- Larry Fink projected that the American tax crisis could stimulate the value of BTC.

- The executive also greeted tokenization as a ‘democratization’ of markets.

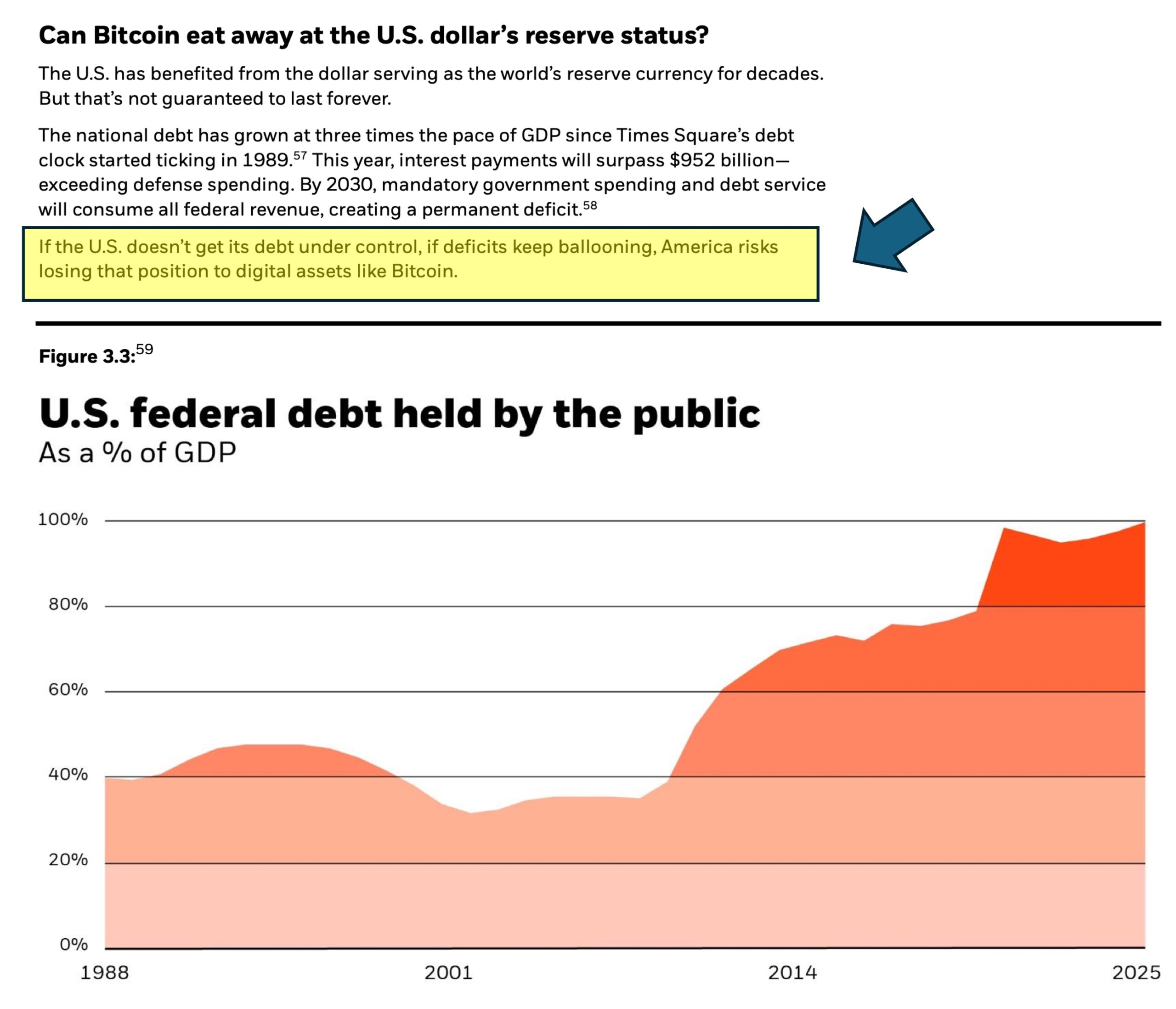

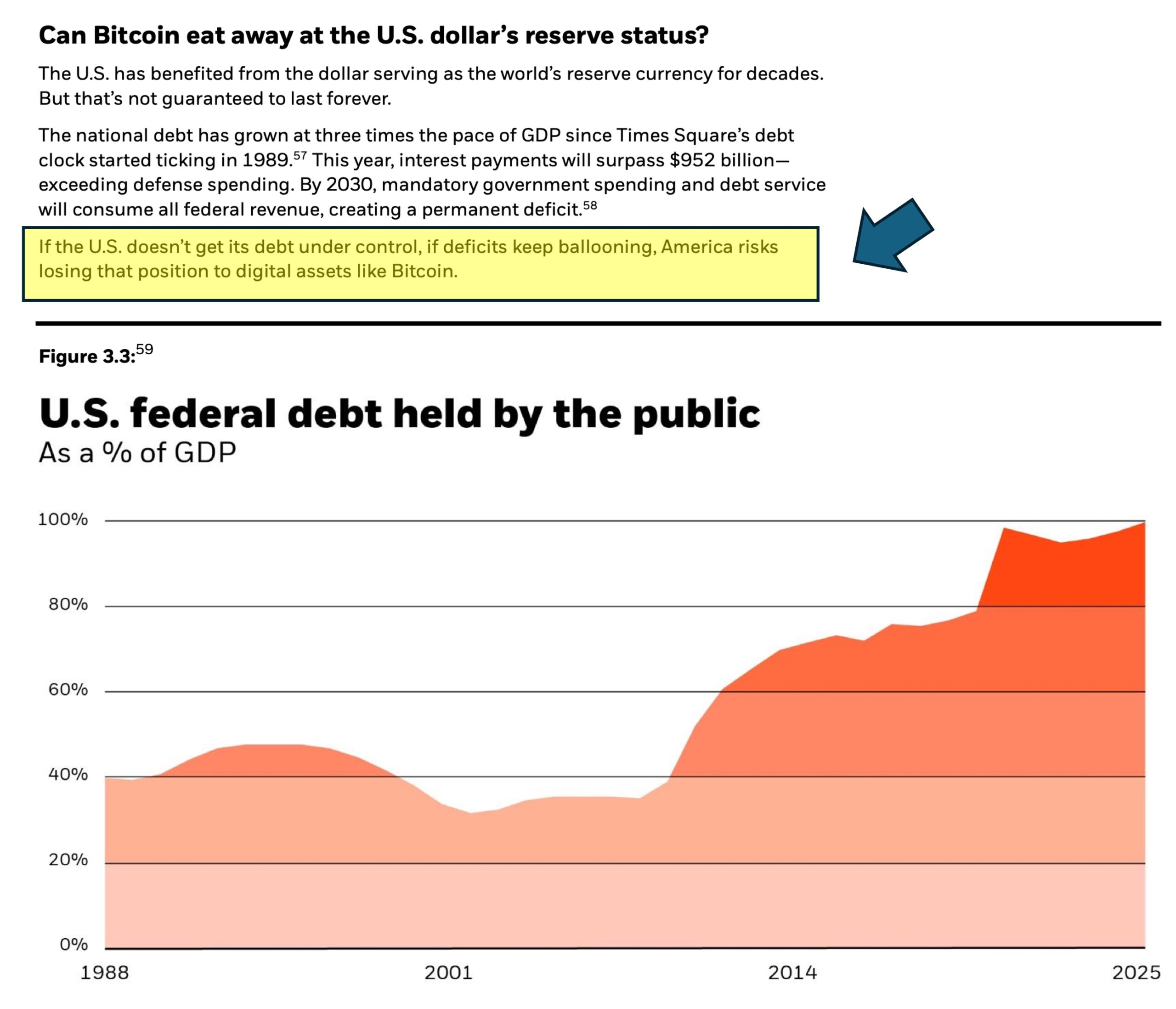

Larry Fink, CEO of the world’s largest asset manager, BlackRock, projected that Bitcoin [BTC] Can release the US dollar from the global reserve status.

Fink warned that the US dollar has already enjoyed the currency of the world reserve for decades, but that will not last forever. Part of his annual letter to investors read”

“If the US does not get its debt under control, if shortages remain ballooning, America runs the risk of losing a position on digital assets such as Bitcoin.”

Source: BlackRock

The US currently has around $ 36 trillion on debts, with interest payments only for almost $ 1 trillion for 2025. Fink,

“By 2030, mandatory government spending and debt service will use all federal income, creating a permanent deficit.”

Great for BTC?

In 2023, Galaxy Digital Founder Mike Novogratz made A similar projection, because the rising tax debt increases the fear of currency evaluation and inflation.

BlackRock even made a recent call, entry That a recession would stimulate the value of BTC. In such a scenario, investors can resort to scarce alternatives, such as gold and BTC, as a store of value.

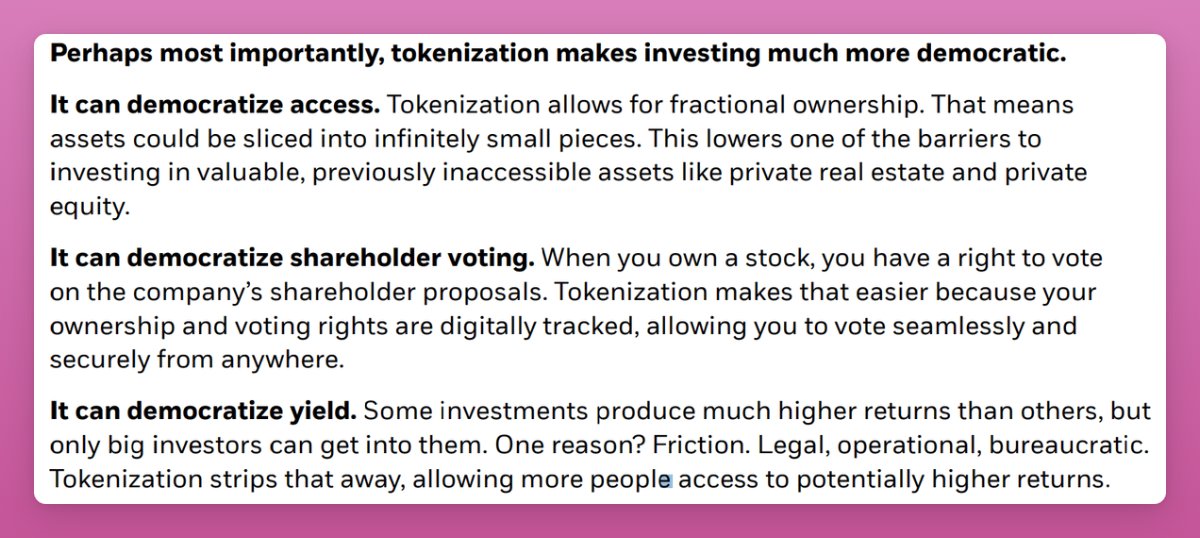

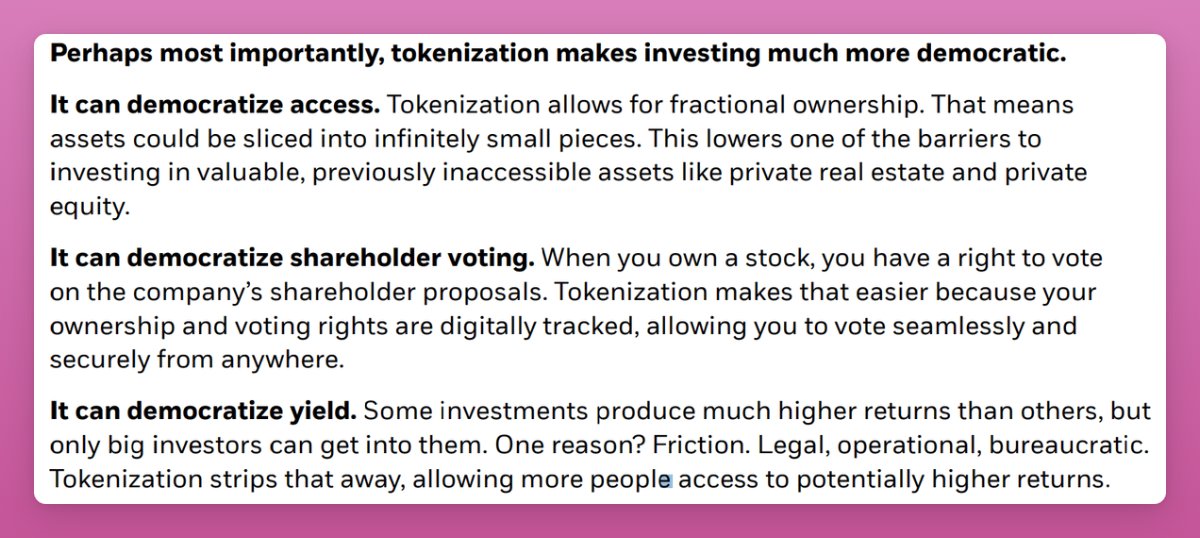

In addition, Fink Real-World expected Tokenized Assets (RWA) to get a grip and called it ‘democratization’.

“Every shares, every bond, any fund – every assets – can be taught.

Nate Geraci from ETF Store responded to the explanation of the link and said that managers were of top assets’All. ‘

For his part, Defi Research Analyst, Ignas, affected Fink’s look at tokenization as ‘super bullish for crypto’.

Source: BlackRock

That said, BTC was appreciated at $ 83k for the new rates of President Donald Trump.