- Texas promotes SB 21 to set up the first Bitcoin reserve of the nation managed by the State.

- New Hampshire leads the adoption while Florida Bitcoin withdraws investment accounts.

As a momentum around Bitcoin at state level [BTC] Adoption fluctuates by the US, Texas doubles its bet.

Although various states have cooled their enthusiasm after the proposal of Donald Trump’s federal level Bitcoin Reserve, Texas pushes ahead.

Texas continues with the Bitcoin Reserve Bill

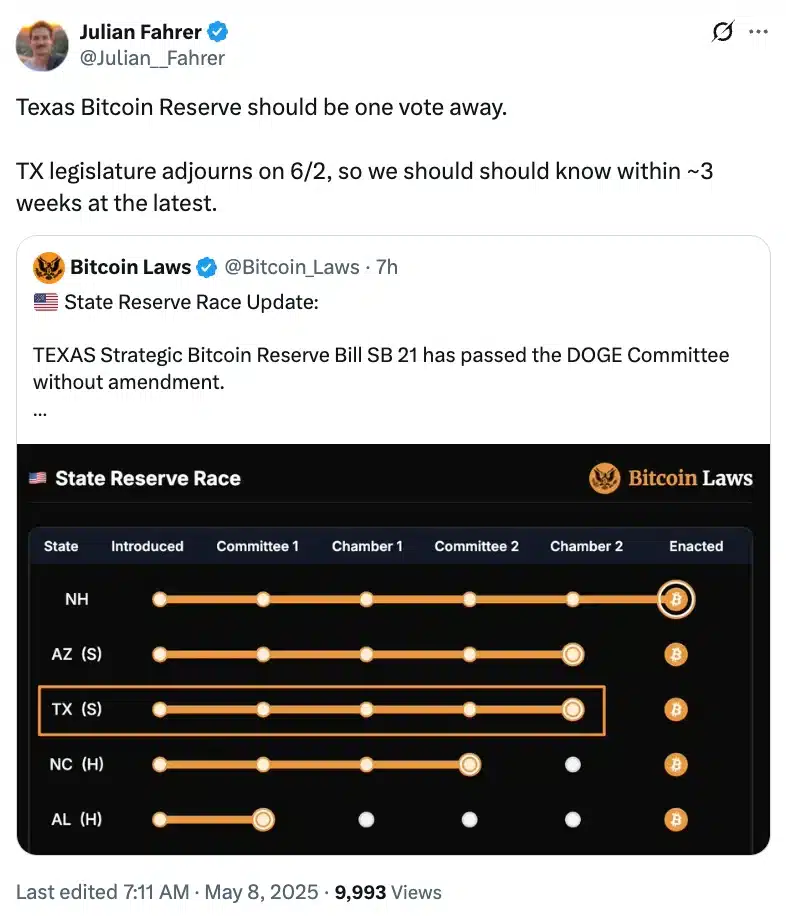

The Texas House Committee on Government Efficiency advanced Senate Bill 21, a proposal to create a “Texas Strategic Bitcoin Reserve”.

With the bill that the Senate is already cleaning up, there is now only a complete mood of the house between Texas and he becomes the first state to officially draw up a Bitcoin reserve that is managed by the State Constoller.

Note about the same, Pierre RochardCEO of the Bitcoin Bond Company, noticed,

“The Texas House Committee has approved SB 21, the following steps a mood of the Texas house by all members and the signature of the Governor. It probably looks that Texas will have a strategic Bitcoin reserve, the big open question is how much BTC will be acquired.”

Initially introduced in January by the Republican Senator Charles Schwertner as a BTC-exclusive measure, Senate Bill 21 later evolved later to possibly house other digital assets.

The revised version, again filled in February, reflects a broader approach to digital asset strategy at state level.

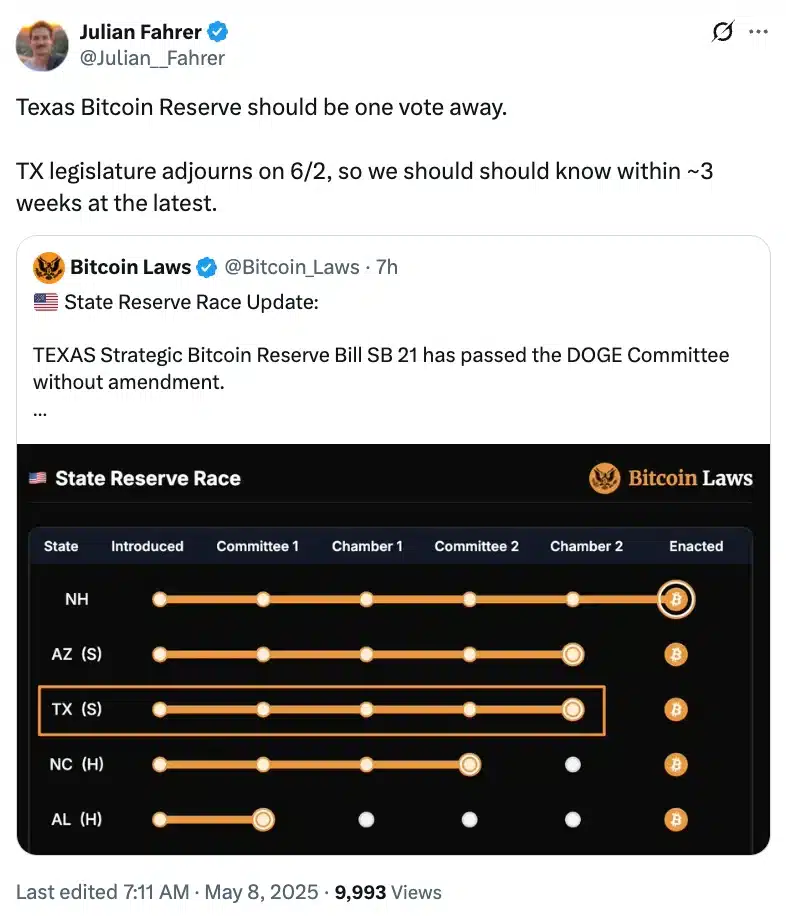

Furthermore, the founder of Bitcoin Laws Julian Fahrer emphasized that the fate of the bill is likely to be decided before the legislative power of Texas is postponed on 2 June.

Source: Julian Fahrer/X

In the meantime, BTC’s recent price mark act on $ 99,637.37 During the press, after a profit of 2.72%, the further momentum adds to the relevance of the bill, since the flagship Cryptocurrency closer to the milestone of $ 100k Randt.

Other states and their diverse Bitcoin records

In addition to Texas, various American states increase their involvement in bitcoin and digital activation strategies.

For example, on May 6, New Hampshire set up a national precedent by officially performing a Bitcoin reserve account, so that they earned praise from governor Kelly Ayotte for leading the indictment.

In the meantime, North Carolina took a big step in the direction of Crypto integration when the house was passing the “Digital Assets Investment Act” (HB92) with a voice of 71-44.

Moreover 7 May the Governor of Arizona Katie Hobbs House Bill 2749 signed in the law. This has set up the first Bitcoin and Digital Asset Reserve Fund of the State.

The aim of the fund is to manage unclaimed digital interests instead of making new investments. Her decision follows an earlier veto of a more ambitious proposal for reserve.

Although some states continue with Bitcoin’s adoption, others have taken a step back.

Florida, once seen as a potential leader in integrating BTC in his state treasury, has quietly suspended his ambitions.

The State officially withdrawn two accompanying accounts: HB 487 and SB 550, which wanted to allocate up to 10% of the specific public funds in Bitcoin, as the legislative session was concluded on 3 May.

This step reflects a more cautious position in the midst of the broader national debate on the role of crypto in government financing, indicating that not every jurisdiction is ready to embrace digital assets.