On Wednesday, January 10, the US Securities and Exchange Commission (SEC) finally approved the launch of spot Bitcoin ETFs, representing a remarkable event in US trading history.

So far, market data on these mutual funds has confirmed theories of increased institutional demand for Bitcoin, with total net inflows exceeding $800 million and trading volume of $3.6 billion during the first two trading days.

Although this influx has yet to be reflected With the price of BTC down 2% over the past week, the Bitcoin ETFs in the market have certainly taken off with a bang, indicative of potential gains for the world’s largest assets and the overall crypto market.

Spot Bitcoin ETFs Attract More Than $1.4 Billion in Two Days – Bloomberg Data

In a X message on January 13, Bloomberg ETF analyst Eric Balchunas shared some insight into the impressive performance of the spot Bitcoin ETFs during their debut trading week.

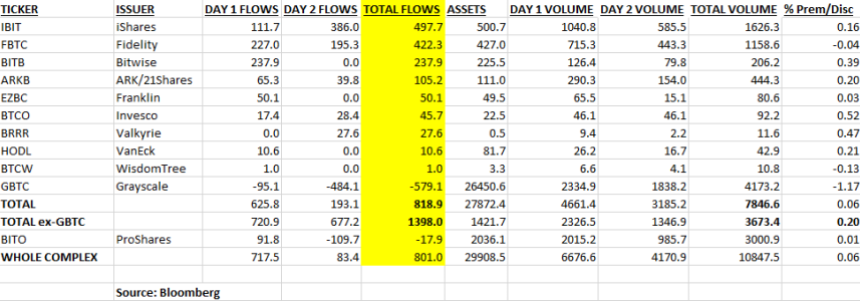

Balchunas noted that of the eleven approved spot BTC ETFs, nine have recorded total inflows of more than $1.4 billion. Leading the way is BlackRock’s IBIT, with an estimated asset inflow of $497.7 million, followed closely by Fidelity’s FBTC, which has approximately $422.3 million in investments.

BTC spot ETFs Bitwise and ARK/21 Shares also posted a significantly positive performance, raising $237.9 million and $105.2 million, respectively. On the other hand, Grayscale’s GBTC was the outcast in the market, with a staggering $579 million outflow over its first two trading days.

Source: Bloomberg

Following the SEC’s approval on Wednesday, investors have benefited big time from GBTC, which recently converted from a closed-end fund to a spot ETF. SkyBridge Capital founder Anthony Scaramucci has done just that already commented on this trend and describes it as one of the possible reasons behind Bitcoin’s dip over the past week.

In total, the spot Bitcoin ETF market recorded an impressive net inflow of $818.9 million during its first week of trading. These numbers are likely to improve in the coming weeks as sales volume eventually decreases. Meanwhile, investors are still anticipating the debut of Hashdex’s spot ETF – DEFI – which is undergoing a fund conversion from the company’s Bitcoin futures ETF.

BTC price overview

At the time of writing, Bitcoin is exchanging hands at $42,980, reflecting a loss of 0.73% on the last day. Meanwhile, the token’s daily trading volume has plummeted by 62.33% and is now valued at $16.9 billion. However, with a market capitalization of $842.23 billion, Bitcoin remains the largest cryptocurrency in the world.

BTC trading at $42,916.07 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Feimage from Yahoo Finance, chart from Tradingview

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.