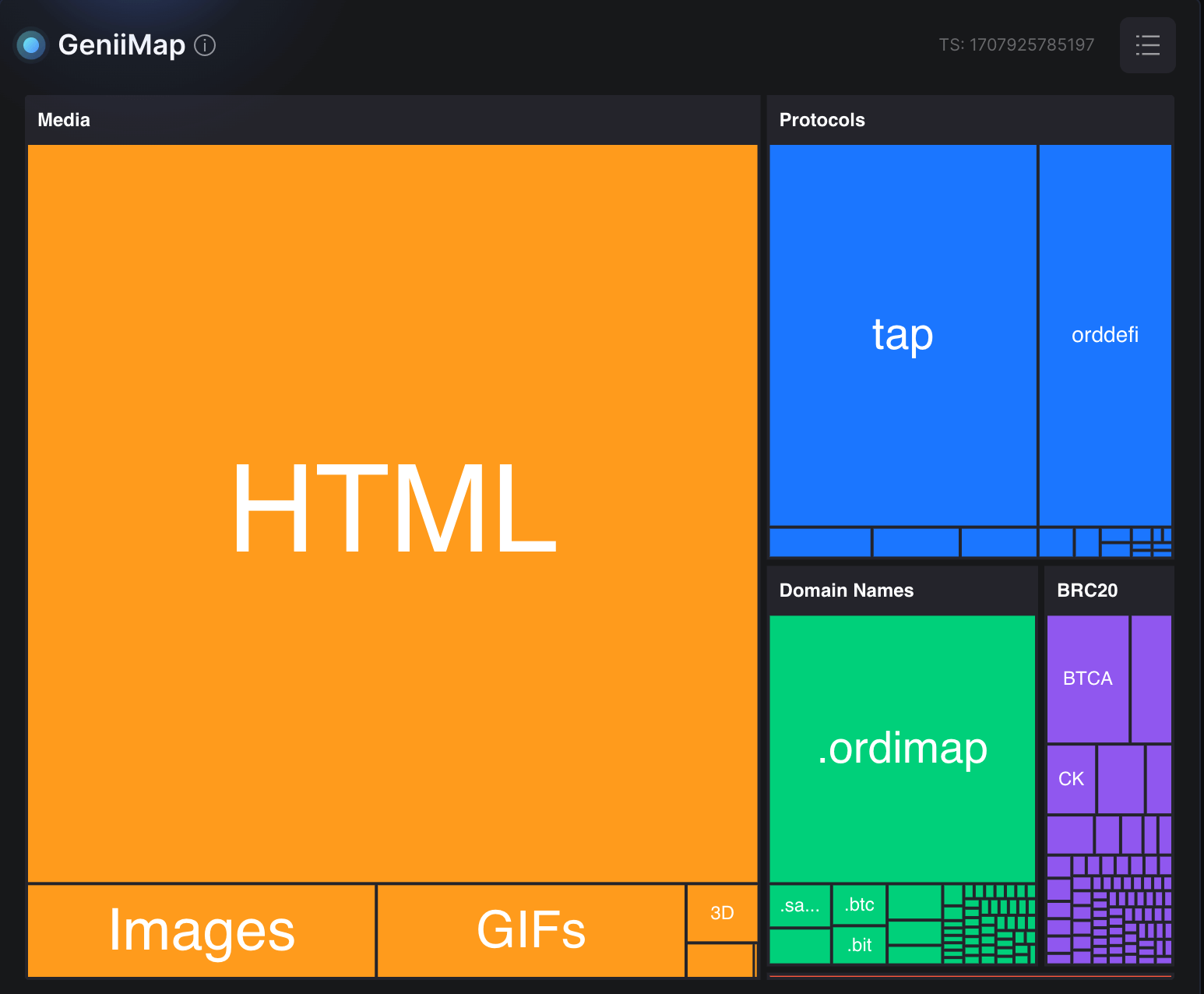

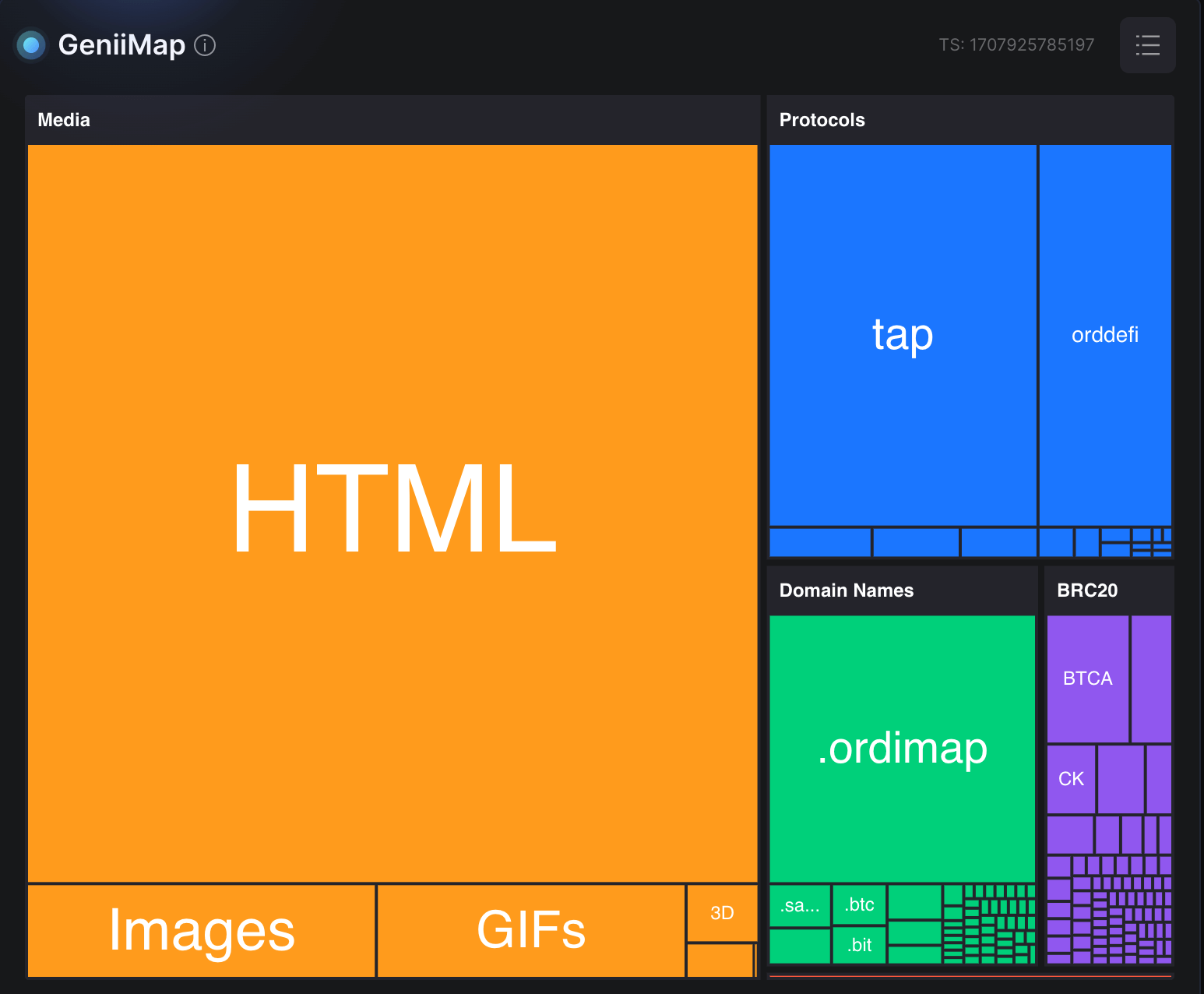

Tap Protocol, designed to support DeFi applications on Bitcoin Ordinals, has become the most active protocol on Bitcoin’s Ordinals network over the past 24 hours. Genii data indicates that Tap Protocol has handled almost double the transactions of BRC-20 or OrdDefi.

While Genii tracks BRC20 activity separately from other protocols, it brings the total activity of all tokens in the last 24 hours to 297, while Tap saw 645 transactions.

Furthermore, Tap Protocol’s native token, TRAC, is now just behind other Ordinals-related tokens with listings on major exchanges in terms of market capitalization. A surge in user adoption is a sign of early success for Tap in building a decentralized indexing infrastructure.

Tap Protocol recently completed a $4.2 million funding round led by Sora Ventures, attracting venture capital firms like Cypher Capital and angel investors including executives from Animoca Brands. This capital will support the expansion of Tap’s developer team and further refine its protocol functionalities, which have already been adopted by more than 14 projects.

Analysts see increased adoption of $TRAC could provide additional infrastructure for Bitcoin’s Ordinals space, potentially following DeFi Summer on Ethereum. A more robust network would incentivize developers and promote innovation on the Bitcoin network, such as the recent TTP Liquid Fund announced on February 13.

Sora’s Jason Fang commented on Tap on X’s growth, saying:

“All this data is a sign that we are already on our way to building a fully decentralized indexing economy! The more holders, the more infrastructure $TRAC supports, the more robust the TAP protocol becomes and the more developers we will attract to Bitcoin!”

Tap Protocol’s dominance in Ordinals transactions highlights the fluid development landscape on the Bitcoin network. With the continued focus on Bitcoin, including companies like MicroStrategy focusing on a Bitcoin development company, the spotlight is clearly on Bitcoin protocols.

Disclaimer: Sora Ventures is an investor in Crypto.