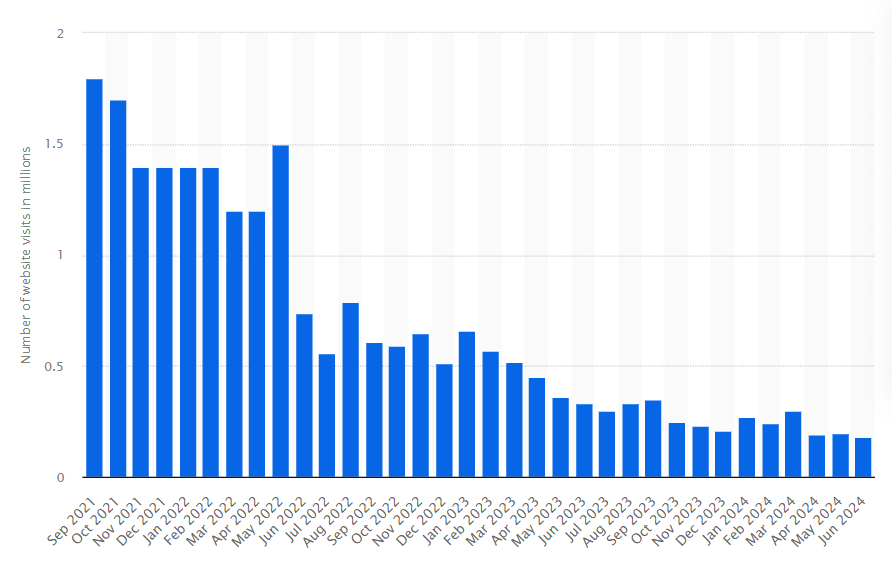

SuperRare, a prominent player in the digital art market, has reported a significant 45% decline in monthly visits year-over-year. This is evident from data from Statista. The decline in visits to SuperRare reflects a broader trend of declining NFT sales and widespread disinterest in digital artwork.

Estimated total number of visits to the digital art market website superrare.com Source: Statista

The number of monthly SuperRare visits drops to a new low since 2021

2024 started quite well for SuperRare, with a notable improvement in monthly visits from December 2023, representing a 29% increase over January figures.

However, from February onwards, the number of visits fell to 240,000, before falling further to 180,000 in June 2024. The drop in monthly visits represents the lowest number SuperRare has seen since 2021, marking a significant drop of 45% from the corresponding period in 2023 and 10% from May.

The United States, Spain and South Korea had the highest visits to SuperRare.com in June. The US held firm about 20% of total visits, while Spain and South Korea lagged behind with 17% and 13% of total cumulative monthly visits, respectively. France and Russia followed with 8% and 6% respectively.

NFT Marketplace users and wallets are plummeting

The decline in monthly visits to SuperRare is just one piece of a larger puzzle. In the fourth quarter of 2021, most NFT marketplaces were at their peak, with over 1.9 million active walletsfive times as much as in the previous quarter. Since then, however, the total number of wallets trading NFTs has declined, with only 1 million active wallets by the end of 2022.

2023 marked an even bigger drop, with the number of portfolios falling to 213,000 in the last quarter of the year, and into 2024 there was another 7% drop in the number of active portfolios in the first quarter, to 197,000.

Furthermore, the decline is echoing in the number of users, with NFTs losing over 1.75 million in just two and a half years, marking a 90% drop from the market’s 2021 rebound. By early June, there were already a greater number of sellers than buyers, indicating that there is more supply than demand in the NFT space. This affected NFT prices, further reducing their market value.

The average value of an NFT also fell by almost 60% in June compared to March. By the end of the second quarter NFT sales volume plummeting by more than 45% quarter over quarter, highlighting how NFT collectors are choosing to hold on to their assets while prices are unfavorable.