- Solanas sUSD reaches deposit milestone after launch.

- The network recorded the largest inflow after Bitcoin.

In a remarkable debut, Solayer USD [sUSD]—Solanas [SOL] first real possession [RWA]-backed synthetic stablecoin, over 10 million USDC in deposits within the first hour.

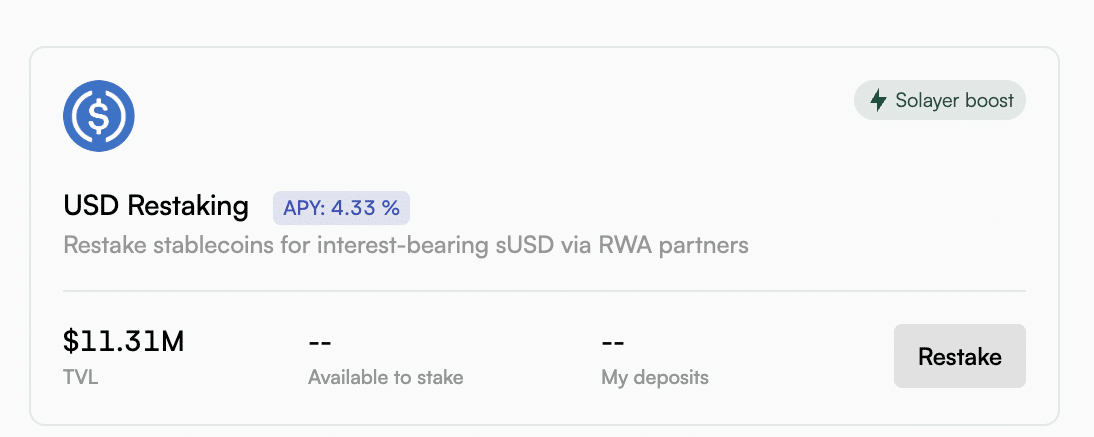

According to facts from Lookonchain, the asset saw almost 5,900 deposits. At the time of writing, Total Value Locked (TVL) was $11.31 million.

Source: Solayer

sUSD on Solana

sUSD was launched this week by resuming protocol, Solayer Labs, in partnership with OpenEden Labs, a tokenized T-Bill issuer.

It is a decentralized, yield-bearing stablecoin, pegged 1:1 to the US dollar and backed by US government bonds.

Designed as a benchmark for interest-bearing token expansion in 2022, sUSD strengthens the stability of its USD peg. This improves revenue generation for the stablecoin ecosystem.

The protocol works as a non-custodial Request-for-Quote (RFQ) marketplace, where only token holders can mint or burn sUSD. Like sSOL, sUSD serves as collateral for the open internet, supported by real infrastructure.

As Proof-of-Stake (PoS) collateral, sUSD supports off-chain systems running alongside Solana, including bridges, oracles, and Layer 2 networks.

Finally, sUSD automatically earns a 4.33% stake from US TBills in USDC without the need for a mint or strike.

Impact on the price of SOL

Meanwhile, SOL has continued to enjoy the sector-wide bull run fueled by Bitcoin [BTC] remarkable comeback.

The launch of sUSD pushed it above $180 for the first time in almost three months.

At the time of writing, the altcoin lost some of its gains to exchange hands at $175.

According to CoinMarketCapThis meant a depreciation of 0.53% over the past day. However, this loss was overshadowed by the weekly gain of 1.76%.

Solana’s growing appeal to Ethereum

The launch of sUSD marked an important milestone for the Solana ecosystem. It introduced a yield-bearing stablecoin.

It also indicated growing investor interest in Solana as an alternative asset. This was evident from the remarkable influx.

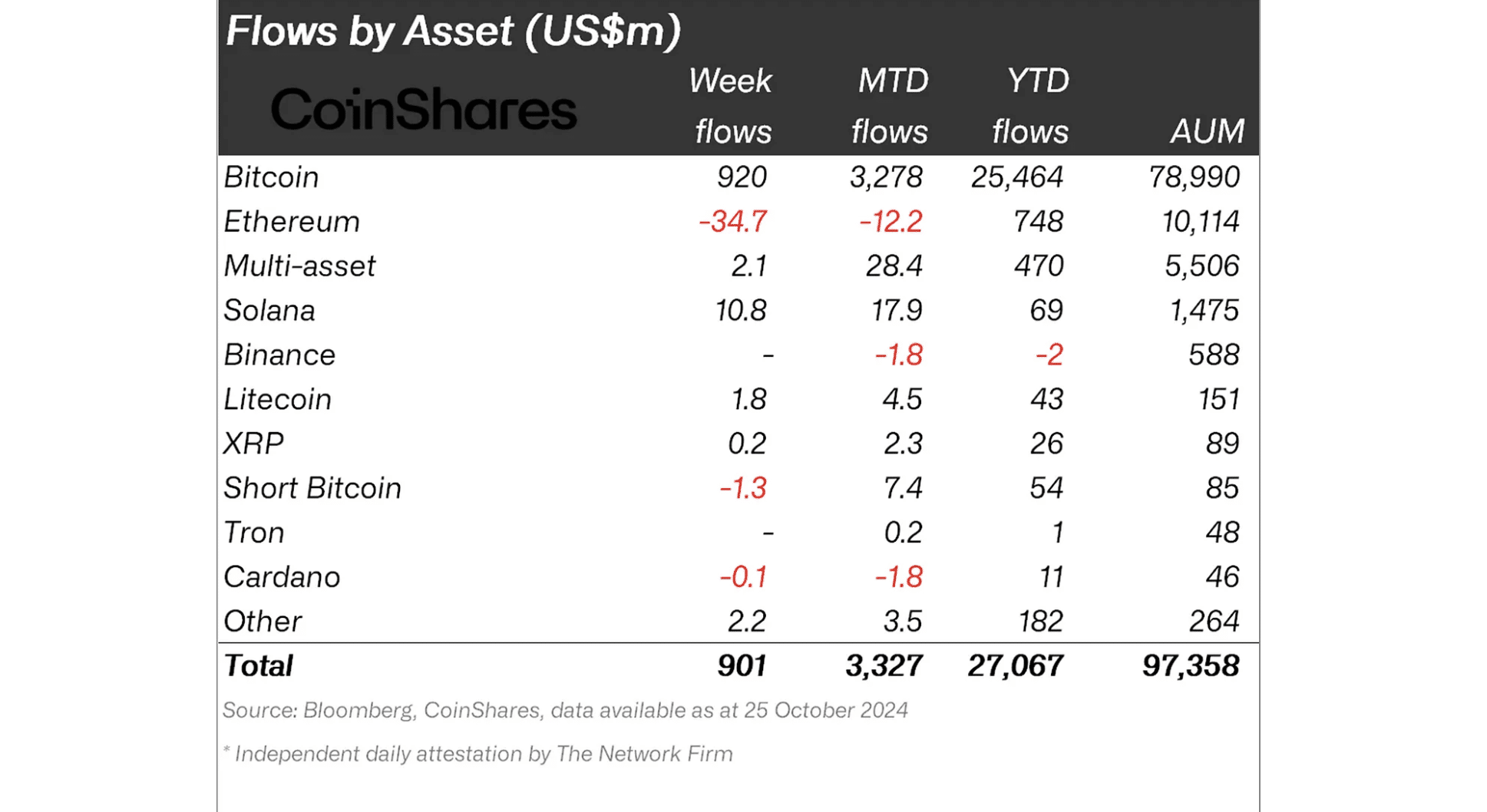

According to the weekly CoinShares reportSolana recorded an inflow of $10.8 million, ranking only second behind Bitcoin’s $920 million inflow.

Source: CoinShares

However, the same was not the case for Ethereum [ETH]which experienced an outflow of $34.7 million last week. Yet there is an annual influx [YTD] Ethereum still overtook Solana.

As Bitcoin continues to benefit from US political factors, Solana’s inflow highlighted its clear value proposition in scalability and decentralized applications.