Sotheby’s will auction a series of blue-chip NFTs that belonged to now-defunct crypto hedge fund Three Arrows Capital, with the auction house proverb the “multi-part sales series” begins in May and runs throughout the year.

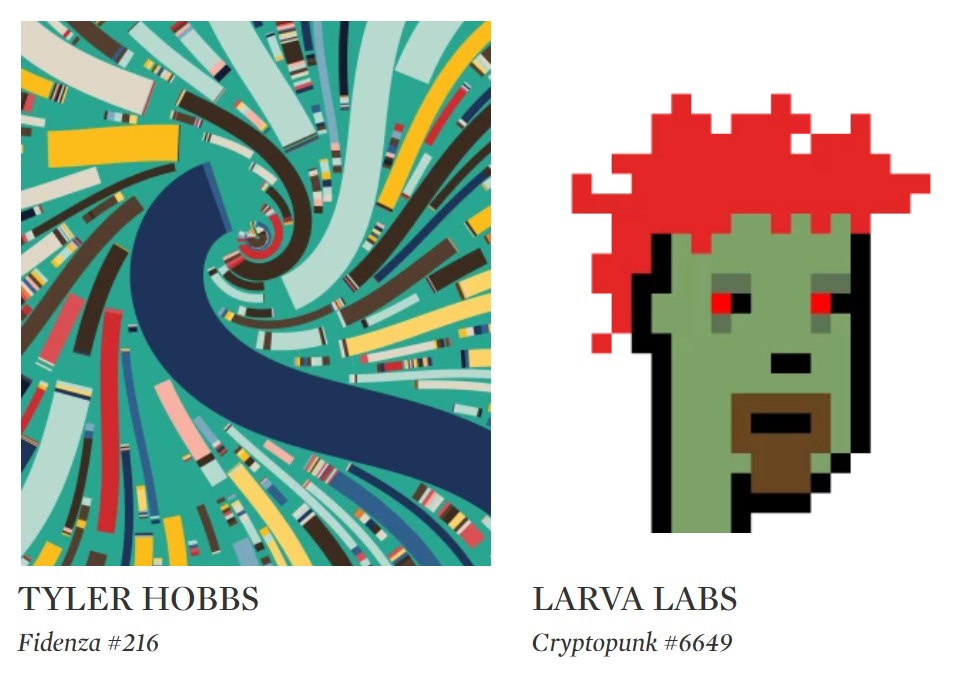

Listed NFTs in the “Grails” collection include zombie-style CryptoPunk #6649, Ringers #879 by Dmitri Cherniak, and Fidenza #216 by Tyler Hobbs.

“This extensive collection marks an important moment in the emergence of generative art on the blockchain in 2021, and was guided by an ethos of acquiring the highest quality and rarest works available on the market,” Michael Bouhanna, Sotheby’s head of digital arts and NFTs, said in a statement.

The history of the collection is infamous, given the dramatic rise and fall of the previous owner. It was seized as part of a long-running lawsuit that began after the hedge fund, once a top investor in the crypto market, filed for bankruptcy last July. Court documents at the time showed that creditors had borrowed billions of dollars from 3AC.

Sotheby’s Grails Collection

Screenshot of works from Sotheby’s “Grails” collection.

During its peak, 3AC spent lavishly on NFTs. The company spent 1,800 ETH – worth about $5.6 million at the time of sale – on Ringers #879, popularly known as The Golden Goose.

“Thesis: We love the goose,” 3AC co-founder Su Zhu tweeted Than.

Sotheby’s, which started showcasing NFTs in 2021, saw a lukewarm response to its “Oddly satisfyingauction last month, where the best-selling piece, artist Anyma’s “Eternity,” fetched just €50,800 ($55,653) compared to an estimated closing price of between €70,000 and €100,000.

Bouhanna said the March auction brought in about $316.00, with 93% of the pieces sold.

© 2023 The Block Crypto, Inc. All rights reserved. This article is for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial or other advice.