- Bitcoin offered a shopping option, but the downward trend was not over yet.

- The sale can end and BTC token transfer volumes looked at their 2023 levels.

Bitcoin [BTC] has shifted almost 5% since Friday and dragged the fear and greed index lower. The short -term holders had to deal with losses, while holders prefer to accumulate gifts in the longer term.

This may not cause an immediate recovery, but a recovery can brew.

The Stablecoin -Ratio channel meant a buying option for BTC and Altcoins. The increase in the STABLecoin range indicates increased liquidity and tends to act during Bearish market phases.

Markets are cyclical and the market will swing bullishs – the question is when.

The Coinbase Premium Index follows the price difference between Coinbase and Binance. A positive premium implies a greater demand from investors established in the US.

This has not been the case in the last three months, a sign of fear from American investors.

The CB Premium Index is currently near neutral levels. The movement would depend on the BTC price movement, which is biased at the time of the lower time base in the under the age of time.

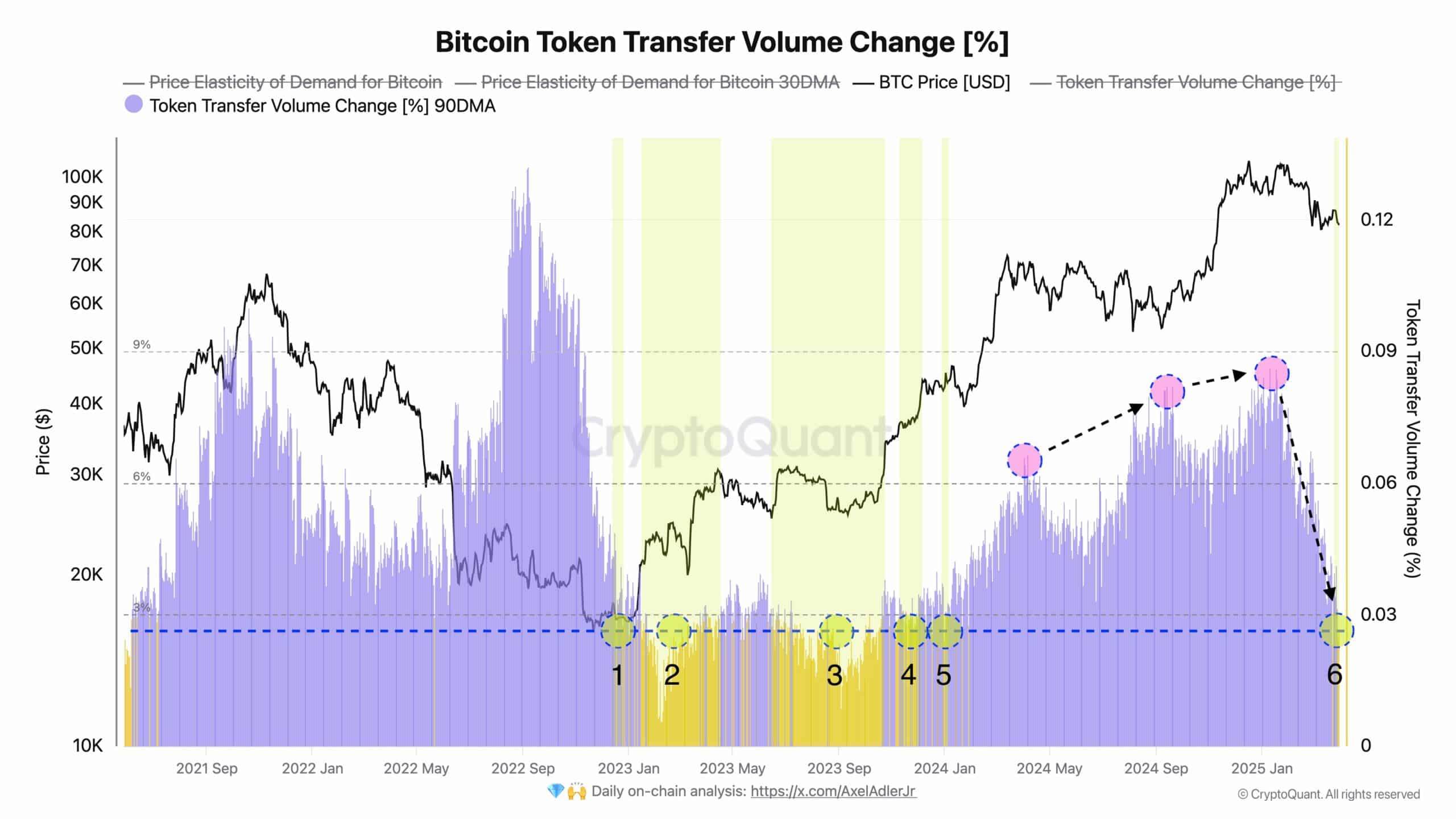

However, the sales pressure can end. Crypto analyst Axel Adler JR observed in A message on X that the 90-day advancing average of the Bitcoin token transfer volume change (%) fell.

It was currently in the vicinity of the LOS points of 2023, which corresponded to a period of BTC accumulation.

The indicator shows the average change in transaction volume over the past 90 days compared to the previous day.

The recent retreat meant that big sale was over and Bitcoin could start to trends to trends on the price chart.

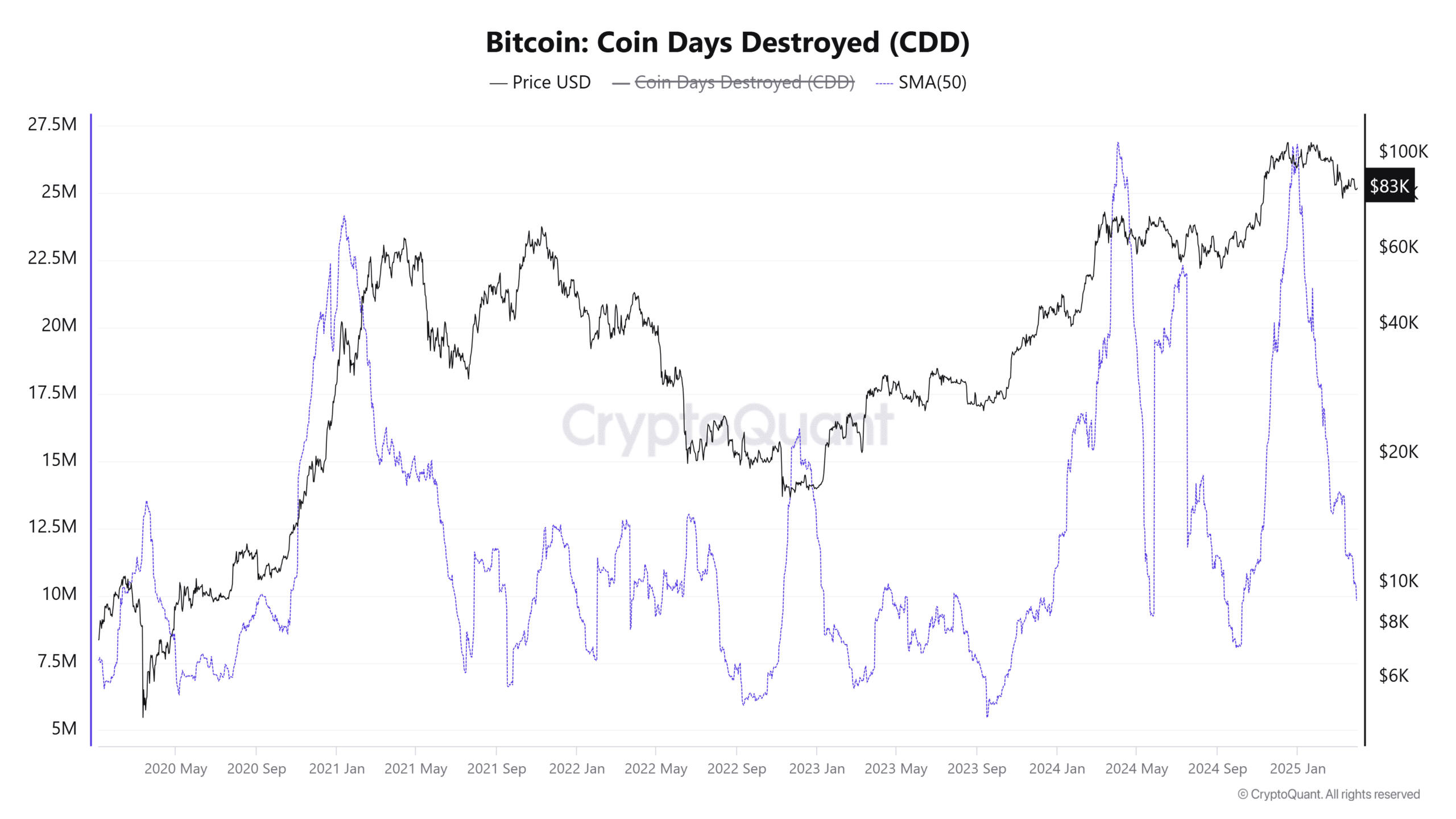

The BTC coin days destroyed (CDD) follows the long-term activity.

When a coin is spent, the number of days that the coin was held is multiplied by the number of moved coins to arrive at CDD. High CDDs indicate long -term holders that sell and can mark important trend shifts.

In the past three months, the 50DMA of the BTC CDD metthriek has fallen. This meant a reduced sales pressure of long -term holders.

By putting together the instructions, it seemed that Bitcoin was approaching the end of the downward trend.

However, it does not indicate an immediate reversal of the trend, and traders and investors must be careful to be too enthusiastic to catch the price base.