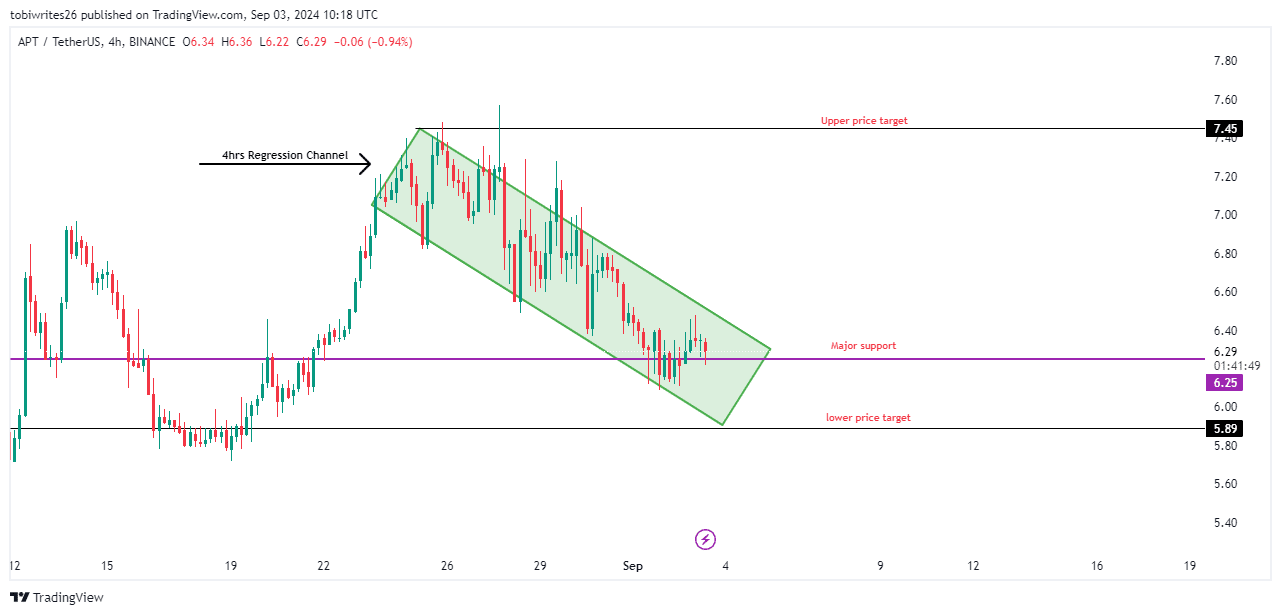

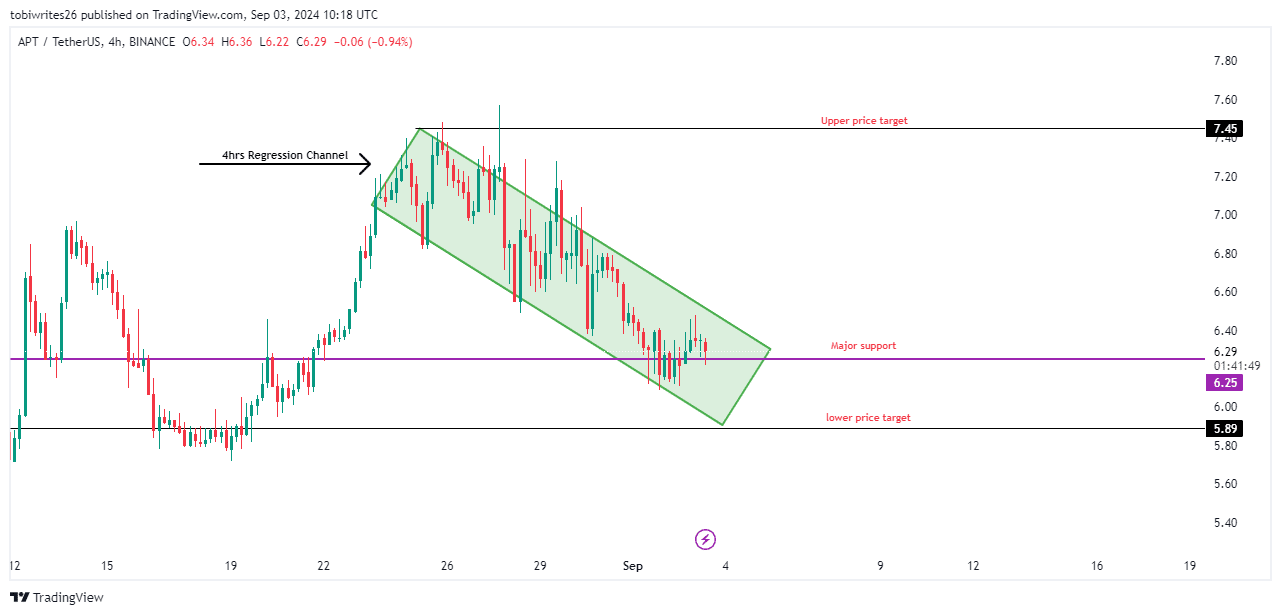

- This new regression channel, set on a four-hour time frame, could push APT towards $7.5.

- The market sent mixed signals, with positive, neutral and negative short-term forecasts.

Aptus [APT] has recently gone through a tough market cycle, suffering a decline of 6.63%. When it reached the support level of the current regression channel, it gained 3.95% in the last 24 hours.

While the outlook for APT is trending toward bullish, there is an underlying bearish sentiment that requires careful analysis of both trends.

Major bullish confirmation

Between April and August, APT traded within a regression channel pattern.

This pattern is characterized by a downward diagonal movement between two defined levels – the upper and lower lines – that act as supply and demand zones.

The pattern is generally bullish and is confirmed by a break of the channel’s upper line. Recently, APT broke above the daily regression channel, indicating that buying pressure is increasing.

However, it is now included in another regression channel within the 4-hour time frame.

Source: TradingView

Such a move strengthens the bullish confirmation.

At the time of writing, APT was trading at the bottom of this regression channel, which aligned with another key support level at $6.25. This alignment indicated strong buying pressure.

This buying interest is likely to drive APT’s price to the top of the channel at $7.45, which served as a short-term target. Looking ahead, a long-term target is projected near $10.

Trader interest remains high

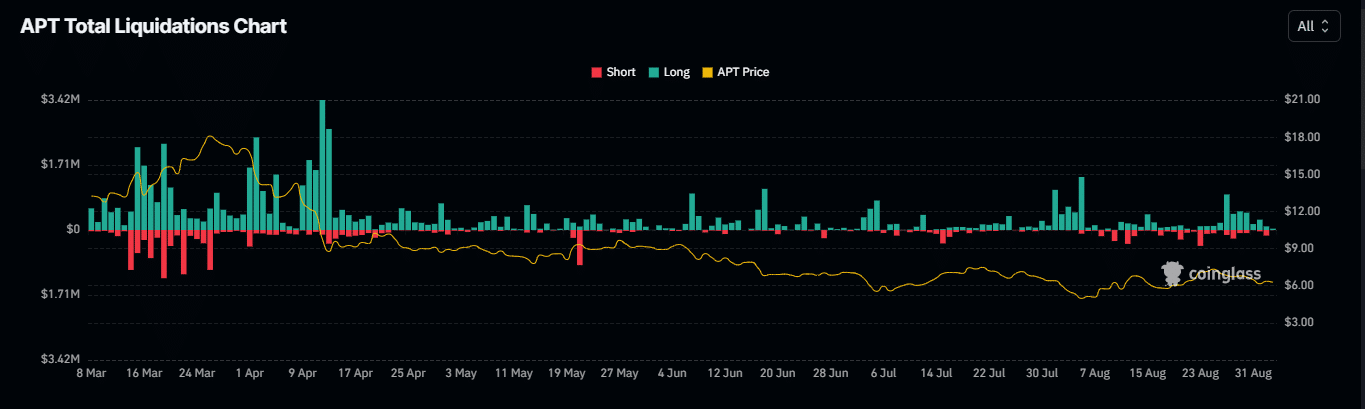

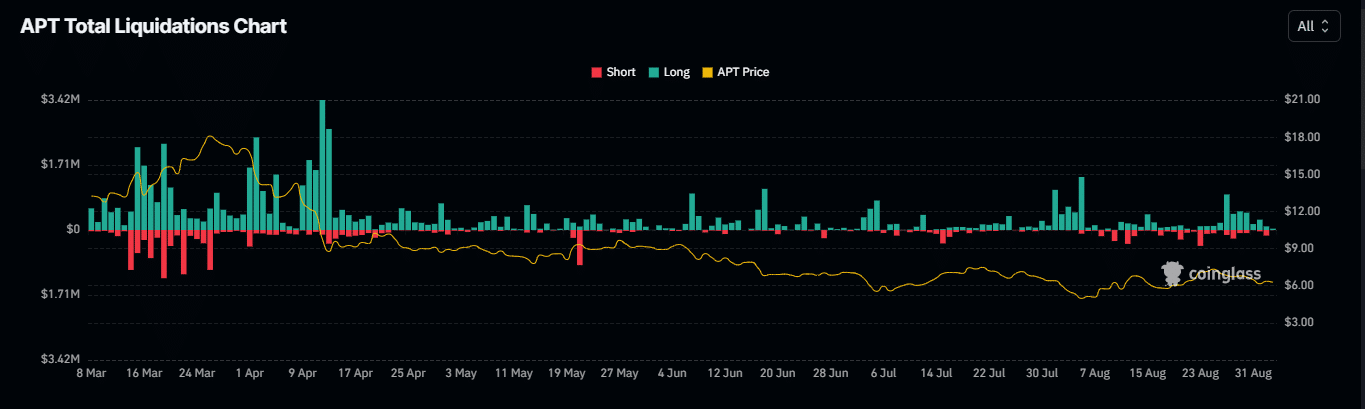

According to one Coinglass liquidation chartAMBCrypto reported that traders expected a drop in APT over the past 24 hours and faced significant liquidations.

Of the total liquidated amount of $199.59k, shorts contributed $143.80k, compared to $55.79k from longs, indicating bullish market sentiment.

This trend suggested increasing confidence in APT’s potential upside, potentially driving its market price higher.

Source: Coinglass

Furthermore, the Relative Strength Index (RSI) – a momentum oscillator that identifies overbought (above 70) and oversold (below 30) conditions – positioned APT in the neutral zone with a score of 48.73.

It was striking that the RSI showed an upward trend and almost approached the top of neutrality. Historical patterns indicated that if the RSI enters bullish territory – above 50 – the price of APT is likely to rise in response.

The bears are still around

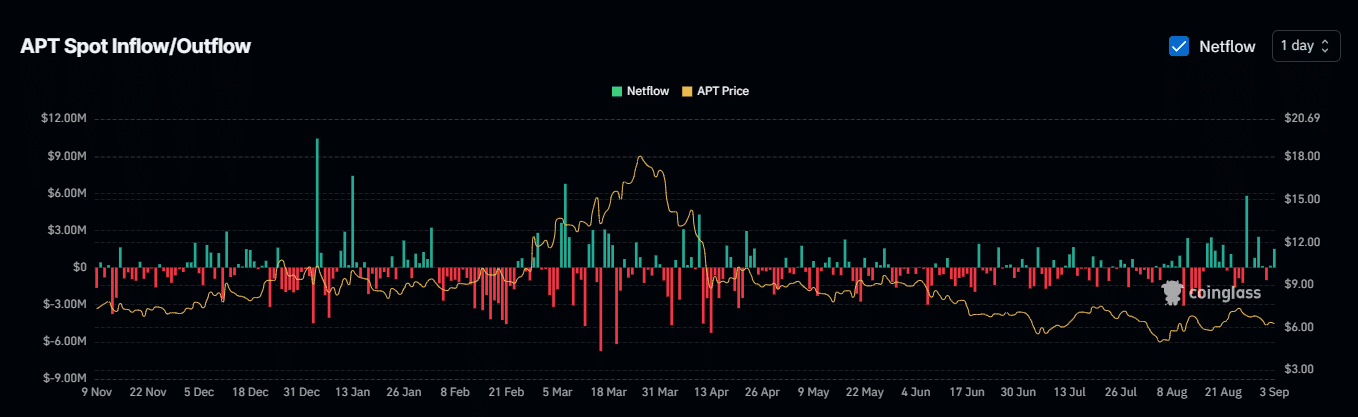

According to NetFlow data from Coinglassthe presence of bears remains clearly present. NetFlow is calculated by subtracting the inflow of an asset from the outflow on exchanges.

Typically, a negative flow indicates a bullish market as it reduces the supply of assets on the exchanges.

However, for APT the situation is reversed; it has consistently shown positive NetFlow, indicating increased APT deposits on exchanges, increasing supply and sales potential.

Currently, NetFlow for APT was $1.59 million over the past 24 hours, a trend that has continued over the past week.

Source: Coinglass

Read Aptos’ [APT] Price forecast 2024–2025

Moreover, Open Interest has been declining since the beginning of September. A decrease in Open Interest indicates continued bearish sentiment.

If short traders dominate, APT could potentially fall to $5.89, as shown in the accompanying chart above.