This article is available in Spanish.

Crypto analyst Jelle has highlighted a bullish pattern on the Bitcoin chart, which he predicts could see its price rise to $90,000. He also provided a timeline for when this parabolic rally could begin. This comes amid a bullish outlook for the flagship crypto after the Fed interest rate cuts.

A falling wider wedge could send Bitcoin to $90,000

In one X messageJelle mentioned a descending widening wedge pattern that had formed on Bitcoin’s chart. He claimed that the pattern has a price target of $90,000 and added that he expects the price breakout to this target to begin in October. The analyst also noted that the fourth quarter of this year should be “fun” for Bitcoin.

Related reading

Based on history, it is indeed true Bitcoin could earn significant returns in October, November and December this year. The flagship crypto has achieved positive monthly returns in the fourth quarter of last year two half-lives. Furthermore, the fourth quarter always delivers the highest returns of the year for Bitcoin.

Meanwhile in another X messageJelle highlighted the key price levels that Bitcoin must rise above in order to rise to a level new all-time record (ATH) and this $90,000 price target. He noted that claiming $62,000 will be a good start for the flagship crypto and that once the price rises above $65,000, the train to a new ATH will not stop.

Bitcoin’s current ATH stands at $73,000, a price level reached earlier this year in March. However, analysts like Jelle have continued to suggest that it is still well below the crypto market peak this bull run. There is also the possibility that Bitcoin will rise above $100,000 during this bull run.

Standard Chartered predicts that BTC could reach this price level this year. The bank has also predicted that Bitcoin could rise to $150,000 if Donald Trump wins the election.

BTC’s bull case just got stronger

Jelle also mentioned that Bitcoin’s bull case strengthened following the Fed’s rate cuts. The The US Federal Reserve announced this a 50 basis points (bps) rate cut on September 18, a move widely considered bullish for the flagship crypto. The crypto analyst said that expansionary policies are in the offing as looser monetary policy has been reintroduced.

Related reading

More liquidity is expected to flow into risky assets like Bitcoin, leading to a surge in the crypto price, which has been stagnant for a while due to low demand. The bulls also appear to be back after the rate cuts, which could mean a bullish reversal for BTC.

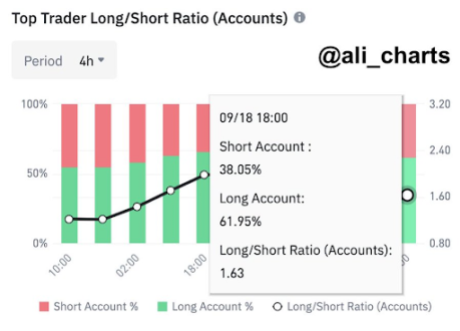

Crypto analyst Ali Martinez recently revealed that 61.95% of top traders on Binance are going long on the flagship crypto. Previously, there was a bearish sentiment among these traders, such as NewsBTC reported that 51.41% of them shorted Bitcoin.

At the time of writing, Bitcoin is trading around $61,900, up more than 2% in the past 24 hours. facts from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com