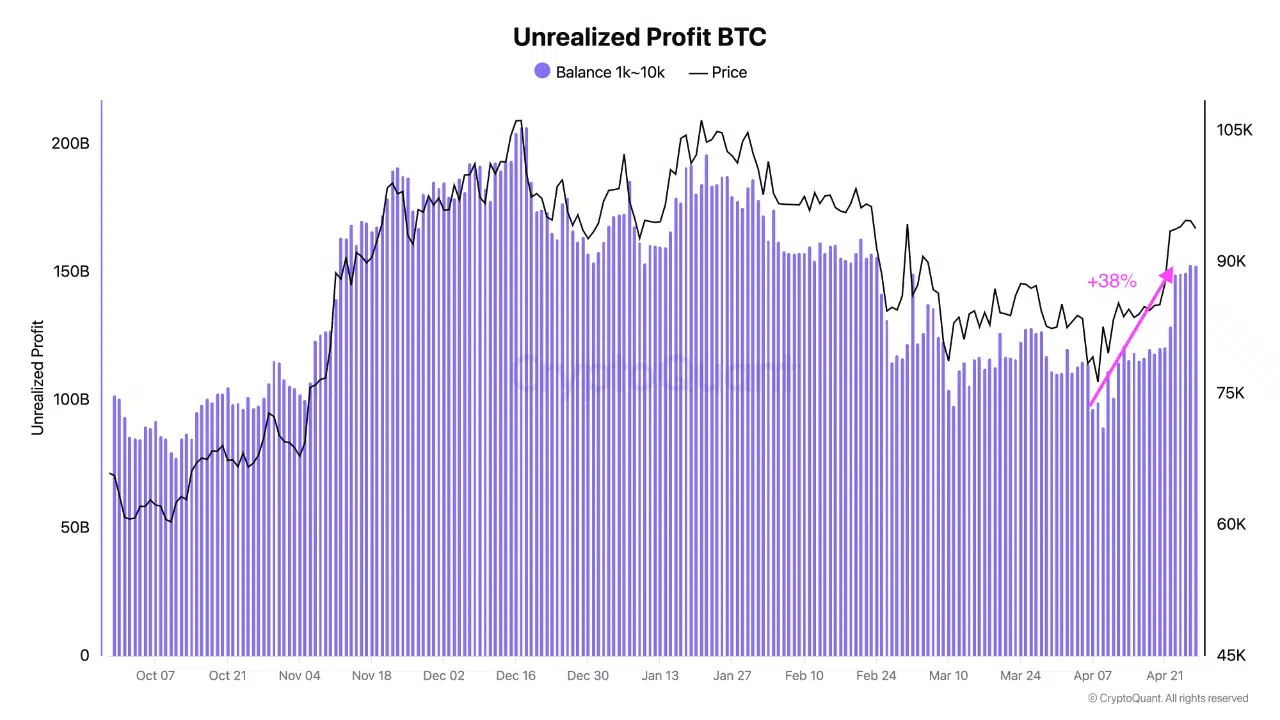

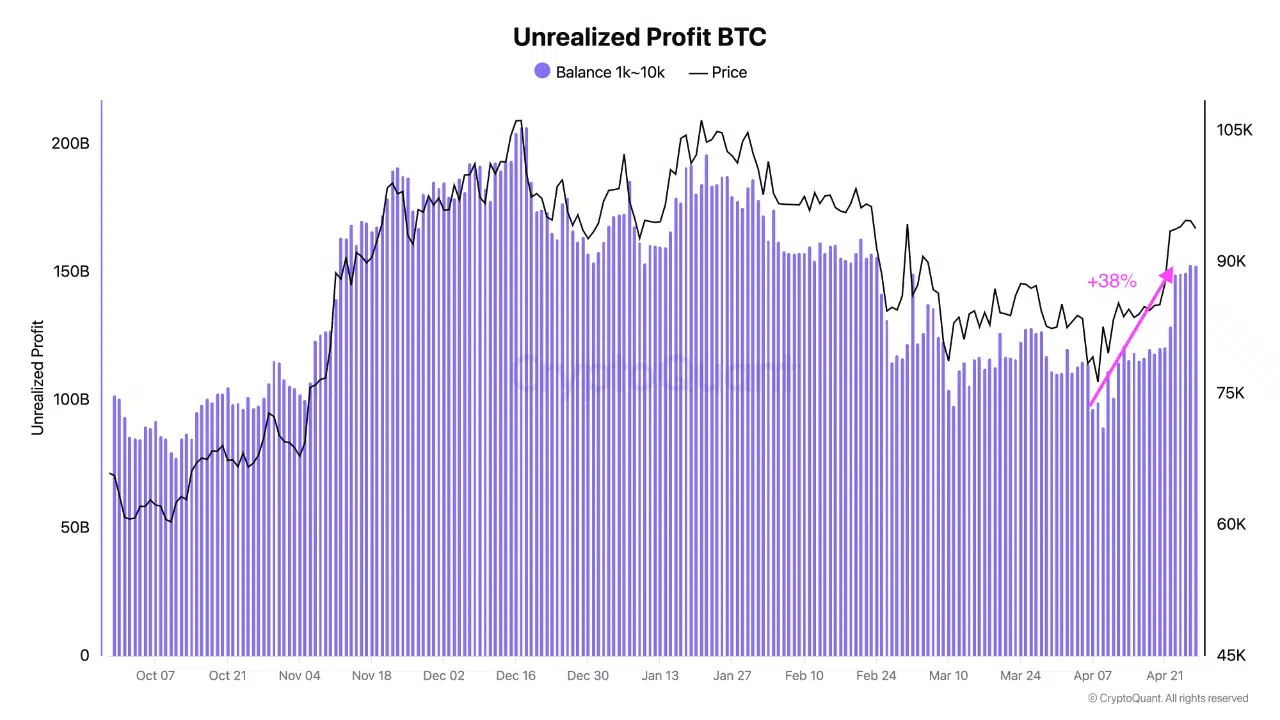

- Bitcoin whales’ unionized profit rose to $ 150 billion, indicating potential short-term market shifts

- MVRV ratio indicated surplus value, which suggests a possible correction if the profit is realized

Bitcoin [BTC] Whales, which hold between 1k to 10k BTC, have seen their non -realized profit by around 38% since the beginning of April – with $ 150 billion.

Historically, when this profit almost $ 200 billion, whales tend to take a profit, which may be delayed by Bitcoin’s upward momentum.

Such a walk in whale profits often refers to possible shifts in market sentiment, so that questions are raised about whether BTC can continue its upward process or get a price correction. At the time of the press, Bitcoin traded at $ 94,811.68, after a modest increase of 0.16% in the last 24 hours.

Source: Cryptuquant

Daily active addresses, transactions indicate healthy network growth

The network activity of Bitcoin is robust, with 808.82k daily active addresses and 392.47K transactions recorded on the press of the press. These figures hinted at a growing level of adoption and transactional activities, to support the bullish story for Bitcoin.

Although these statistics just do not guarantee persistent price growth, strong network activity is often correlated with a greater demand from investors, which could further feed the Bitcoin rally.

As the number of active addresses continues to rise, the demand for BTC can also climb. This could possibly push the price in the coming weeks.

Source: Santiment

High MVRV ratio – What does it mean?

At the time of the press, the MVRV ratio of Bitcoin was 2.37 – a high value that indicated potential overvaluation. This also suggested that BTC may act above its “fair” value, as measured by the average price with which coins were last moved on the blockchain.

Historically, when the MVRV ratio is high, this is often suggested at the start of a market correction.

The to-flow ratio for BTC also rose to 725.39, which indicates an increasing scarcity. This statistics reflects the decreasing range of Bitcoin in the course of the time traditional a long-term bullish indicator.

As BTC becomes scarce, its value can rise, provided that demand remains strong. The peak in the to-flow ratio suggested that although Bitcoin is confronted with the volatility in the short term, the long-term proposal can continue to attract a scarce active.

Source: Santiment

Bitcoin is fighting the key resistance – can it break $ 95k?

Bitcoin has recently tested critical price levels, including a resistance zone at $ 95k. At the time of writing, the RSI was 66.98, indicating that Bitcoin overbough can approach conditions. If BTC can break the $ 95k resistance, this can focus on the next level around $ 105k.

However, if it is confronted with rejection, it can test support at $ 85k. The Bollinger tires underline that BTC was near the upper range, so that the idea was further supported that it could actively get a withdrawal if the momentum is justified.

Source: TradingView

Will BTC continue to rise or will be confronted with a price correction?

The market conditions of Bitcoin blink mixed signals. Although whales increase their non -realized profit and network activity, the high MVRV ratio is a sign that Bitcoin can be overvalued.

The increase in the shares-to-flow ratio emphasized long-term scarcity-a bullish signal. However, Bitcoin’s price levels and technical indicators suggested that a potential price correction could be the following if the resistance at $ 95k turns out to be too strong.