- Stellar Lumens’ pullback was heading towards key support levels at $0.3 and $0.36

- An upward liquidity move could influence a likely price recovery towards $0.50.

Stellar lumens [XLM] rose 45% in early January, but erased some gains. The recent market sell-off could provide swing traders and investors with a new buying opportunity.

After rising from $0.30 to almost 50 cents, XLM’s continued pullback was heading towards key levels that could be of interest to bulls again.

Stellar Lumens Price Prediction

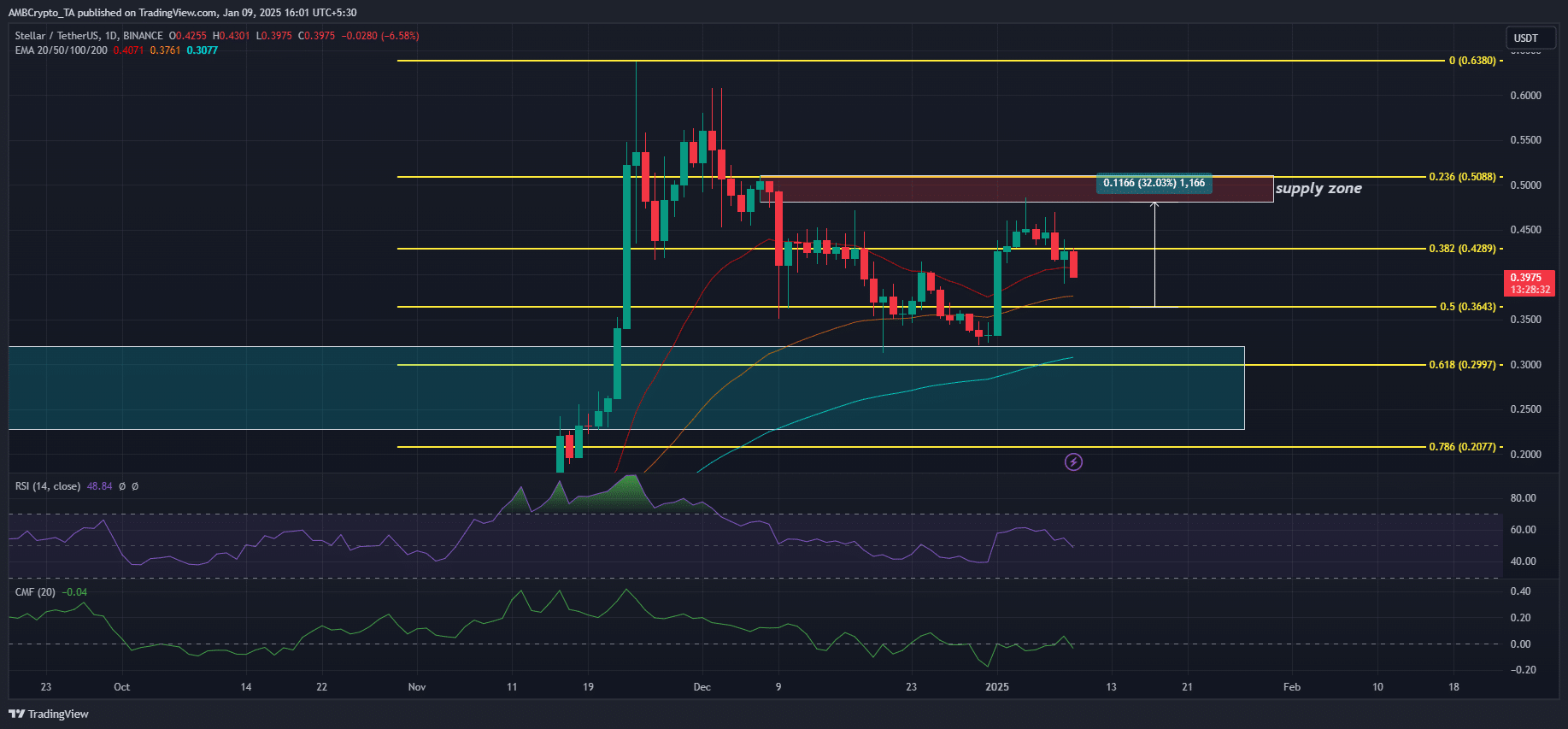

Source: XLM/USDT, TradingView

First, the New Year’s rebound made the market structure on the daily chart turn bullish. This could shift if the retracement were to extend below the recent low of $0.32.

Until this bearish market structure shift occurs, the current outlook was primed for bulls.

The recent pullback was around 18% to close at the key $0.36 level, and December support stopped the holiday sell-off at $0.30.

The two levels could mark a return to the market for bulls targeting the overhead offering below $0.50 (red zone). A bullish idea would be negated if XLM were to extend its decline below $0.30.

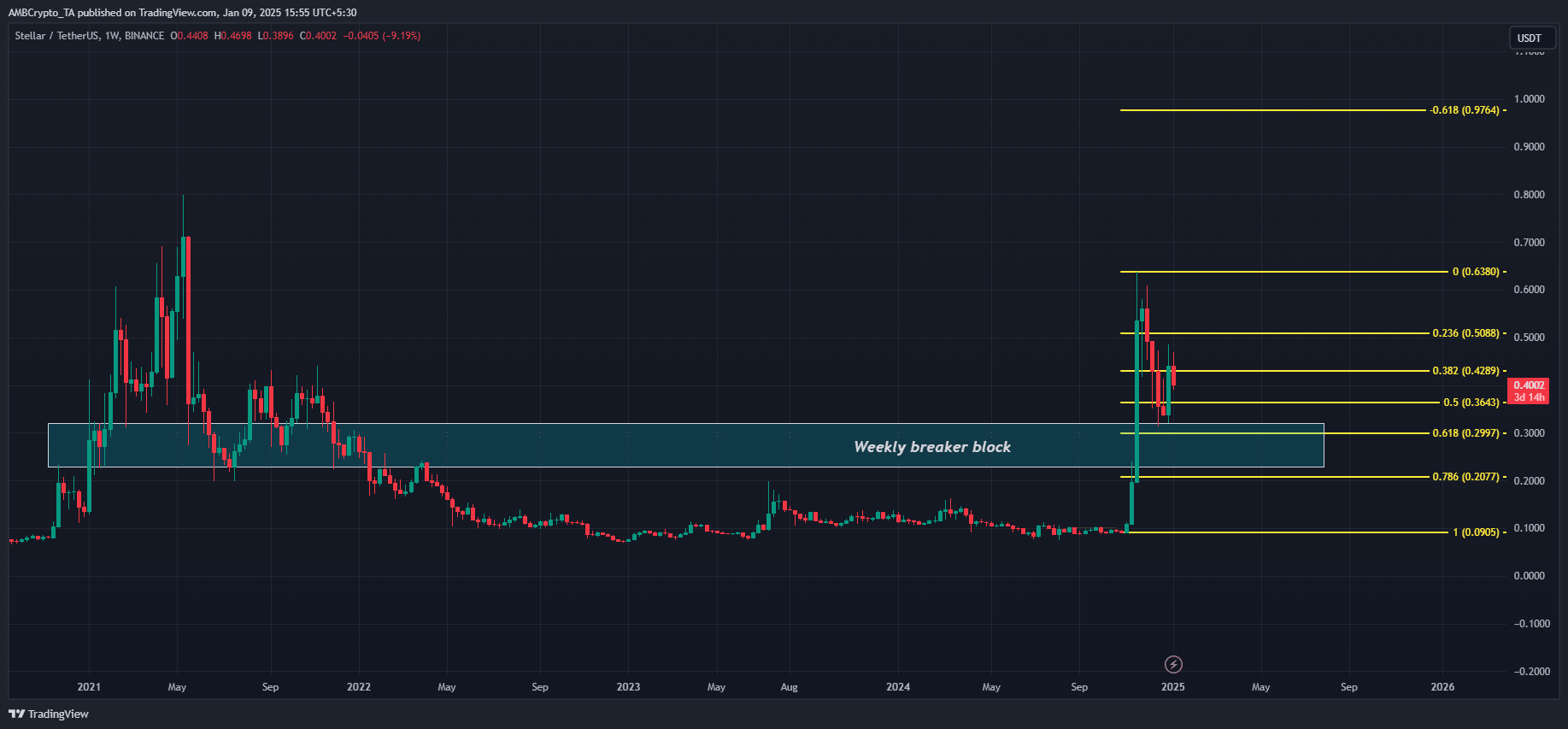

Source: XLM/USDT, TradingView

The $0.30 support was further strengthened by the weekly charts, which marked the cyan area as a break block that, if defended, could trigger a price rebound.

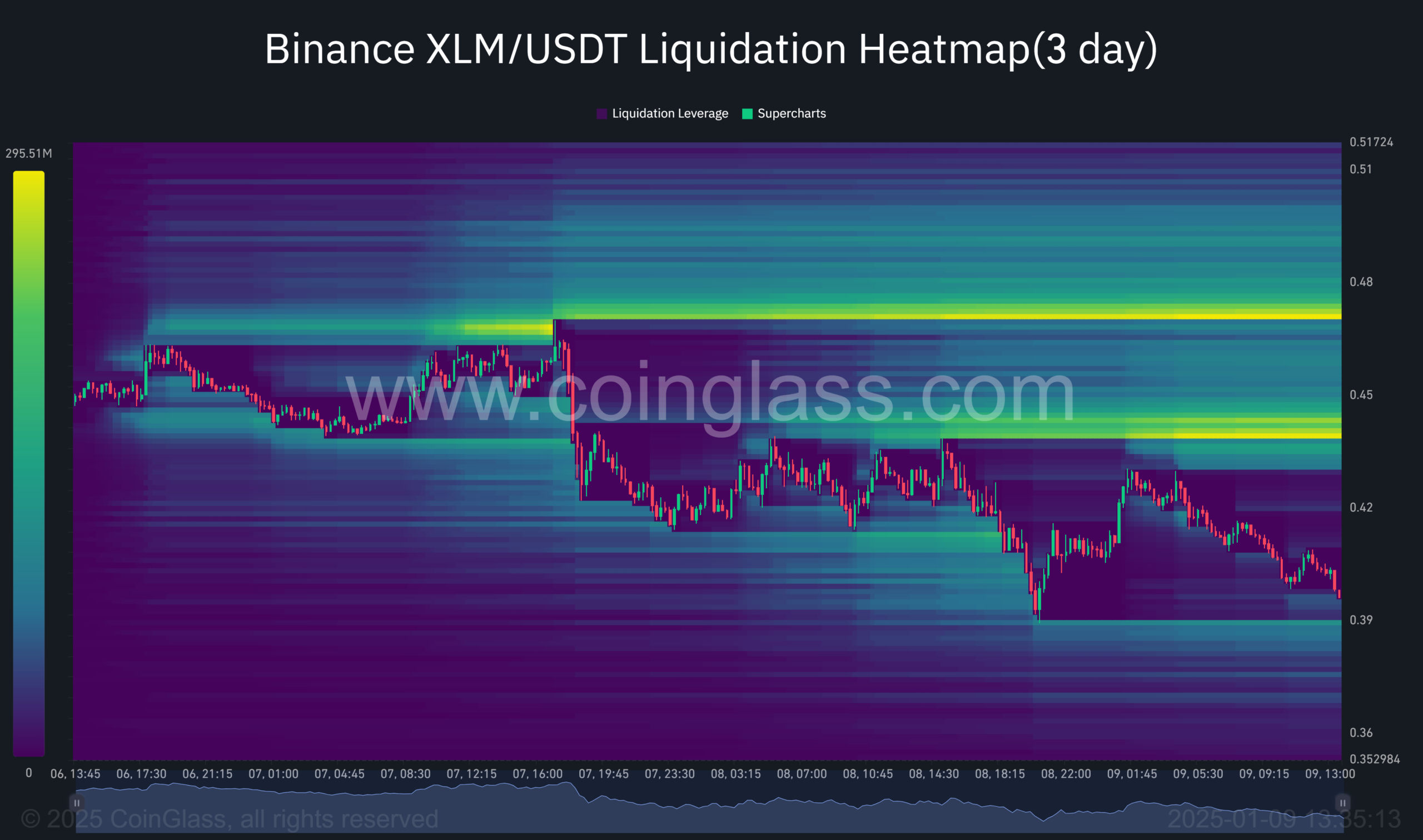

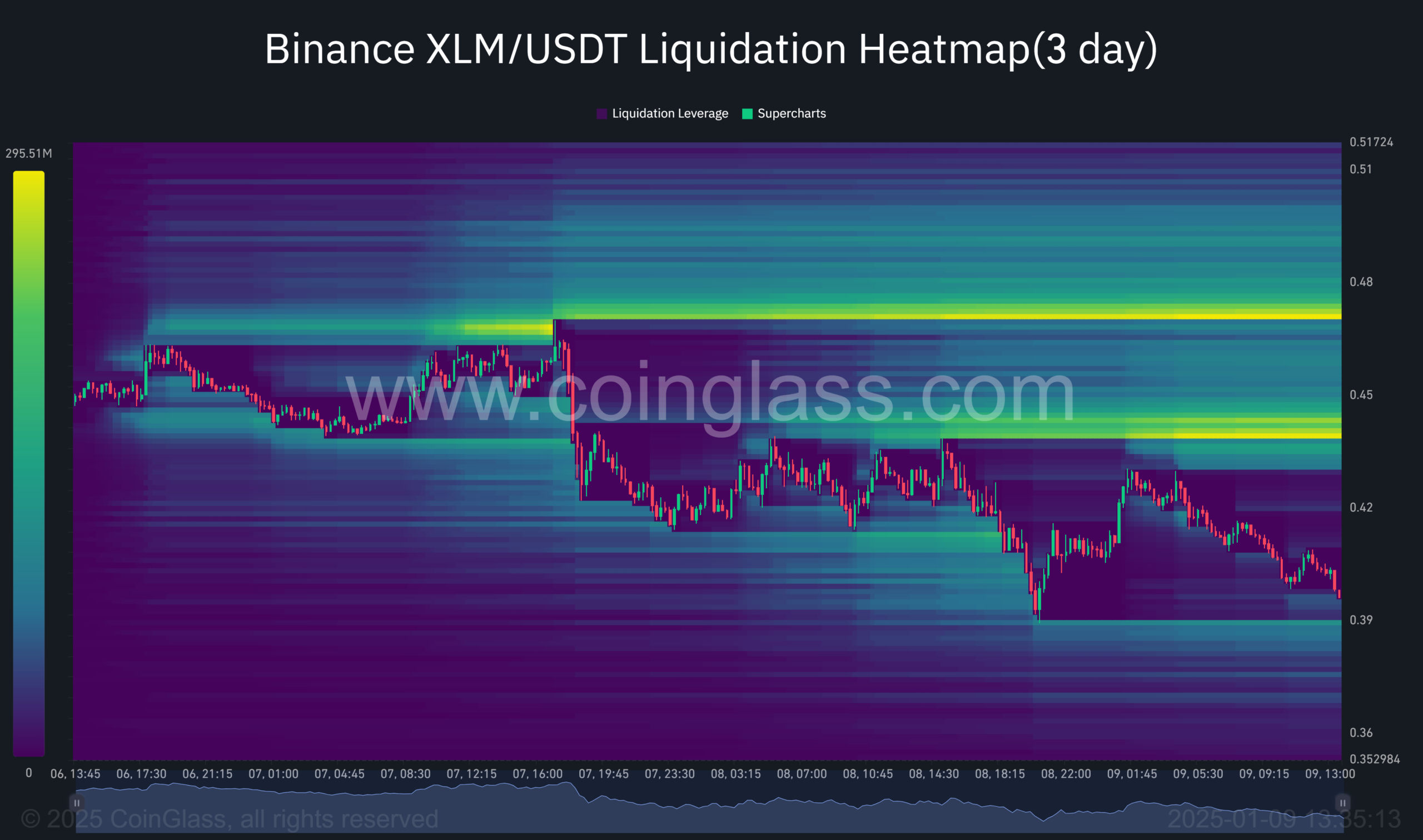

Upside liquidity could pick up the XLM price

From a liquidity analysis perspective, there were two upside liquidity levels worth monitoring. The first was between $0.43 and $0.45, and the second $0.48.

In most cases, these high liquidity zones always act as magnets for price action.

If so, they could be the next major upside targets to be tapped by a likely XLM recovery. Interestingly, the upper liquidity zone corresponded to the sub-$0.50 supply zone on the price charts.

In short, one could make a partial profit on the first target and liquidate the rest when the price reaches the $0.48-$0.50 target.

Source: Coinglass

Read Stellar lumens [XLM] Price prediction 2025-2026

In conclusion, XLM’s market structure and liquidation heatmap suggested a great buying opportunity if the pullback extends to $0.30.

However, a sustained sell-off below $0.30 would encourage sellers and negate the bullish thesis.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer