Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

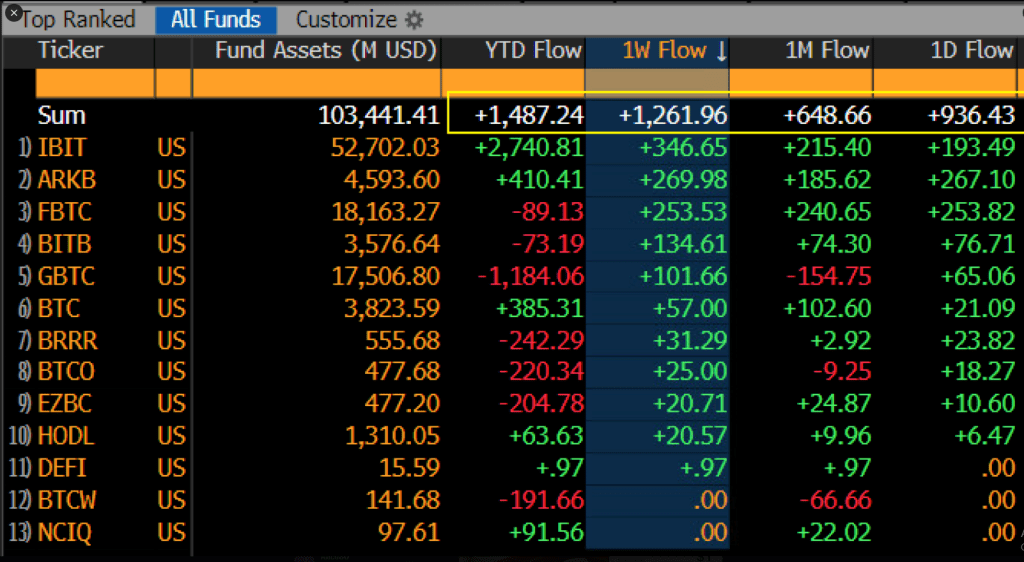

Capital flowed this week in Bitcoin-Bitcoin-listed funds, with almost $ 1 billion in fresh money witnessing on Tuesday alone.

The Rush pushed weekly inflow to $ 1.2 billion and total assets under management (AUM) to $ 103 billion, based on Bloomberg data. Investment damage took place while the price of Bitcoin was higher than $ 93,000 and reached $ 93,700 – the highest since the beginning of March.

Related lecture

BlackRock Fund remains top dog under rivals

Blackrock’s Ishares Bitcoin Trust (IBIT) remains ahead of a year to date of $ 2.7 billion. The fund only took $ 346 million last week.

The Bitcoin funds of ARK Invest ARKB and Grayscale are left behind with a considerably smaller inflow of annual to date of $ 410.41 million and $ 385.31 million.

However, not everything comes on roses. GBTC from Grayscale has seen $ 1.18 billion in outsource since January, against the general positive tide.

The Bitcoin ETFs location yesterday went PAC-MAN mode, +$ 936 million, $ 1.2 billion for week. It is also remarkable that 10 out of 11 of the originals also took cash. Good sign to see the current depth vs say $ Ibit Do 90% of the lifting. Price $ 93.5k. Quite strong everything as IMO as IMO. pic.twitter.com/helwffgt8f

– Eric Balchunas (@Ricbalchunas) April 23, 2025

The increasing institutional confidence that is reflected in broad participation

Ten out of 11 spot Bitcoin ETFs saw inflow of fresh funds this week, Bloomberg reported senior ETF analyst Eric Balchunas. They go “pac-man mode”, the analyst said on X. That broad involvement indicates that institutional players diversify their bets in different funds instead of concentrating on one or two.

The value that was traded on all Bitcoin spot -sets was $ 496 million, while Netto -Activa now represent almost $ 57 billion -equal to around 2.80% of Ethereum’s market capitalization.

Ethereum -products continue to lose streak while XRP shocks

While Bitcoin-linked investments thrive, Ethereum products simply do not seem to have a break. According to reports from Coinshares, investment products around Ethereum lost another $ 26.7 million last week.

This costs their outflow of eight weeks to a staggering $ 772 million. Even in the light of this continuous outflow, Ethereum remains in second place for the inflow of year-to-date at $ 215 million.

Short Bitcoin products under constant pressure

Short Bitcoin products experience the squeeze. Short BTC products had their seventh consecutive week of outing, with $ 1.2 million left these funds.

Data from Coinshares show that these short bets have now lost $ 36 million for seven weeks – 40% of their assets management. The continuous outflow of short positions are consistent with the recent price strength of Bitcoin.

Related lecture

XRP is the only exception between alternative coins, and his investment products attracted more than $ 37 million last week, the third highest for the inflow of year-to-date at $ 214 million. This defies the trend that is observed in most other altcoins, which are still confronted with sales pressure.

Certainly, all this new money that is deposited in Bitcoin ETF investments is perhaps the clearest sign, but traditional financial institutions come to cryptocurrency as an activa class.

We are talking about almost $ 1 billion in just one day: this seems to be even greater at the start of a new era in which the acceptance of the activa class through the mainstream is even greater.

Featured image of Wallpapers.comGraph of TradingView