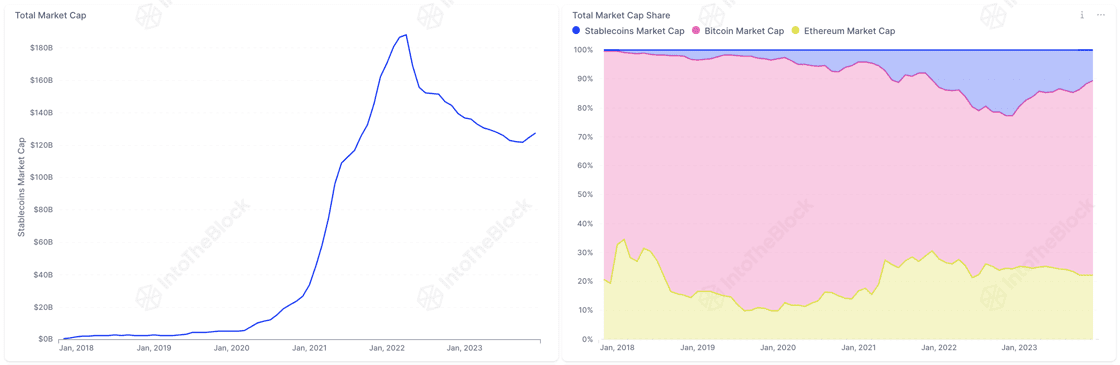

Leading analytics firm IntoTheBlock says the market capitalization of all stablecoins is increasing, indicating an increase in the purchasing power of crypto market participants.

It appears that the total value of all stablecoins will rise for the second month in a row in December, after falling for a year and a half straight, which IntoTheBlock has indicated. say is a “positive sign for crypto liquidity.”

IntoTheBlock also looks at Bitcoin’s exchange networks, tracking Bitcoin (BTC) moving in and out of centralized crypto exchanges by subtracting the amount of a coin’s withdrawals from its deposits.

Bitcoin included There were $860 million in net inflows into the stock markets this week, the largest in nine months, according to the analytics firm.

A 2021 study published by crypto analytics firm Santiment indicates that large increases in currency inflows often lead to an average price drop of 5% for crypto assets.

Conversely, however, IntoTheBlock notes that whales collected 22,000 BTC this week as Bitcoin fell to $41,000.

Says the company,

“This underlines their belief in the long-term value of Bitcoin, despite market declines.”

Bitcoin is trading at $42,248 at the time of writing, down 1.70% in the past 24 hours.

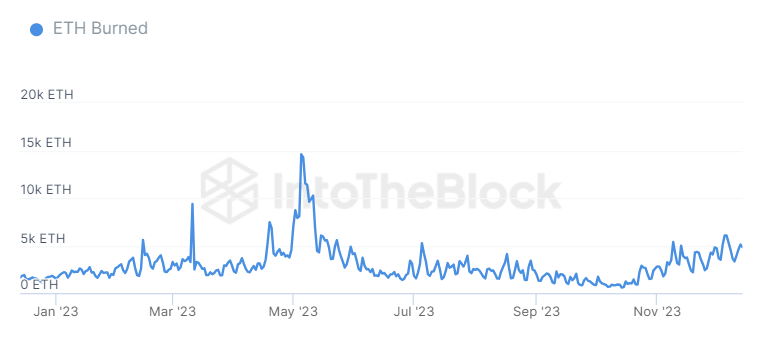

Also IntoTheBlock notes that the cost of Ethereum (ETH) has remained at a high level this week, impacting the supply of the second largest crypto asset.

“With over 35,000 ETH burned in the last seven days, Ethereum maintains its negative net issuance trend that started in early November.”

Ethereum is trading at $2,251 at the time of writing, down 1.80% in the past day.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney