In a recent interview with Bloomberg, Reggie Browne, Co-Global Head of ETF Trading and Sales at GTS, shared insightful predictions about the potential trading dynamics of spot Bitcoin exchange-traded funds (ETFs). Browne expects these ETFs to trade at a significant premium, estimated to be as much as 8% above their net asset value (NAV).

Why Spot Bitcoin ETFs could trade at an 8% premium to NAV

“I think spreads will be very competitive and tight. The market making community is resilient and willing to provide a lot of liquidity,” Browne said declared. However, he highlighted a critical concern, saying: “I think this will be the premium to NAV… US broker-dealers cannot trade Bitcoin cash within their broker-dealers. So you’re going to have to trade hedges instead of futures and trade them at a premium, and then take that away, and I think there’s a lot of complexity in that.”

This complexity, according to Browne, stems from the cash creation model enforced by the SEC and the regulatory restrictions that limit direct Bitcoin trading within U.S. broker-dealers, forcing them to rely on futures for hedging. He said: “What I think you could potentially see is 8% of the premium above fair value. It’s a big number, but let’s see how it works out.”

In addition, Browne discussed the topic of in-kind creations and redemptions, aspects that were points of contention during negotiations with the Securities and Exchange Commission (SEC). Despite the challenges, he remains optimistic about its future implementation. “Absolutely, I think this was really just to get the ball moving… the reward won’t come until we’ve climbed a few mountains,” Browne noted.

Echoing Browne’s sentiments, Eric Balchunas, a Bloomberg ETF expert, commented on the potential premium and expressed surprise at the expected high interest rate. He drew a comparison with Canadian spot ETFs, which are also cash creations but have much smaller premiums, despite occasional spikes.

[Browne] thinks bid-ask spreads on spot ETFs will be tight, but (thanks to cash-only creations) premiums could be as high as 8%. That’s really high and I’m a little shocked. For context, Canadian spot ETFs are cash creations and their premiums are very small, albeit an occasional 2% day.

The crypto community is keeping a close eye on the SEC as it approaches a critical deadline to decide on the first batch of several spot Bitcoin ETF applications by tomorrow, January 10. Prominent asset managers such as BlackRock, Fidelity, Ark Invest, Bitwise, Franklin Templeton, Grayscale, WisdomTree and Valkyrie are among the pending applications.

Browne believes that the adoption of spot Bitcoin ETFs could attract significant investor interest, generating massive inflows in the first year. “I expect investors will add at least $2 billion to spot Bitcoin ETFs within the first 30 days of trading, if approved. For the full year, I see between $10 and $20 billion in the funds,” he noted. This prediction underlines the significant interest and potential market impact of spot Bitcoin ETFs.

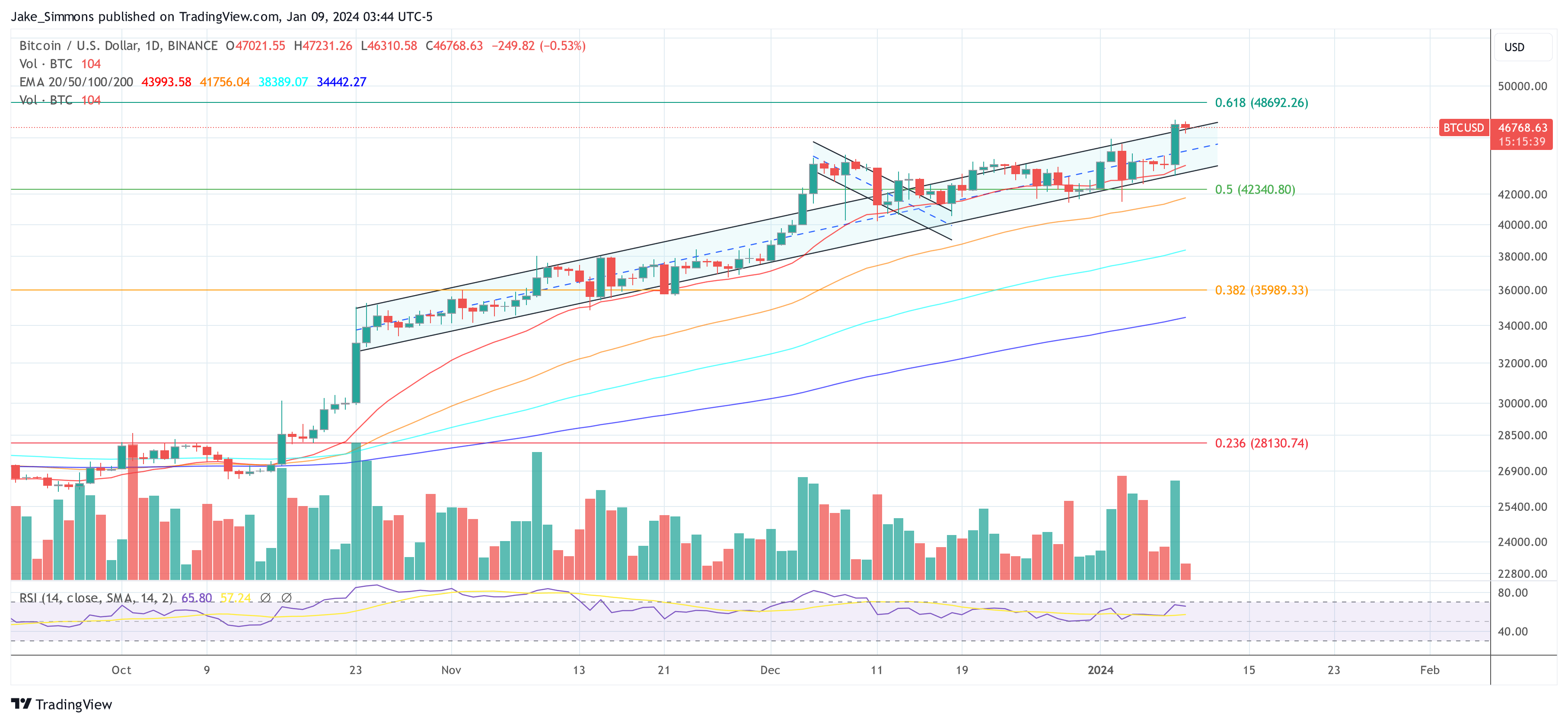

At the time of writing, BTC was trading at $46,768.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.