- SUI could be preparing for a breakout as weak hands leave the market.

- If this happens, there could be a shift in the rankings within the top 20.

Sui [SUI] has made a significant impact over the past 30 trading days by surpassing Litecoin [LTC] in terms of market capitalization. The growing user base has certainly fueled this upward trend.

However, a recent weekly decline of more than 3% has led to SUI entering the market top losers chart.

This difference prompted analysts at AMBCrypto to investigate whether the recent pullback was a deliberate attempt to shake out weak hands, paving the way for a stronger push that could see the SUI close around $2.40.

If so, a recovery could ALMOST cost it its position as the 17th largest cryptocurrency by market cap; otherwise, Litecoin seems poised to regain its place.

SUI reaches a transactional milestone

Interestingly, SUI has shown strong upside potential over the past two months. Despite the bearish cycles, the bulls have managed to avoid any retracement, maintaining the last support level at $0.53.

SUI was trading at $2.06 at the time of writing and has posted impressive gains in a short period of time. This increase was marked by a significant spike, with the RSI reaching overextension.

However, despite these concerns, the token has maintained its upward trajectory, experiencing only minor hiccups, which were strategically smoothed out by bullish support.

This momentum is amplified by the network’s design, which aims to address the blockchain’s traditional shortcomings by enabling faster transactions without overloading the network.

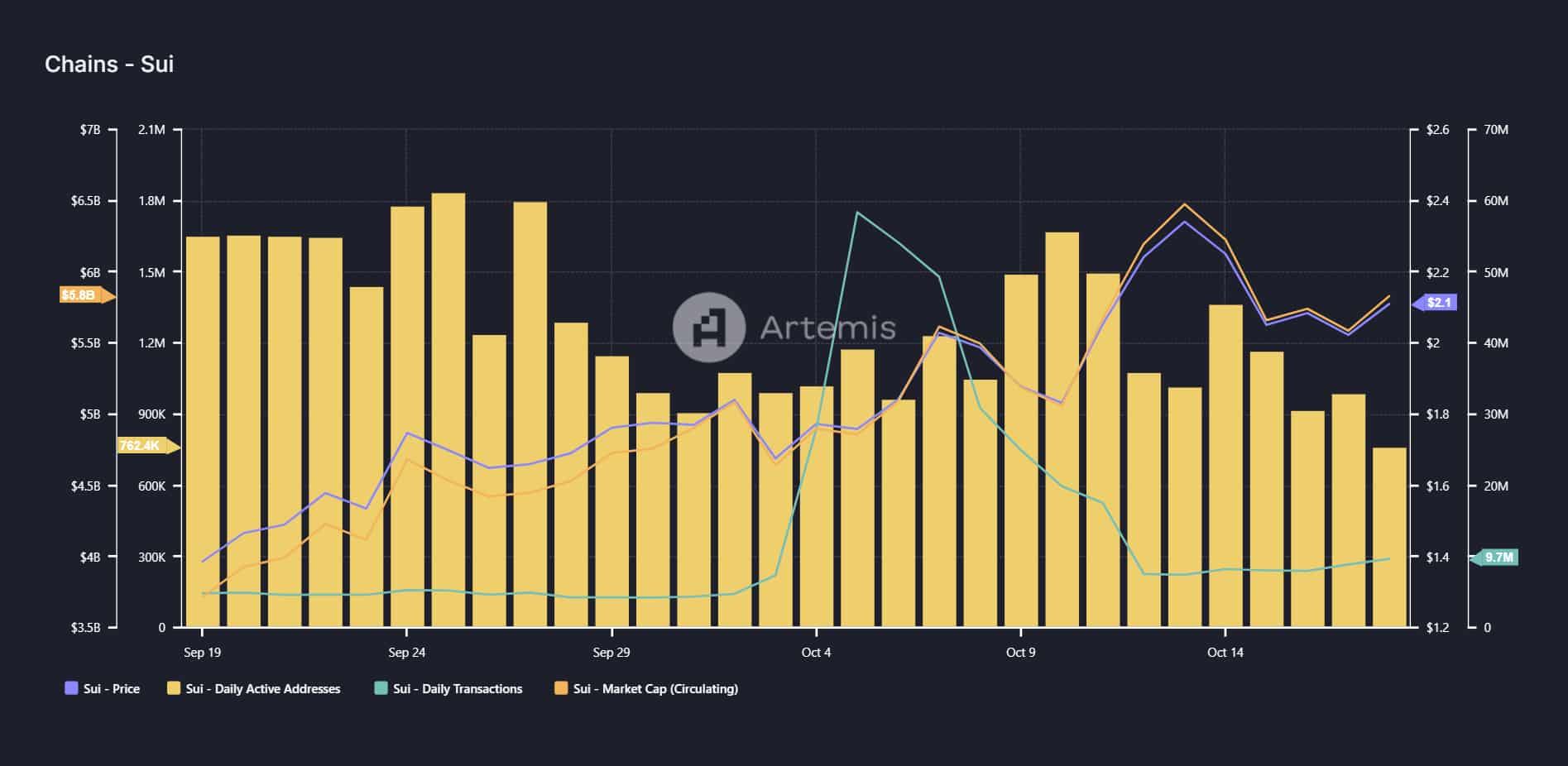

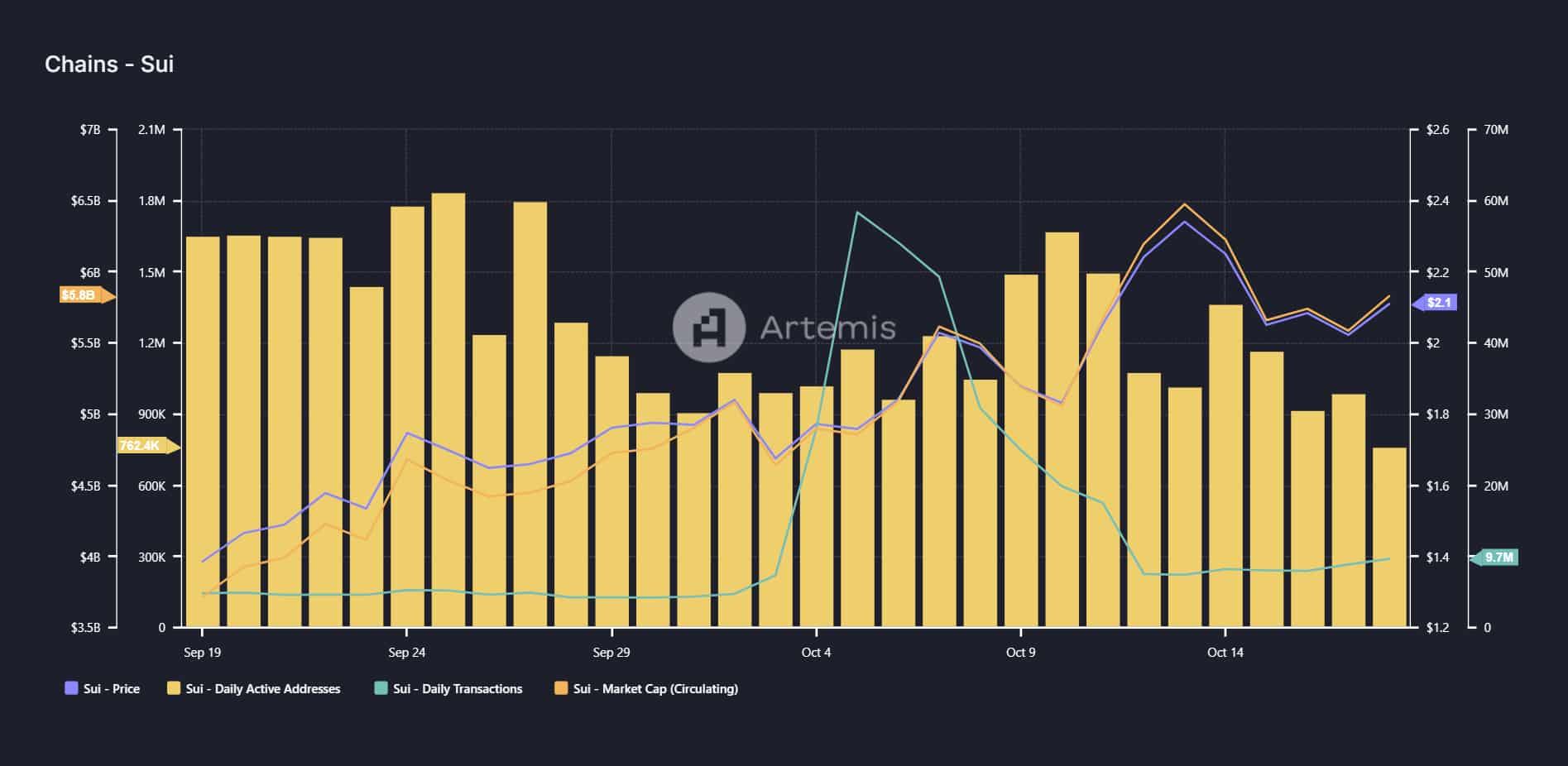

Achieving 270,000 TPS, SUI has resonated well with crypto users, with a notable transaction volume of $6 billion.

This success took SUI to an ATH of $2.40 a week ago.

However, as this price range indicated a potential top, many wallets began to offload their holdings, leading to a significant drop in the number of daily transactions, which fell by half to $20 million.

Source: Artemis Terminal

This trend indicates that the surge has moved many stakeholders toward profits, pushing weak hands to exit the business.

However, for a recovery to take place, it is crucial that new buyers target the local low of $2 as a potential dip, in anticipation of a rally that could deliver substantial returns.

If this trend continues, SUI may experience an intense recovery, potentially leading to a new ATH. In such a scenario, the market capitalization of the market could trigger a shift in the industry rankings top 20.

Intense rivalry ahead

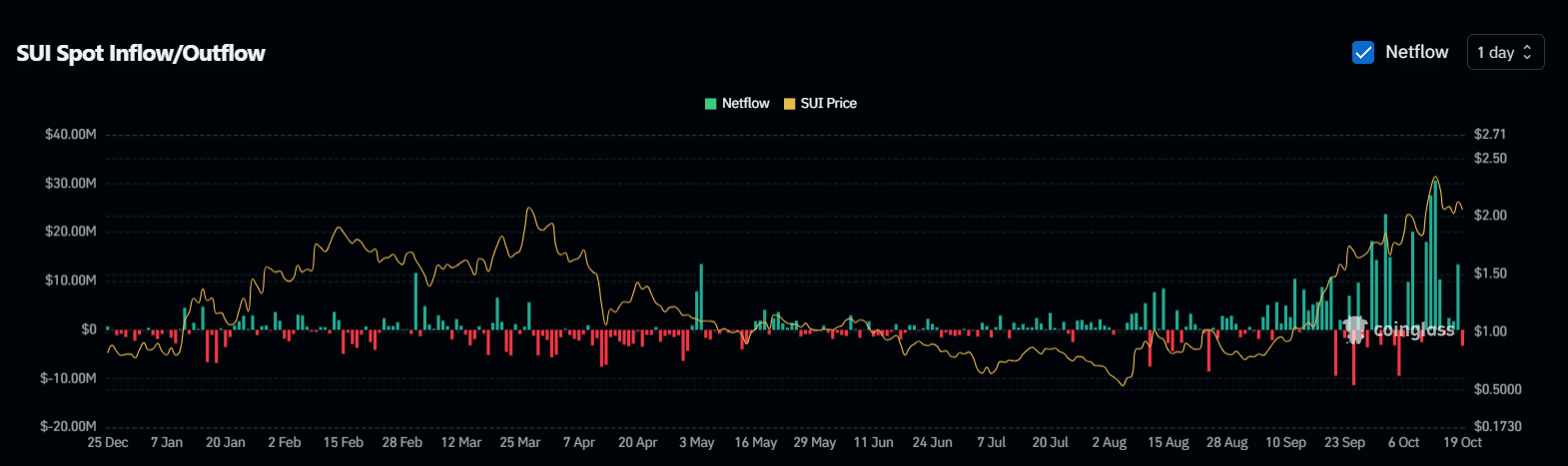

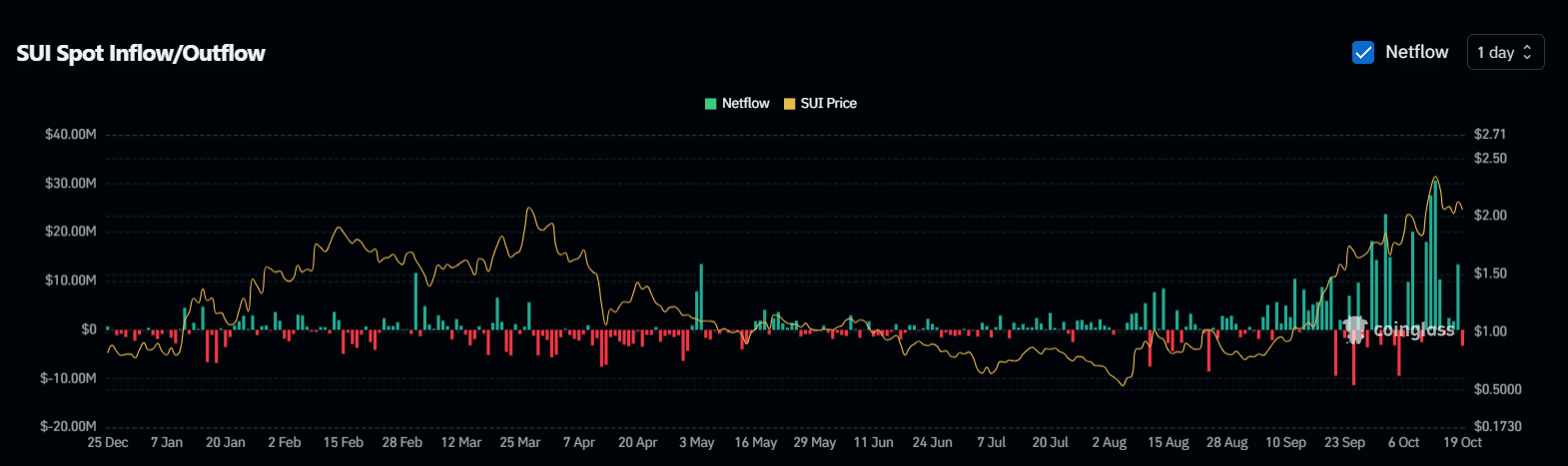

Surprisingly, despite the surge SUI has experienced over the past 60 days, spot traders continued to unload their positions, causing daily volume to drop to $30 million.

However, the price has stabilized, indicating possible accumulation by stakeholders, which is crucial for a recovery.

Source: Coinglass

The recent weekly pullback has taken SUI close to $2.05, making it essential for holders to consider this as the ideal entry point. The recent red fuse indicates that many may adopt this strategy.

Read Sui’s [SUI] Price forecast 2024-25

If this trend continues, SUI could be setting up for a significant correction near $2 as a recent MACD crossover has turned bearish, suggesting prices could fall unless spot traders increase their buying activity.

If this renewed interest materializes around the $2 mark, a strong recovery could follow. However, to surpass NEAR, the rebound needs to take SUI back to around $2.40.