- Bitcoin’s short -term holder has increased. Is this shown that a potential market shift or continuous uncertainty?

- The most important resistance in the vicinity of $ 87,000 can determine BTC’s next outbreak, because holders adjust their positions in the short term.

Bitcoin’s [BTC] Price promotion has caused remarkable shifts in market participation, especially with holders in the short term [STH].

Recent data shows that STH supply has increased considerably in the past month, which is a reflection of renewed speculative interest, because BTC tries to reclaim the most important resistance levels.

Does this set up a bullish continuation, or are short -term holders set up a distribution phase?

The influence of short -term holders on the Bitcoin price trend

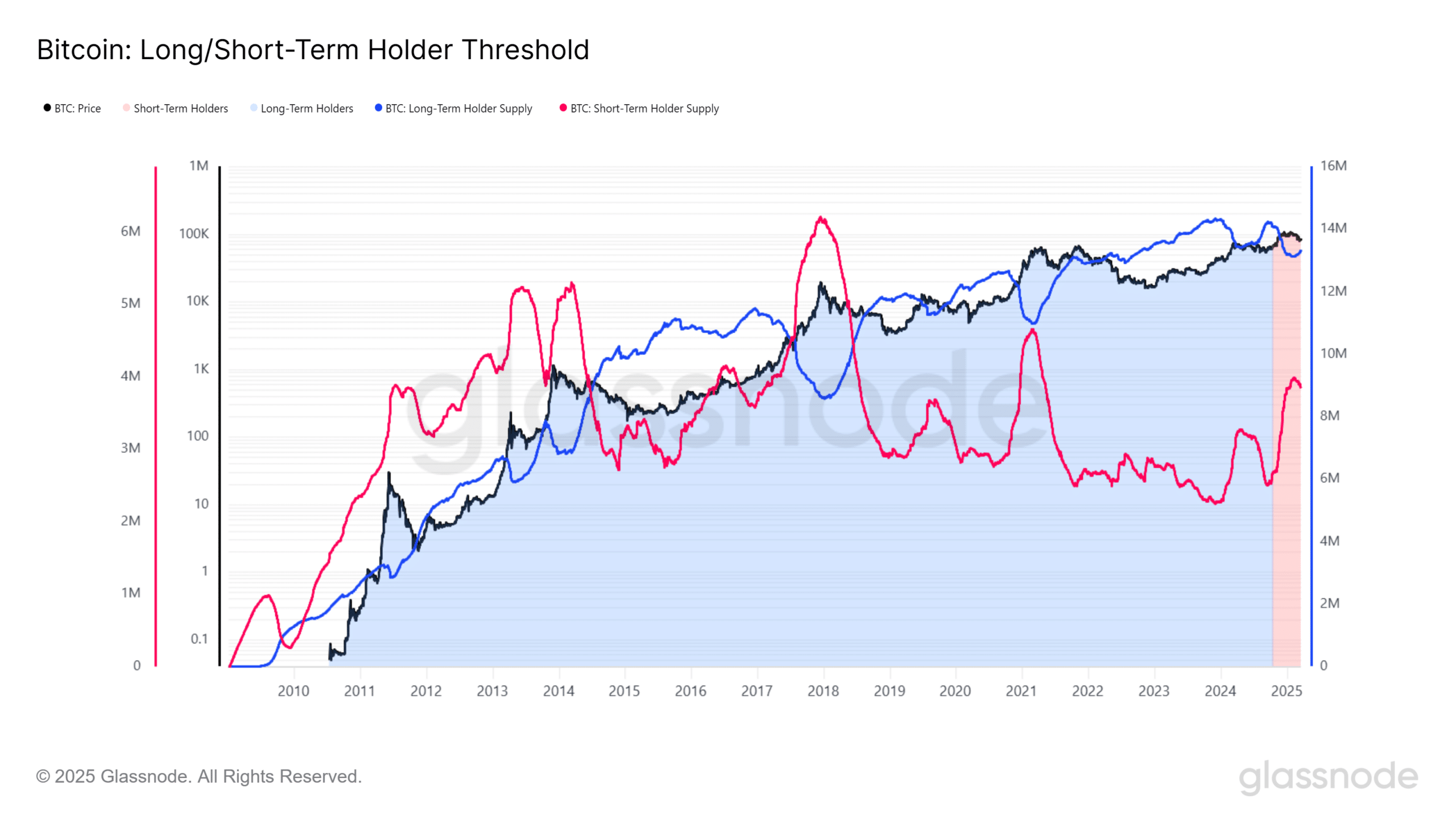

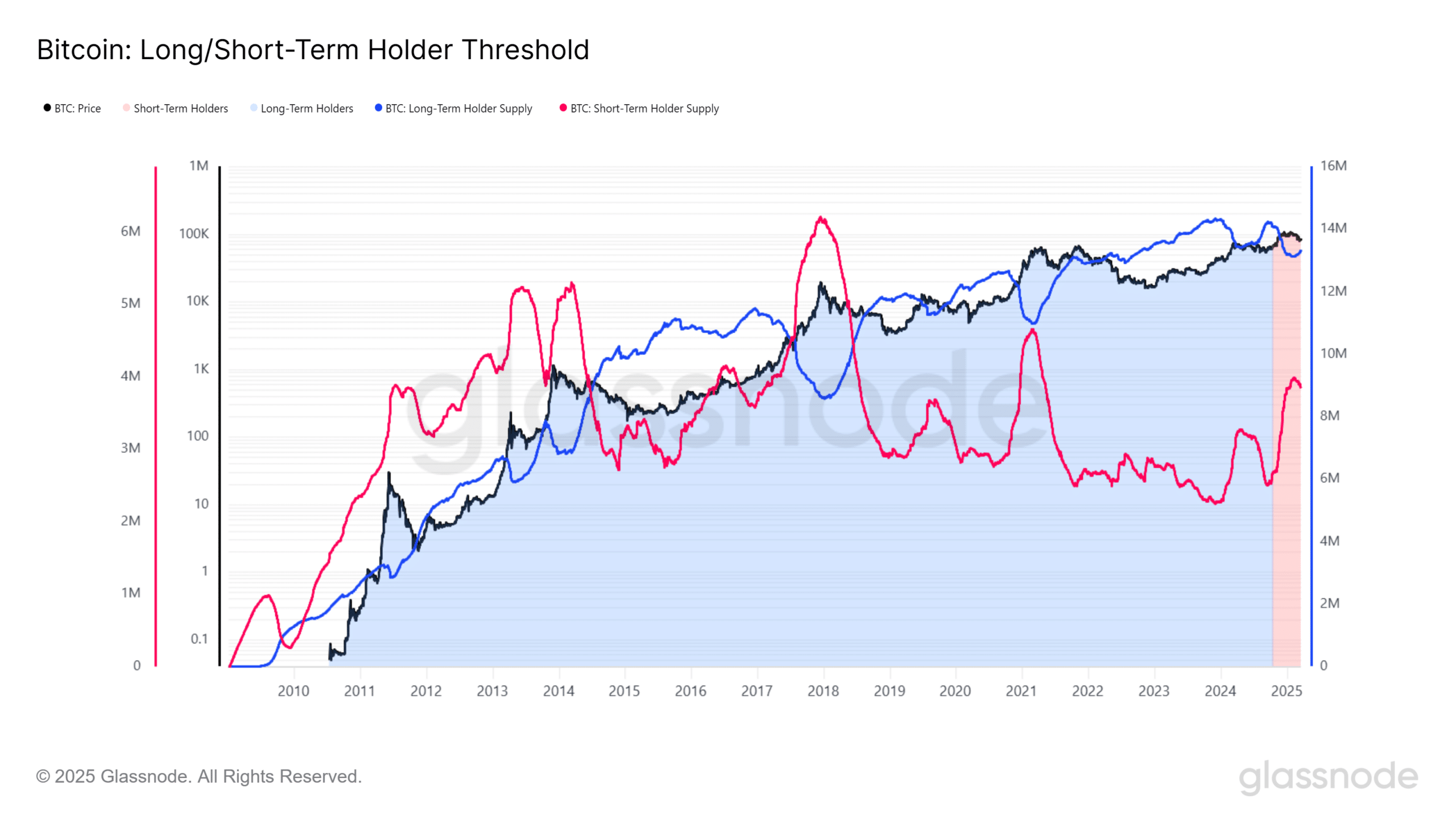

Glassnode’s Long/short -term holder [LTH/STH] Threshold data suggests that STH Supply has seen a strong increase in correlation with the recent price repair from Bitcoin to $ 85,856.

Historically, an increase in STH companies often indicates an increased trading activity during an upward trend, which leads to persistent bullish momentum or profitable that the price growth turns.

Source: Glassnode

The newest graph shows that although holders in the long term [LTH] Maintaining a dominant position, the recent increase in STH Supply suggests a shift in market sentiment.

STH offering tends to rise when new market participants arrive during a rally, but if taking profit power accelerates, this can add the sales pressure that limits the upward potential of BTC.

Important BTC prize levels and market implications

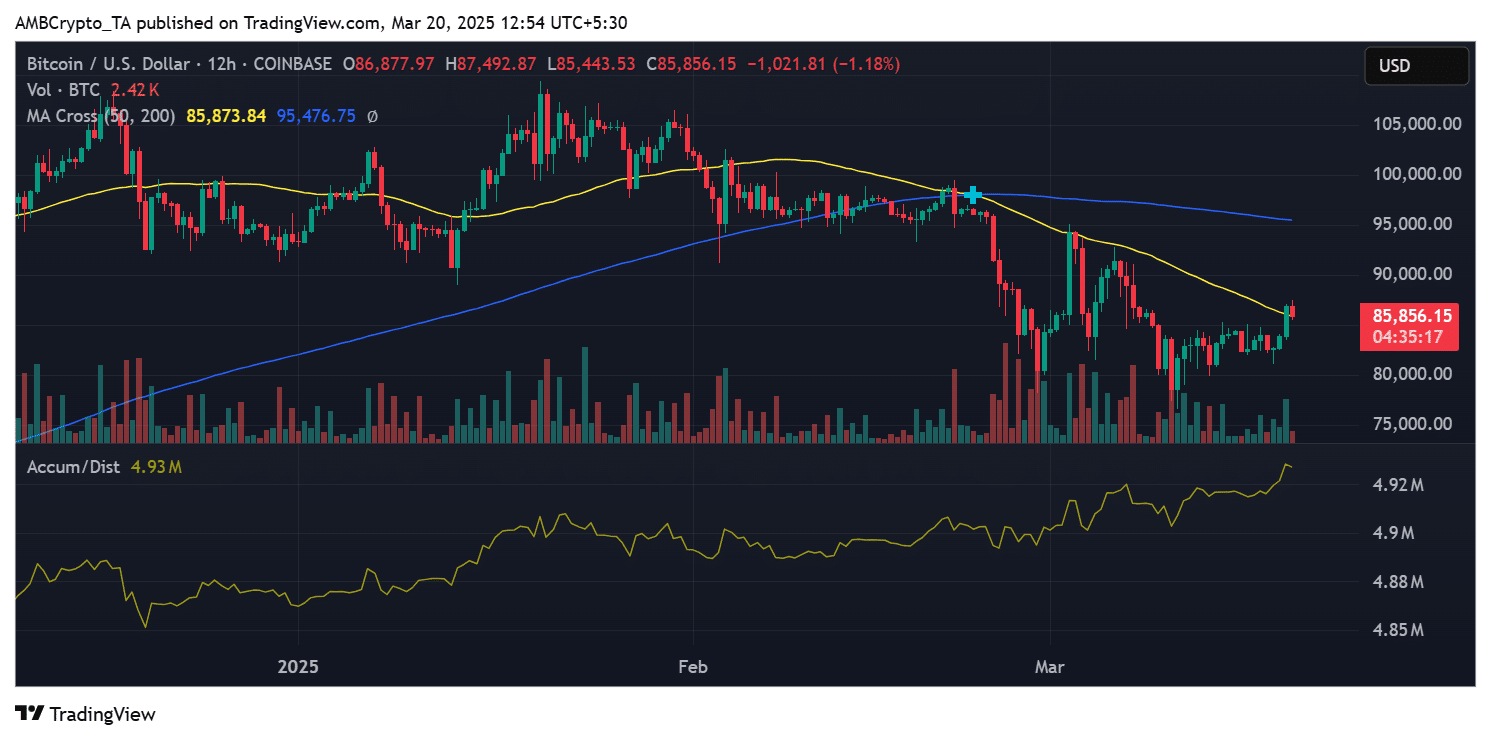

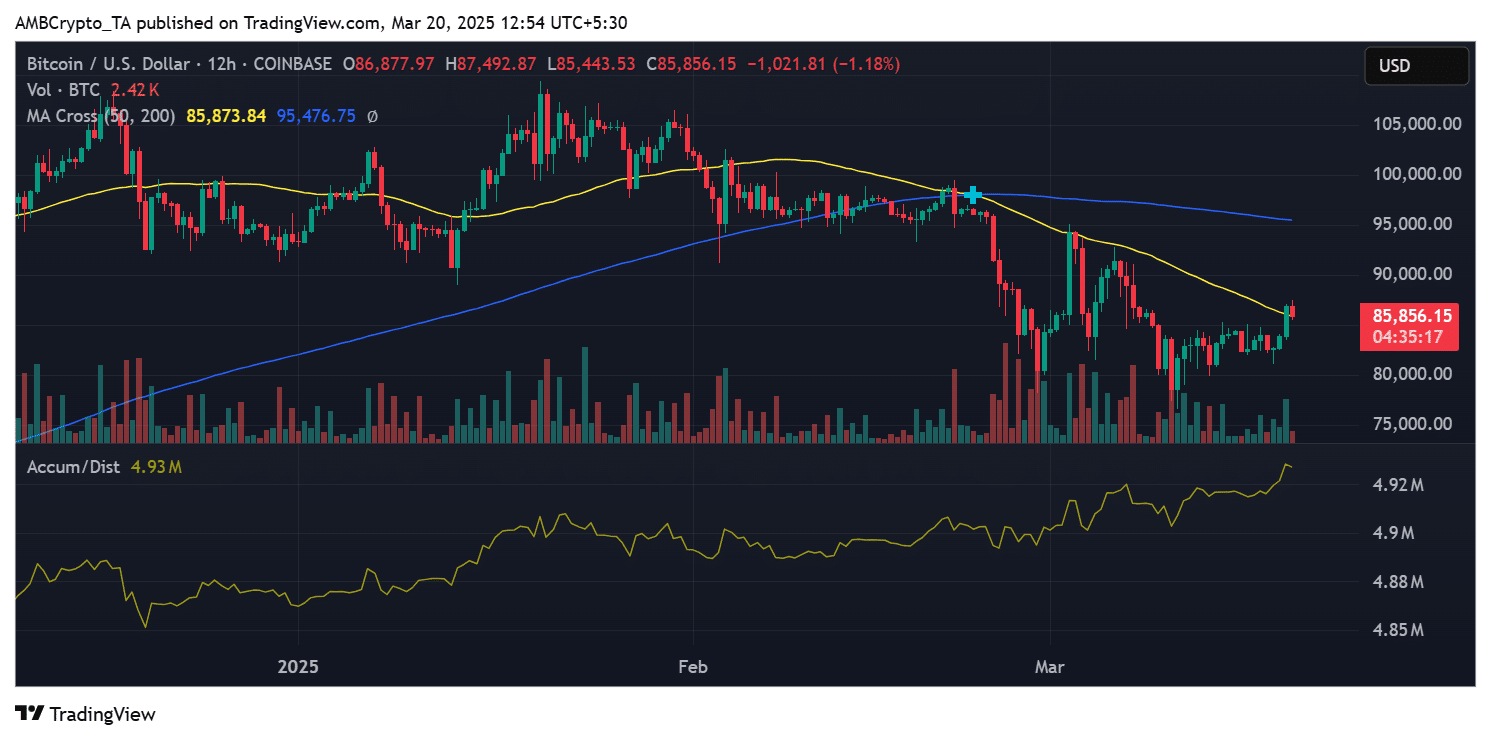

The price of Bitcoin was $ 85,856 at the time of the press, the testing of resistance near its 50-day advancing average at $ 85,873.

If holders continue to accumulate in the short term and stick to their positions, BTC could try an outbreak in the direction of the 200-day advancing average at $ 95,476.

However, if STHs start unloading their possession at resistance levels, BTC can get a correction in the direction of the support range of $ 82,500- $ 83,000.

Source: TradingView

Another critical factor are accumulation trends. At the moment, the accumulation/distribution -indicator showed an increasing trend at 4.93 million BTC, which points to the current question.

If this continues, it can form a basis for BTC to stabilize and push higher.

Continue upside down or volatility for BTC?

The recent increase in STH offer emphasizes the growing activities of the trader, which can either support further upside down or can lead to volatility in the short term.

The market reaction to the most important resistance levels will determine BTC’s next large move.

If the question remains strong, Bitcoin could regain his bullish momentum, but if the sales pressure increases, a deeper withdrawal can be on the horizon.