David Lawant, the head of research for FalconX, an institutional crypto trading platform tailored for financial institutions, recently made an insightful prediction about the future of Bitcoin (BTC) prices in light of the expected launch of a spot Bitcoin ETF in the United States. Sharing being predictions via X (formerly known as Twitter) he put into words the financial variables that could play a decisive role.

Lawant noted: “The next important variable to watch during the BTC ETF launch saga will be how much AUM these instruments will collect once they launch. I think the market currently expects these inflows to be between $500 million and $1.5 billion.”

The magic number that pushes the Bitcoin price past $40,000

The crypto community is eagerly awaiting a positive sign for a Spot Bitcoin ETF, either in late 2023 or early 2024. A crucial date on the calendar is January 10, 2024, which has been set as the final deadline for the ARK/21. Stocks application, leads the current series of applications.

Undoubtedly, a green signal from regulators for the spot ETF will be a game changer for the entire crypto asset class. Lawant emphasized the importance of this development, stating: “It will open up space for big pockets of capital who do not have good access to crypto today, such as financial advisors, and earn a stamp of approval from the world’s most prominent capital markets regulator .”

The pressing question, however, is the immediate impact on capital inflows. “The first few weeks after launch will be crucial to test how much interest there is currently in crypto in these relatively untapped capital pools,” Lawant emphasizes.

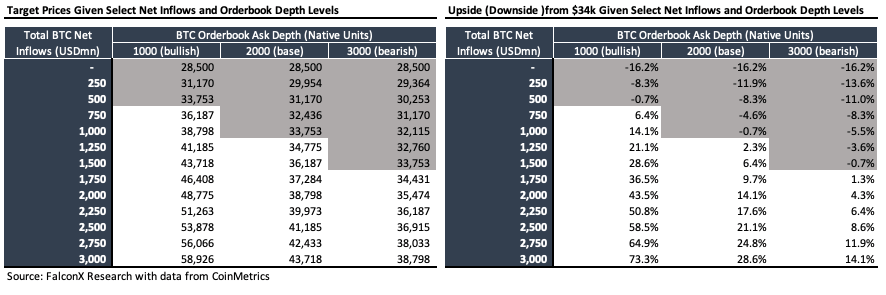

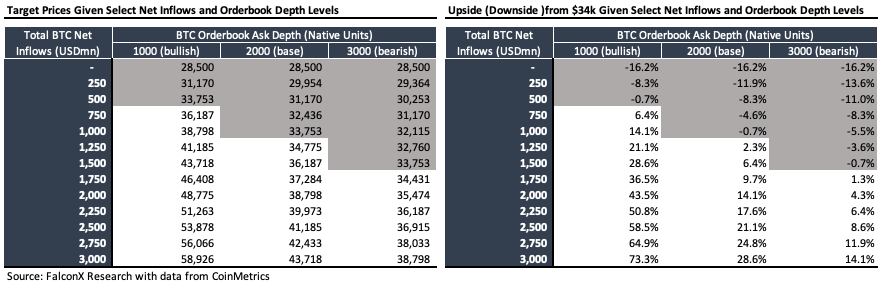

Drawing on historical data, Lawant pointed out the stability of the demand side of BTC’s order book, especially at prices above $30,000. This data allows for an approximation of how capital inflows could impact BTC’s price trajectory.

Using various inflow scenarios against a spectrum of market scenario depth, Lawant infers that the market may be forecasting net inflows ranging between $500 million and $1.5 billion within the first weeks of launch.

Lawant drew conclusions from his analysis and suspected:

For BTC to reach a new range between current levels and over $40,000, total net inflows would need to reach $1.5 billion+. On the other hand, if total net inflows fall below $500 million, we could go back to the $30,000 level, or even below.

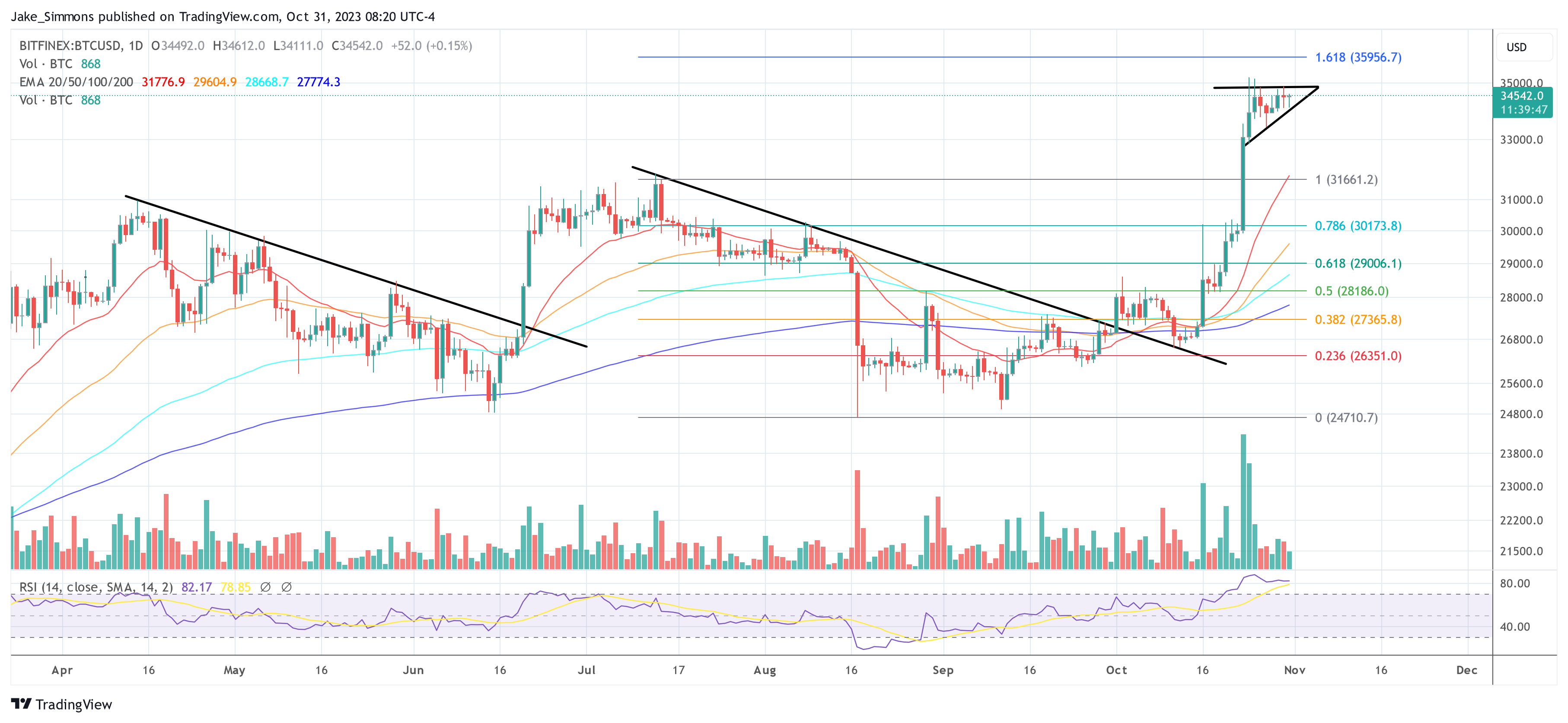

However, it is of utmost importance to take into account the inherent assumptions in Lawant’s analysis. He admits: “One is that the move from $28.5k to $34.0k was entirely attributed to the market anticipating price-insensitive net inflows following the launch of the ETF.” This means, among other things, that the current price increase was not caused by the correlation with gold, nor by the global crises or turmoil in the bond market.

Lawant also highlighted the potential variability in BTC price movements in the order book. Nevertheless, given the status of issuers such as BlackRock, Fidelity, Invesco and Ark Invest in the SEC queue, the current favorable macroeconomic environment for alternative monetary assets and expected improved liquidity conditions, Lawant remains optimistic about BTC’s potential price appreciation post the ETF. debut. He concluded with: “Ceteris paribus, I am still excited about how the BTC price might react to the launch of the ETF.”

At the time of writing, BTC was trading at $34,542.

Featured image from Shutterstock, chart from TradingView.com