- Stablecoin reserves and SSR trends pointed to strong purchasing power and impending Bitcoin rally potential.

- Technical indicators and liquidations confirmed the bullish sentiment, with $110,000 a realistic target.

Bitcoins [BTC] The latest price surge has sparked debate, fueled by Binance’s massive stablecoin reserves and positive market trends. These reserves reached $44.5 billion as of December 31, demonstrating enormous purchasing power ready to drive BTC higher.

Bitcoin was trading at $93,592.03 at the time of writing, up 1.20% in the past 24 hours. This combination of liquidity and momentum means that the outlook for the cryptocurrency market is becoming increasingly optimistic.

How stablecoin reserves are fueling Bitcoin rallies

Stablecoins provide instant liquidity and often act as a catalyst for Bitcoin price increases. Historically, significant inflows of stablecoins to exchanges have led to BTC rallies due to increasing demand.

For example, during the December 11 rally, a surge in stablecoin activity saw Bitcoin gain 4.7% in one day. Therefore, current reserve levels suggest that a similar rally could occur soon, reinforcing investor optimism.

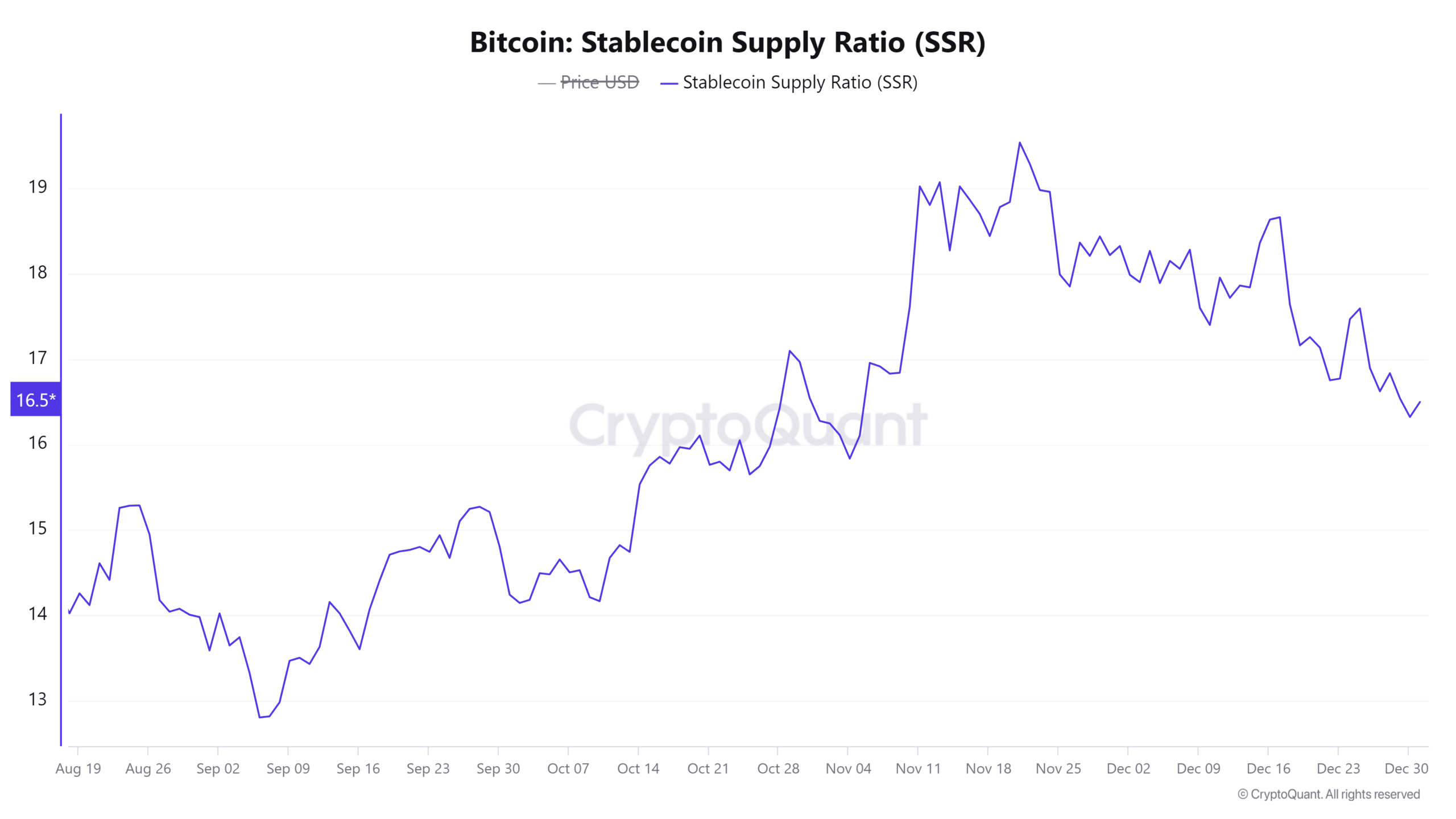

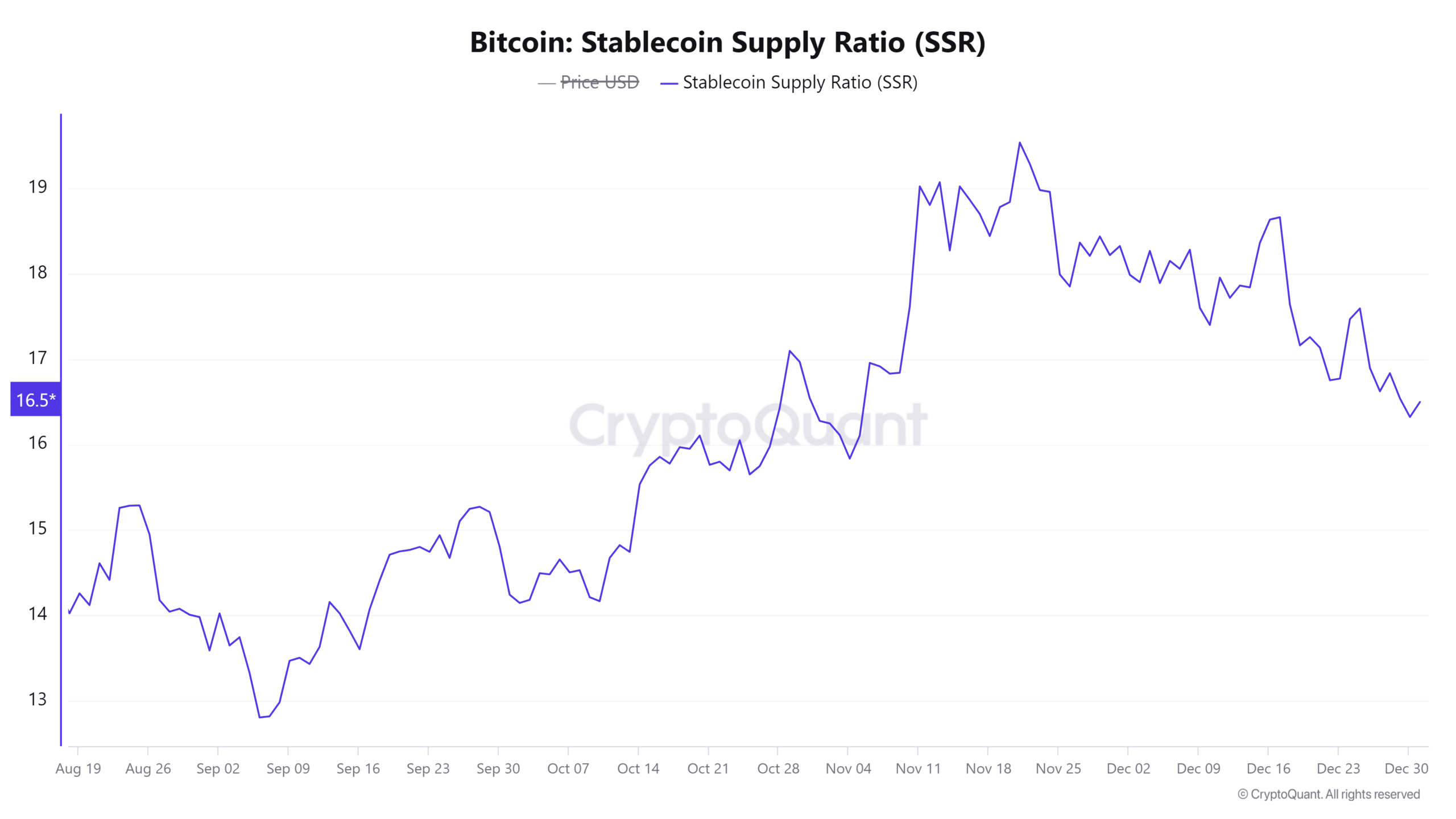

Does the SSR indicate more upside potential?

The Stablecoin Supply Ratio (SSR) is an important metric that indicates Bitcoin’s growth potential. Currently at 16.55, with a daily increase of 1.01%, the SSR reflects sufficient liquidity compared to Bitcoin’s market cap.

This indicates a favorable environment for a rise in Bitcoin’s price as more stable coin liquidity is available to drive demand. Consequently, SSR trends strongly support the possibility of continued upside momentum.

Source: CryptoQuant

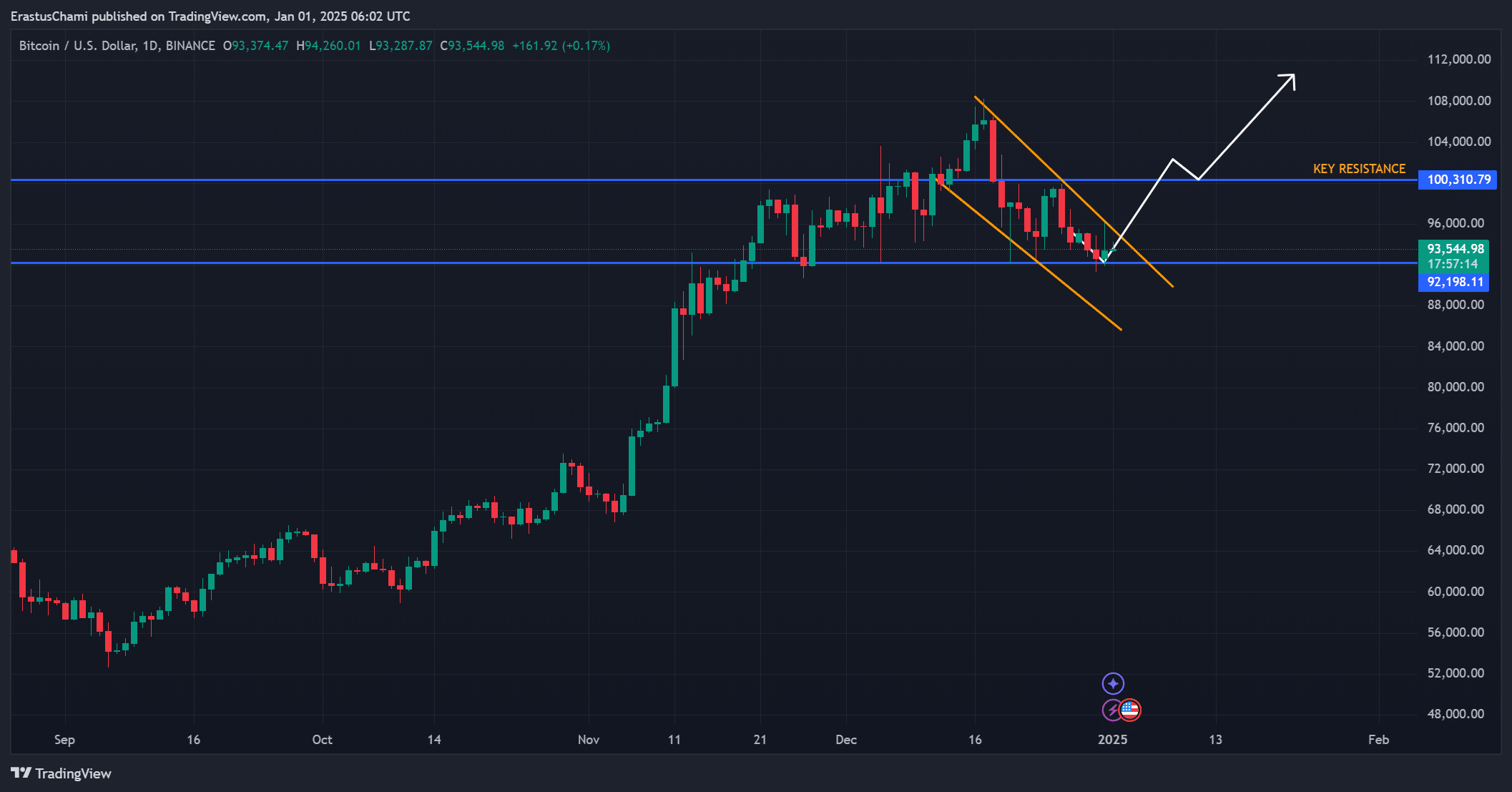

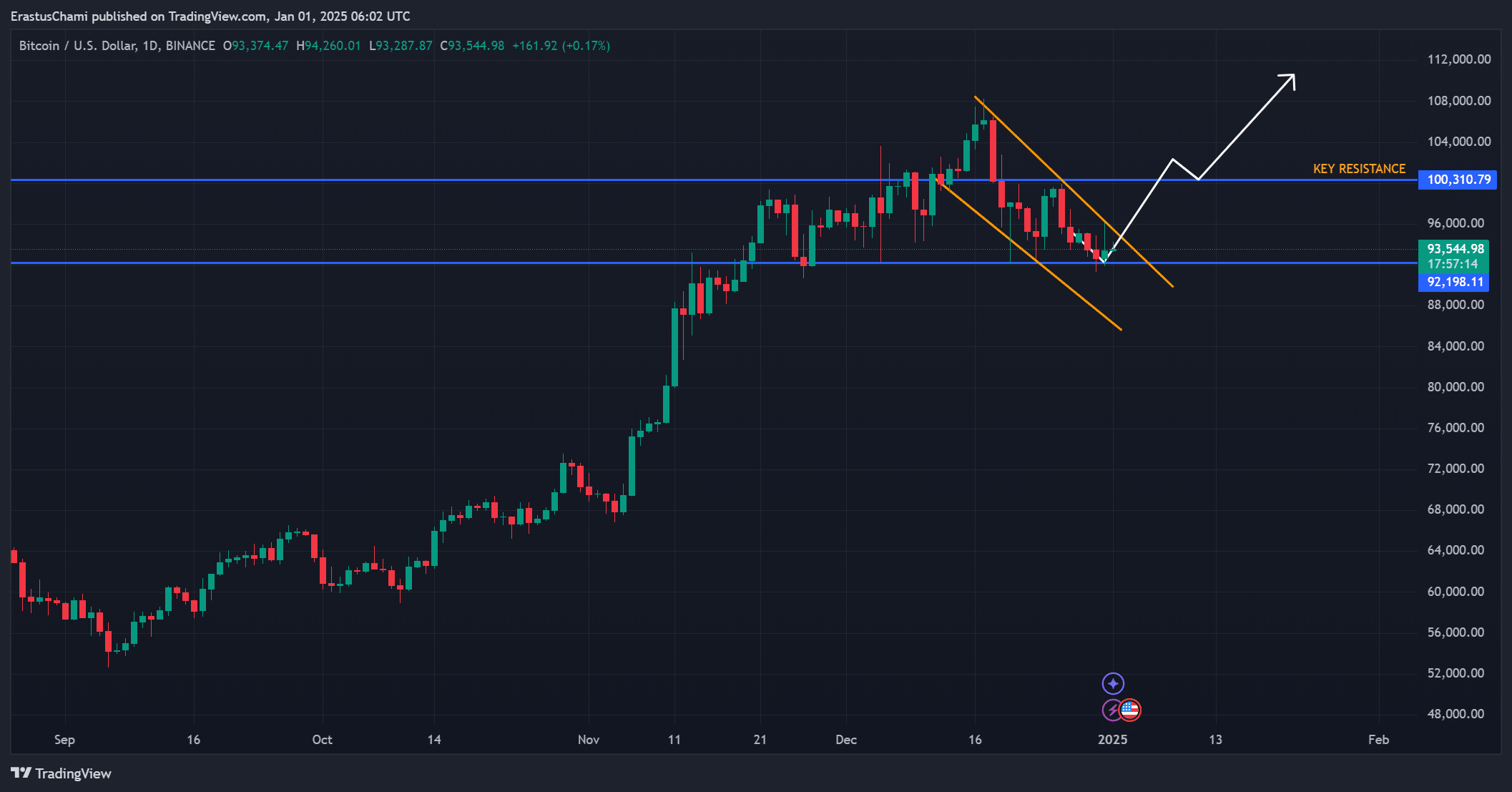

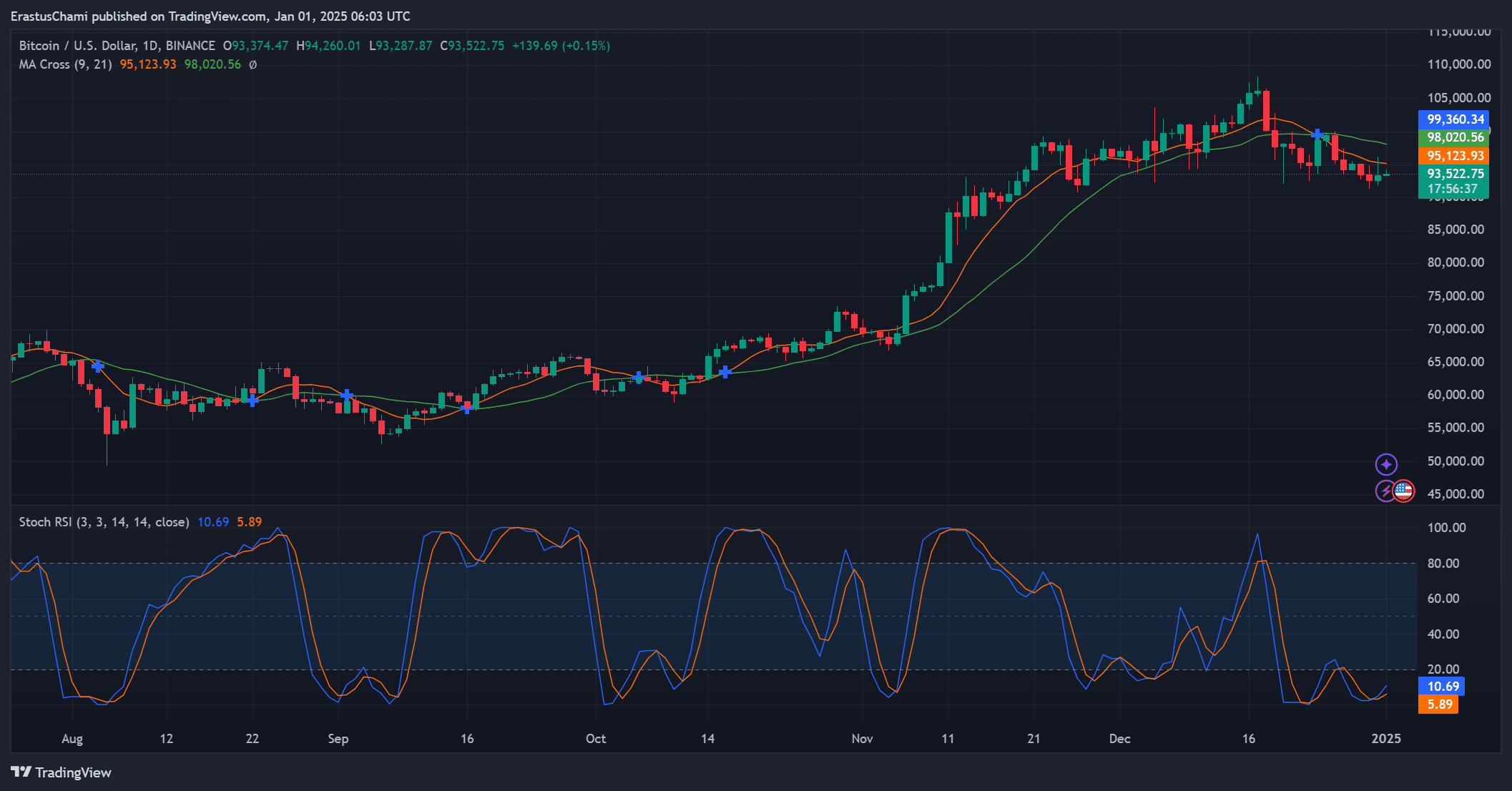

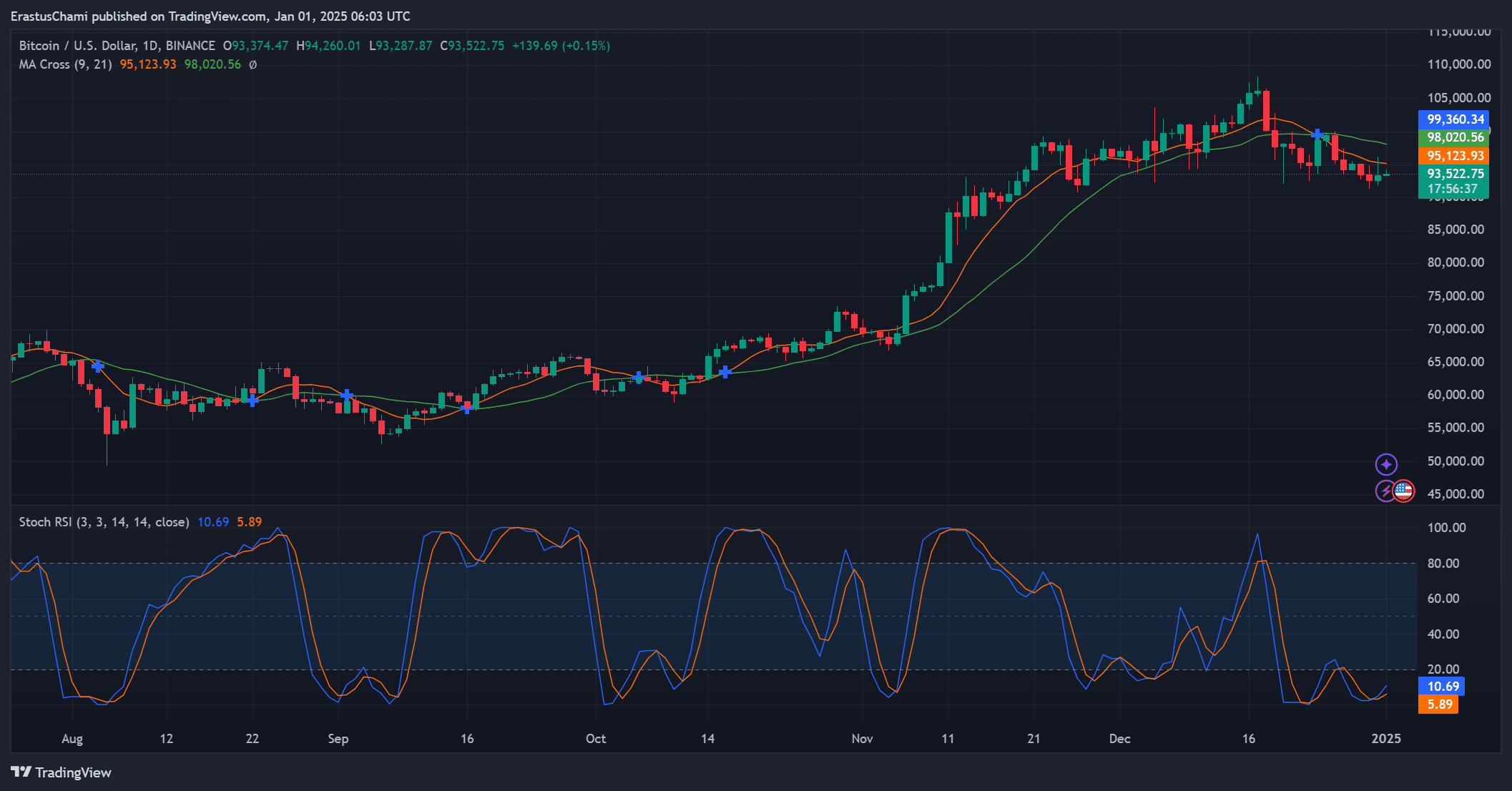

BTC Price Action: Is a Breakout Imminent?

Bitcoin’s price has risen from the demand zone to $92,198.11 and is now nearing a potential breakout from a falling wedge. Historically, such patterns indicate bullish reversals, and Bitcoin’s move suggests a similar outcome.

Key resistance at $100,310.79 could pave the way for a medium-term target of $110,000. Therefore, BTC’s price action strongly indicates a continuation of the current uptrend.

Source: TradingView

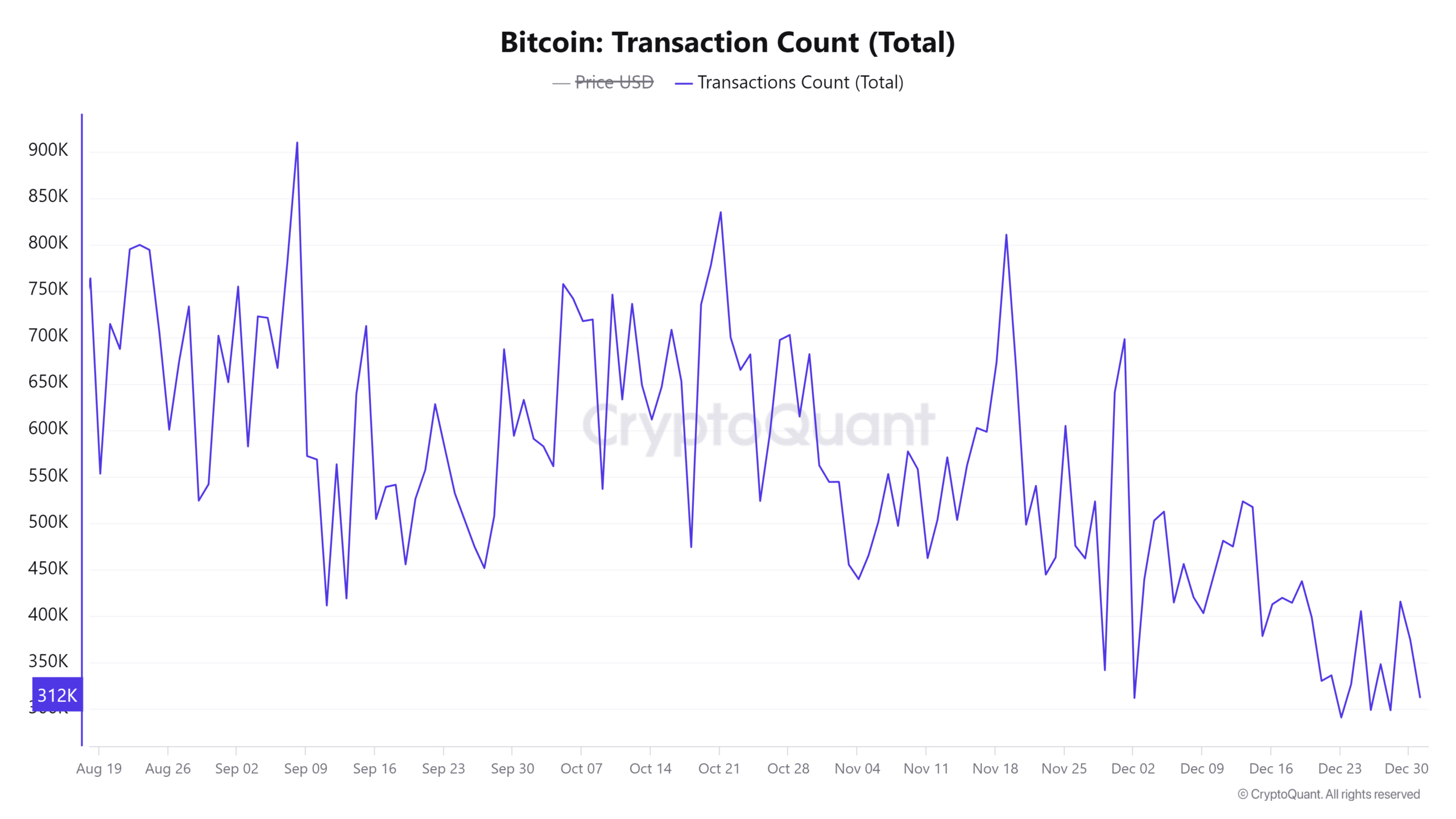

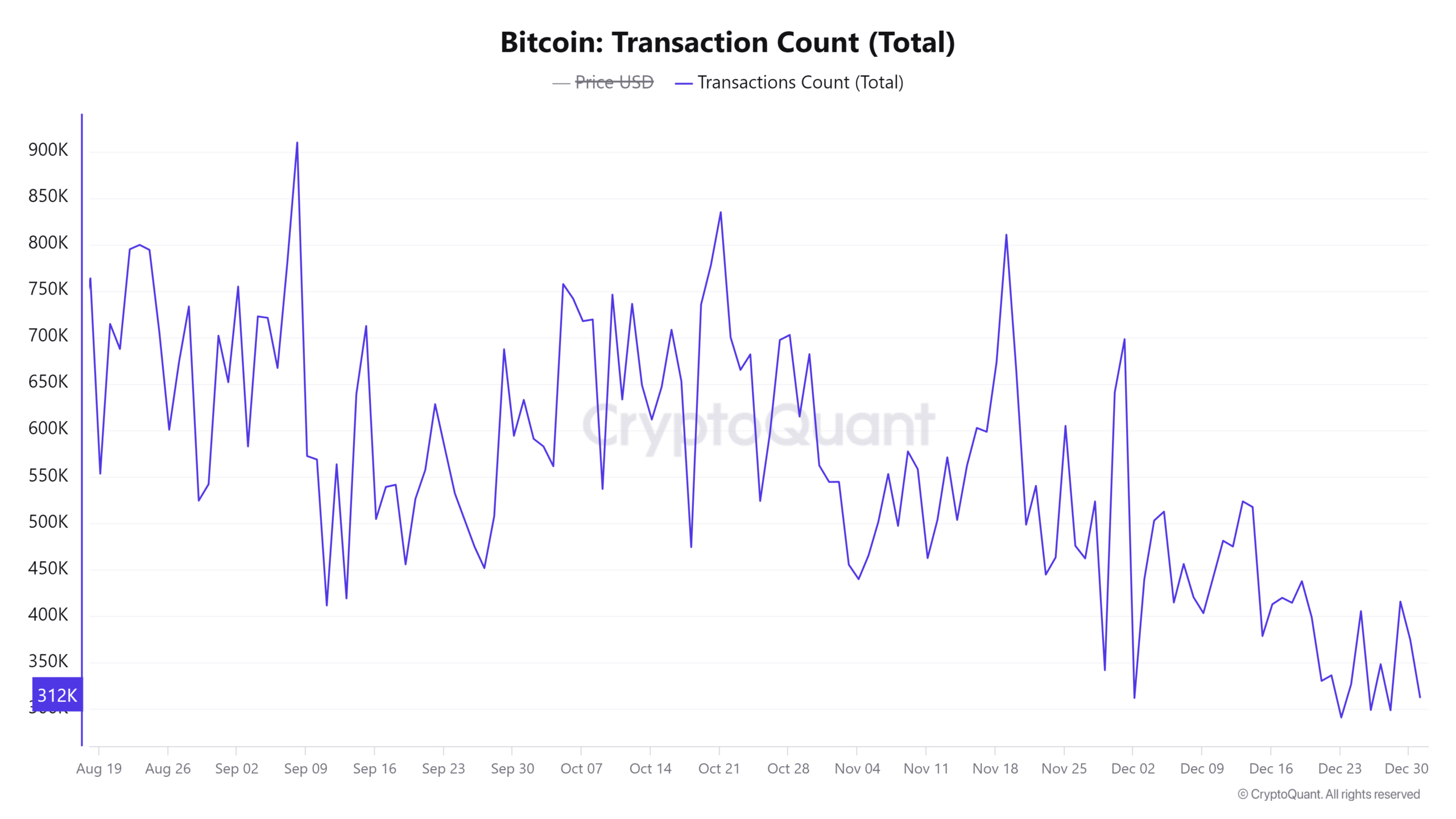

Transaction trends confirm investor confidence

Transaction counts show consistent activity, with 312,056 transactions recorded at the time of writing, marking an increase of 0.92% over a 24-hour period. This metric indicates increased participation in the Bitcoin network, which is typically observed when investors are actively accumulating.

Therefore, steady transaction volume reinforces positive sentiment and indicates robust market engagement going forward.

Source: CryptoQuant

Technical indicators support further gains

Technical analysis highlights BTC’s bullish potential. The Stochastic RSI shows an oversold condition of 10.69, indicating that an upward reversal is imminent.

Additionally, the 9-day moving average (MA) of $95,123.93 remained above the 21-day MA of $98,020.56, indicating strong buying momentum. These signals collectively predict a continuation of Bitcoin’s rally.

Source: TradingView

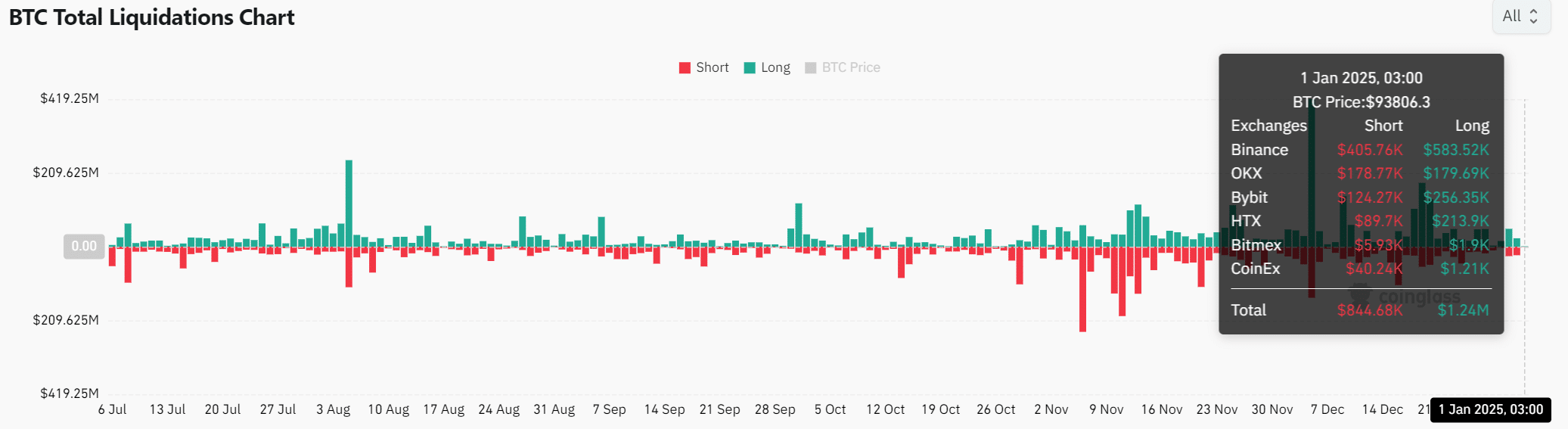

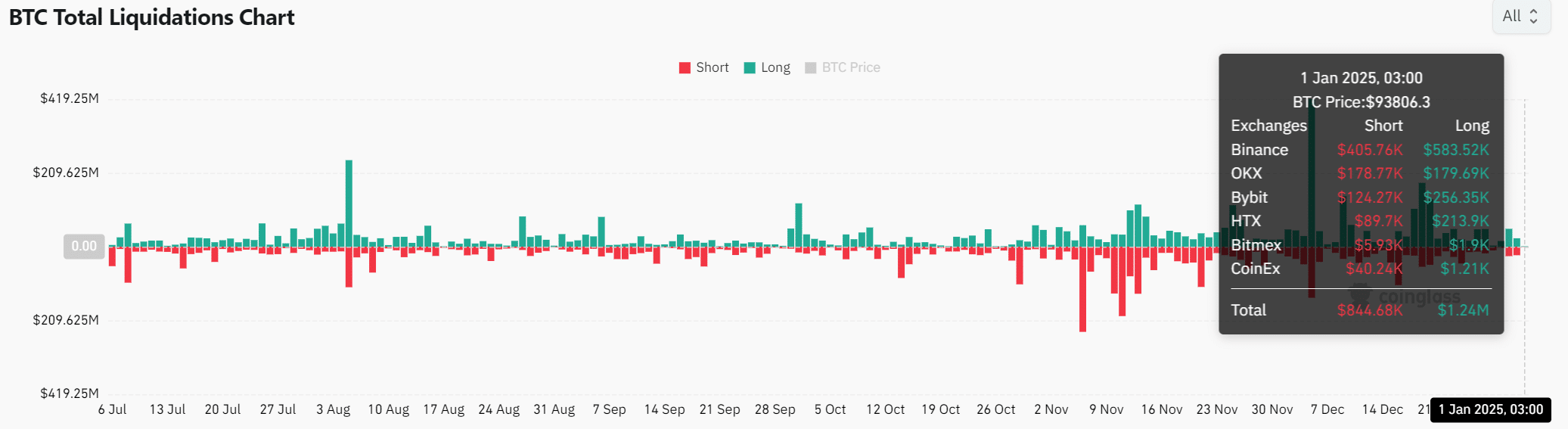

BTC liquidations reveal bullish market sentiment

Liquidation data shows a dominant bullish sentiment, with $1.24 million in long positions cleared, compared to $844,000 in short liquidations.

This imbalance underlines the significant buying pressure, further confirming the market’s confidence in BTC’s upward trajectory. Furthermore, it suggests that bullish momentum is likely to continue in the near term.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024-25

Binance’s $44.5 billion stablecoin reserves provide immense liquidity that strongly supports BTC’s ongoing rally.

Combined with technical and transaction trends, investors can confidently expect Bitcoin to reach $110,000 in the medium term.