Este Artículo También Está Disponible and Español.

In a memorandum published on Tuesday, Jurrien Timmer, director of Global Macro, discusses at Fidelity Investments, how a shifting economic landscape could influence the markets, central banking policy and the process of both Bitcoin and Gold. With the S&P 500 that affects new highlights and the so-called “Trump Trade” reversing course, Timmer offers nuanced insights into tax policy, inflation and role of risk assets in a “limbo” market environment.

The Trump effect

Carpenter perceive that the first six weeks of 2025 have brought unexpected market movements and an unusually high “noise signal ratio”. The dominant market expectation that comes in the year – the “higher yields, a stronger dollar and the better performance of US shares” – is abruptly reversed. He notes: “It seems so 2025 that the consensus trade in higher yields, a stronger dollar and the better performance of US shares in the opposite has become the opposite.”

Timmer emphasizes that Bitcoin, fresh from an end of the year, remains on top of the rolling return of three months, closely followed by gold, Chinese shares, raw materials and European markets. At the bottom of the table, the American dollar and treasure chests raise the back.

Related lecture

Despite the record levels of the S&P 500, Timmer calls this a “digestion period” after the optimism after the elections. He explains that the market under the headline index is much less decisive. According to Timmer, the equivalent index remains on hold, with only 55% of the shares that are traded above their 50-day advanced averages.

“Sentiment is bullish, credit spreads are narrow, the Equity Risk Premium (ERP) is in the 10th decile and the VIX is 15. The market seems priced for success.” Timmer underlines that although profit growth was robust by 11% in 2024, revisions seem faint, and there are open questions about what could happen if the long -term rates to 5% or then climb.

One of the most critical pieces of Timmer’s analysis focuses on the policy of the Federal Reserve. He points to the recent CPI report, with a year-on-year core inflation of 3.5%, as an near-consensus indicator that the FED will remain in break. “It is now almost unanimous that the Fed will be on hold for some time. That’s right, in my opinion. If neutral is 4%, I believe that the Fed must be a smidge above that level, given the potential probability that ‘3 the new 2.’ Is ”

He warns of the possibility of a ‘premature pivot point’, and remembers the policy errors from the period 1966-1968, when the speed reductions took place too early, so that inflation could eventually gain a foothold.

With the Fed apparently put aside, Timmer believes that the next market driver for interest rates will come from the long side of the curve. In particular, he sees tension between two scenarios: one with endless deficiency expenditures and rising term premiums-it-made of share valuations and another emphasizing tax discipline, which would probably entail the long-term bond returns.

Timmer also notes that weekly unemployed claims can focus more sharply on bond markets, given how the government spending under the new administration can influence employment data.

Related lecture

Timmer points to a potentially bullish pattern-a main and shoulder floor-in the Bloomberg Commodity Spot Index. Although he stops mentioning a definitive shift, he notes that raw materials remain in a wider secular upward trend and can see renewed investor interests if the inflation pressure remains increased or tax conditions remain loose.

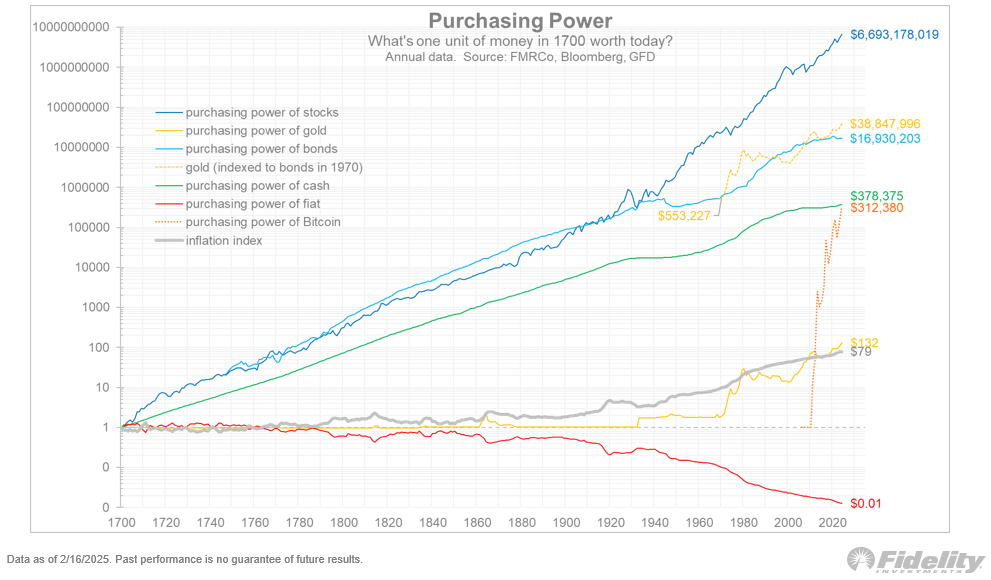

Gold, he notes, has been ‘a big winner’ in recent years and has surpasses the expectations of many skeptics: ‘Since 2020, it has produced almost the same return as the S&P 500 while it has lower volatility. In my opinion, gold remains an essential part of a diversified portfolio in a regime in which bonds can continue to be reduced. “

Timmer sees gold the critical level of $ 3,000 tests in the midst of a worldwide increase in money supply and a decrease in the real proceeds. Historically, gold has shown a strong negative correlation with real yields, although Timmer believes that the strength of the metal of Laat can also reflect the tax rather than monetary dynamics – in particular geopolitical demand from central banks in China and Russia.

Bitcoin vs. Gold

According to Timmer, the outperformance of both gold and bitcoin has ‘had a lot of conversation about monetary inflation’. However, he makes a distinction between the “amount of money” (the money supply) and the “price of money” (price inflation).

“The aim of this exercise is to show that the growth of traditional active prices over time cannot be explained alone by monetary debasement (which is a favorite pastime of some Bitcoiners),” he writes.

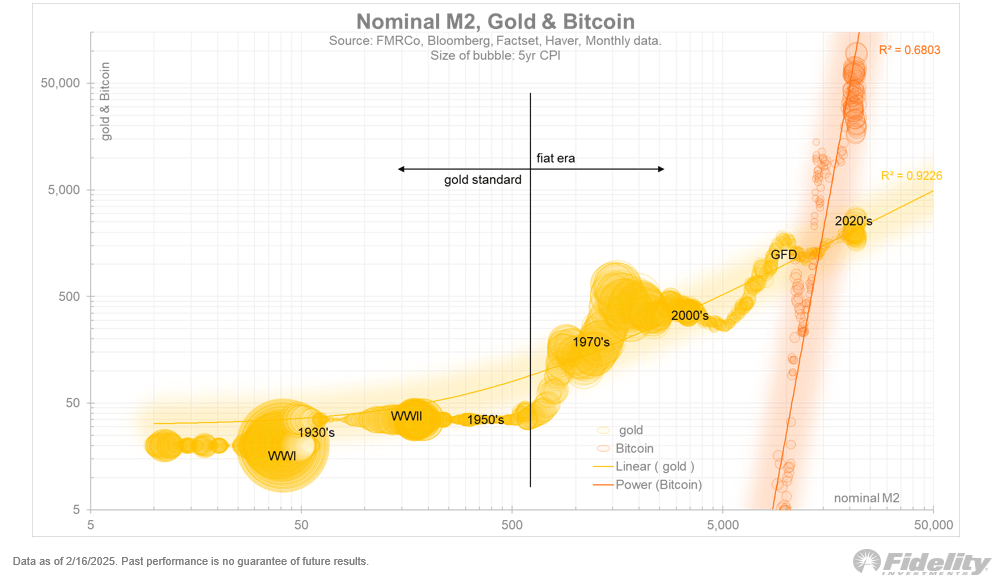

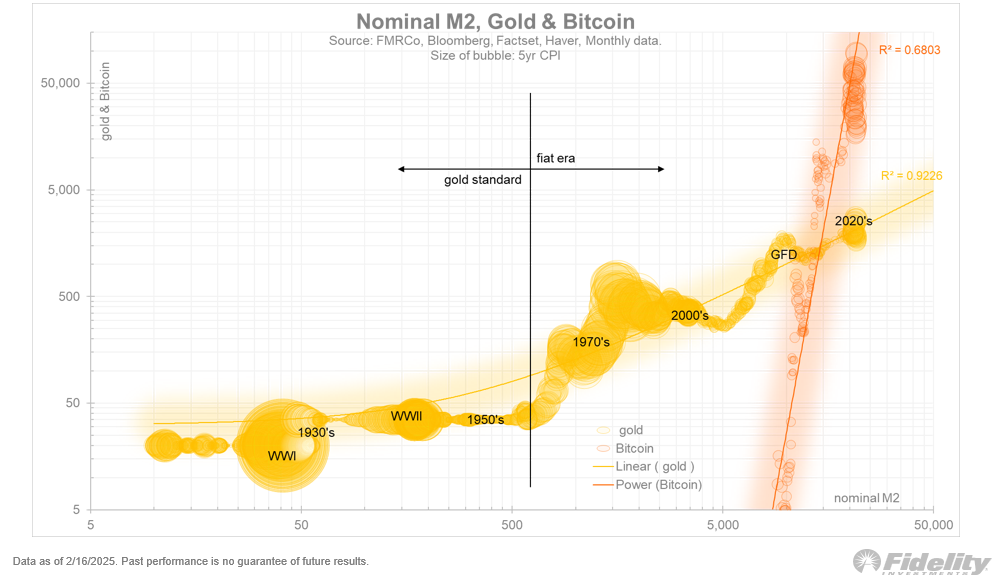

The graphs of Timmer suggest that although nominal M2 and the nominal GDP have moved near Lockstep for more than a century, the inflation of the consumer price (CPI) lagged behind the growth of money supply. He warns that adjusting asset prices can only cause misleading conclusions against M2.

Nevertheless, it notes from his analysis that both Bitcoin and Gold have strong correlations with M2, albeit in different ways: “It is interesting that there is a linear correlation between M2 and Gold, but a power curve between M2 and Bitcoin. Different players in the same team. “

Timmer emphasizes Gold’s long-term performance since 1970 and notes that it has actually kept the value created by many bond portfolios or even surpassed. He sees the role of Gold as a ‘hedge against bonds’, especially if sovereign debt markets remain under pressure due to tax deficits and higher long -term rates.

Timmer’s memorandum underlines that the strong performance of Bitcoin cannot be isolated from gold or the wider macro -economic environment. With proceeds in Flux and policymakers who struggle with shortages, investors can be forced to re -assess the traditional 60/40 portfolio model.

He emphasizes that although extensions from the past of the money supply have often stimulated inflation, the relationship is not always one on one. According to Timmer, the meteoric rise in Bitcoin could reflect a market perception that tax care – not just monetary policy – stimulate prices for assets. “And as you can see on the dotted Oranje Line and De Groene Lijn, Bitcoin has added the same amount of value that lasted more than 300 years to create,” he concluded.

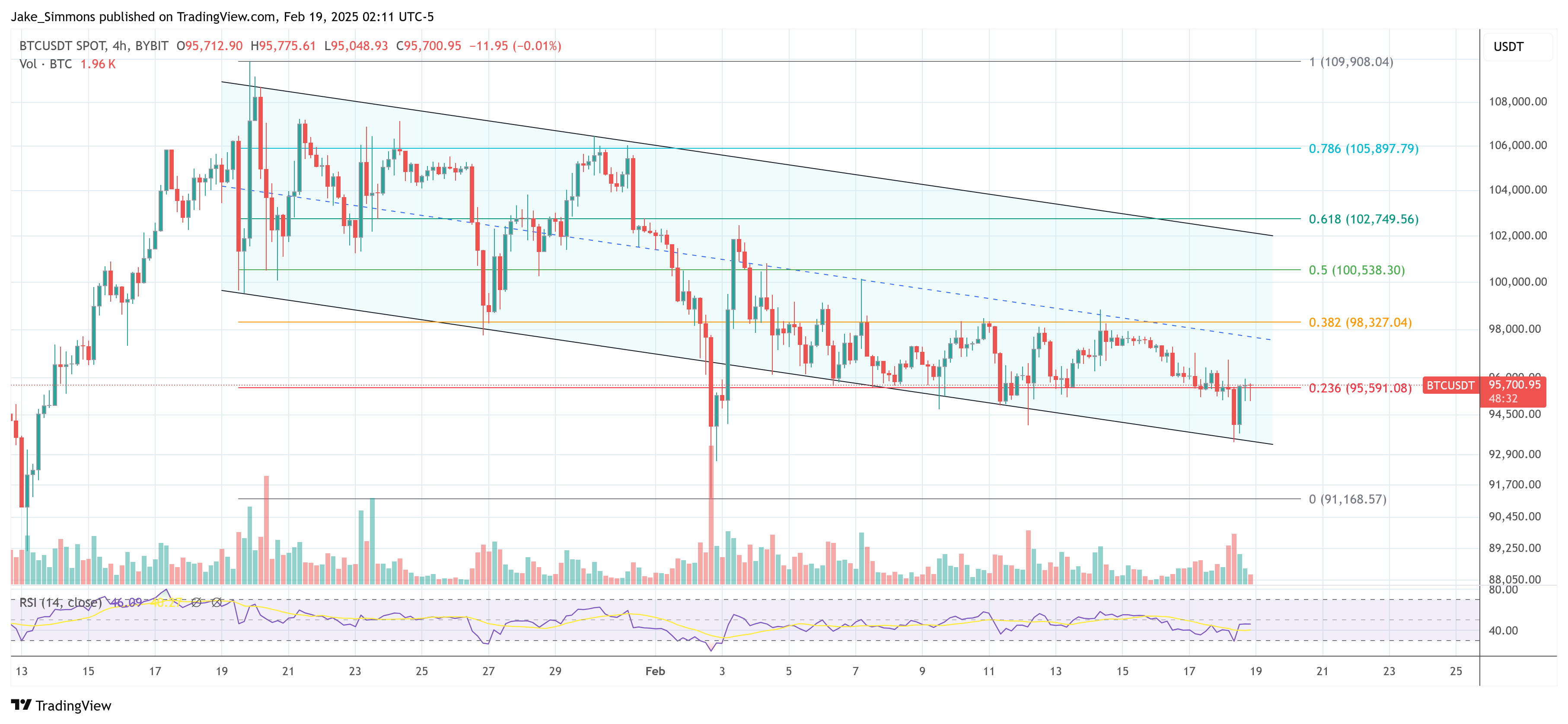

At the time of the press, BTC traded at $ 95,700.

Featured image of YouTube, graph of TradingView.com