Currently, the crypto market’s attention is on Ripple’s XRP and its ‘brother’ cryptocurrency, Stellar Lumens (XLM). The announcement that Ripple’s XRP was not a security had a significant impact on the market, pushing the price of XLM above crucial resistance lines. However, XLM’s price faced a heavy drop after enjoying a surge, which appears to be a brief stumble. Currently, XLM is displaying bullish tendencies once more, with prices gaining momentum and aiming to surpass immediate resistance levels.

XLM Community Remains Bullish

Over the past two months, Stellar Lumens (XLM) has stood out as one of the top-performing cryptocurrencies in terms of market capitalization and price gain. It managed to record a remarkable 110% increase in price, soaring from its lowest to its highest price point during this eight-week period. However, recent trends suggest a potential slowdown, indicating that the bullish momentum behind XLM may be experiencing fatigue.

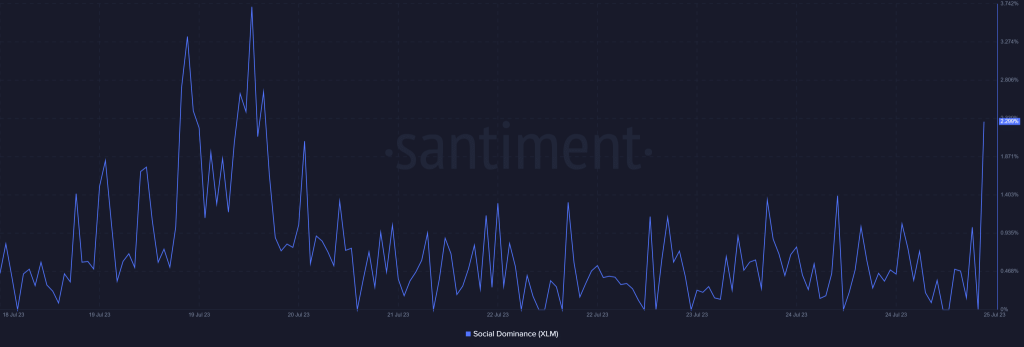

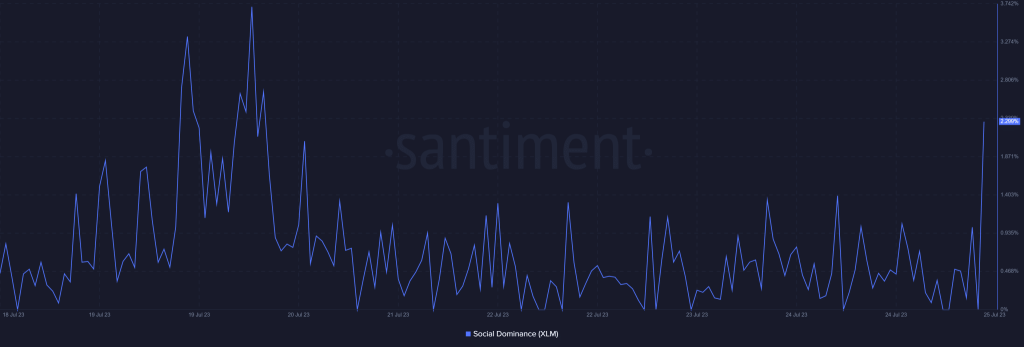

Despite recent trends, trading volumes remain significantly higher than the monthly low, indicating continuous market interest. Additionally, a slight increase in weighted sentiment from Santiment’s data suggests bullish optimism. The social dominance metric, which spiked in recent days, signifies massive attention due to Stellar’s recent expansion to Changera App.

Moreover, Stellar continues to expand its market dominance, as announced on its official X account. The Stellar-based USD Coin (USDC) stablecoin is now accessible at 322,000 off-ramp locations. This accessibility far surpasses that of USDC on Ethereum, which is available at only 30,180 locations.

Stellar’s native token, XLM, is also widely accessible, with availability at 26,221 locations, making it one of today’s most reachable native cryptocurrencies. Although Stellar competes directly with XRP, it has successfully established its own unique space in the market, a factor that currently accelerates the probability of a skyrocketing trend ahead.

What’s Next For XLM Price?

XLM price dipped beneath the 50-day Exponential Moving Average (EMA) at $0.14, nearing the horizontal support line.

However, bulls found this as a lucrative opportunity to dive into, and they stepped in, buying the dip and driving the price back above the 50-day EMA line. XLM price continued to rise, breaking above multiple Fib channels. The price is steadily approaching the crucial resistance line as it recently surged past $0.16.

If buyers manage to continue the current uptrend and push the XLM price above the crucial resistance line of $0.183, it will likely open further long positions and test the upward channel pattern at $0.21-$0.22. The surging EMA20 trend line and the RSI in positive territory suggest potential breakout momentum ahead.

However, the bullish outlook may become invalid if the XLM price fails to gain buying pressure near resistance levels. A severe bearish trend might occur if the price drops below the support level of $0.138, leading to a consolidation near $0.125.