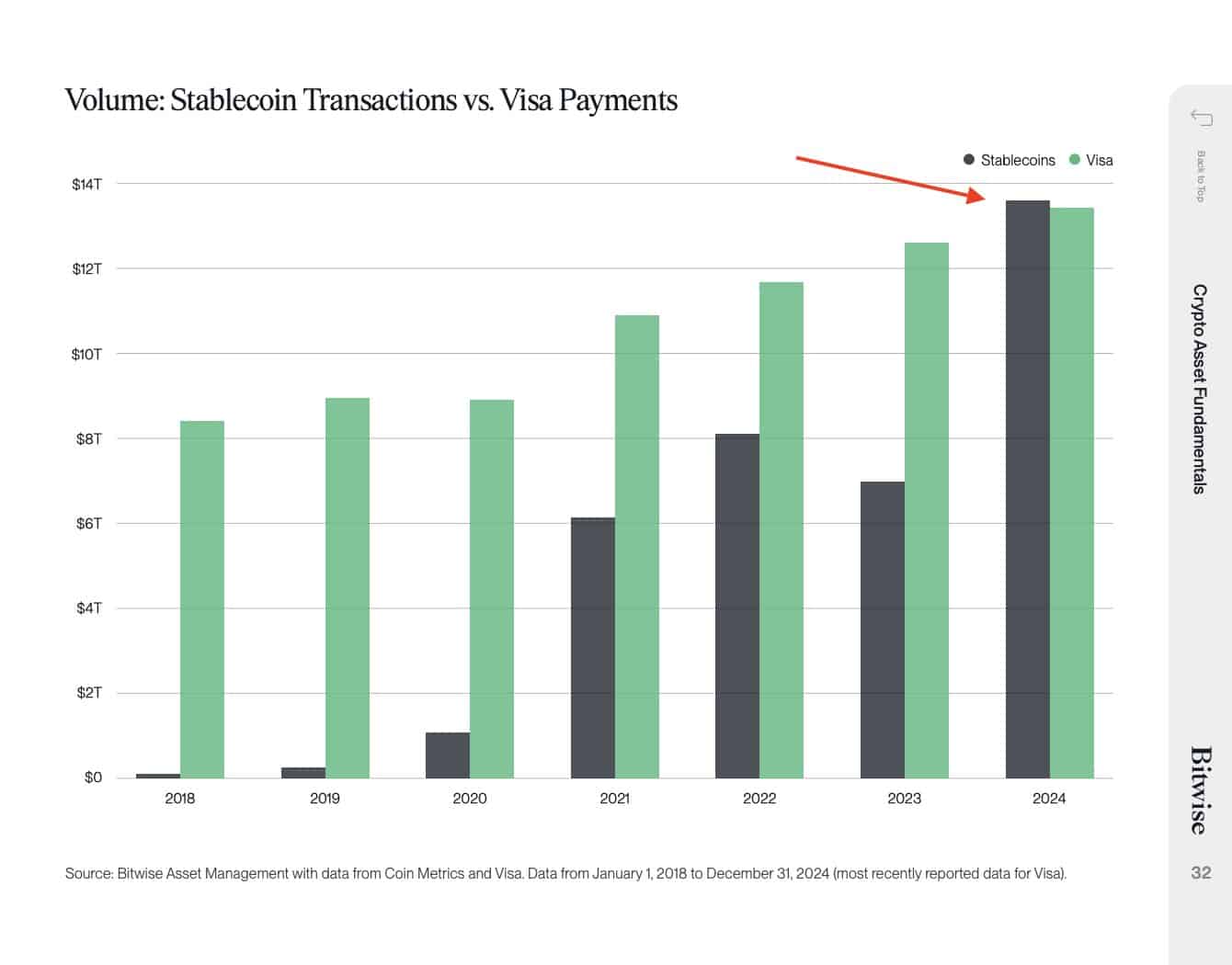

- In 2024, Stablecoins surpassed the visa in transaction volume.

- Fed Chair noted that the stablecoin legislation was a ‘good idea’ in the midst of massive adoption.

Stabile Transaction volume surpassed the visa for the first time ever in 2024, according to a BitWise report.

In 2023 the visa transaction volume rose to around $ 13 trillion, while Stablecoins registered $ 7 trillion. The first attacker in 2024 doubled the annual Stablecoin volume to almost $ 14 trillion, while Visa was marginal higher than $ 13 trillion.

Source: Bitwise

What does it mean for crypto?

For context, Stablecoins have the most viable crypto-use cases and cross-border payments, dominated by Tradfi companies such as Visa, the first segment can be ripe for disruption.

In fact, in February, Bitwise CEO Matt Hougan projected Those stablecoins can dominate cross -border payments of $ 44 trillion.

“Stablecoins will dominate $ 44 trillion cross-border Retail B2B transaction market within the next 5 years.”

Hougan called renewed interest When launching or supporting Stablecoins by PayPal, Fidelity, Stripe, Bank of America, And others as meaningful signs of the upcoming adoption.

In contrast to volatile cryptocurrencies, Stablecoins are supported by 1: 1 by reserve activa to maintain a ‘stable’ value that is linked to currencies such as the US dollar or raw materials such as gold. Until now, the most popular stablecoins are based on US dollar, led by Tether’s USDT and Circle’s USDC.

According to the BitWise report, the current Stablecoin legislation (two legislative proposals in the Senate and the House of Representatives) could be adopted by July. If so, this can stimulate further adoption on a scale.

The report added that the enormous adoption could go over in Defi and the overall crypto space.

“The growing acceptance of the Stablecoin will go to adjacent sectors, including Defi and other crypto applications.”

In addition, Fed Chairman Jerome Powell repeated similar feelings and noted that the Stablecoin legislation was a ‘was’good idea‘In the midst of increased mainstream adoption.

From April, Tether’s USDT dominated the Stablecoin sector with $ 148 billion in market capitalization, followed by USDC’s $ 59 billion.

Source: Artemis