In recent months, there has been an increase in the number of crypto professionals’ bank accounts that have been frozen or restricted in the UK, US and EU. They say that often you don’t care until it happens to you; Well, this week it did. To my genuine surprise, it came from the one place I least expected it.

Revolut has long been considered the most crypto-friendly bank in the UK, offering in-app crypto purchases and finally adding the ability to send and receive crypto in 2023, albeit with certain restrictions. However, recent events have called into question the bank’s commitment to providing a seamless experience to its cryptocurrency customers.

Despite Britain no longer being part of the European Union, under which the EU’s MiCA regulations apply, the newly implemented Travel Rule requires similar disclosures. This means that users are now required to disclose and identify the owners of unhosted wallets who are the recipients of withdrawals from Revolut.

However, UK crypto companies are allowed to apply a risk-based approach to determining when to collect information about non-hosted wallets. They simply need the ability to identify where their customers are transacting with unhosted wallets and assess the risks of those transactions.

How the UK’s most crypto-friendly bank froze my 0.23ETH account

Two days ago I bought a modest 0.23 ETH (£550) via the Revolut app and attempted to transfer the funds to my personal Ethereum wallet, which is linked to a well-known ENS domain. To my surprise, Revolut blocked the transaction and deducted charges from the account. In addition, my entire bank account, including a joint account with my wife, was frozen.

After several hours of frustration and confusion, the account was finally unblocked and the fees refunded after another request. However, the specific wallet address remains blocked, preventing me from sending money to that account. This experience has made me question the true nature of Revolut’s supposed crypto-friendliness. Considering the alternatives in Britain, Revolut remains the best option for those dissatisfied with traditional banks, but the bar is low. I believe incidents like this have less to do with Revolut being ‘anti-crypto’ and more to do with fear of retaliation from regulators.

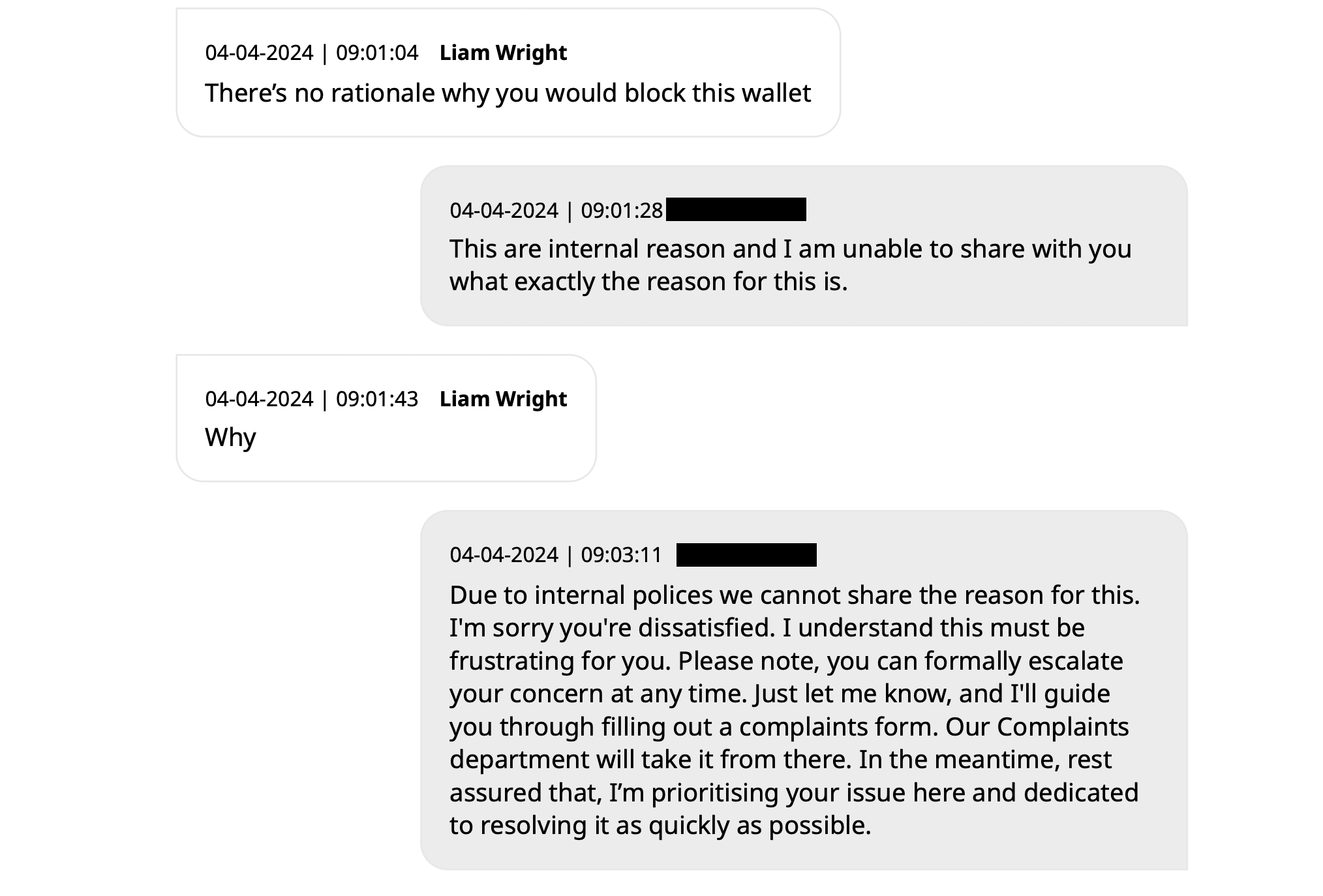

Yet, the transcript of the chat between Revolut’s support team and me shows a lack of transparency regarding the reasons behind the account freeze and wallet address blocking. The aid representatives were unable to provide a clear explanation, citing internal policies that prevent them from sharing the specific reasons for these actions.

This incident raises concerns about the autonomy and control Revolut users have over their own money, especially when it comes to digital asset transactions. Blocking a personal wallet address without a satisfactory explanation undermines confidence in the bank’s ability to facilitate smooth crypto transactions.

As Britain navigates the post-Brexit financial landscape, banks like Revolut must strike a balance between regulatory compliance and providing a user-friendly experience for their customers. The strict enforcement of laws and lack of transparency in addressing account and wallet issues risks alienating crypto users who rely on these services. This is especially true as the company wants to open a dedicated crypto exchange offering.

Debanking of crypto users in the United States

In the United States, even crypto users who have been long-time customers of traditional banks are facing account closures due to their involvement with digital assets. John Paller, co-founder of ETH Denver, recently shared his experience on Twitter, revealing that Wells Fargo bailed him out after 26 years of patronage and millions in fees paid. Paller’s checking, savings, credit card, personal line, non-profit and business accounts were all closed without explanation, despite him not using his personal accounts for crypto purchases in recent times.

Caitlin Long, founder and CEO of Custodia Bank, responded to Paller’s tweet, noting a significant increase in inquiries from crypto companies urgently trying to replace bank accounts closed by their banks. She called this trend a new wave of “Operation Choke Point 2.0,” indicating a full-on witch hunt for crypto-related companies.

Bob Summerwill, director of the Ethereum Classic Cooperative, echoed the sentiment and emphasized the need for banks like Custodia. He shared his own experiences with PayPal, which closed the Ethereum Classic Cooperative’s account without providing specific reasons, stating only that the decision was permanent and could not be reversed.

These incidents highlight a growing concern within the crypto community: Even those who have built relationships with traditional banks and have a history of compliance are at risk of losing access to banking services. The lack of transparency and abrupt nature of these account closures raise questions about the underlying motivations behind these actions and the potential impact on the growth and adoption of cryptocurrencies in the United States.

Positive friction really just means a terrible user experience

Anecdotally, I have also heard of at least five other individuals working in crypto who regularly move significant sums of FIAT money through traditional banks with accounts frozen. I’m not advocating a Wild West; common sense regulation is all I ask.

The UK’s approach to regulation also includes what it considers ‘positive friction’. The concept refers to a set of regulatory measures designed to introduce certain barriers or controls that slow down the process of investing in digital assets. These measures are intended to counteract social and emotional pressures that could lead individuals to make hasty or ill-informed investment decisions. The Financial Conduct Authority (FCA) has introduced these ‘positive frictions’ as part of its financial promotion legislation, with the aim of improving consumer protection in the crypto market.

Specific examples of “positive friction” include personalized risk alerts and a 24-hour cooling-off period for new investors to a company. These measures are intended to ensure that individuals are adequately informed of the risks associated with crypto investments and have sufficient time to reconsider their investment decisions without the influence of immediate emotional or social pressure.

The reality is a series of questions designed to deter new investors, followed by an ugly banner warning at the top of every crypto app that seemingly never goes away even after you’ve met all the requirements.

I would like to know when the government will test fractional reserve banking for all traditional finance customers? We need to be aware of the nuances of government regulation in crypto, such as who the FCA oversees and whether a white paper is required. Suppose we asked ten people on the street what would happen if you deposited money into their checking account. I wonder how many people would pass the test?

How many know that US and UK banks’ reserve requirements are 0%? Previous limits of 5 to 10% were abolished in 2020, and now it is up to the bank’s discretion how much of its customers’ money is actually held in cash. Therefore, it is perfectly legal for a bank to make a deposit of £1,000 and lend the total amount to another party.

Of course, traditional financing is regulated and money is ‘guaranteed’ by government insurance, so we don’t have to worry. Let’s just not look back to 2008, when we still had to rely on such tools, okay? It took less than 10% of customers to withdraw money from Northern Rock before it collapsed.

Banks don’t have all your money; well-managed crypto exchanges and self-custodial wallets do, but the regulations suggest we should be terrified of crypto?

I think it’s the banks that are terrified.

I asked Revolut’s support and X teams if the PR department would comment on my situation ahead of this op-ed, but the question was repeatedly ignored.