- Auction could collect up to $ 76 and $ 93 next

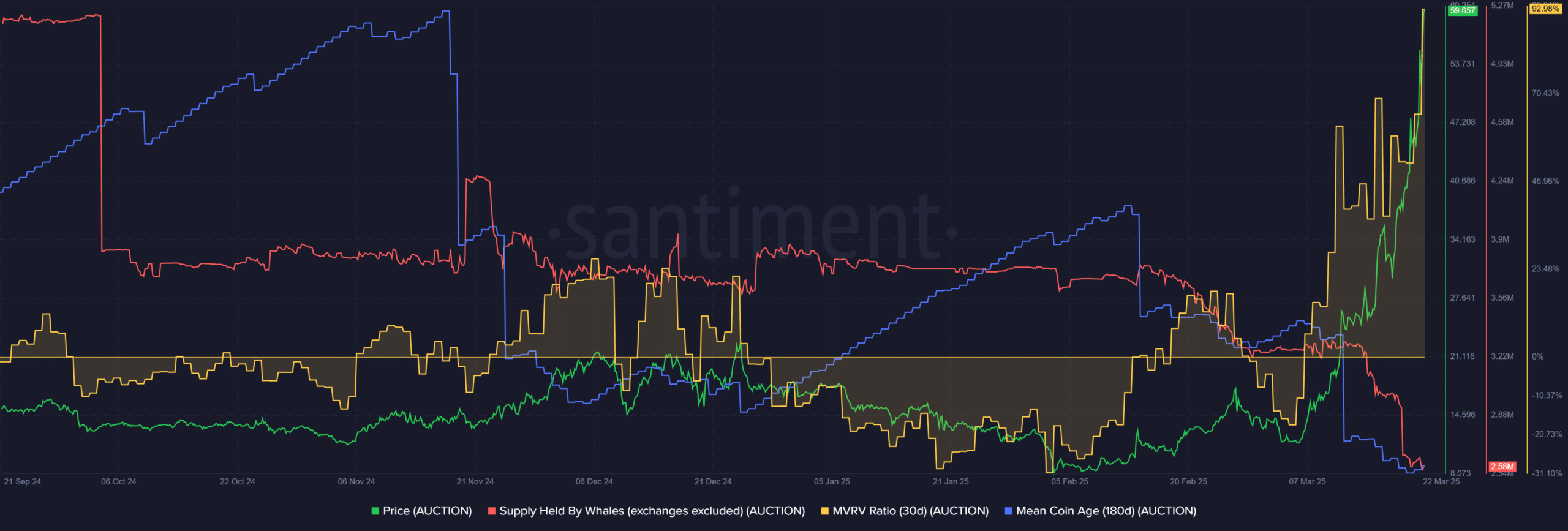

- On-chain statistics revealed that it was flashing token distribution trends

Bounce [AUCTION] has been rallyed with 140.89% since last Saturday. At the time of writing, the token traded at $ 60.3, with its 24-hour trade volume also remarkably high. The data from Coinmarketcap even shown that it was $ 1.33 billion volume. With a market capitalization of only $ 395.84 million, the volume -MCAP -Ratio was 335%.

This seemed to be extraordinary bullish – in the short term. The price was also slightly less than 17% away from the all time of $ 70.44.

Hence the question – should holders now take a profit or wait for more profit?

Greed and Fomo should not take over the upper hand now

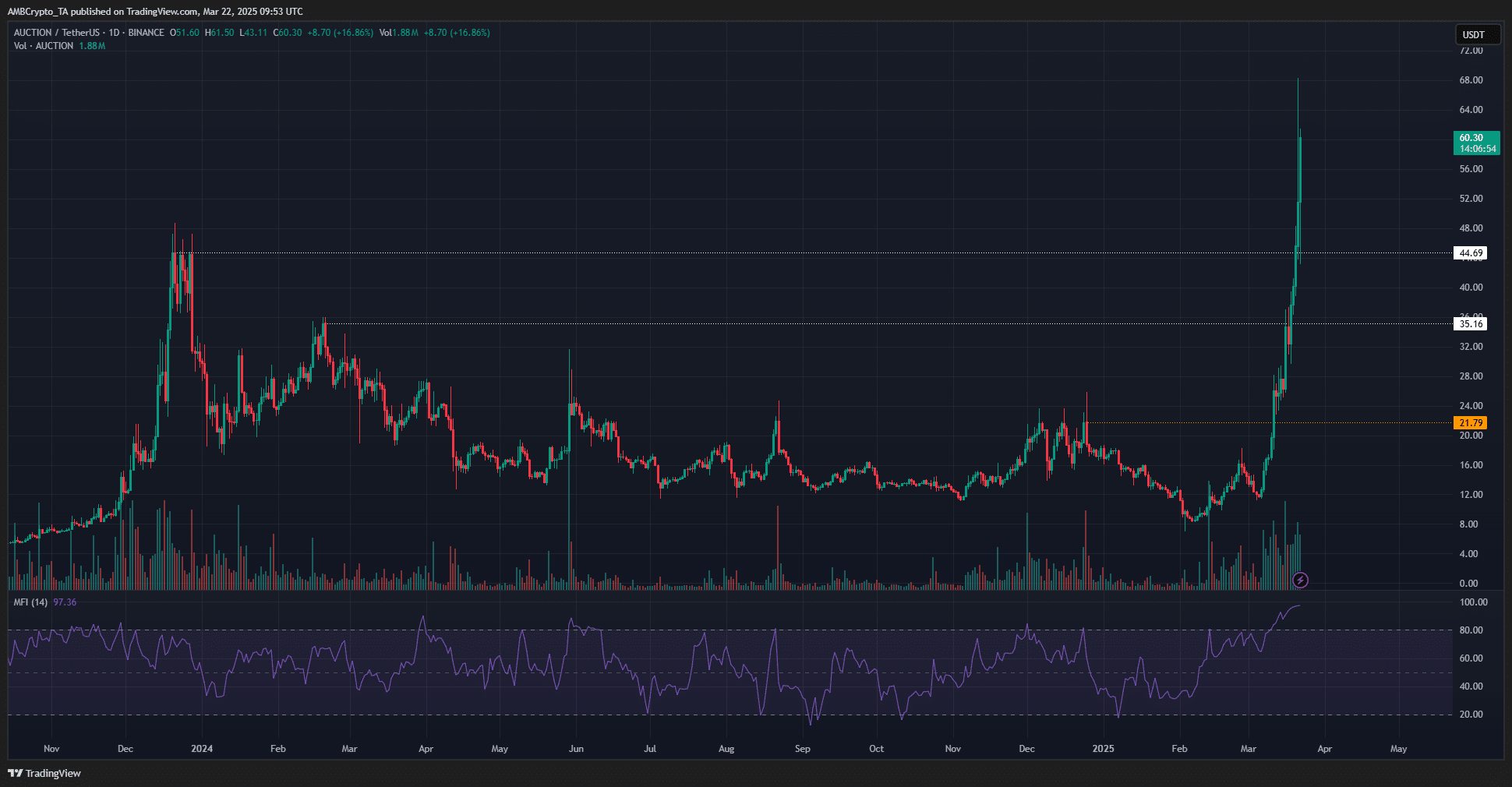

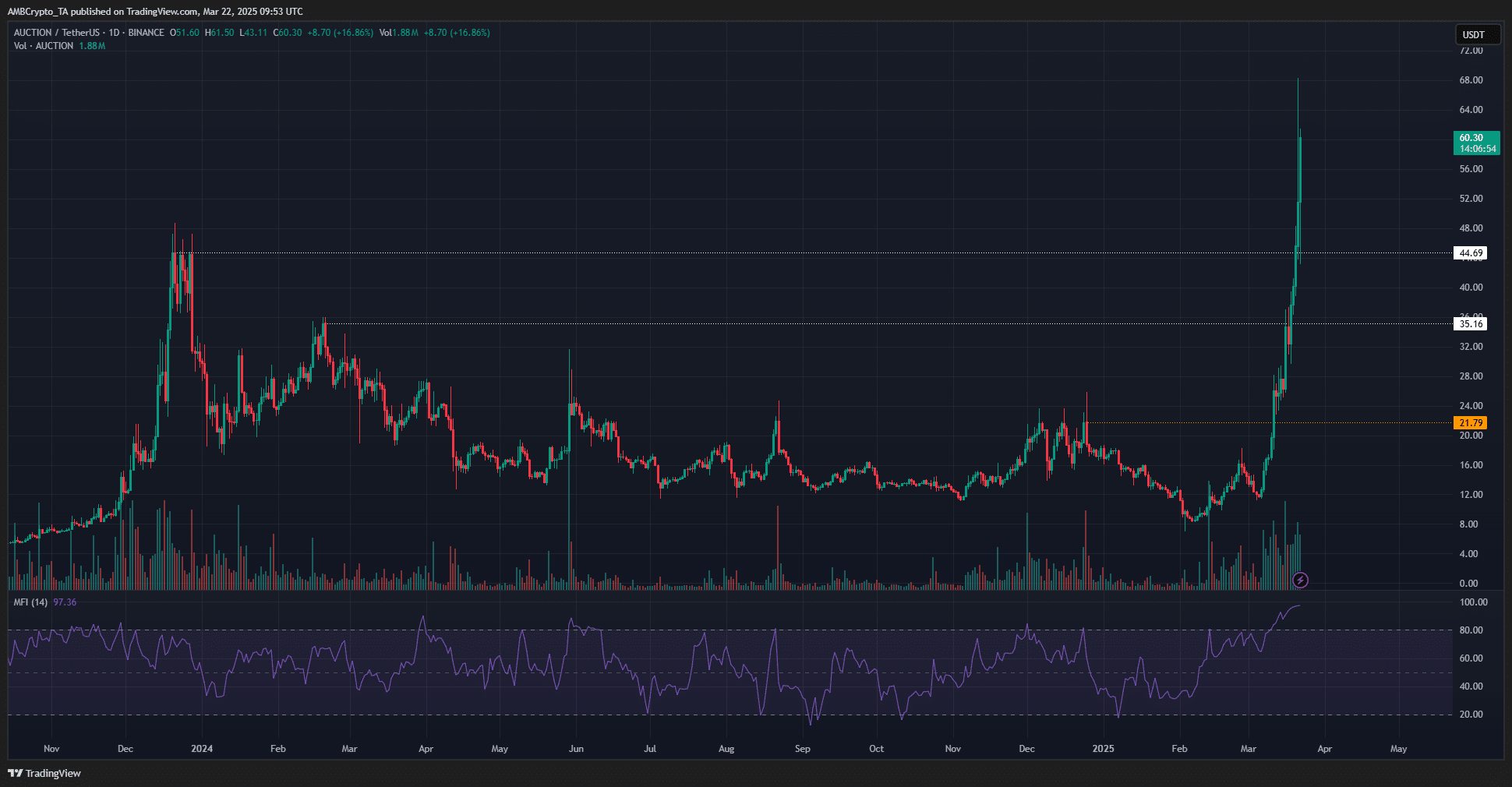

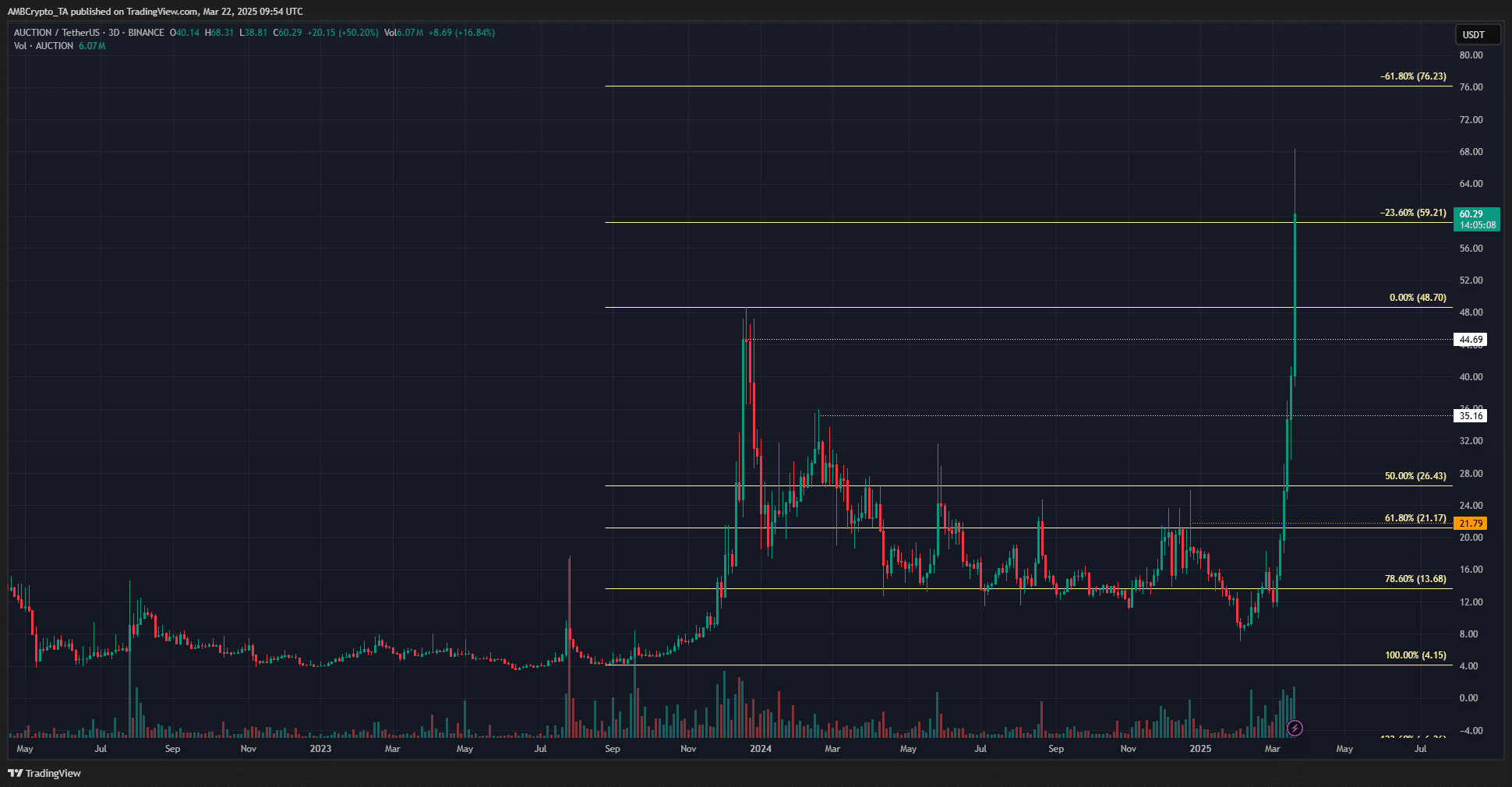

Source: Auction/USDT on TradingView

The 1-day price diagram revealed that the trade volume has increased since February. It surpassed the volumes of November-December and maintained its advantage, even as the price got higher.

The Money Flow Index was on 97 on this time frame on the second highest level after a value of 98 was posted in July 2023. With the price of an auction now just a stone’s throw from his all time, it might be a good chance to make a profit.

Other very good reasons to take a profit were illuminated by santiment statistics. The range of whales has deteriorated since mid -February. This suggested that whale ownership was in a distribution phase.

The average currency age has also been trending to the south since February. Together they emphasized a network -wide distribution. The decline of the whale stock meant that the larger market participants used the rally to make a profit.

The 30-day MVRV ratio was at 92.98%-the highest that it has been since December 2023. This implied that holders had a high profit in the short term. This can be a good time to take a profit, at least partly.

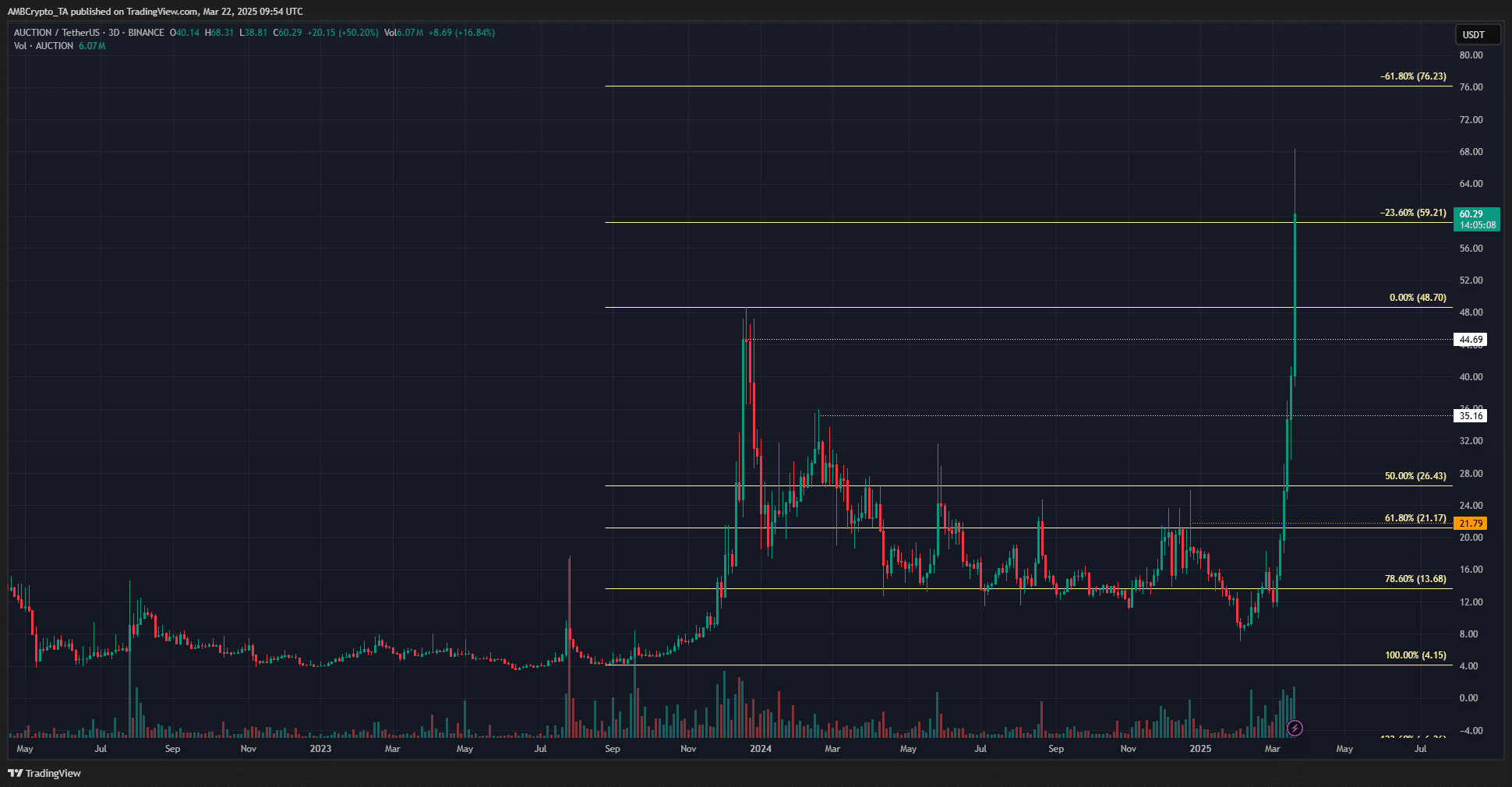

Source: Auction/USDT on TradingView

For auction holders who were determined to have HODL, the Fibonacci levels showed that the next target was $ 76.23. Apart from that, it showed 100% Fibonacci retracement level that $ 93.25 would be the next goal.

These goals would be feasible. The circulating market capitalization of the project was only $ 404 million. Given the sentiment on the market and especially for smaller altcoins, taking profit can be the sensible way of acting for investors.

New buyers were profitable in recent days because of the fast profits, but Fomo might be a bad idea. Especially since the MFI indicated that the market was overloaded.