- The bull run has been caused by favorable macroeconomic conditions, the US presidential elections and growing institutional adoption

- Report claimed that Bitcoin [BTC] could potentially rise to $150,000, with Ethereum [ETH] Reach $8,000

The market’s momentum has been increasing since the beginning of the year. In fact, the total cryptocurrency market capitalization increased by 4.21% to $3.41 trillion. Trading volumes also increased by 18.20%, with total valuations reaching $114.86 billion.

Steno Research has now identified this as the first phase of a broader bull cycle. Multiple tokens are expected to reach all-time highs, with major assets such as BTC and ETH entering crucial phases of price discovery.

Favorable market conditions and the ‘Trump effect’

According to Shorthand researchA supportive economic environment and the upcoming inauguration of Donald Trump as the 47th President of the United States, known for his pro-crypto position, could provide a major boost to the market recovery.

The ‘Trump effect’ was already visible in November 2024, when Bitcoin [BTC] rose to a new all-time high of $108,000 after his election victory, peaking in December. As discussions around a potential Bitcoin Reserve continue to gain traction, this could further fuel the expected market rise.

Steno Research attributed the expected rally to several factors, with Bitcoin and Ethereum particularly benefiting [ETH]. The report noted:

“An unprecedentedly favorable regulatory environment for cryptocurrencies, a supportive macroeconomic environment characterized by falling interest rates and improved liquidity, and Bitcoin’s historically strong post-halving performance.”

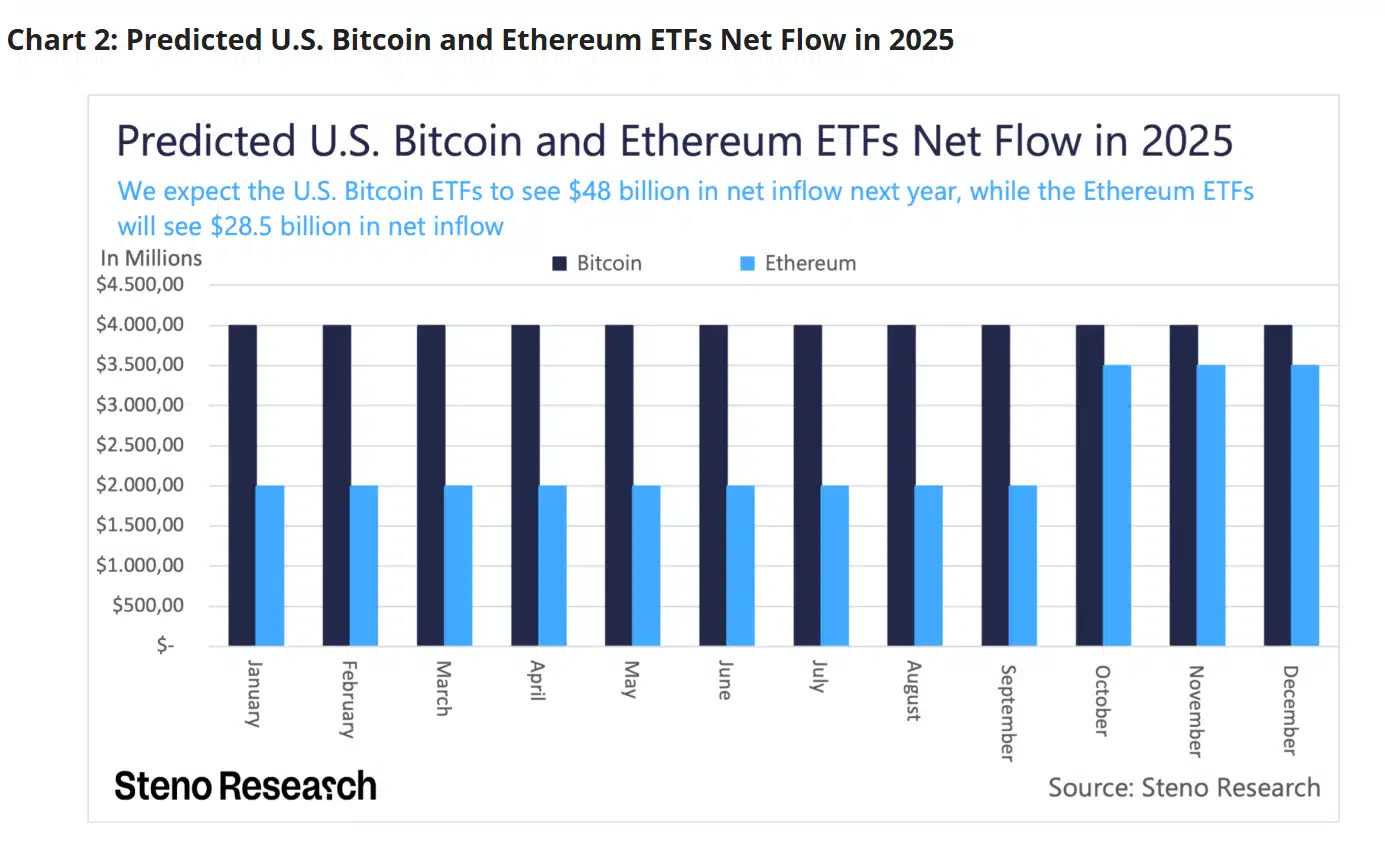

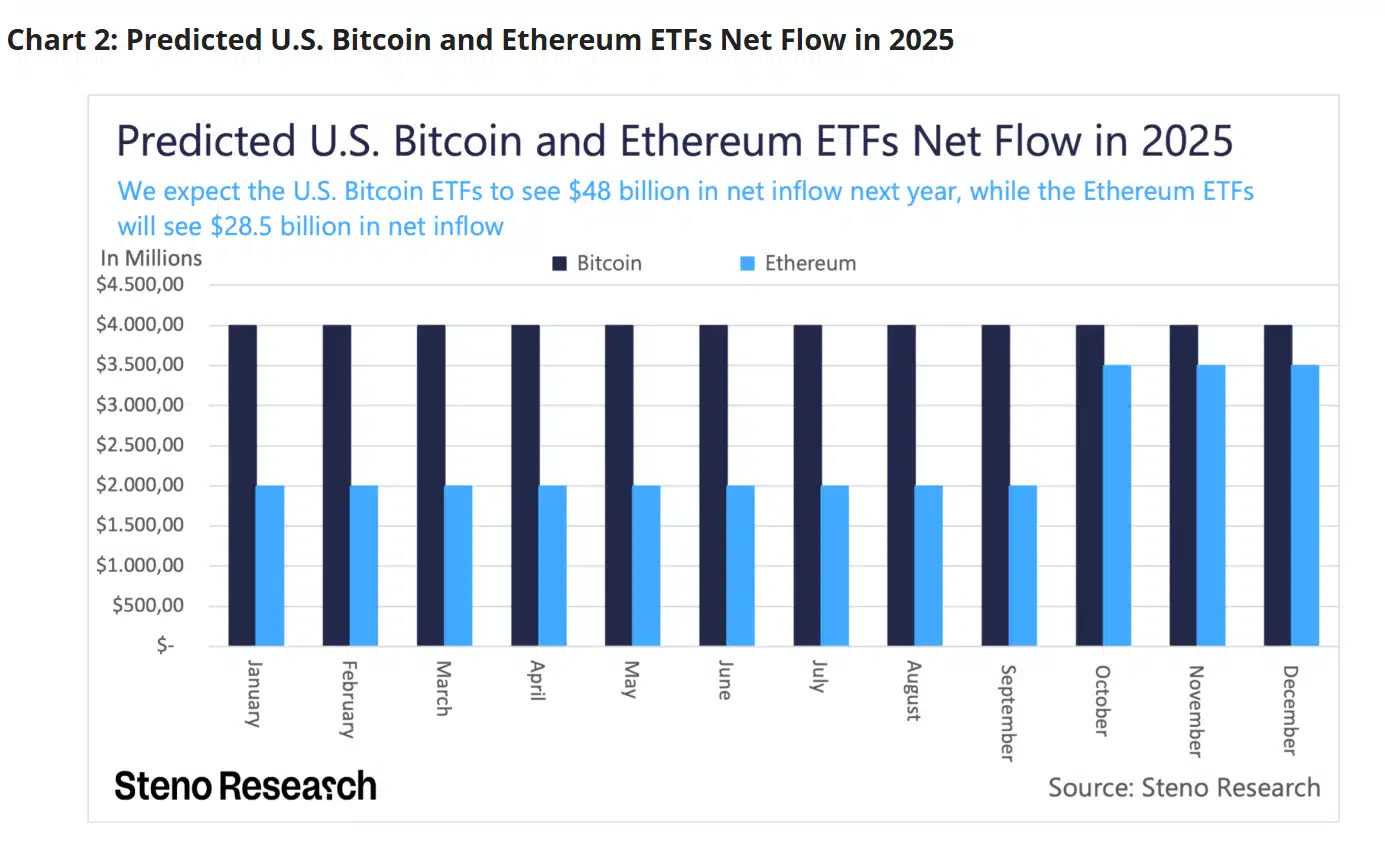

Additionally, Steno predicted that the US-based Bitcoin and Ethereum exchange-traded funds (ETFs) will reach new milestones, with BTC and ETH ETFs expected to reach $48 billion and $28.5 billion in assets under management, respectively. The greater awareness among institutional investors of these assets is expected to drive these inflows.

Source: Steno research

“With institutional adoption set to reach unprecedented levels, inflows into Bitcoin and Ethereum ETFs will continue to grow.”

The increase in talk of ETFs for other tokens could also contribute to broader market growth, implying an expansion beyond just the top two assets.

BTC, ETH and altcoins poised for significant gains

Steno Research also claimed that Bitcoin [BTC] and ether [ETH] could post huge gains, with BTC expected to hit an all-time high of $150,000 and ETH to rise to $8,000. These predictions seemed to be related to factors previously outlined.

Steno also pointed to a coming altcoin rally, driven by a rising ETH/BTC ratio and a decline in Bitcoin’s dominance.

Here it is worth noting that the ETH/BTC ratio measures the value of Ethereum against Bitcoin. A higher ratio indicates a rising ETH value and has historically preceded altcoin increases.

Steno predicted that the ETH/BTC ratio will reach “at least 0.06,” marking the start of a broader altcoin run. At the same time, Bitcoin’s dominance is expected to drop to 45%, further paving the way for the growth of altcoins.

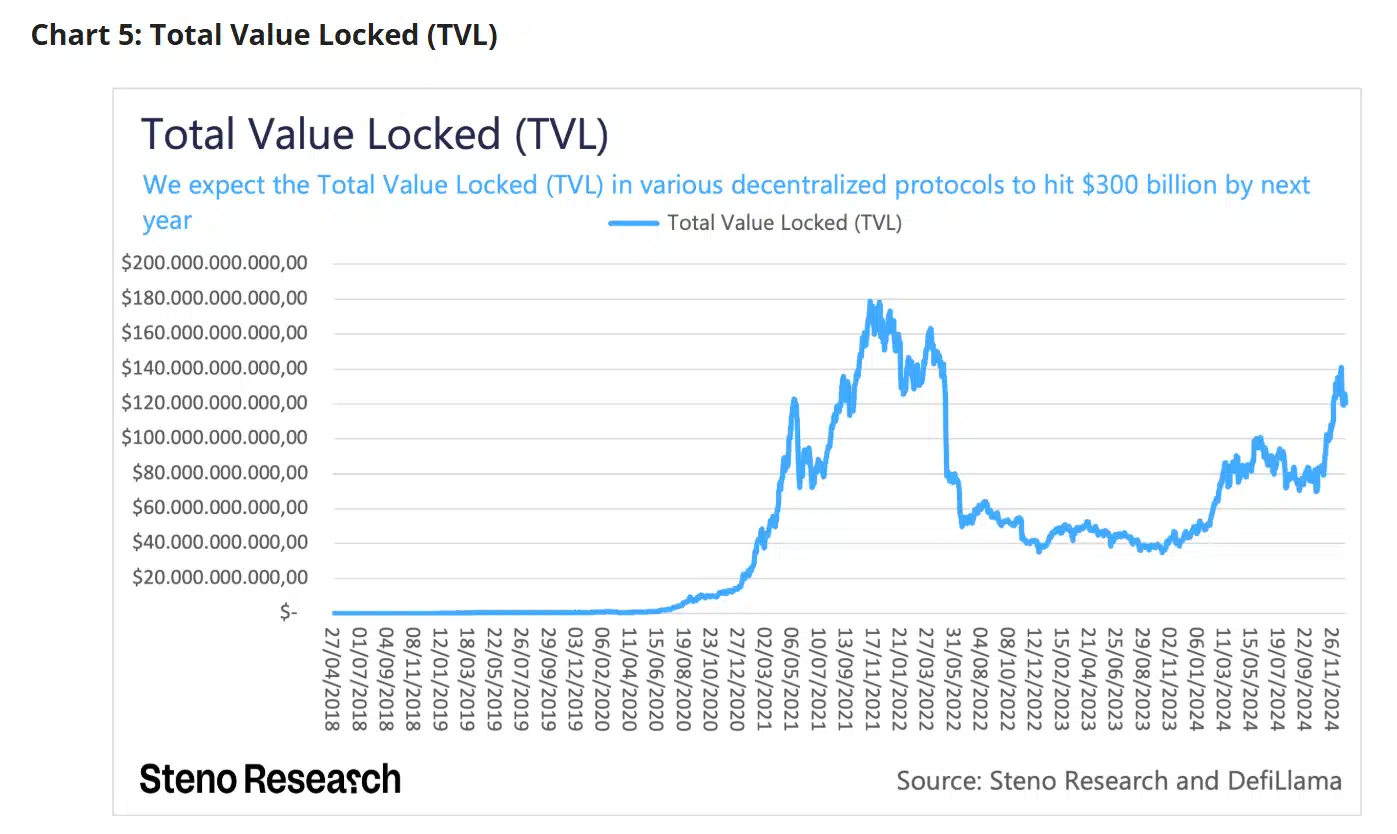

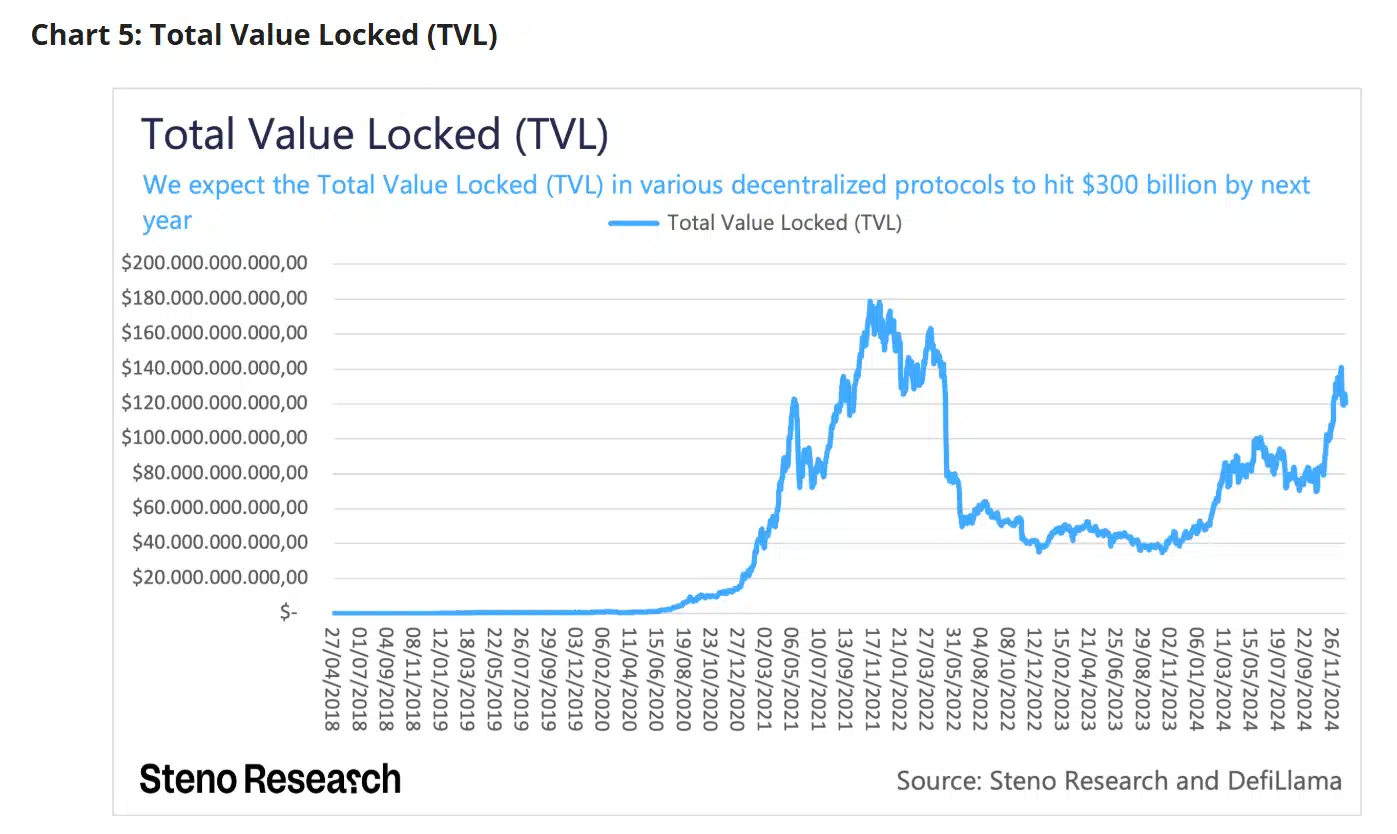

The decentralized finance (DeFi) sector is also expected to flourish. According to the aforementioned report, the Total Value Locked (TVL) for decentralized protocols will rise to $300 billion – nearly doubling the previous record high of $180 billion in 2021.

Source: Steno research

This rise in TVL highlights the potential for massive liquidity inflows into decentralized protocols – a clear indication of growing confidence in the sector’s long-term prospects.

Market is preparing for an increase in liquidity

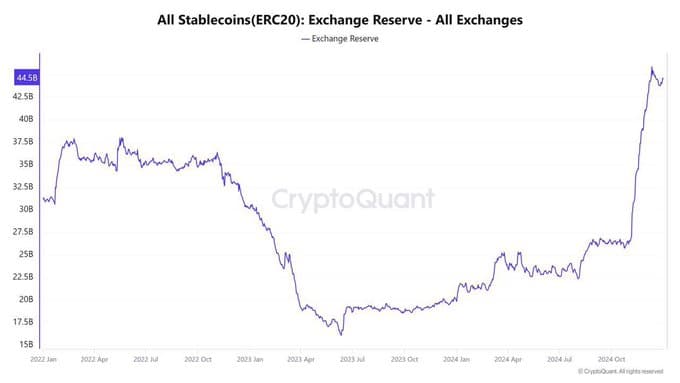

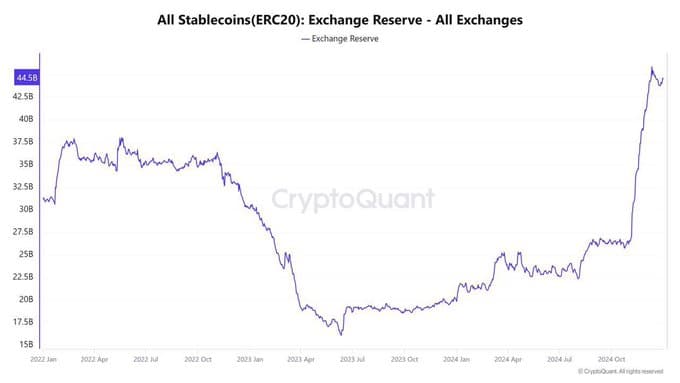

The optimism in the market is already taking shape, and the same is reflected in the increase in the Stablecoin Exchange Reserves.

In fact, Binance’s stablecoin reserves had risen to $44.5 billion as of December 31, 2024, indicating a remarkable liquidity pool ready to support asset purchases that can begin at any time.

Source: CryptoQuant

Historically, an increase in stablecoin reserves on exchanges means the market is preparing for a big move – in line with the expectations outlined in the Steno report.