- Sui eclipsed Solana and Ethereum in terms of net inflows.

- But SUI’s pullback could be lower to $1.7 if the weakening continues.

Sui [Sui] will be among the top emerging blockchains in 2024, poised to destroy part of Ethereum [ETH] and Solana’s [SOL] market share.

Recently, the chain surpassed ETH and SOL in terms of net inflows noted by Mysten Labs co-founder Adeniyi Abiodun, who also leads the team behind the Sui chain.

He said,

“Sui recorded higher net inflows than Solana and Ethereum combined at $24.3 million”

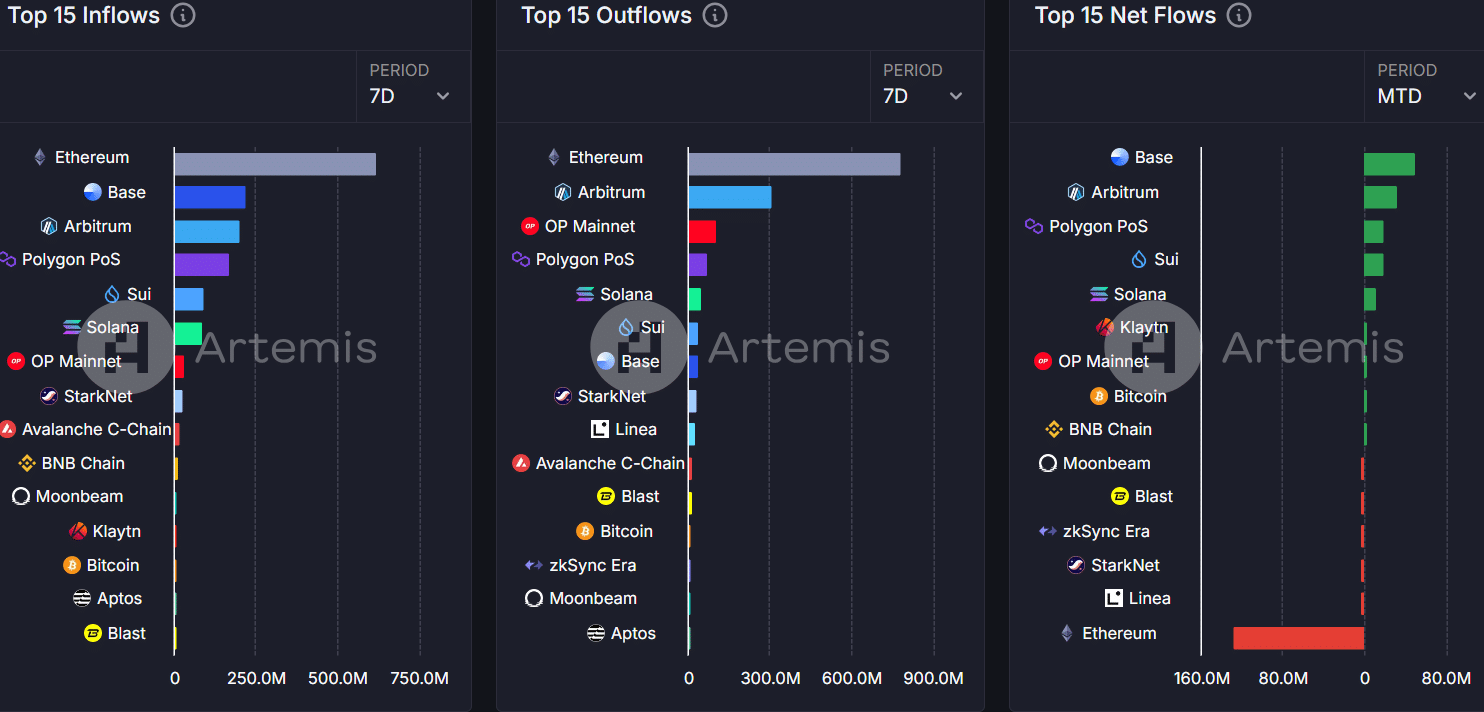

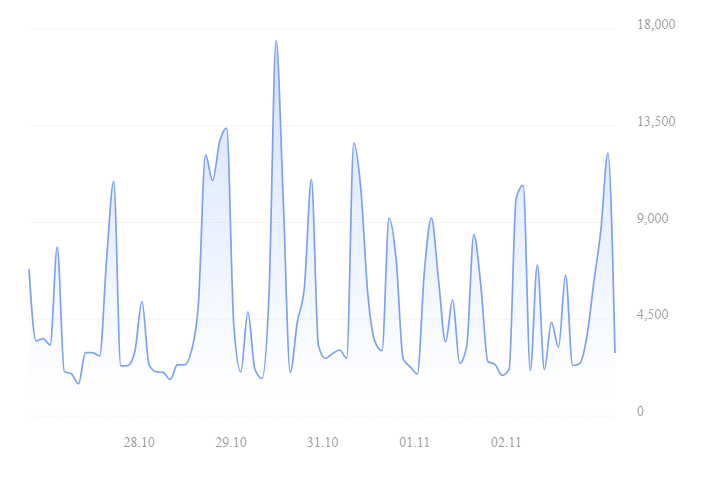

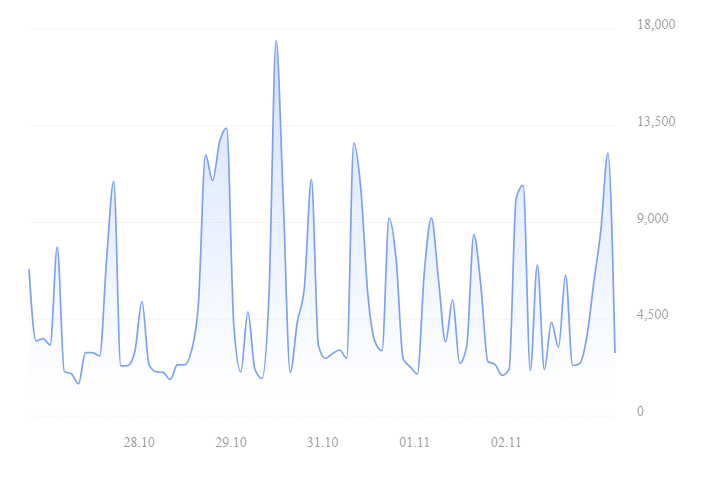

Source: Artemis

Artemis data showed that Sui had a significant lead in terms of inflows, outflows and net flows over the past seven trading days.

It saw more entry than Solana on the weekly charts. On a monthly basis (MTD), net inflows were $19.3 million, compared to Solana’s $12.3 million at the time of writing.

SUI vs SOL

Sui is considered a great alternative to SOL, and some analysts even believe that SUI’s price action could follow SOL’s trajectory.

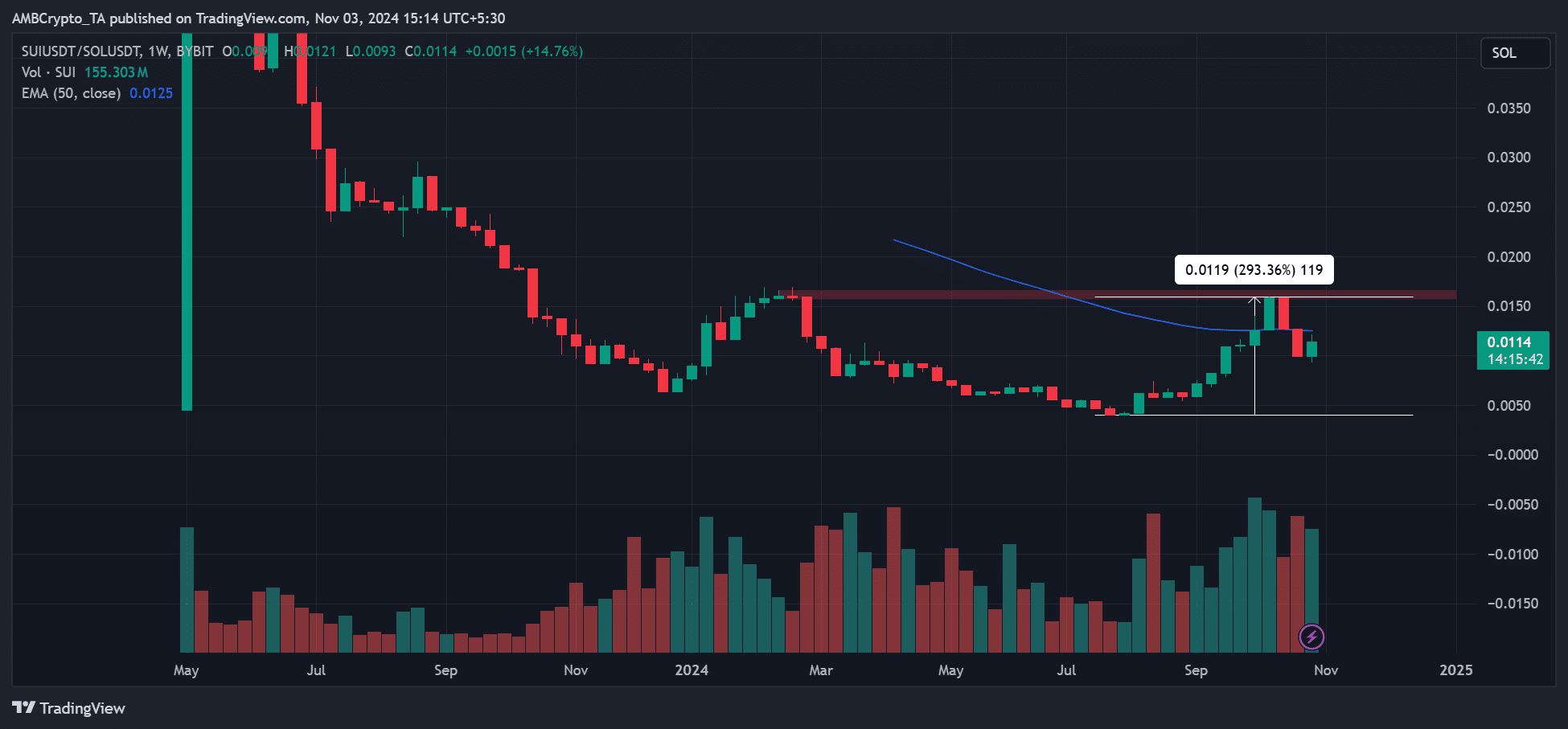

On the price charts, SUI actually outperformed SOL in August and September, as evidenced by the wild 300% increase in the SUI/SOL ratio.

Source: SUI/SOL, TradigView

The SUI/SOL ratio tracks the relative performance of SUI versus SOL. However, in October the ratio declined, indicating that SUI was underperforming SOL.

However, the chain still saw modest network growth, which could indicate increased interest and provide a boost to SUI prices. Are new accounts rose 5% over the past 7 days to reach 862.7K, marking increased market interest in the altcoin.

Source: Sui Explorer

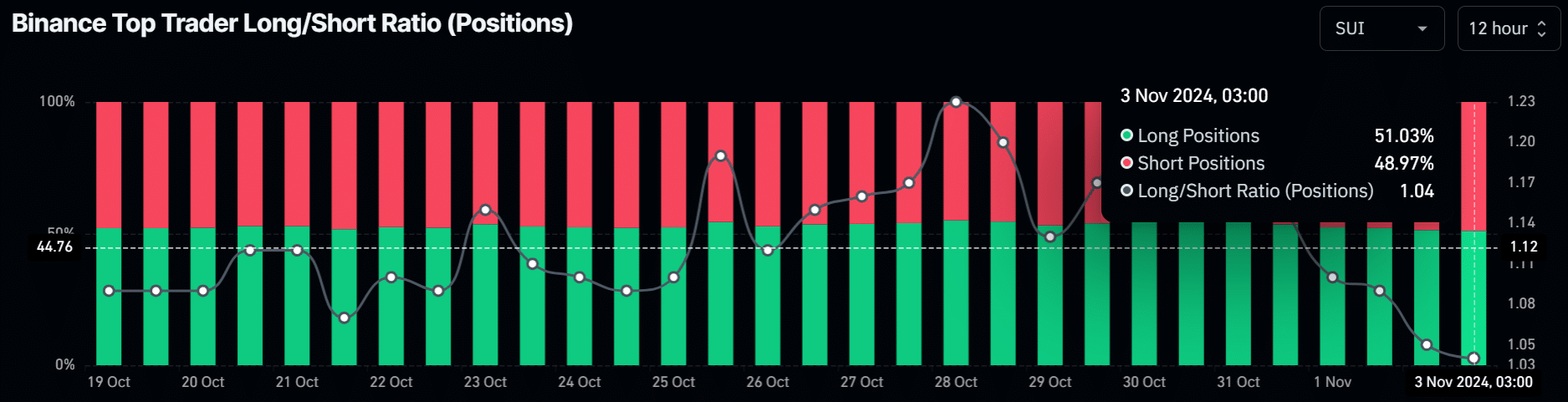

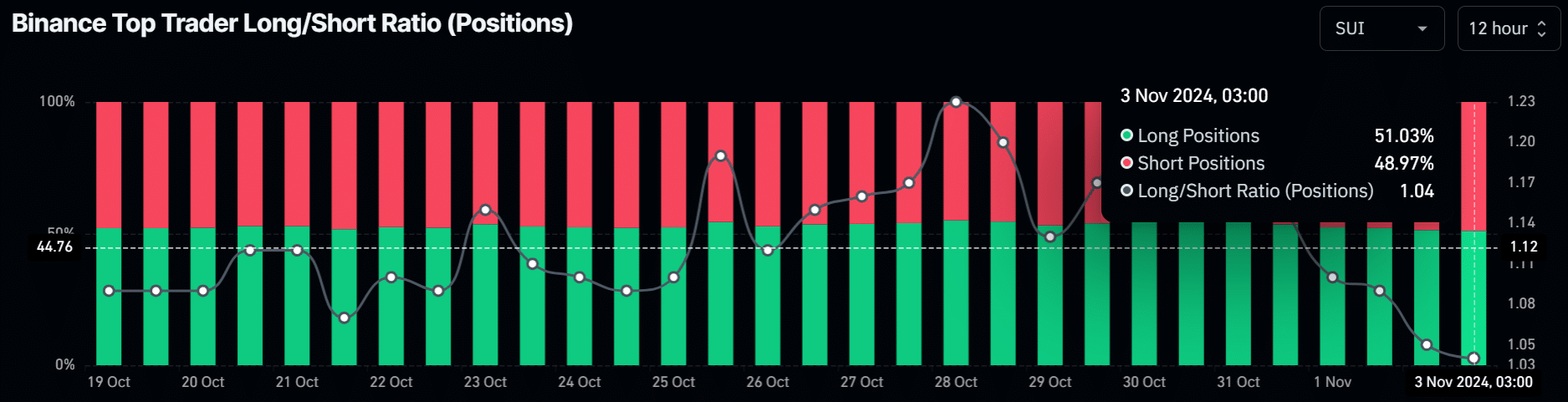

Despite the increased interest, SUI’s market positioning was broadly neutral, reflecting broader market sentiment ahead of the US elections.

Read Sui [SUI] Price prediction 2024-2025

Top traders on Binance had a slight dominance in long positions, at 51%, compared to almost 49% shorts. The negligible difference meant that the market could go either way in the short term, depending on the election outcome.

Source: Coinglass

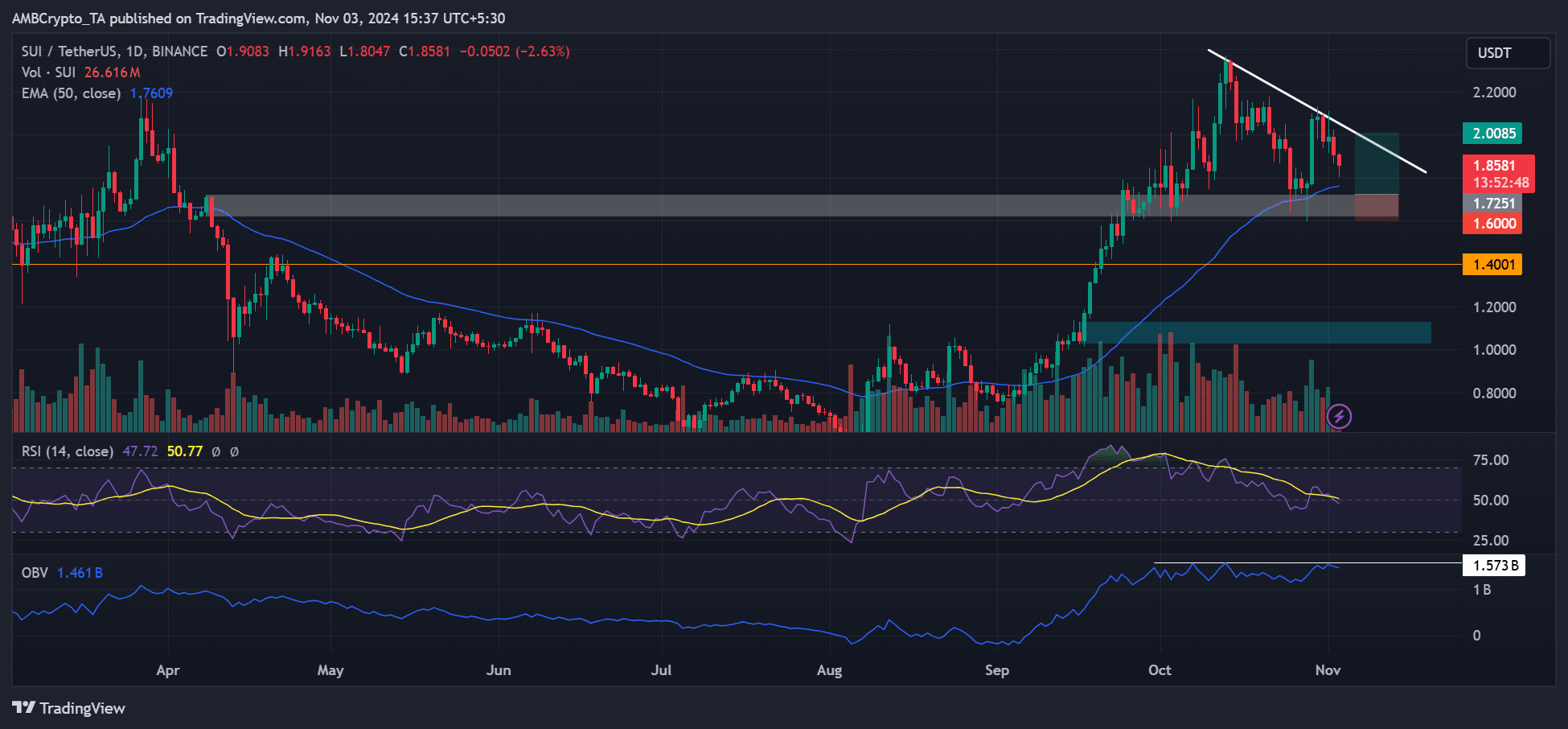

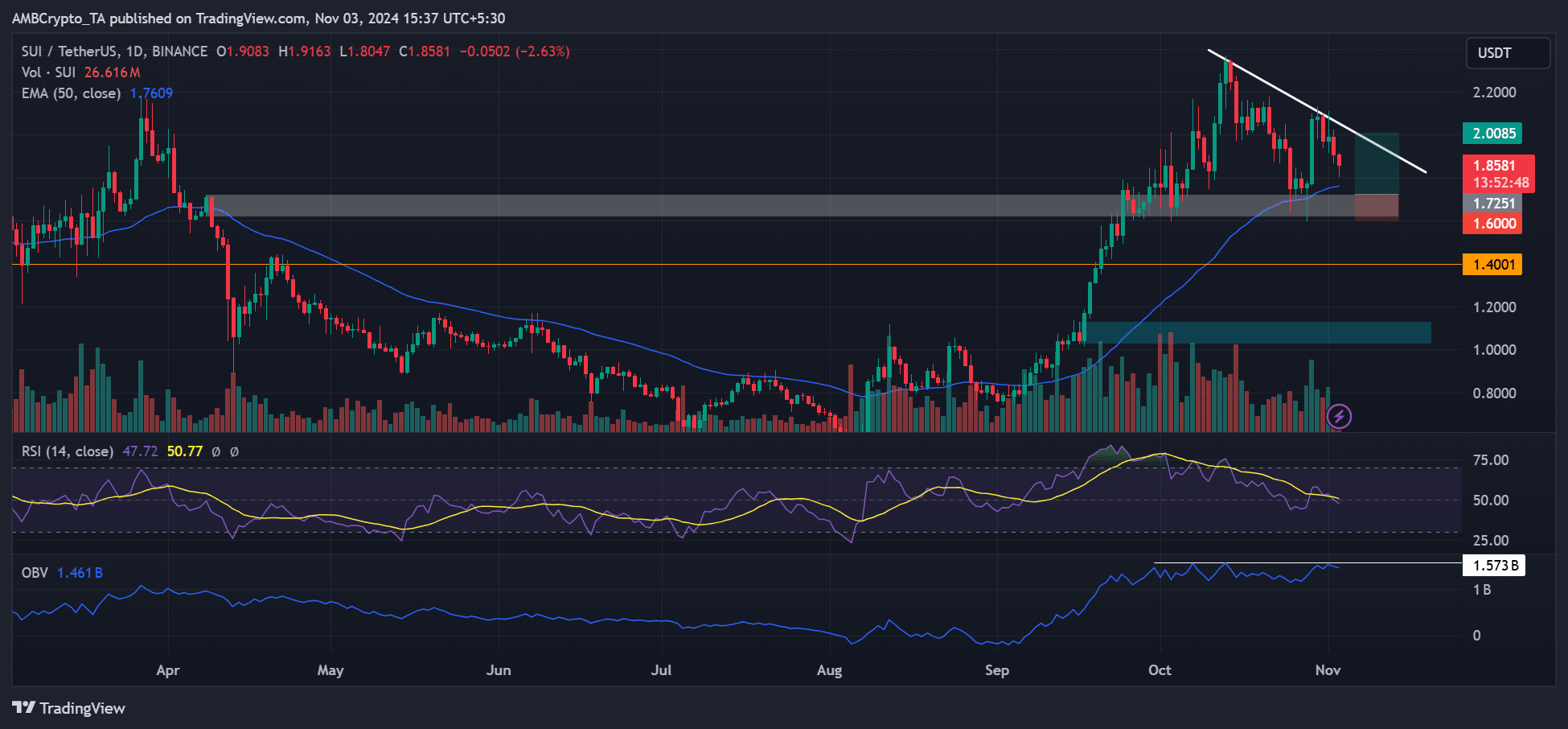

However, the price chart showed strong support above $1.6, triggering a price rebound in September and October.

If the pattern repeats, SUI could rebound from it and eye the trendline resistance near $2. That would be a potential 16% recovery from the $1.6 – $1.7 support zone.

Source: SUI/USDT, TradingView