The possible approval of a spot Bitcoin ETF in the United States has attracted a lot of attention in recent weeks. Dan Morehead, CEO and Founder of Pantera Capital, has now shared valuable insights on this in his latest “Blockchain letter”, highlighting the unique circumstances surrounding this event.

Morehead challenges Wall Street’s traditional mantra: “Buy the rumor, sell the news,” and questions its relevance in today’s spot ETF context. He reflects on how this adage has played out historically, specifically citing the launch of CME Futures and Coinbase’s public listing. Both cases showed significant price increases in the BTC market before their respective events, followed by steep declines, in line with the adage’s prediction.

Spot Bitcoin ETF is a “Buy the Rumor, Buy the News” event

In his detailed analysis, Morehead shares how the Bitcoin market rose dramatically, up 2,448%, leading up to the launch of CME futures. However, this bullish trend abruptly reversed on the day the futures were listed, marking the start of an 84% decline into a bear market. He compares this to the scenario before Coinbase’s public listing, where the market rose again, this time by 848%, reaching its peak on the day of Coinbase’s listing, only to be followed by a 76% decline.

Morehead notes with a touch of humor in his letter: “Would someone please remind me the day before the Bitcoin ETF officially launches? Maybe I’d like to get some chips from the table.’

But “this time it’s different,” Morehead says. As he delves further into the potential impact of a spot ETF, he argues that such an ETF would represent an important step in adoption. Unlike futures, which he says are a “step backwards,” the spot ETF could fundamentally change access to BTC, open up new investor pools, and potentially permanently change the demand function for Bitcoin.

Unlike the previous events of the CME futures and Coinbase listing, which had little impact on Bitcoin’s accessibility in the real world, Morehead believes the spot ETF scenario is fundamentally different. He claims: “A BlackRock ETF fundamentally changes access to Bitcoin. It will have a huge (positive) impact.” He believes the ETF will introduce BTC to broader investor classes, significantly changing the investment landscape.

Drawing a parallel to the history of gold ETFs, Morehead suggests that Bitcoin ETFs could similarly revolutionize Bitcoin investing, broadening its appeal and legitimacy. He predicts a substantial shift in demand dynamics for Bitcoin, similar to how gold ETFs changed the gold market.

In his closing remarks, Morehead returns to the original question of whether the launch of the ETF would be a ‘sell the news’ event. He states: “Buy the rumor, buy the news.” This sentence summarizes his belief that, contrary to past events, the introduction of a Bitcoin ETF will not lead to a sell-off, but will mark the beginning of a new era in Bitcoin investing.

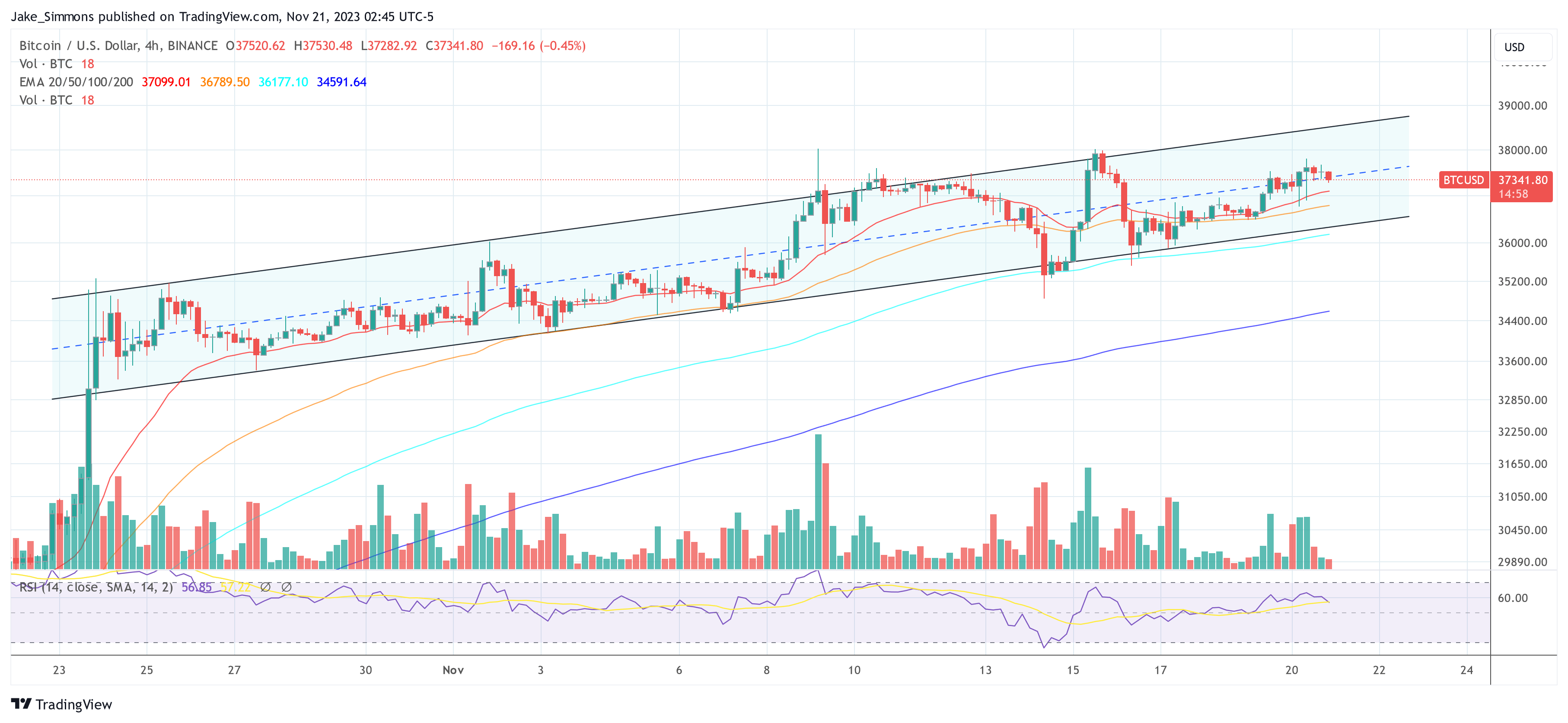

At the time of writing, BTC was trading at $37,341.

Featured image from Shutterstock, chart from TradingView.com