Perpetual futures are a unique derivative product in the crypto market. Unlike traditional futures contracts, which have a fixed expiration date, perpetual futures have no expiration date and are intended to mimic spot market prices. They achieve this through a mechanism known as the funding rate, which ensures that the futures price remains in line with the spot price. Given their close association with the spot markets and their ability to provide traders with leverage, understanding the dynamics of perpetual futures becomes critical when analyzing Bitcoin’s price performance.

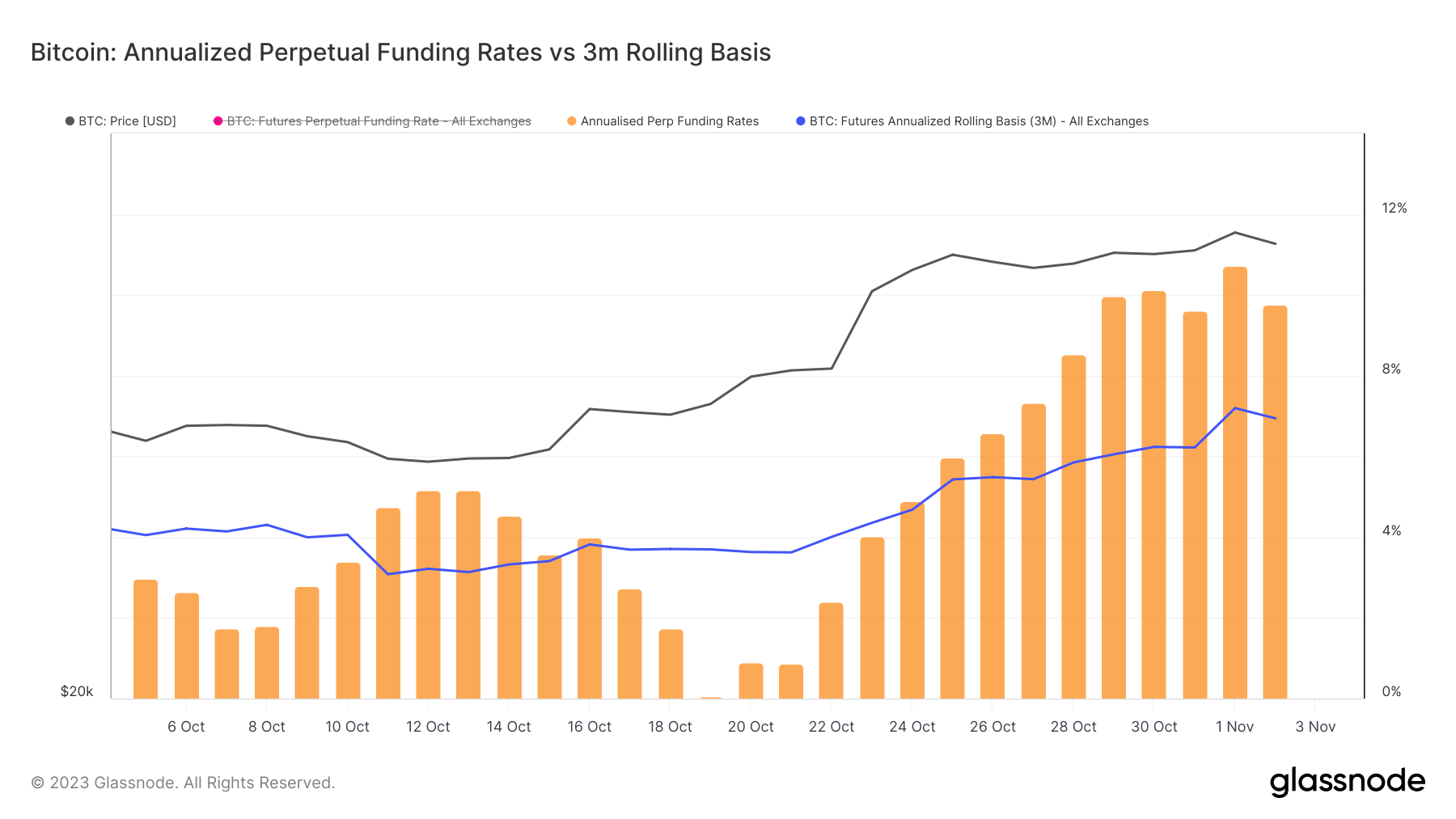

Between October 14 and November 3, Bitcoin’s price rose significantly, from $26,800 to $34,900. On November 2, it even briefly reached $35,400. Coupled with this bullish move, Bitcoin three-month annualized futures rose from 3.322% on October 14 to an all-time high of 7.194% on November 2. At the same time, the annualized funding rate escalated from 4.541% to 10.74% on November 1, reaching 9.774% on November 2 – also the highest level since the beginning of the year.

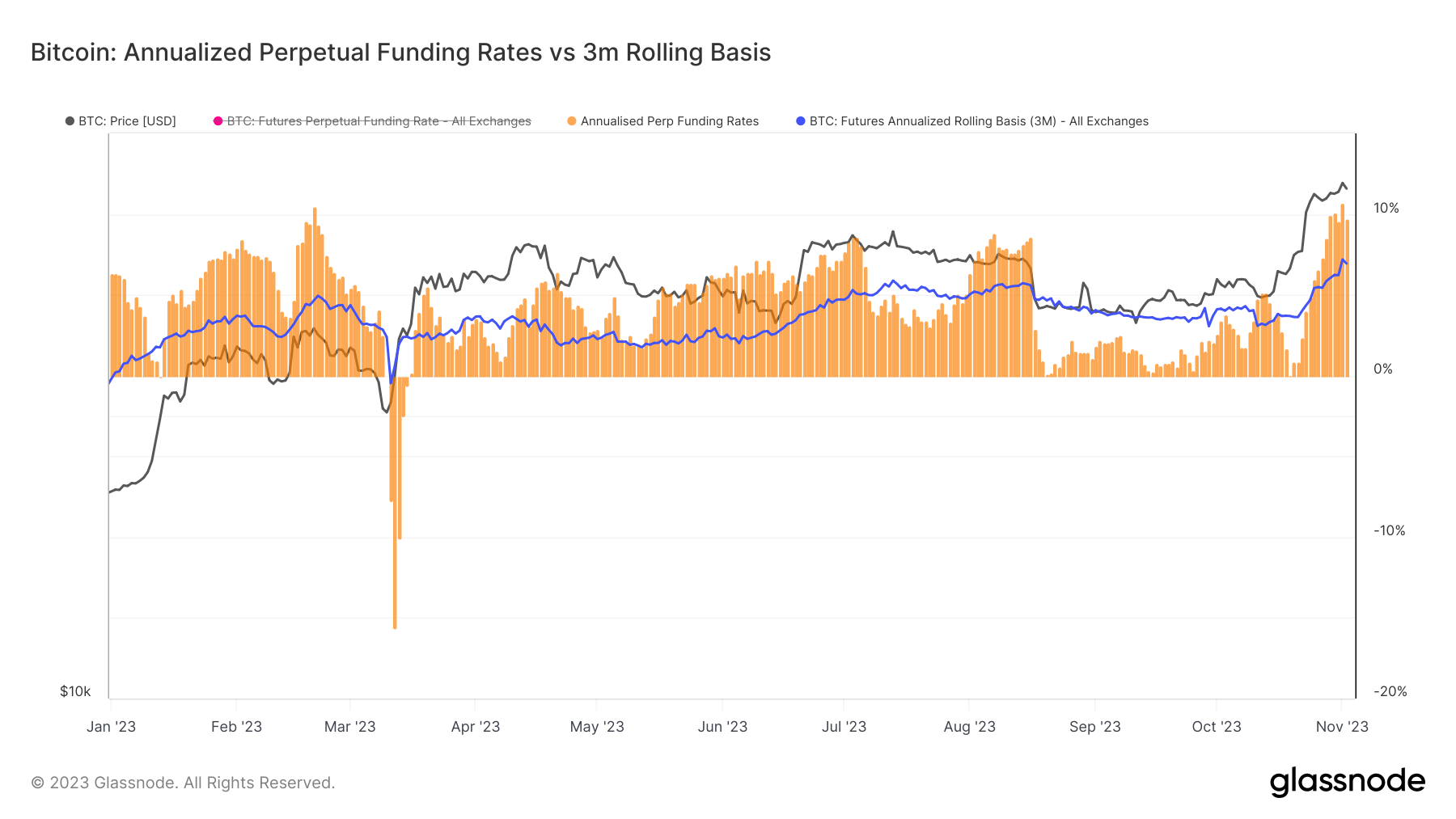

A three-month rising base indicates bullish sentiment for Bitcoin’s medium-term prospects. Traders appear willing to pay a premium for the futures, expecting Bitcoin’s price to continue its upward trajectory in the coming quarter. On the other hand, a sharp rise in the perpetual funding rate indicates an extreme bullish path in the short term. This can be attributed to the high demand for leverage by bullish traders in the perpetual markets. The current significant difference between the perps rate and the three-month rate indicates an over-indebted market. Historically, periods when the perpetual basis rises above the three-month basis often indicate extreme optimism among market participants.

While current data underlines the prevailing bullish sentiment, it also points to potential vulnerabilities. Increased demand for both perpetual and three-month futures could indicate that traders expect the price of Bitcoin to rise further. The robust base increase supports this sentiment and shows strong confidence in Bitcoin’s future performance. However, the observed differences, especially in the percentage of perpetrators, could also pave the way for possible price corrections as market sentiment changes.

The post Perpetual futures market paints a rosy medium-term picture for Bitcoin appeared first on CryptoSlate.