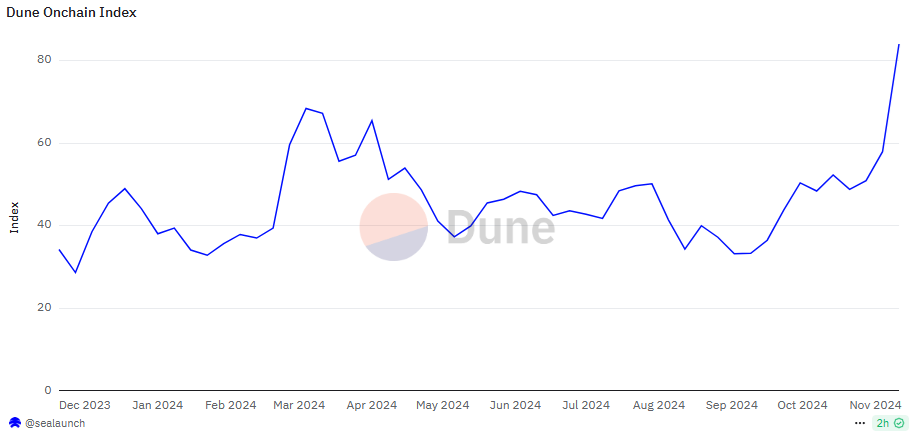

The Dune index, which tracks on-chain activity and user profiles, points to a new record in crypto adoption. The activity depends on top chains, including Bitcoin (BTC), and points to both portfolio growth and token turnover.

The Dune Index points to an all-time high in crypto adoption, following a steady growth trend since September. The index grew from a local low of 33 points to 84 points, coinciding with Bitcoin (BTC)’s all-time high above $99,600. Cryptocurrency adoption data surpassed the market peak in March and reflected the most successful weeks of the bull market in the last quarter. The index points to the most valuable networks and the most common applications for crypto.

The Dune crypto adoption index hit a new all-time high of 84 points after new price records for Solana and Bitcoin. | Source: Dune Analytics

The overall Dune index depends on chains achieving an optimal mix of fees, dollar transfer volumes, and the number of on-chain transactions. The normalized index shows which chains have more vibrant economic activity. The index weights value and costs more heavily than raw trades because some chains have low-quality volumes. As a result, Dune filters out some chains that report high traffic but without enough app activity or value transfers.

In the fourth quarter, Solana, Bitcoin and Ethereum were the leading chains driving adoption. TRON ranked fourth, albeit with a different focused ecosystem. The index fluctuates per chain, depending on current circumstances. Some of the former leaders lost their footprint in the index, with outflows from Arbitrum, Avalanche and Base.

Solana will be the biggest net gainer based on its Dune index

The Dune index also measures the success of specific chains. Solana had the largest index change, underscoring its emergence as the chain for the largest influx of new users. On a weekly basis, Solana also saw net gains in adoption, while most other top L2 and other networks saw their usage index decline. Solana also achieved a result 3.442% growth in on-chain fees due to demand for fast DEX swaps.

Base had the second highest annual growth, but was stagnant in the short term. One of the reasons for the lower adoption is the observation that L2 chains weren’t really taking advantage of the meme token trend. Technically, almost all L2 chains could carry meme tokens. The base was specially equipped and even held a chain for a summer to pilot meme tokens for fun. In the short term, Gnosis saw the strongest month-over-month growth, thanks to the influx of interest in prediction markets.

While Solana had significant on-chain activity and fees, Bitcoin and TRON were leaders in terms of share net transfers. In the case of BTC, the transfers are larger and more valuable. TRON has a different user profile and gets a boost from USDT transactions. Both chains achieved much higher dollar transfers, while Solana and Base executed multiple low-value transactions.

Solana has yet to outperform Ethereum in absolute terms of locked value, market capitalization or available liquidity. However, the chain showed the necessary conditions for much broader adoption and consolidated liquidity. In comparison, the Ethereum ecosystem had a wider distribution of apps and versions, leading to user confusion and fragmented markets.

Ethereum still handles the majority of value transfers

L2 chains have increased their adoption, but not as much as expected. In the Ethereum ecosystem, the main chain still accounts for over 66% of economic activity. The rest is distributed across the top L2, with negligible contributions from niche chains.

The Dune index remains strong for Arbitrum, Base, Optimins, Celo and Mantle, with no significant adoption by companies like Zora, ZKEVM or ZKSync. Those chains continued to decline after the initial hype surrounding the airdrop periods.

The Ethereum ecosystem reached its peak in March 2024, when the L2 story became more widely hyped. Despite growth over the past month, the Ethereum ecosystem has yet to recover its all-time high. The Dune index is highest for Ethereum, with much lower values for the entire L2 ecosystem. Ethereum’s index also saw the strongest growth, while other chains did not accelerate their adoption. Despite the on-chain index, ETH prices failed to move outside their usual range. ETH traded around $3,300 and continued to mark new all-time lows against BTC.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan