- Sentiment in the short term behind Bitcoin was Bullish and a move to $ 87k is possible

- The start of an accumulation phase can fascinate the sentiment of investors in the long term

Bitcoin [BTC] Has seen a price increase of 13.2%over the past six days, with the crypto again above the most important short -term level at $ 81K. This level had been a strong support in mid -March, but was reversed against resistance in the first week of April.

Although these profits seemed to be Bullish, the famous market analyst Peter broke the move more correct than impulsive. He claimed that the Elliot golf theory, the current bounce, would probably be followed by a deeper price decrease. In fact, a target of $ 72k $ 74k was emphasized as a “max pain accumulation goal”.

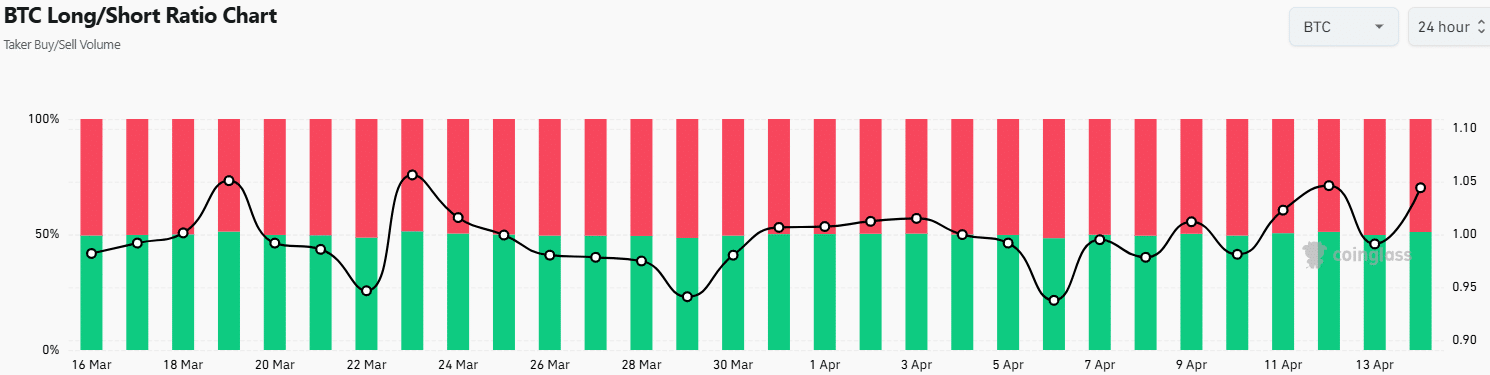

The volume of the Taker Buy/Sell showed that the long/short ratio was 1.04. In other words, 51% of the Taker volume was long, which pointed to a bullish sentiment in the short term. Can BTC Bulls maintain this, or will the prediction of the corrective phase come true?

Potential for a Bitcoin -accumulation phase

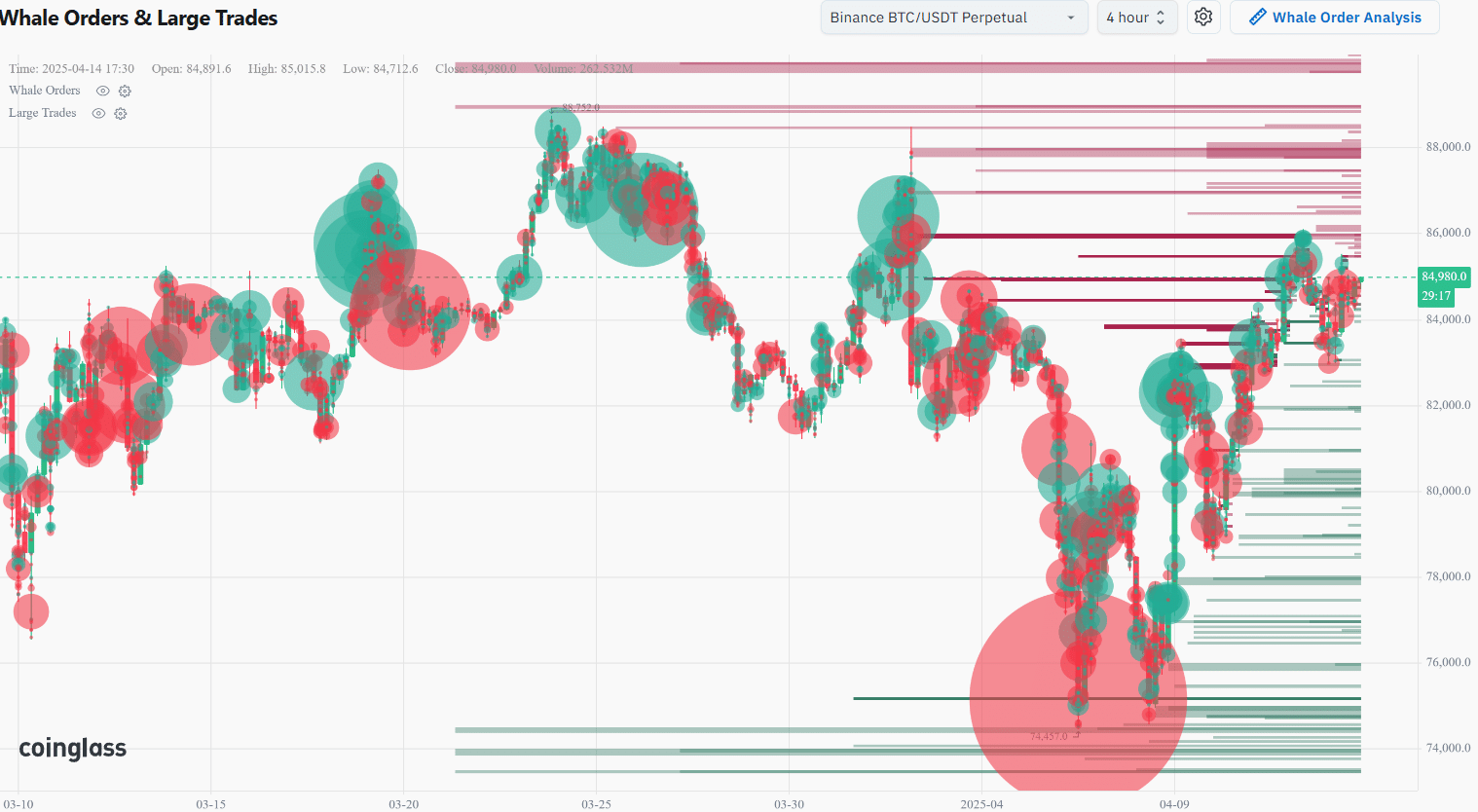

The Whale Orders -Grafiek from Coinglass showed a considerable sales wall for $ 86k, $ 88k and for $ 91k. That is why traders can use these levels in a long position in the coming days to take a profit.

The whale sales volume earlier on Monday indicated a few large sales orders, but this was not enough to stop the slow climb to $ 85k.

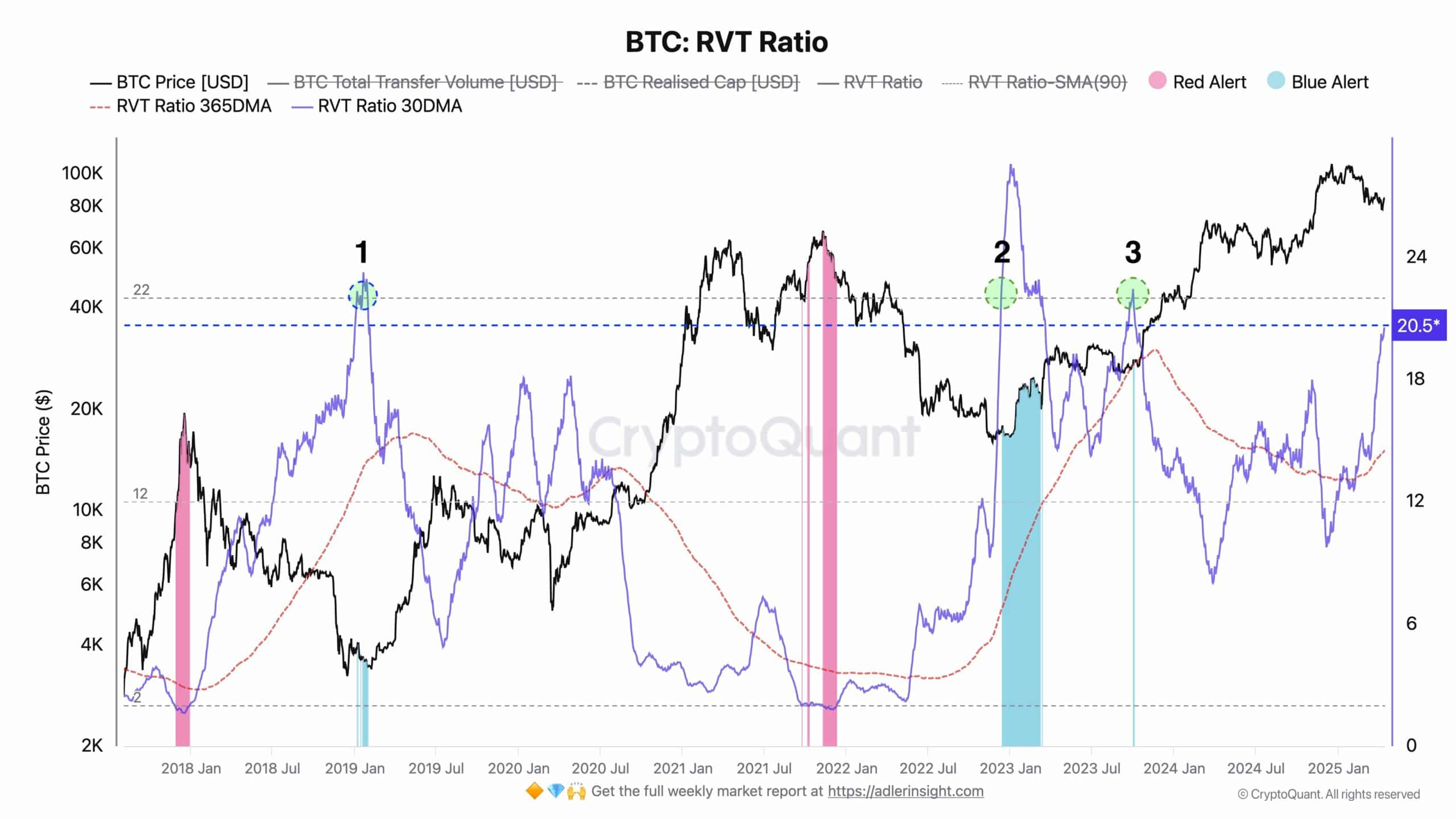

For investors with a higher time horizon, the findings of Crypto analyst Axel Adler JR Would be more relevant. The analyst observed in one Post on X The fact that the Bitcoin realizes the value for transaction volumeratio (RVT) can be about to activate a bullish signal.

The Supervisory Board is a counterpart to the network value and transaction volume (NVT) ratio, but with a higher conviction. Both ratios are related to the P/E ratio that is used for the appreciation of companies and their shares. The Supervisory Board uses the realized cap instead of market capitalization in its calculation, making it also less volatile.

The 30-day advancing average of the RVT Metric was at 20.5 and the climb beyond 22 generally marks a battery phase. This would indicate that a large amount of capital on the network does not participate in daily transactions, which signals accumulation.

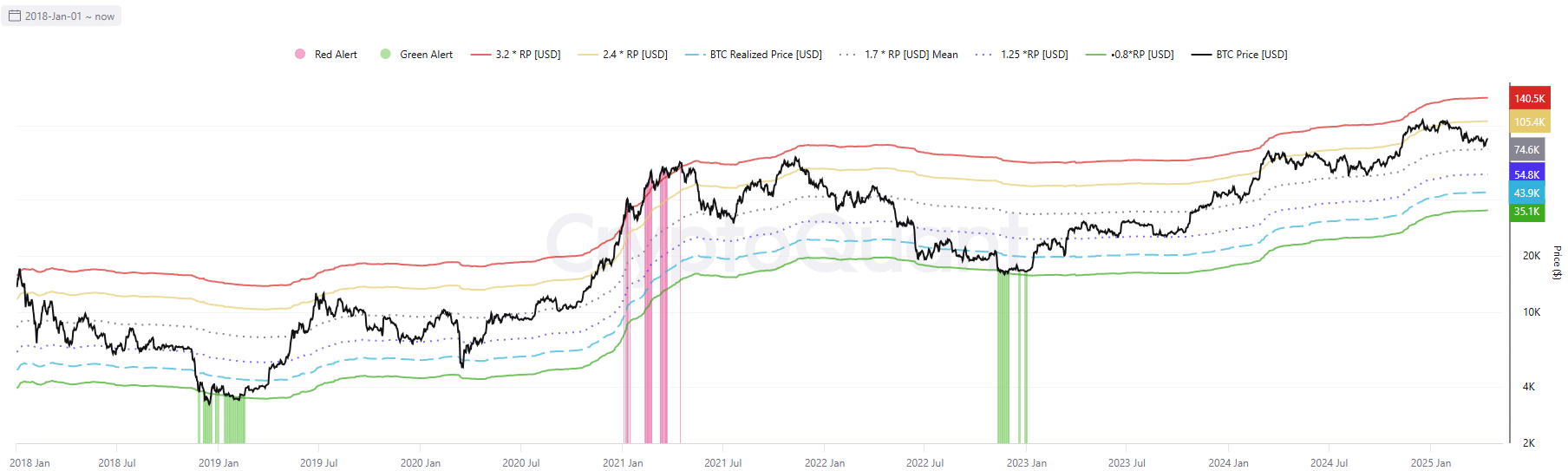

The realized price tires of Bitcoin also meant a potential price bouncing to $ 105k or higher. In the past two weeks they bounced higher from the 1.7RP at $ 74.6K (the price realized was at $ 43.9k at the time of the press).

The 1.7RP was tested in September last time. In the following months, a bouncer was over 2.4rp materialized. Whether BTC would continue the current corrective phase and test $ 74k again before such a bouncer is now unclear. However, an BTC accumulation phase is also something that can positively influence the price trends.