This article is available in Spanish.

In his last essay titled “Black or White?” Arthur Hayes, co-founder and former CEO of crypto exchange BitMEX, explains an analysis that predicts Bitcoin could soar to $1 million. Hayes argues that upcoming US economic policies under Donald Trump’s second term could set the stage for unprecedented Bitcoin growth.

Hayes draws parallels between the economic strategies of the United States and China and introduces the term ‘American capitalism with Chinese characteristics’. He suggests that the US, similar to the Chinese approach under Deng Xiaoping and continued by Xi Jinping, is moving towards a system in which the primary goal of government is to maintain power, regardless of whether the policies are capitalist, socialist or fascist .

Why the Fiat system is broken

“Like Deng, the elite who govern Pax Americana do not care whether the economic system is capitalist, socialist or fascist, but whether the policies implemented help them maintain their power,” Hayes writes. He emphasizes that America in the early 20th century is no longer purely capitalist, noting: “Capitalism means that the rich lose money when they make bad decisions. That was banned back in 1913 when the US Federal Reserve was established.”

Hayes criticizes the historic shift from trickle-down economics to direct stimulus measures, particularly those implemented during the COVID-19 pandemic. He distinguishes between ‘QE for the rich’ and ‘QE for the poor’, highlighting how direct stimulus measures for the general population boosted economic growth, while quantitative easing mainly benefited wealthy asset owners.

Related reading

“From the second quarter of 2020 to the first quarter of 2023, Presidents Trump and Biden bucked the trend. Their Treasury Departments have issued debt that the Fed has bought using printed dollars (QE), but instead of handing it out to the rich. [individuals]the Treasury Department sent checks to everyone,” he explains. This led to a decline in the US debt-to-nominal GDP ratio as the increased purchasing power of the average citizen stimulated real economic activity.

Looking ahead, Hayes expects that Trump’s return to power will usher in policies aimed at relocating crucial industries to the US, financed by expansionary government spending and bank credit growth. He points to Scott Bassett, who he believes will be Trump’s pick for Treasury Secretary, noting that Bassett’s speeches outline plans to “boost nominal GDP by providing government tax credits and subsidies to crucial industries .”

“The plan is to increase nominal GDP by providing tax credits and subsidies to the government to revive crucial industries (shipbuilding, semiconductor factories, car manufacturing, etc.). Eligible companies will then receive cheap bank financing,” says Hayes.

He warns that such policies would lead to significant inflation and currency depreciation, harming holders of long-term bonds or savings deposits. To hedge against this, Hayes advocates investing in assets such as Bitcoin and gold. “Instead of saving in fiat bonds or bank deposits, buy gold (the hedge against boomer financial repression) or Bitcoin (the hedge against millennial financial repression),” he advises.

Related reading

Hayes supports his argument by analyzing the operation of monetary policy and the creation of bank credits. He illustrates how ‘QE for the poor’ can stimulate economic growth through higher consumer spending, in contrast to ‘QE for the rich’, which inflates asset prices without contributing to real economic activity.

“QE for poor people stimulates economic growth. The Treasury handing out stimmies encouraged the plebes to buy trucks. The demand for goods allowed Ford to pay its employees and apply for a loan to increase production,” he explains.

Furthermore, Hayes discusses possible regulatory changes, such as exempting banks from the Supplemental Leverage Ratio (SLR), which would allow them to purchase an unlimited amount of government bonds without additional capital requirements. He argues that this would pave the way for “infinite quantitative easing” aimed at productive sectors of the economy.

“If government bonds, central bank reserves and/or approved corporate bonds were exempted from the SLR, a bank could buy an infinite amount of debt without having to burden itself with expensive shares,” he explains. “The Fed has the power to grant an exemption. That is exactly what they did from April 2020 to March 2021.”

How Bitcoin Could Reach $1 Million

Hayes believes that the combination of aggressive fiscal policy and regulatory changes will result in an explosion of bank credit, leading to higher inflation and a weakening of the US dollar:

The combination of legislated industrial policy and the SLR exemption will result in a flow of bank credits. I’ve already shown how the monetary velocity of such policies is much higher than that of traditional QE for rich people under Fed supervision. Therefore, we can expect Bitcoin and crypto to perform as well, if not better, than they did between March 2020 and November 2021.

In such an environment, he claims that Bitcoin will benefit the most due to its scarcity and decentralized nature. “This is how Bitcoin goes to $1 million because prices are set at the margin. As Bitcoin’s freely traded supply diminishes, most fiat money in history will look for a safe haven,” he predicts. Hayes supports this claim by pointing to his custom index that tracks US bank credit supply, which shows that Bitcoin has outperformed other assets when adjusted for bank credit growth.

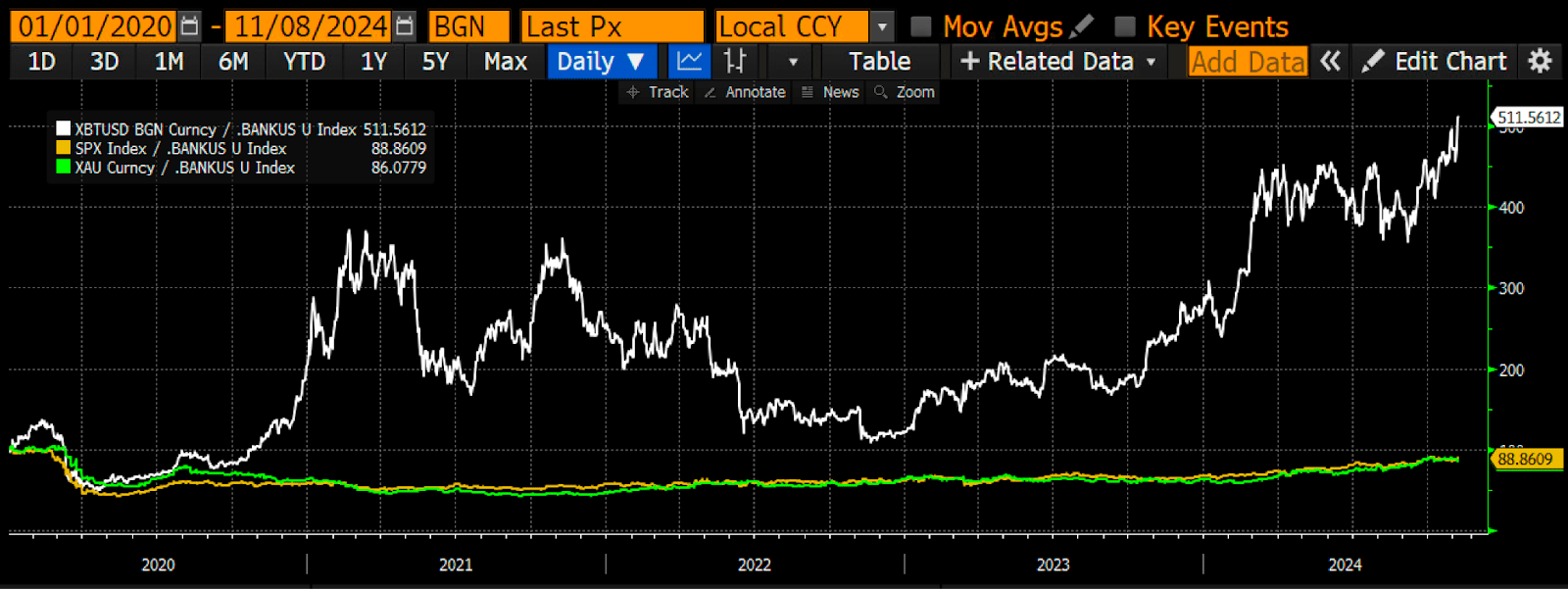

“What is [..] What is important is how an asset performs when it is deflated by the supply of bank credit. Bitcoin (white), the S&P 500 Index (gold), and gold (green) are all divided by my bank credit index. The values are indexed at 100, and as you can see, Bitcoin is the standout, up over 400% since 2020. If there’s only one thing you can do to counter the fiat decline, it’s Bitcoin. You can’t argue with the math,” he claims.

Concluding his essay, Hayes urges investors to position themselves accordingly in anticipation of these macroeconomic shifts. “Grow tall and stay tall. If you doubt my analysis of QE’s impact on poor people, just read Chinese economic history over the past thirty years, and you will understand why I call the new economic system of Pax Americana “American Capitalism with Chinese Characteristics.” he advises.

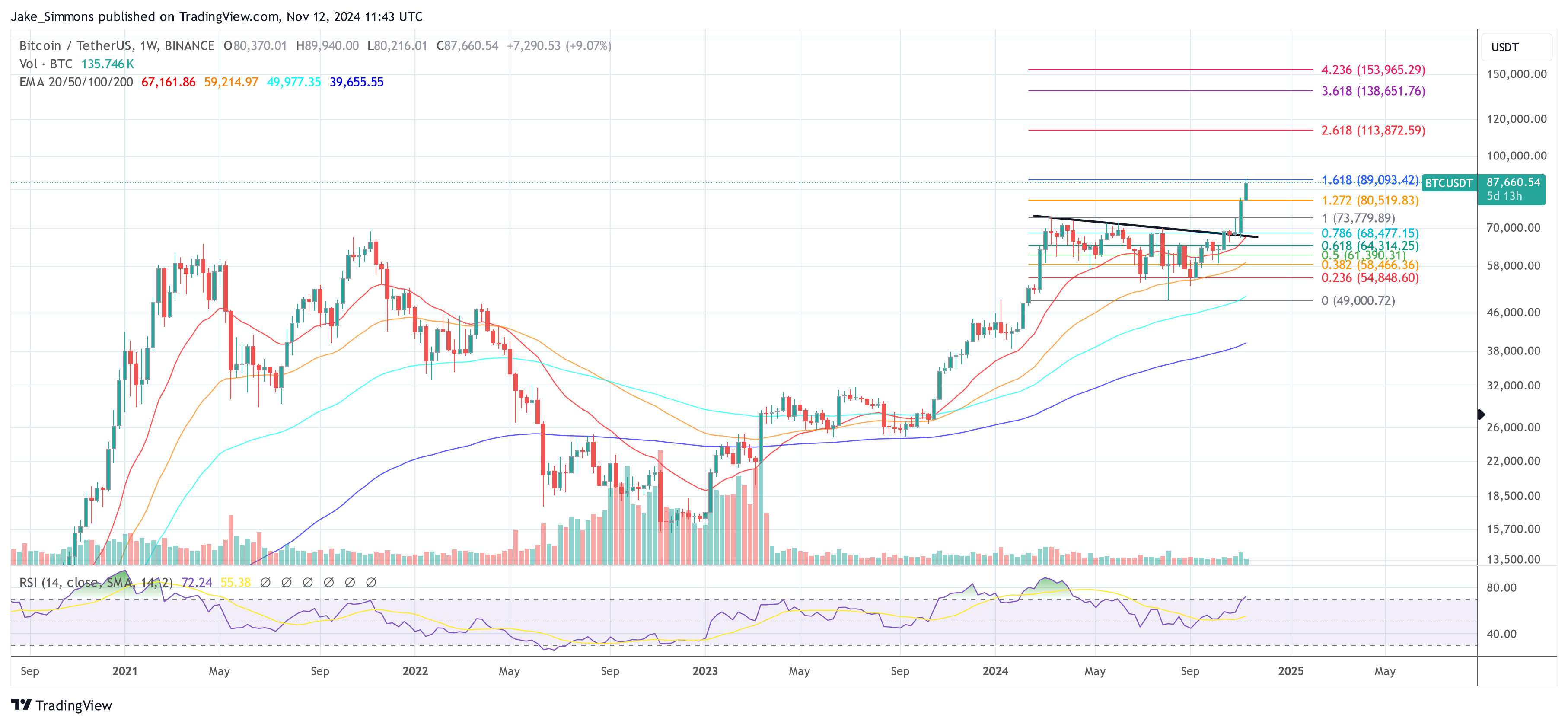

At the time of writing, BTC was trading at $87,660.

Featured image from YouTube, chart from TradingView.com