- SUI has witnessed an increase in outflows this week after the uptrend encountered resistance.

- In the absence of buyer support, the SUI could decline to test support before another rebound occurs.

Sui [SUI] has been one of the top performers in the cryptocurrency market in recent months. In the past 30 days, SUI has doubled its market cap to over $5 billion after its price rose more than 98%.

SUI’s gains set it apart from the choppy trends seen in other altcoins.

However, after over a month of steady gains, the rally is now showing signs of exhaustion, and it could reverse to find support before the uptrend resumes.

SUI price analysis

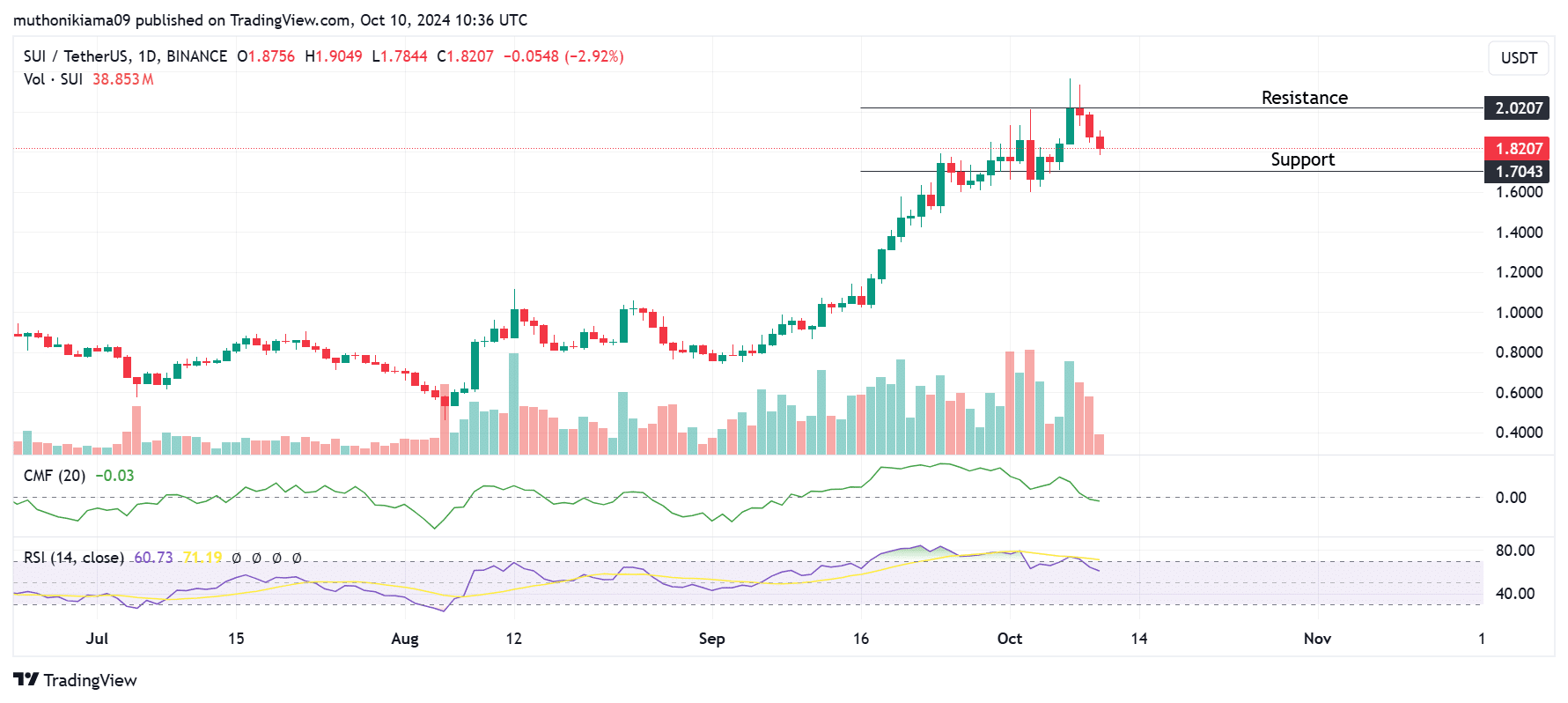

SUI was trading at $1.82 at the time of writing, having fallen 4.4% in 24 hours. According to the report, trading volumes have also fallen by 6% CoinMarketCap, which shows that interest in this token is decreasing.

Additionally, the volume histogram bars have been red for the past three consecutive days, indicating that sell-side pressure is high.

Purchasing activity around SUI is also decreasing. The Chaikin Money Flow (CMF) has been on a downward trend this week, an indication that money is flowing out of the token.

The CMF had also turned negative on the one-day chart as selling pressure exceeded buying pressure. This could be caused by traders taking profits after the uptrend showed signs of weakening.

Source: TradingView

The selling activity started after the Relative Strength Index (RSI) crossed below the signal line, forming a sell signal. Buyers are likely to return to the market as this measure reenters bullish territory.

If buying activity remains thin and sellers continue to dominate, the price is likely to drop to test the support at $1.70. Buyers can use this drop to find a new entry point.

However, for a sustained uptrend, SUI must break the resistance above $2.

Analyzing derivatives data

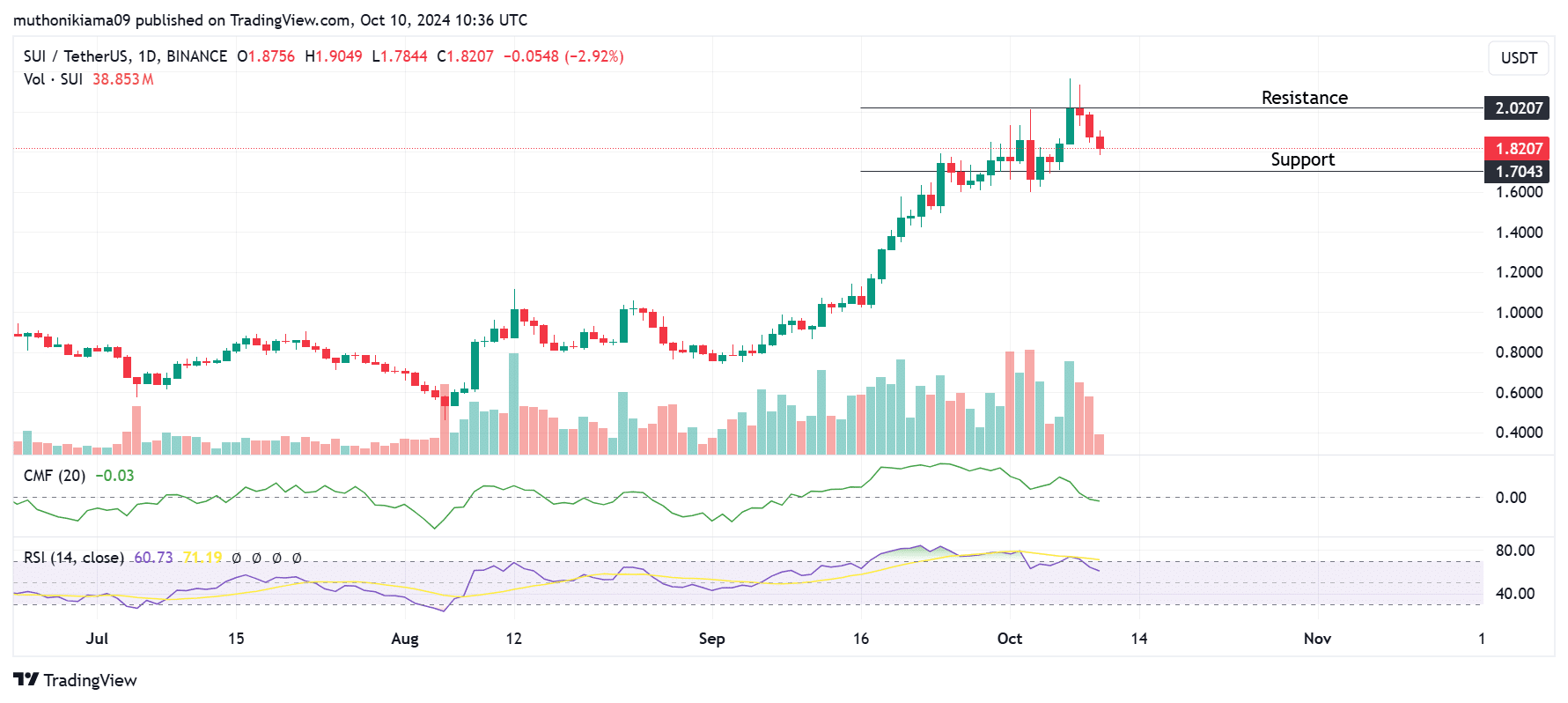

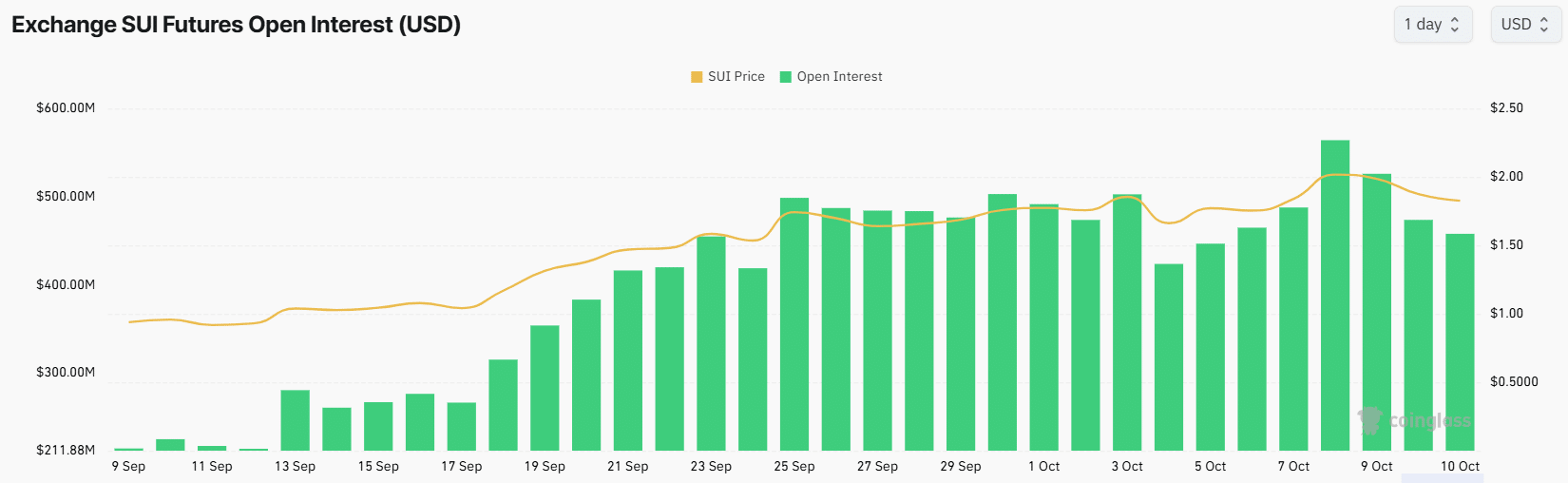

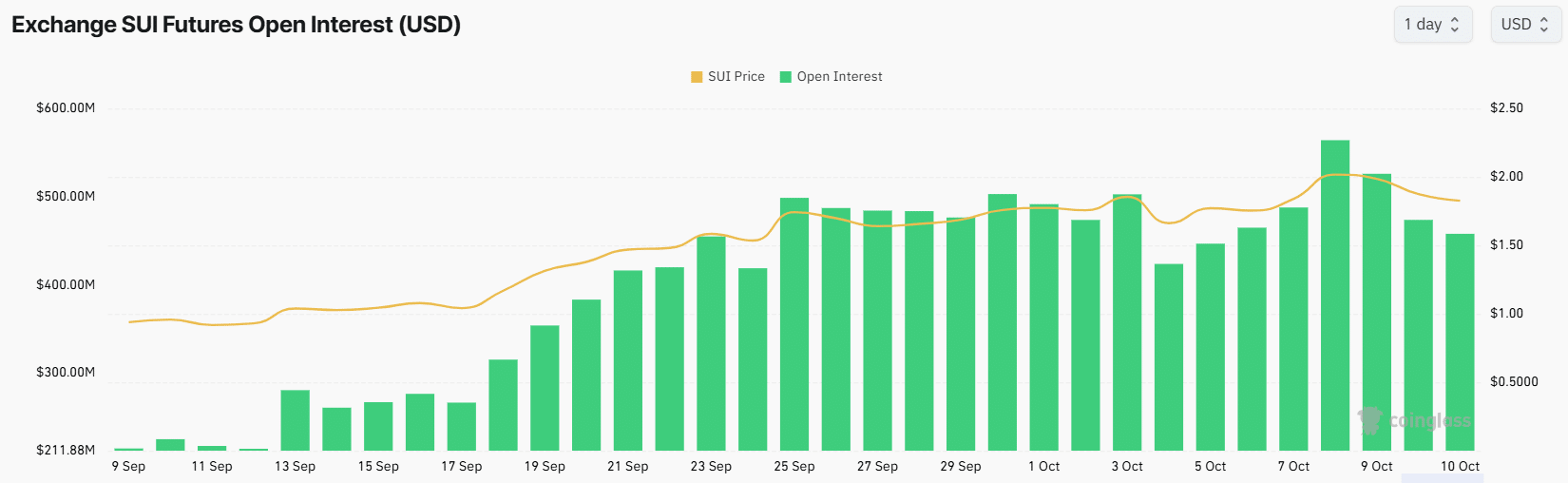

Data from the derivatives market shows that SUI is cooling down after overheating. Open interest is down 11% over the past 24 hours to $457 million at the time of writing, per Coinglass.

SUI’s Open Interest hit an all-time high above $563 million earlier this week, but has since fallen by more than $100 million. This shows that traders are closing their positions on the token as interest rates decrease.

Source: Coinglass

Read Sui’s [SUI] Price forecast 2024–2025

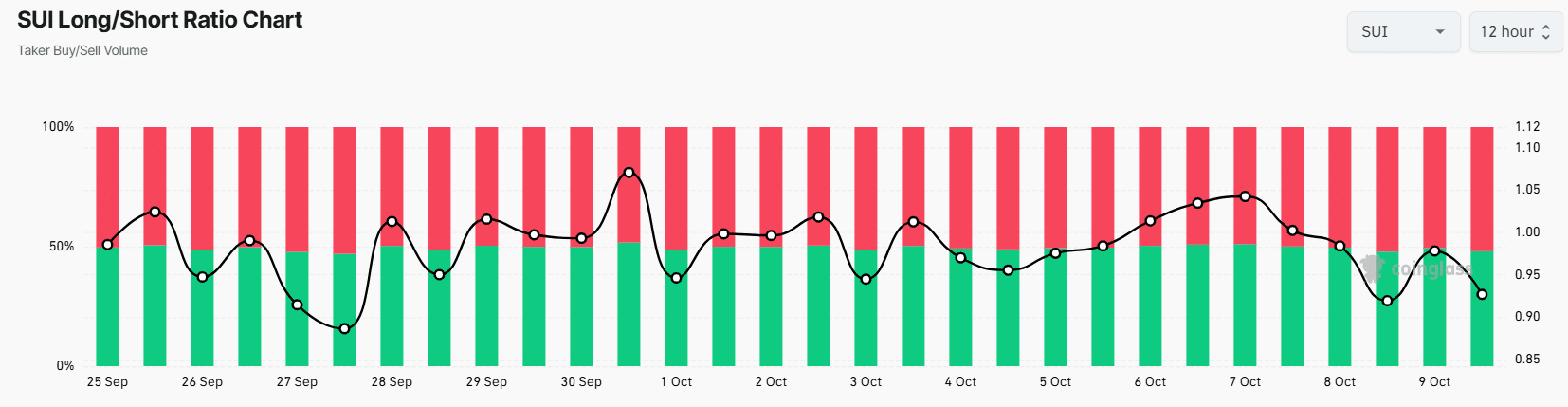

Additionally, SUI had the fourth highest liquidations in the last 24 hours, with $6 million. Most of the liquidated traders were those with long positions, which creates bearish sentiment.

The long liquidations have also had an impact on the Long/Short Ratio, which has fallen to 0.92. Although this is close to the neutral zone, it appears that there are slightly more short traders than long traders.

Source: Coinglass