- Stacks blockchain relies on the Proof of Transfer model, which uses Bitcoin’s Proof of Work consensus mechanism

- The rollout of the Nakamoto mainnet marked a significant step toward improving Stacks’ transaction speed and security capabilities

Bitcoin Layer 2 project Stacks (STX) has revealed the updated timeline for the highly anticipated Nakamoto hard fork. In its latest announcement, the Stacks Foundation said that core developers have scheduled the mainnet activation for Bitcoin Block #867,867, which is expected to take place around October 30, as shown by the countdown on Stacks’ website.

“It’s fitting that just before the 15th anniversary of the Bitcoin whitepaper you have fast blocks on the industry-leading Bitcoin L2,” Stacks Foundation wrote in his October 17 blog.

The selection of the new block for the hard fork is the final preparation step in the Nakamoto activation sequence.

However, the run-up to Nakamoto’s completion has been bumpy, culminating in delays that have frustrated the Stacks community. According to the original timeline, the Foundation planned to complete the Nakamoto activation on Bitcoin Block 864,864. However, it did not materialize.

Expectations after Nakamoto

The Nakamoto hard fork represents a critical upgrade to the Stacks blockchain as it addresses pain points in the existing design. These include slow confirmation times that stem from Bitcoin’s block production speed and microblocks that have become ineffective due to limitations in the current protocol.

Once activated, it will put into practice several core improvements to address these issues, most notably by separating Stacks block production from Bitcoin’s block diagram. This decoupling adjustment allows blocks to be produced in seconds, ultimately improving transaction speed.

Furthermore, Nakamoto’s release aims for a finality that is closely tied to Bitcoin’s block finality. A transaction once confirmed on the Stacks blockchain would be as difficult to undo as reorganizing Bitcoin itself.

Nakamoto will also improve the cryptographic sorting algorithm to ensure fairness. It will specifically tweak the algorithm to make it more resilient to miner extractable value (MEV) by requiring competitive spending and increasing randomness in miner selection. This will effectively reduce Bitcoin miners’ ability to exploit their position to unfairly extract value.

Stacks (STX) price action

Last month, asset manager acquired Grayscale Stacks (STX). his list of top 20 crypto assets with a potential for returns based on prevailing market narratives and fundamentals. With market participants largely expecting crypto prices to continue rising in the fourth quarter of 2024, Stacks (STX) could be well-positioned for further price gains.

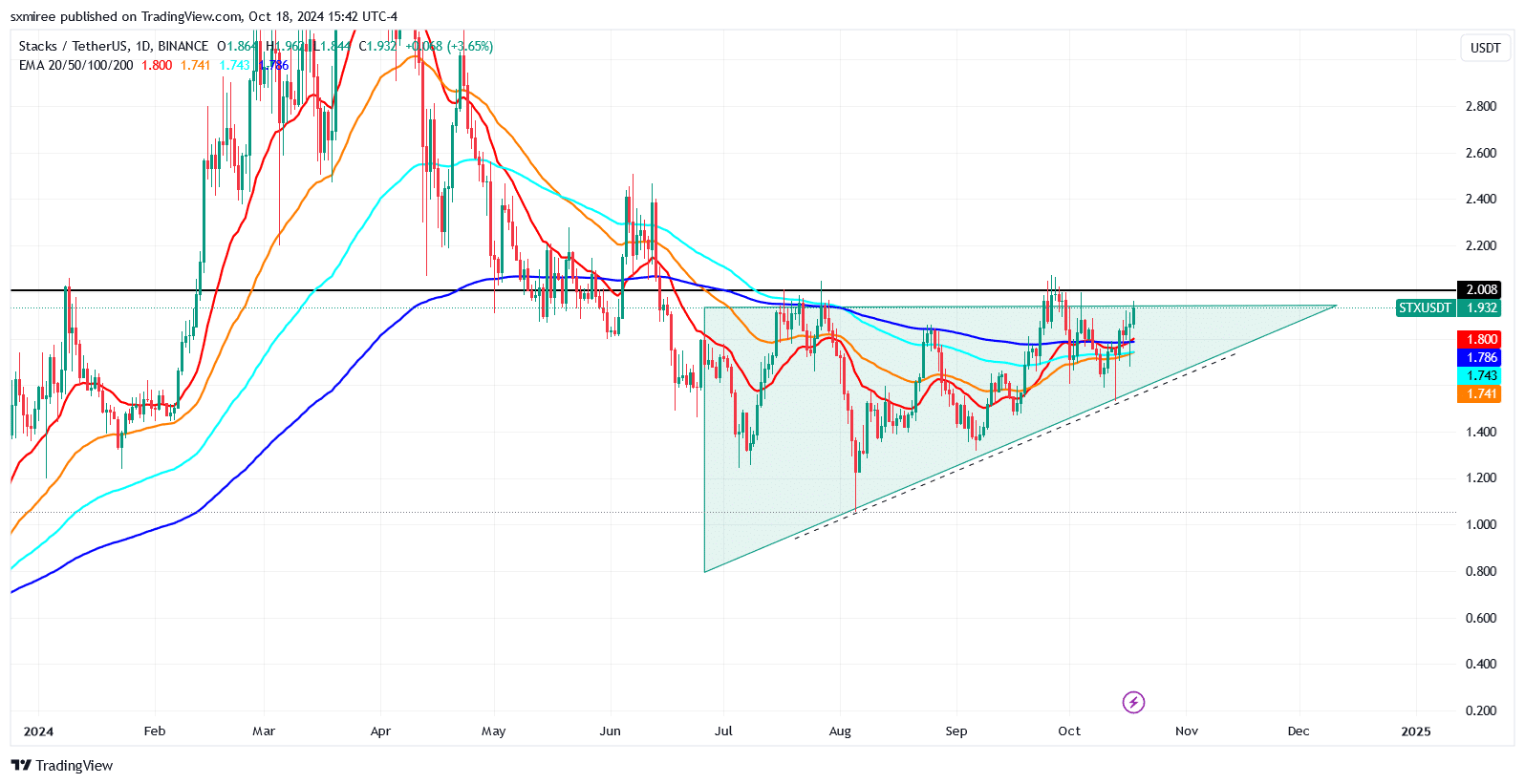

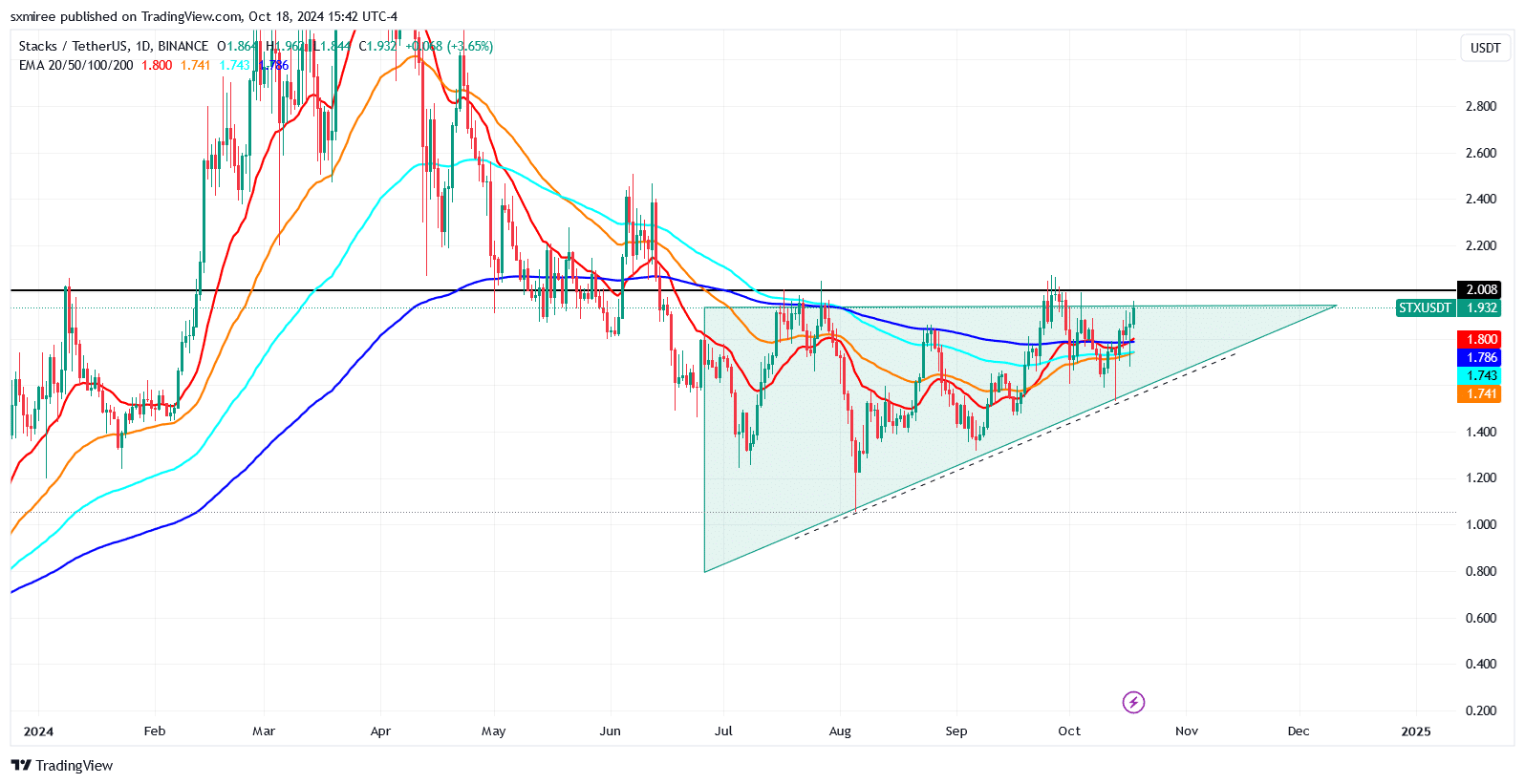

Source: TradingView

Thanks to Bitcoin’s renewed momentum, STX’s price has risen 12% over the past seven days, contributing to a 30% gain over the past month.

On the daily chart, STX was still trading within an ascending triangle above both the short-term and long-term exponential moving averages at the time of writing.