The Spot Bitcoin ETFs have become a major headliner lately due to increased market inflows. According to data from SoSoValuethese ETFs have attracted more than $5 billion in investments over the past three weeks, coinciding with an impressive Bitcoin price rally of more than 23%. However, amid this euphoria, macro investment researcher Jim Bianco says that these Spot ETFs have not contributed significant growth to the Bitcoin market.

Spot Bitcoin ETFs do not bring in new money, only recycled investments

In one series of X messages on November 2, Bianco claimed that the Spot Bitcoin ETFs, despite their impressive inflow record, are not attracting new investments in the underlying asset. First, the analyst applauds the performance of these institutional funds, some of which are among the best-performing ETFs of 2024 following their launch in January.

However, Bianco emphasizes that BTC has failed to surpass its all-time high of 73,750, set eight months ago, despite Spot Bitcoin ETFs generating over $12 billion in inflows since BTC over the same period.

Rather than being less than 4% off the ATH, the analyst explained that such high inflows should have since pushed the major cryptocurrency above the $100,000 mark, especially given other positive indicators such as Fed rate cuts, the halving and public support of the Republican presidential candidate. Donald Trump.

For context, Bianco points to the Gold ETFs with a record over $6 billion in inflows since March 13, resulting in a 25% increase in the gold market price over that period. The market analyst argues that this price growth can be attributed to the ‘new money’ flowing into gold ETFs. However, recycled funds shifted from on-chain wallets or centralized exchanges account for the majority of investments in Spot Bitcoin ETFs.

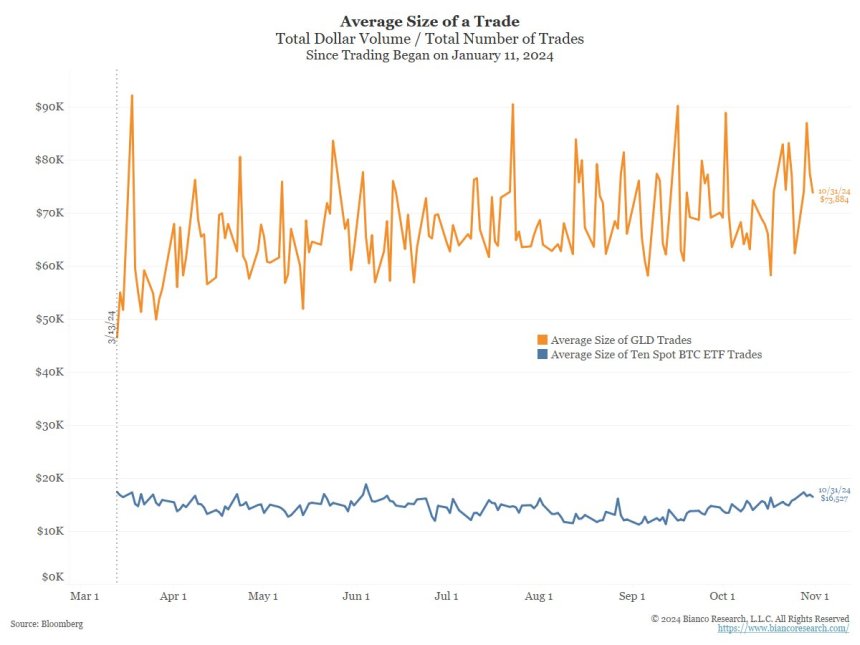

Jim Bianco supports this theory with a report from Alesia Haas, CFO of Coinbase, highlighting a decline in the number of Bitcoin retail traders on the exchange in recent months. Additionally, he also points out the average Spot BTC ETF trade of $16,000, compared to the average Gold ETF trade of $72,000, which is consistent with investment from asset managers and institutions.

In conclusion, Jim Bianco states that the Spot Bitcoin ETFs do not attract “new money” but only circulate existing investments in Bitcoin, which he describes as a worrying trend that could give traditional financial institutions (TradFi) more influence over the crypto market than against the ethos of decentralization.

Bloomberg analyst fires back at criticism of BTC ETF

Popular Bloomberg ETF analyst Eric Balchunas has done just that issued a powerful rebuttal to Bianco’s take on the Spot Bitcoin ETFs, which he describes as mere “mental gymnastics.” Balchunas has praised the performance of these ETFs, which he said played a crucial role in driving Bitcoin’s price from $35,000 in January to its current market price of almost $70,000. The Bloomberg analyst describes the Spot Bitcoin ETFs as “powerful” due to their low costs, high liquidity and association with an established brand name, and advises against betting against them.

At the time of writing, BTC. continues to trade at $68,100, reflecting a decline of 2.55% in the past 24 hours.

Featured image from Blockzeit, chart from Tradingview