In the midst of this Bearish market sentiment, Sui, the indigenous token of the Sui Blockchain Bearish and is probably on the way to a double digits, because it has formed a Bearish price pattern on its daily period. This bearish look at Sui has shifted because it does not mean the crucial support from the rising trendline that it has witnessed for a longer period.

Sui technical analysis and upcoming levels

According to the technical analysis of experts, SUI has successfully confirmed his Bearish extension with today’s price fall and has shifted the entire sentiment to the bearish side.

Based on the recent price action and the historical momentum, if SUI keeps himself below the $ 4 level, there is a strong possibility that it could fall by 35% to reach the $ 2.30 level in the future. On the positive side, Sui’s Relative Strength Index (RSI) is 35.5, indicating that it actively has sufficient space for further price decreases.

Sui currently acts nearly $ 3.66 and has witnessed a price drop of more than 8.50%for the past 24 hours. During the same period, the trade volume fell by 55%, indicating a lower participation of traders.

$ 18.5 in Sui -outflow

In addition, Sui’s Beerarish price action and a strong Bearish market sentiment, long-term holders seem to accumulate the token, which indicates a potential buying, as revealed by the on-chain analysis company Coinglass. Data from the inflow/outflow of the place showed that exchanges have been an important outflow of more than $ 18.5 in Sui -Tokens.

This substantial outflow of the stock markets indicates a possible accumulation and can cause purchasing pressure and further price increases that are difficult to experience because of the bearish sentiment.

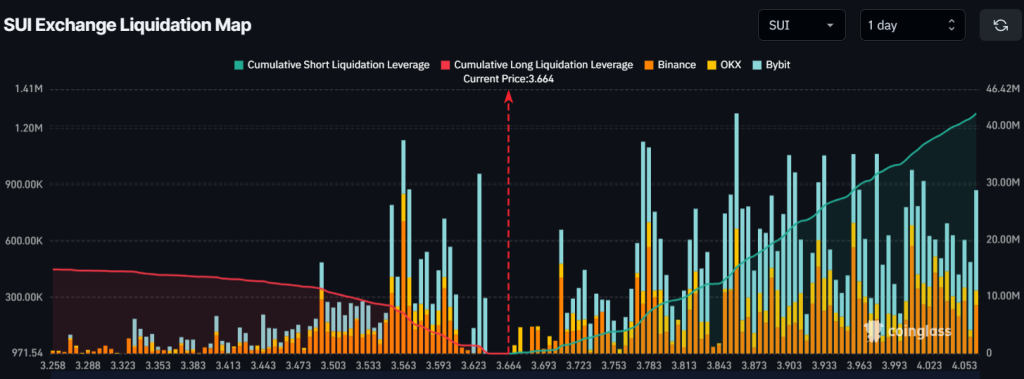

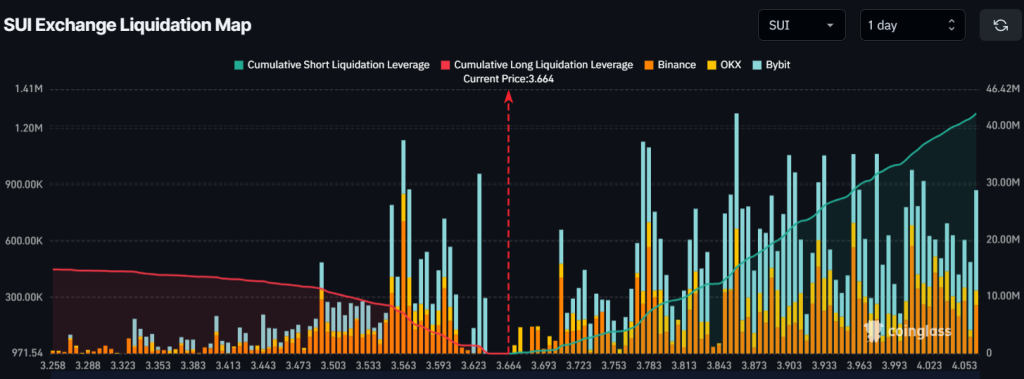

From now on, the most important liquidation levels is nearly $ 3.56 at the bottom and $ 3.85 at the top, where traders at these levels are used too much, as reported by CoingLass.