- ETH’s positive outlook has increased demand for altcoin seasons.

- With BTC falling below $100,000, will the current altcoin seasonal trend be sustainable?

According to market analysts, the long-awaited altcoin season could have arrived, citing strengthening Ethereum [ETH] price and momentum in the segment.

As a health barometer for the sector, ETH’s promising prospects contributed to calls for altcoin season.

Jake Ostrovskis, an options and OTC (Over The Counter) trader at market maker Wintermute, noted that the increased positive outlook for ETH drove capital rotation into altcoins.

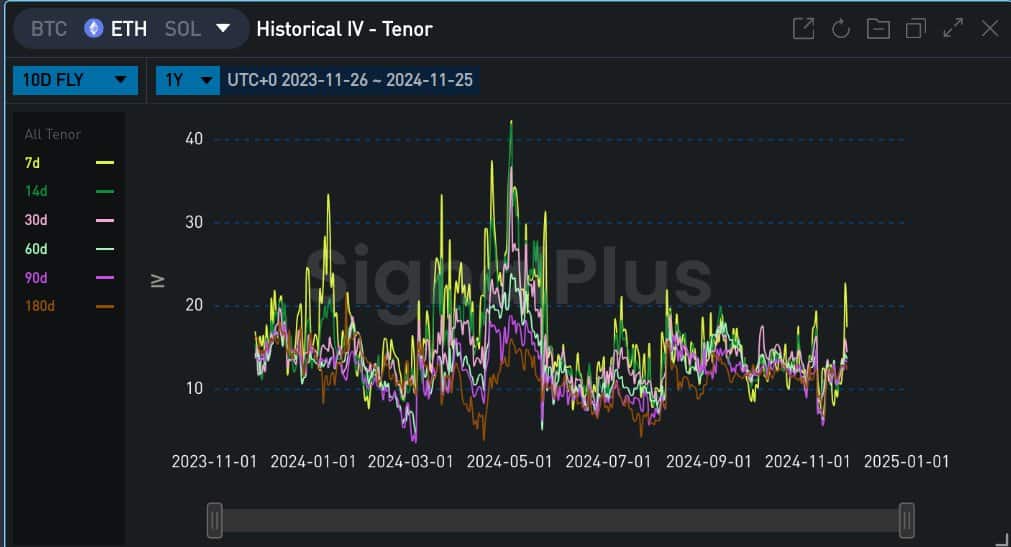

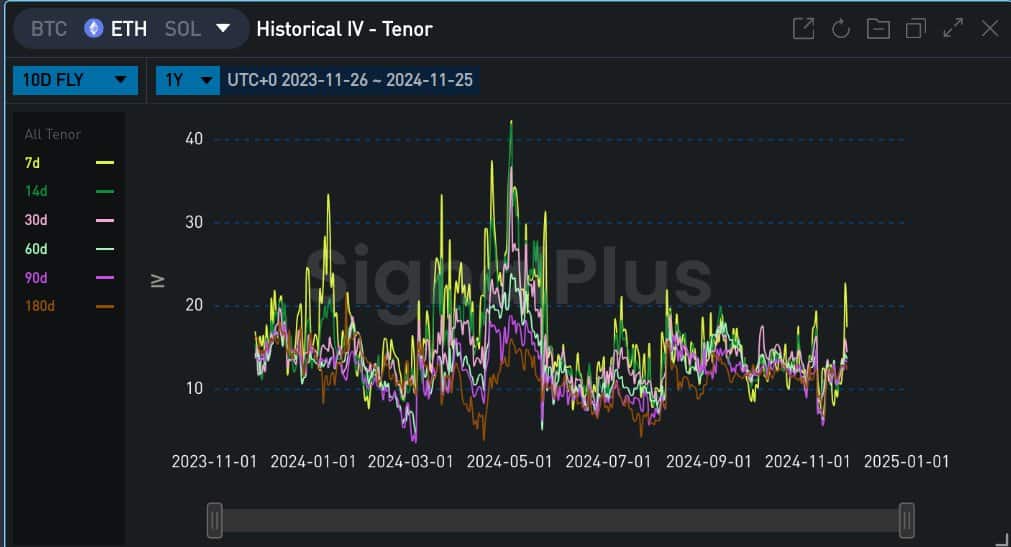

“Is this time (bullish calls) different? The market thinks so. ATM volatility increases, skew rises to a 12-month high and wings (10d) see strong bidding.”

Source: Signal Plus

The spike in implied volatility (IV) left options traders confident and optimistic about ETH’s prospects. If so, it would boost the altcoin segment.

Altcoin season status

DataDash’s Nicholas Merten shared a similar sentiment on YouTube. The crypto analyst mentioned the drop Bitcoin dominance (BTC.D) as a precedent for an additional rally for altcoins.

Merten added that Others, which tracks the altcoin sector excluding the top 10 tokens, had regained key levels and was above the 200-day MA (moving average).

This indicated improved momentum in the segment and the potential for further traction.

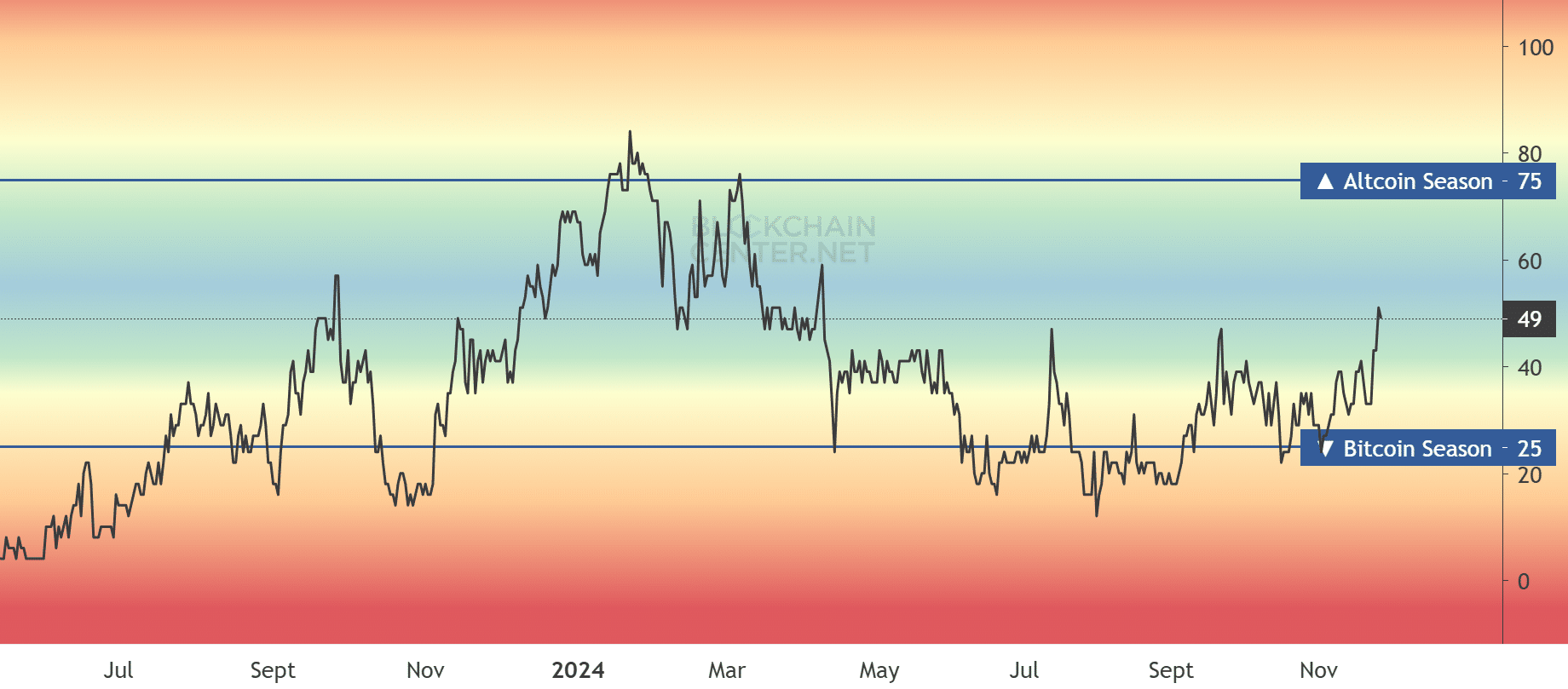

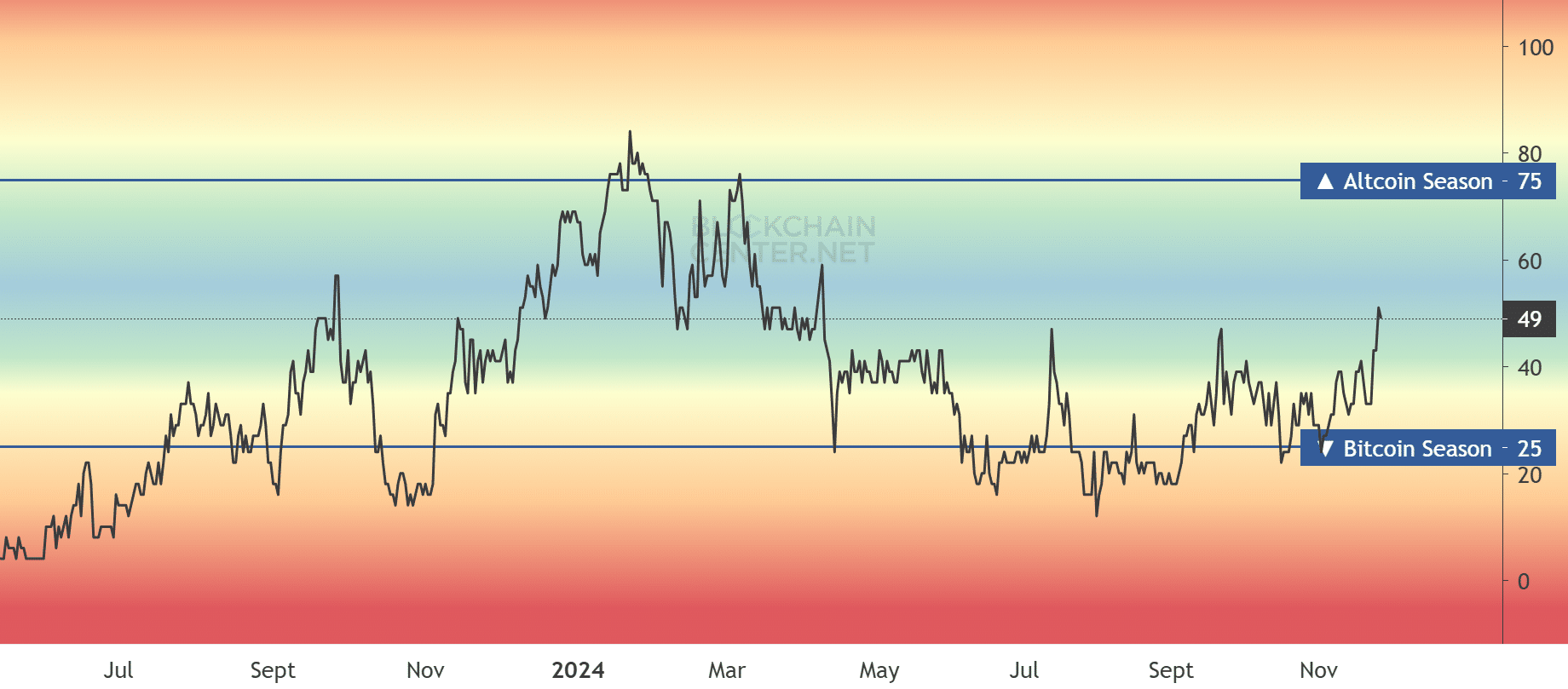

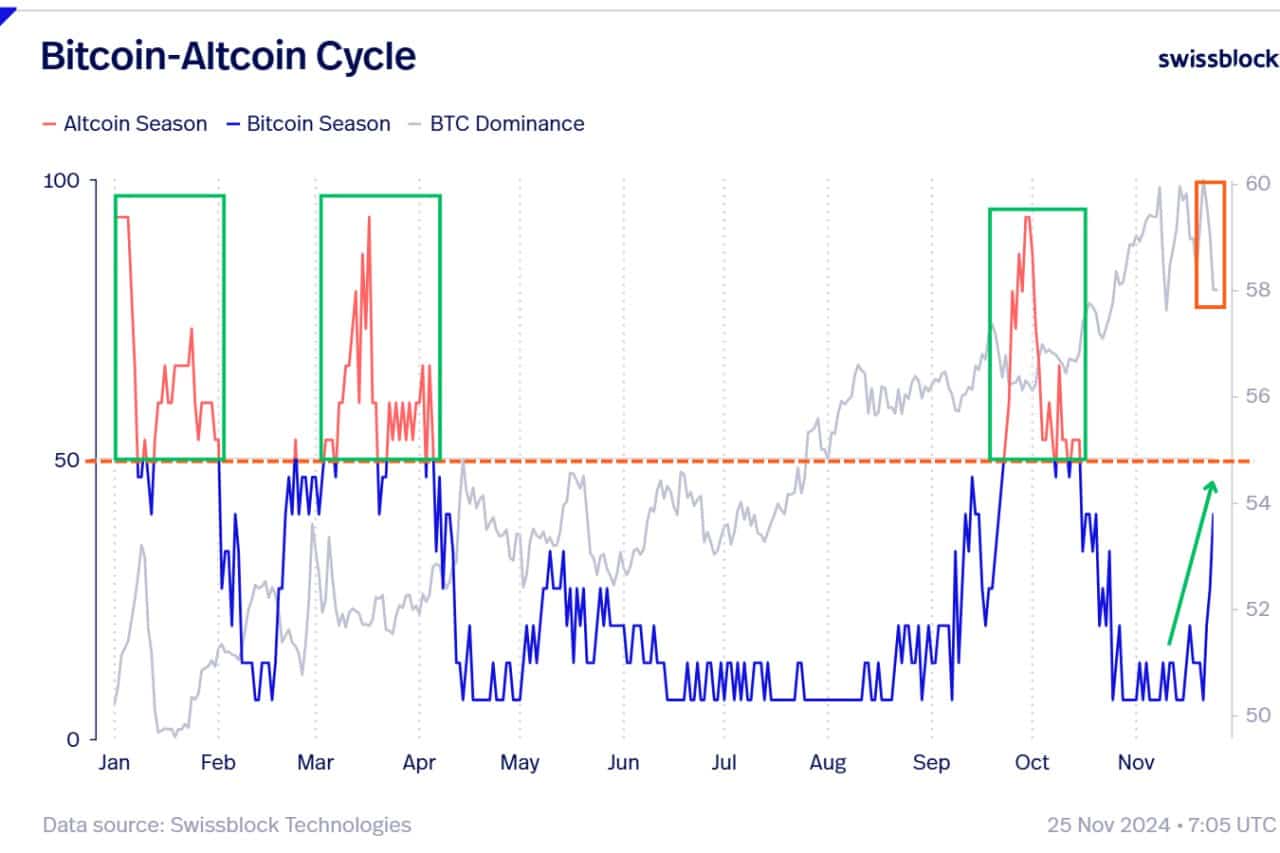

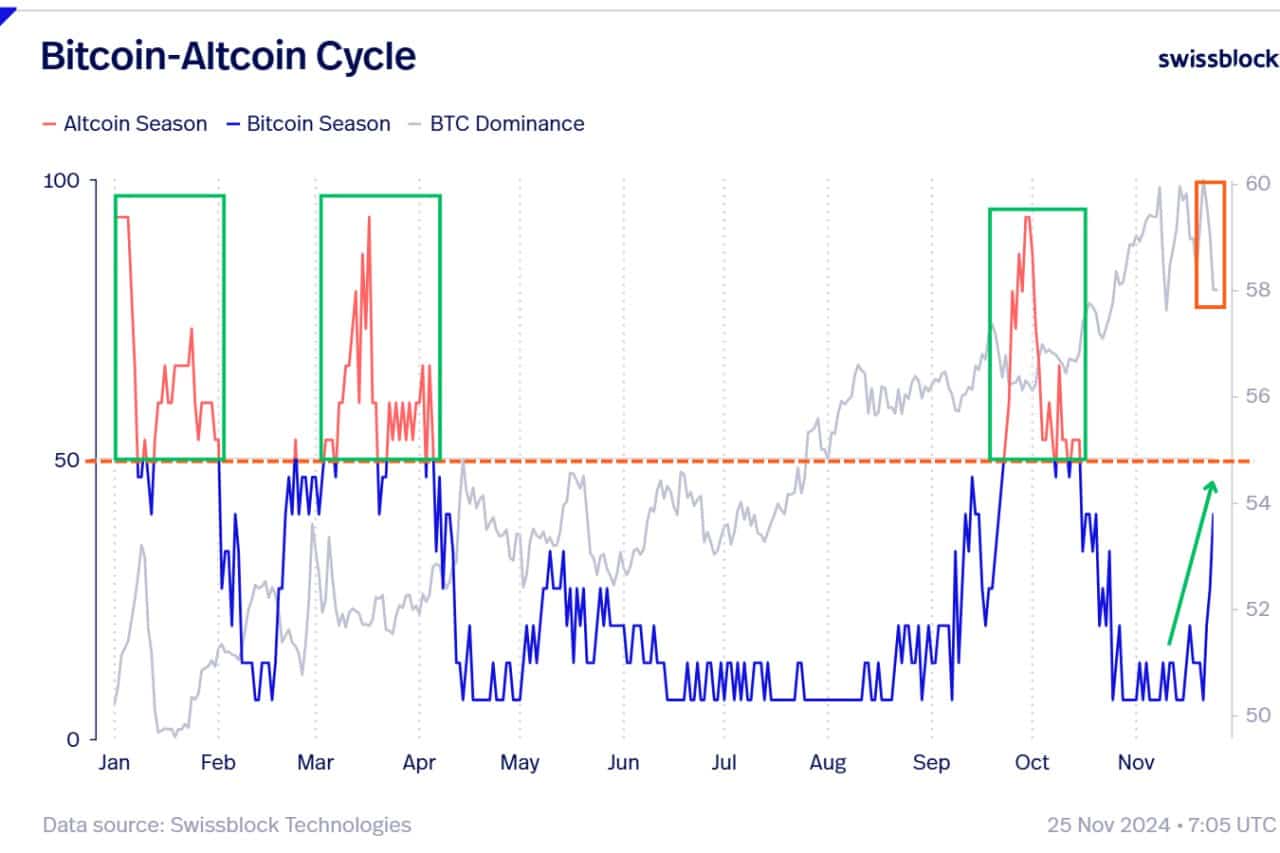

Despite recent traction, a strong and full-fledged ‘Altcoin season‘ was not in play, according to the Blockchain Center’s Altcoin Season Index.

The index value was almost 50%, indicating that only half of the top 50 tokens are the same Stellar [XLM] And Dogecoin [DOGE]have performed better BTC in the past three months.

An altcoin season can occur when more than 75% of tokens outperform BTC.

Source: Blockchain Center

That said, we had similar altcoin momentum spikes in July and September, which faltered as BTC’s dominance peaked. Will this time be different and sustainable?

On November 25, the Ethereum, L2s, GameFi, and DeFi segments reached double digits as BTC fell below $95,000.

However, Glassnode’s founders warned that a full-blown altcoin rally could only happen if BTC rose above $100,000, followed by a decline in market dominance. She said,

“But for a full Altcoin season, we need BTC’s dominance to capitulate. Eyes on $100,000, although market shock may come first!”

Source: Swissblock Technologies

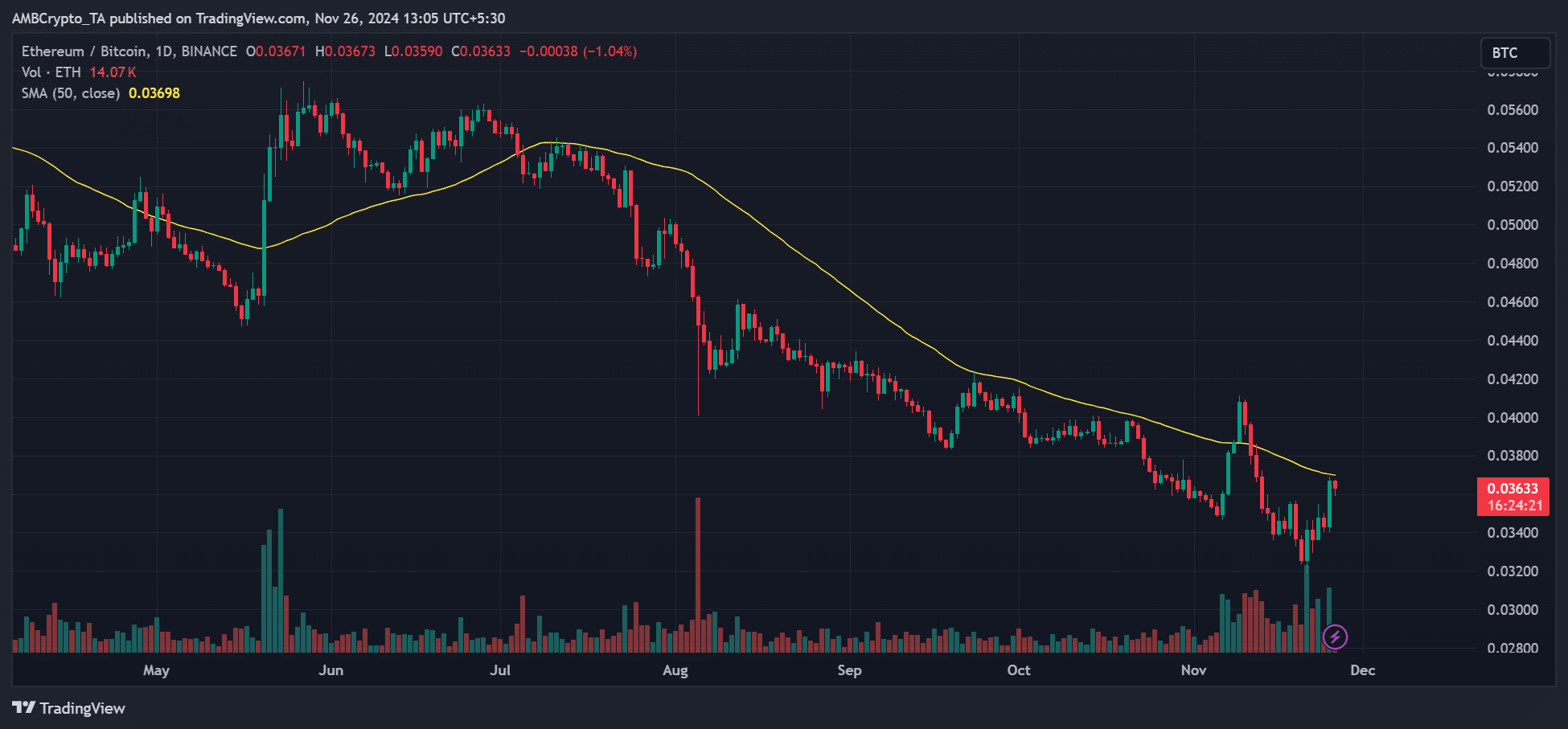

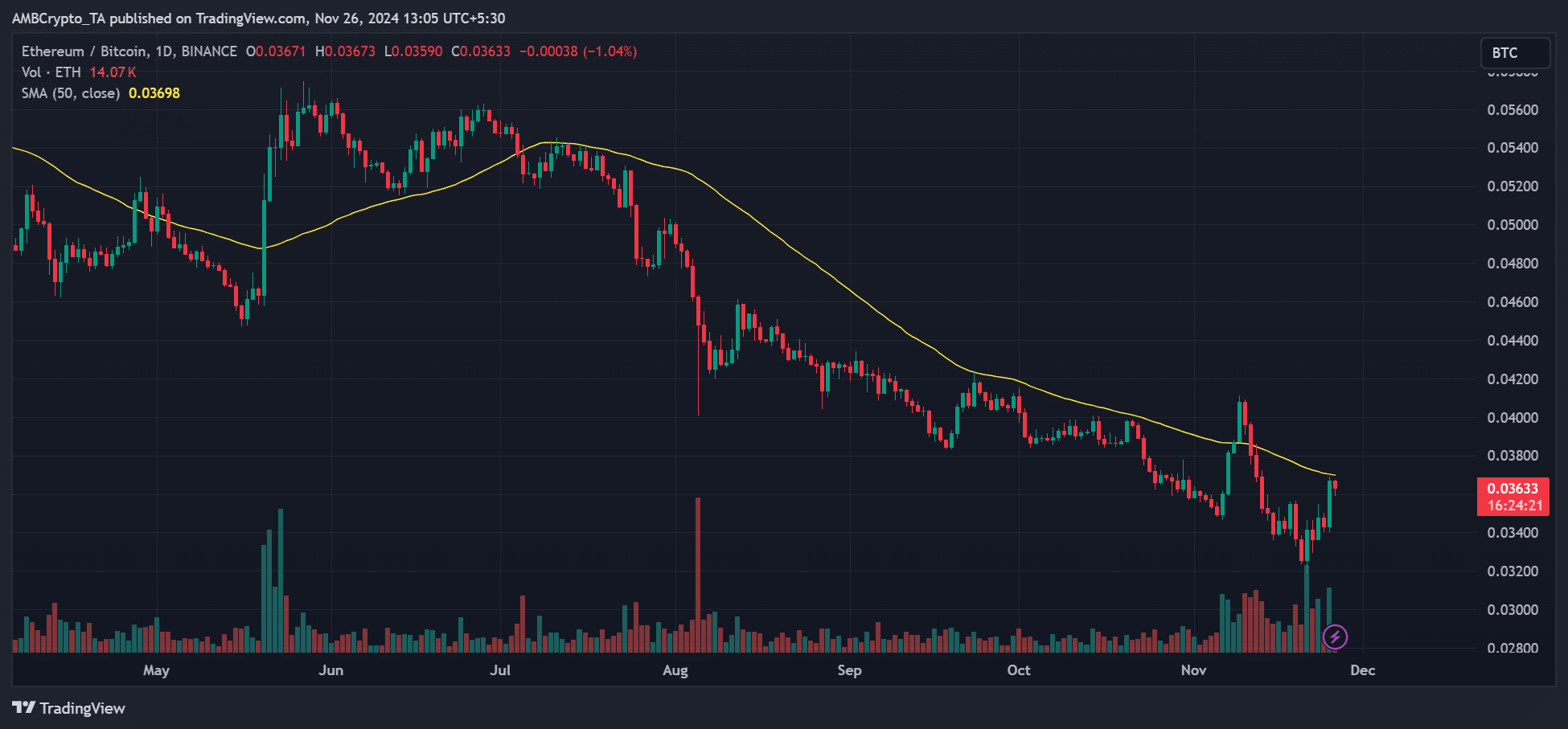

From an ETH/BTC perspective, the outlook seemed cautiously optimistic. For context, a rally in the ETH/BTC ratio indicates that ETH is outperforming BTC, which is a net positive indicator for altcoins.

But Wintermute’s Ostrovskis said the ETHBTC trend was not clear enough for a sustainable, strong altcoin season, at least at the time of writing. He said,

“For a full-fledged ‘alt season’, #ETHBTC needs to maintain strength for more than a few sessions. Every bid in 2024 has been rejected, making the theme extremely important until the end of the year.”

Source: ETH/BTC, TradingView