The Stellar Development Foundation, developers of the Stellar network, has released a financial inclusion framework for assessing the effectiveness of blockchain projects in emerging markets. The framework was developed in collaboration with consultants PricewaterhouseCoopers International (PwC) and explained in a white paper published on September 25.

Using this framework, the teams concluded that blockchain payment solutions significantly improved access to financial products by reducing costs to 1% or less. They also found that blockchain products have increased the speed of payments and helped users avoid inflation.

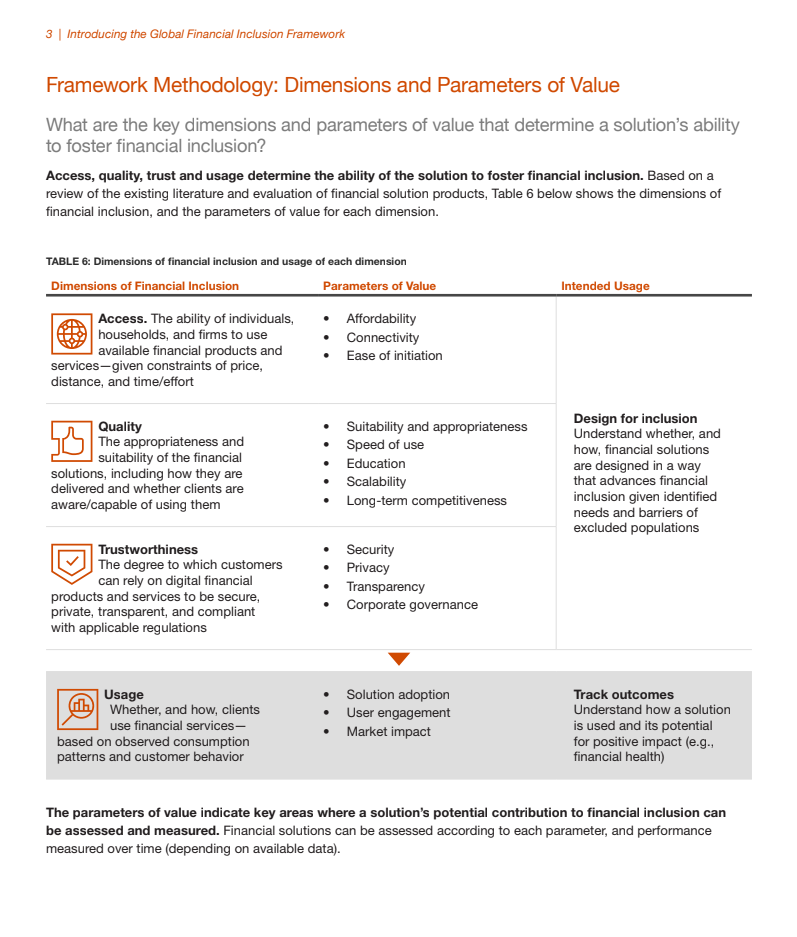

Parameters of the financial inclusion framework. Source: Stellar, PwC.

Some blockchain developers claim their products can improve “financial inclusion.” In other words, they say their products can provide services to the unbanked in the developing world. Making this claim has become an effective way for some Web3 projects to obtain funding. For example, the United Nations International Children’s Emergency Fund (UNICEF) has listed eight blockchain projects it has helped finance so far based on this idea.

However, in their paper, Stellar and PwC argued that projects cannot succeed in increasing financial inclusion if they do not have a framework to evaluate what is needed for success. “As with any technological innovation, the need for robust governance and responsible design principles are key to successful implementation,” they said.

To help advance this governance, the two teams proposed a framework for assessing whether a project is likely to promote financial inclusion. The framework consists of four parameters: access, quality, trust and use. Each of these parameters is broken down into further sub-parameters. For example, ‘access’ is further broken down into affordability, connectivity and ease of initiation.

Each explanation of a subparameter includes a suggested way to measure it. For example, Stellar and PwC list “# of CICO [cash in/cash out] locations within the relevant target region” as a way to measure the “connectivity” metric. This is intended to ensure that projects can measure their effectiveness scientifically rather than relying on guesswork.

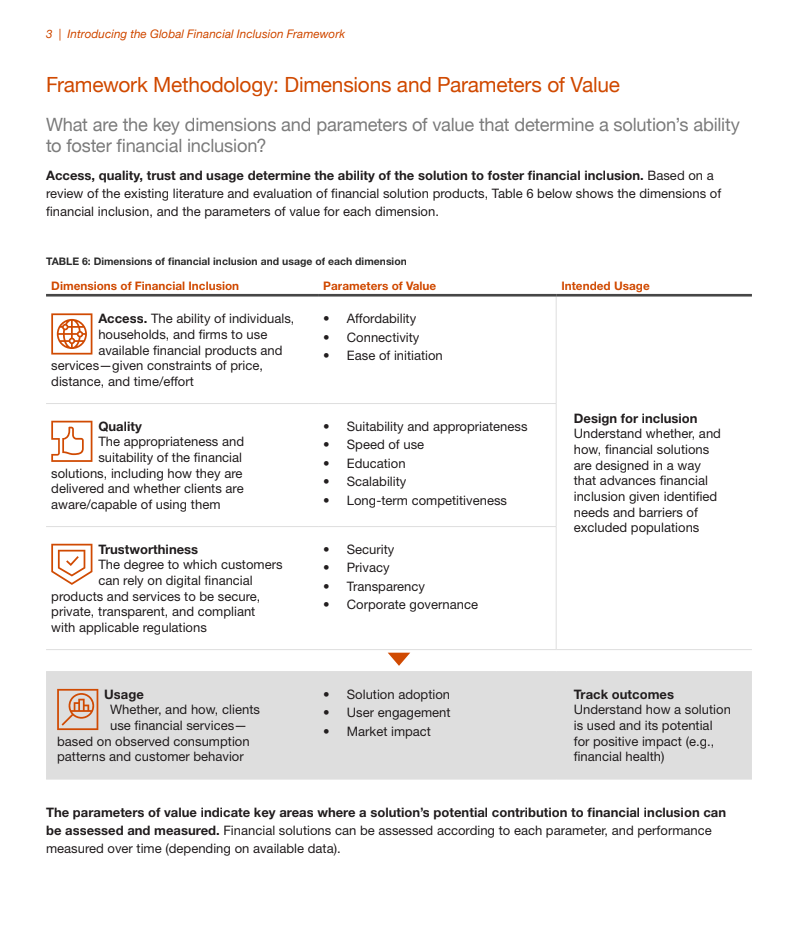

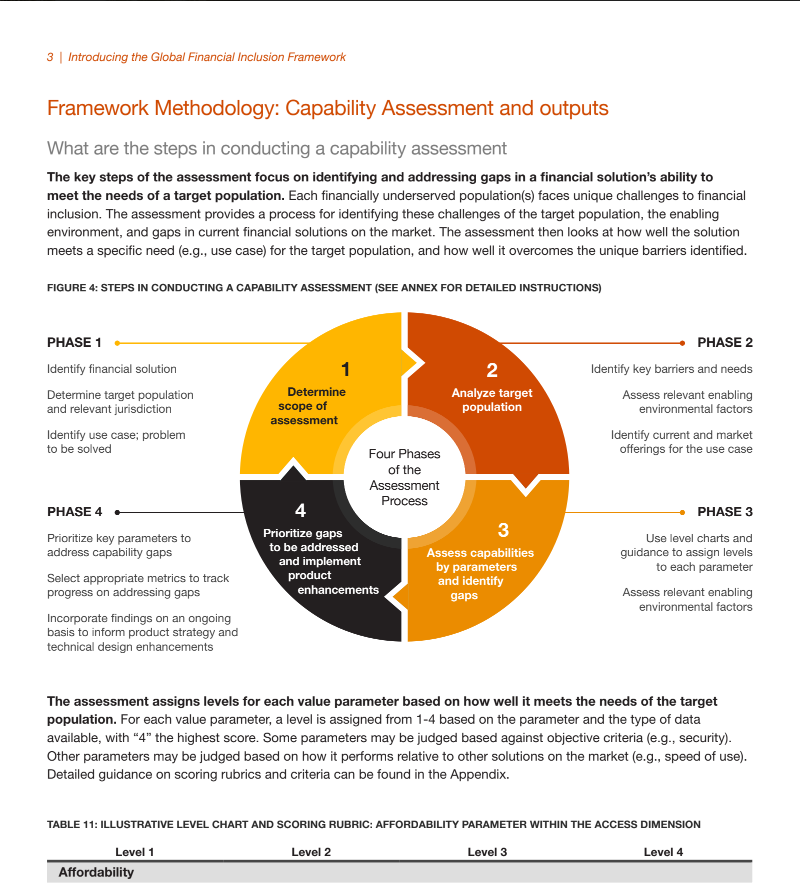

The teams also proposed a four-stage assessment process that projects should undergo to solve a financial inclusion problem. The project must identify a solution, target group and relevant jurisdiction in the first phase. In phase 2, they must identify barriers that prevent the target group from receiving financial services. In Phase 3, they should use “level diagrams and guidance” to determine the biggest barriers to user onboarding. And in the final phase, they must implement solutions that “prioritize key parameters” to make the most effective use of resources.

Phases to implement the financial inclusion framework. Source: Stellar, PwC.

Using this framework, the teams identified at least two blockchain solutions that have proven effective in improving financial inclusion. The first is payments. The teams found that traditional financial apps charge an average of 2.7-3.5% for sending money between the United States and the market studied, while blockchain-based solutions charge 1% or less, based on a study among twelve applications active in Colombia. Argentina, Kenya and the Philippines. They found that these applications increased access by making electronic payments available to people who otherwise could not afford them.

The second effective solution they found was savings. The team claimed that a stablecoin application in Argentina allows users to invest in inflation-proof digital assets, allowing them to preserve their wealth when they would otherwise have lost it.

The Stellar network is at the forefront of taking payments in underserved financial markets. In December, it announced a program to help charities distribute funds to help Ukrainian refugees fleeing war. On September 26, they announced a partnership with Moneygram to produce a non-custodial crypto wallet that can be used in over 180 countries. However, some financial and monetary experts have criticized the use of cryptocurrency in emerging markets. For example, an article published by the Bank of International Settlements on August 22 argued that cryptocurrency has “increased financial risks” in emerging market economies.