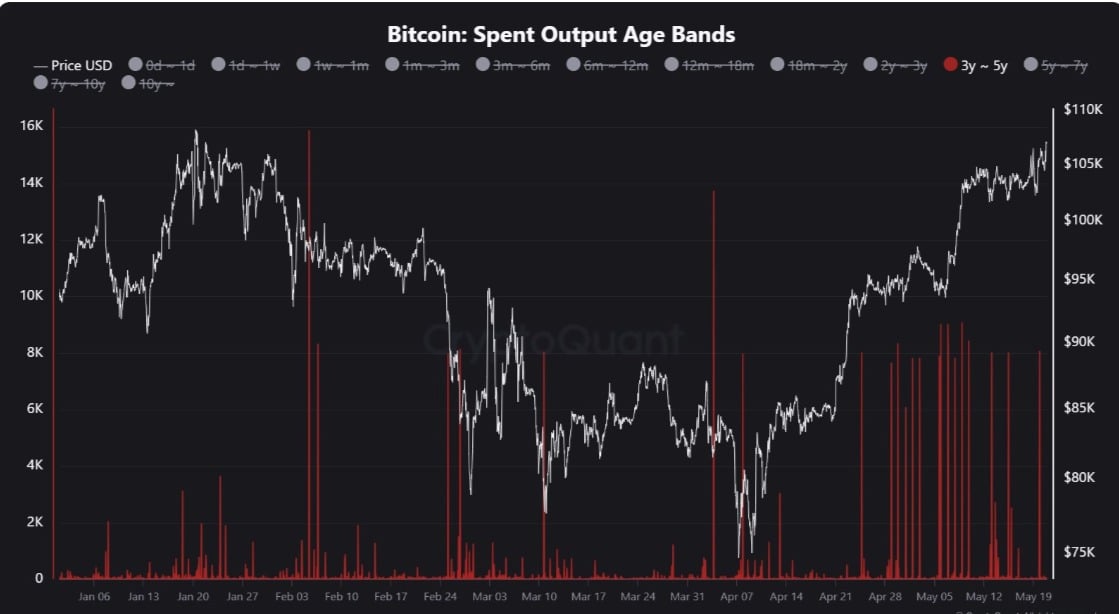

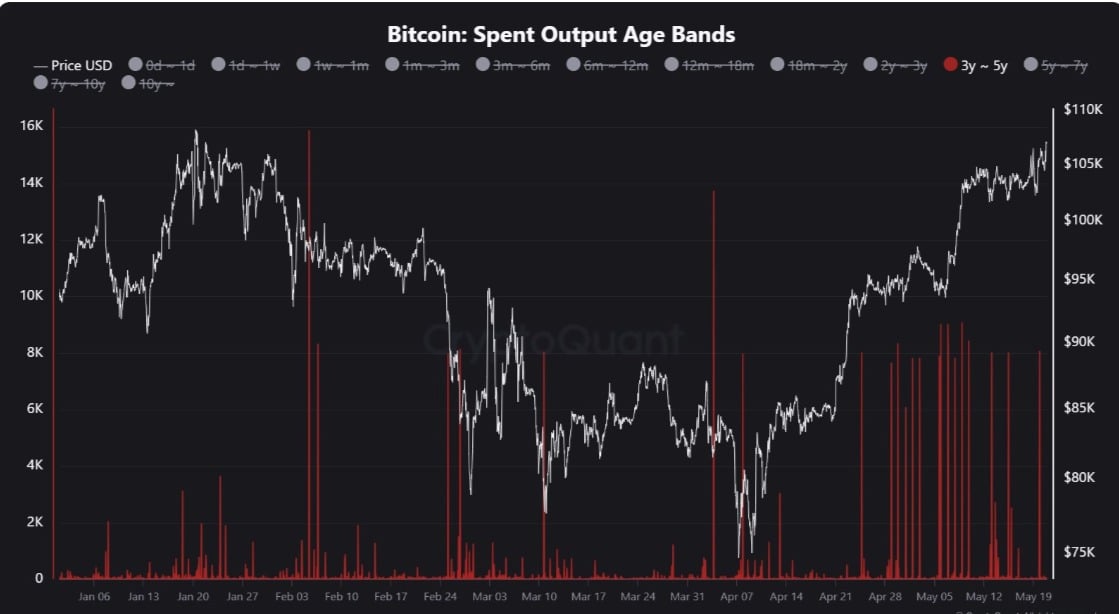

- 8.511 BTC, held 3-5 years, was on the road.

- Bitcoin experienced a strong bullish momentum and set up the crypto for more profit.

Amidst Bitcoin’s [BTC] Prize, long -term holders start moving their coins.

According to Cryptust Analyst Marchunn, 8,511 BTC of the 3-5 age age moved on-chain last day.

This year, the newest step marked the 22nd copy in which more than 5K BTC has been reactivated from this cohort.

Source: Cryptuquant

The reactivation led to an increase in the 90-day coin days destroyed (CDD). This suggests that, since the price climbing of Bitcoin, older coins are redistributed, so that new market participants may be reached.

In the past day, CDD was based on 5 million to 29 million, which indicates a new question. Moreover, the average resting fell from 42 to 33, indicating that new buyers actively enter the market.

Source: Cryptuquant

Assessment of the Bitcoin transfer of Grayscale

According to Marchunn, the newest movement of the old Bitcoin seems to come from Grayscale, who has transferred the BTC to newly created addresses.

However, it remains uncertain whether this volume reflects the actual changes of ownership or an internal adjustment.

Historically, the ETF flows of Grayscale are sometimes negative and these movements can be linked to coming or recent outskirts.

Nevertheless, exchange net flow data suggest that this transfer is probably an internal recasting, which means that the reactivated BTC has not been deposited in trade fairs.

Source: Cryptuquant

Exchange Netflow shows that Bitcoin has registered for three consecutive days of negative value. A persistent period of negative Netflow indicates that markets see more recordings than deposits, which is usually a bullish signal.

Looking at CDD, it is currently 23.8 million, a decrease of 29 million. This meant a decrease of 6 million over the past day. A drop here suggests that large holders started to lower their expenses after the recent increase.

This is often interpreted as bullish, because holders start to take a step back in the market in the long term.

Impact on BTC

Although the movement of old coins can express, this recent transfer was not immediately deposited in the stock exchanges.

The reactivated bitcoin remains in private portfolios, which means that it has not negatively influenced the price action. Accumulators still dominate the market, which strengthens a bullish prospect.

However, if Grayscale decides to sell these coins, it can activate the outflows and push BTC to $ 104k. On the other hand, if the current circumstances persist, Bitcoin’s upward trend will probably continue, which may exceed $ 107k and achieves $ 108k.