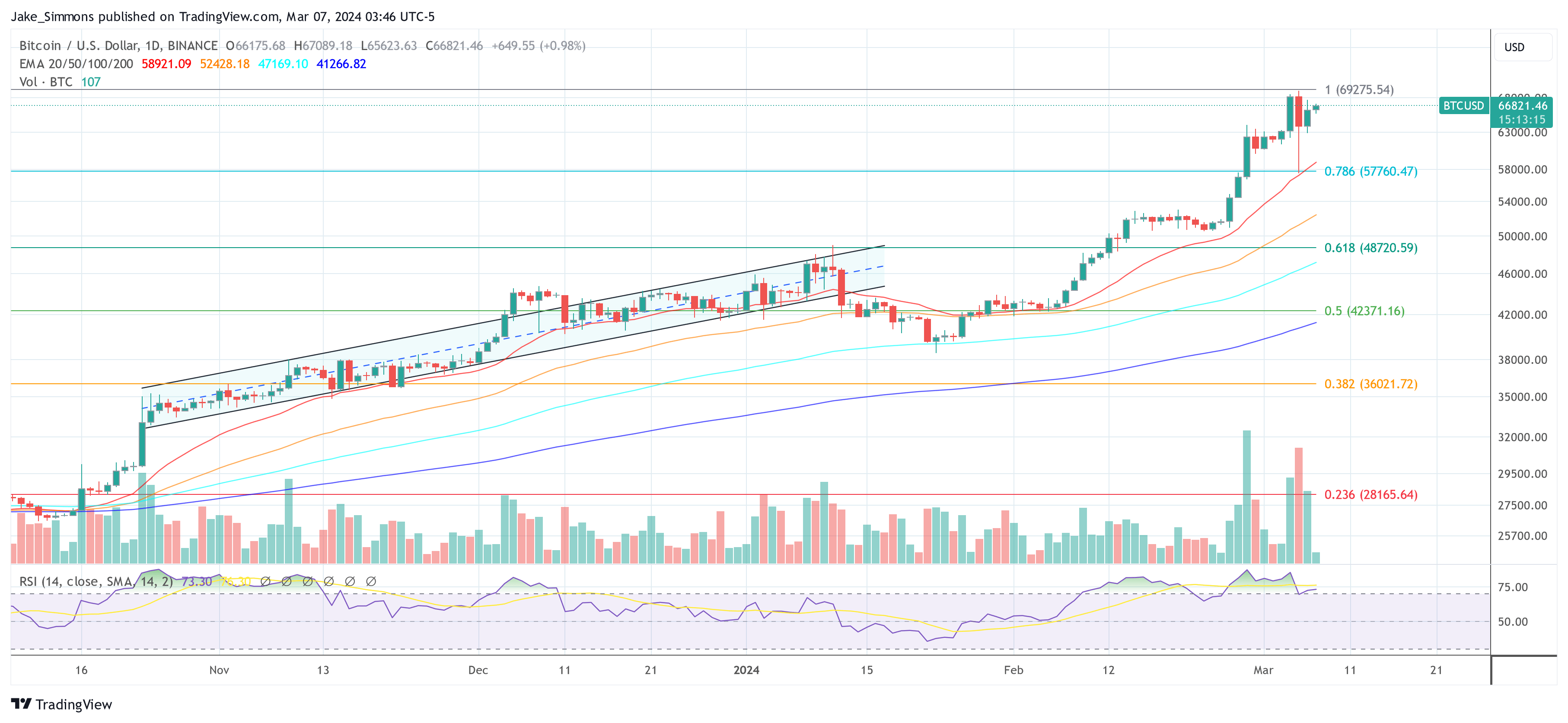

As Bitcoin hovers near its all-time high, industry experts and investors are keenly watching for signs of its next big move. Alex Thorn, head of research at Galaxy, recently shared his views on the Bitcoin price trajectory and the factors influencing its potential breakout. In a detailed after on X (formerly Twitter), Thorn offered insights based on historical data and current market dynamics.

“We will climb the wall of worry,” Thorn proclaimed, setting the tone for his analysis. Bitcoin’s recent price action saw Bitcoin reach $69,324 on Coinbase on Tuesday, marking its first all-time high since November 10, 2021. This milestone came after a period of 846 days of anticipation and speculation, after which the price fell 14.3% to a level of 14.3%. intraday low of $59,224. This volatility, compounded by $400 million in lengthy liquidations within an hour, underlines the unpredictable nature of the cryptocurrency.

Despite the pullback, Bitcoin recovered and traded back at $67,000. Thorn noted: “Volatility is back, and will likely remain so as we climb the wall of worry.” He compared the current situation to 2020, when Bitcoin first approached its then all-time high of around $20,000 from December 2017.

BTC faced initial resistance, experiencing a 12.33% drop after tapping the barrier twice before finally jumping ahead. This pattern highlights the psychological and technical challenges at previous record highs, a natural resistance point for any asset class. A similar (second) move might be needed this time to shake all the sellers out of the market.

Describing the ‘Wall of Worry’, Thorn explains: ‘By my count, from January 1, 2017 to its all-time high of ~$20,000 on December 17, 2017, Bitcoin experienced 13 declines of 12%+ (12 were 15%+, and 8 were 25%+). The same story played out in 2020. Between the March 12, 2020 Covid low ($3858) and the April 14, 2021 ATH of $64,899 there were 13 drawdowns of 10% or more (7 of which were 15% or more).”

Notably, Bitcoin has already had two retracements above 15% since the spot ETFs launched on January 11. This week was the second, the first major drop occurred right after the launch of the ETF, with the price falling by about 20%.

Why Bitcoin is Just Getting Started

In his analysis, Thorn also addressed the role of ‘old coins’ or long-held Bitcoin in shaping market movements. “Some old coins have come back to life and probably sold, which may have helped create the intraday top,” he explained, pointing to blockchain data showing the movement of coins mined as early as 2010. This shift from old to new hands is characteristic of bull markets. in Bitcoin, facilitating its wider distribution and adoption.

Thorn emphasized the importance of market sentiment and investment flows, noting: “And Tuesday was the Bitcoin ETF’s largest day of inflows ever and the second largest day of net inflows (+$648 million) since DAY 1.” This impressive influx of capital into Bitcoin ETFs underlines the growing interest and confidence in the cryptocurrency, even amid volatility.

Thorn remains optimistic about Bitcoin’s future, suggesting that current price dynamics are typical of the cryptocurrency’s bull markets, which are known for their non-linear progression and numerous corrections. Underscoring the resilience and growth potential despite the hurdles, he said: “Nothing about yesterday’s price action makes me think we’re not going higher.”

In conclusion, Thorn’s analysis provides a nuanced view of Bitcoin’s journey to breaking its all-time high. Comparing current events to past market behavior, Thorn provides a compelling argument for Bitcoin’s continued rise, but after a potential consolidation phase with several ticks at all-time highs before a final breakout. “Fasten your seatbelts, people. We have only just started,” he advises.

At the time of writing, BTC was at $66,821.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.