- Members of the Arbitrum community have voted on an initial proposal to implement a staking program within the ecosystem.

- ARB demand has fallen in recent days.

Members of the Arbitrum [ARB] have a management community voted in favor of a proposal to allow holders of ARB tokens to stake their holders to earn rewards.

The proposalthat PlutusDAO filed called for allocating 1.75%, 1.5% or 1% of the total ARB supply (10 billion) from the Arbitrum DAO treasury to the wagering program as a reward, distributed over a period of 12 months.

According to the proposal, having a native staking model on Arbitrum would generate increased interest in the ecosystem and its ARB token. It will also reward users who have demonstrated long-term commitment to the ecosystem, laying the foundation for possible revenue sharing models to be introduced in the future.

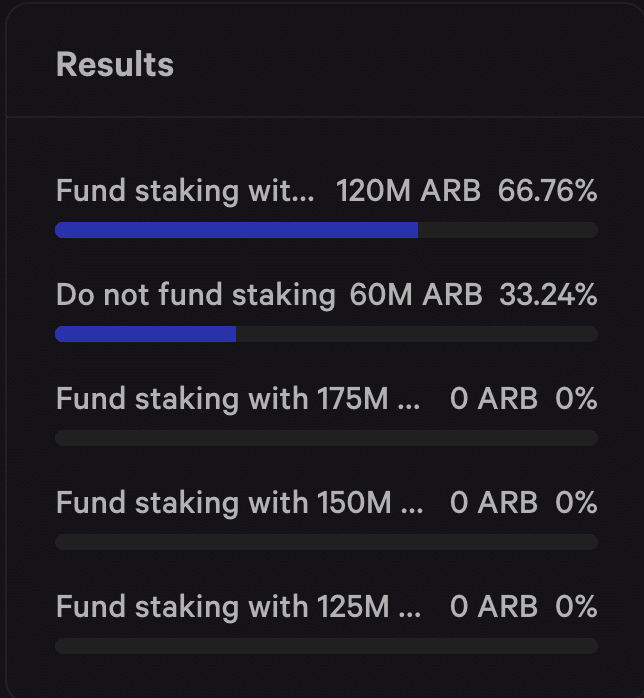

Information from Snapshot showed that 66% of the governance community voted to allocate 1% (100 million) of ARB’s total supply to the staking program.

Source: snapshot

Within the next week, the governing body will be presented with a formalized version of the proposal, including specific implementation details, after which an on-chain DAO voting process will take place.

If the proposal receives sufficient support and is approved through the DAO vote, the implementation phase of the strike program will begin.

ARB maintains an upward trajectory

At the time of writing, ARB was exchanging hands at $1.09. According to CoinMarketCap, the value of the token has increased by almost 15% in the past week. At the current price, ARB was trading at a price level last seen in August.

Among spot traders, ARB accumulation has continued to rise. Readings from the token’s Chaikin Money Flow (CMF) indicator showed increased liquidity inflows into the ARB market.

Since October 23, ARB’s CMF has maintained an uptrend, returning a positive value of 0.33 at the time of writing. In general, a positive CMF value above the zero line is a sign of market strength. Simply put, this means that investors have bought more ARB tokens than they have sold since mid-October.

Key momentum indicators positioned above their respective neutral lines lent credibility to the position above. At the time of writing, ARB’s Relative Strength Index (RSI) and Money Flow Index (MFI) stood at 67.10 and 68.98 respectively.

Source: ARB/USDT on TradingView

With ARB exchanging hands at a multi-month high, profit-taking activity is starting to gain momentum. This has resulted in the token’s network activity declining since November 4, according to data from Santiment.

Realistic or not, here is ARB’s market cap in BTC terms

At the time of writing, information from the on-chain data provider showed that the daily number of addresses trading ARB has since fallen by 55%.

Likewise, new demand for the altcoin has fallen by 65% over the same period.

Source: Santiment