- The Sonic Network Upgrade has led to a huge influx of liquidity to the chain, from which s native token could benefit.

- Spoting and derivative traders benefit from the current market sentiment, place long bets and buying the asset.

The positive developments on the Sonic have not fully reflected in the last 24 hours of trading activities [S] Chain, because the token has fallen 7.22% within this period.

However, the market sentiment remains strong, which means that S still has the chance to continue the winning of 13.95%of the past week, in particular the more liquidity flows into the chain and market participants continue to actively acquire.

Network upgrade Sparks Renewed Interesting

In the last 24 hours, Sonic announced an upgrade to his consensus protocoll layer, known as Soniccs 2.0, aimed at improving overall performance.

The upgrade significantly improves the consensus process and doubles the validation rate of the transaction from 16,000 to more than 30,000 per second.

The memory use has been reduced by 68%, reducing the hardware requirements for validators and promoting greater decentralization by enabling more validators to join the Sonic Network.

The upgrade benefits various protocols on Sonic, including decentralized trade and token transfers.

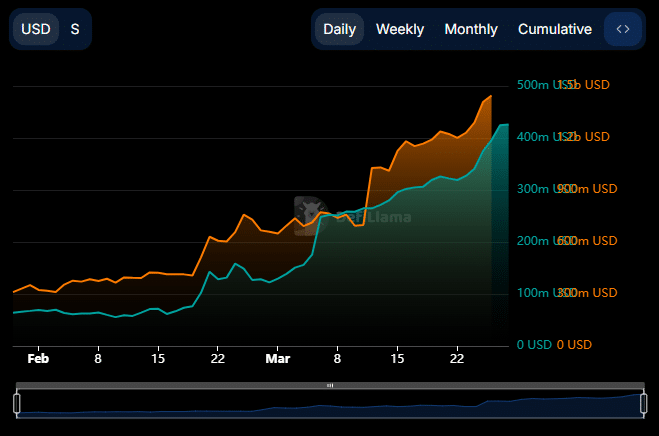

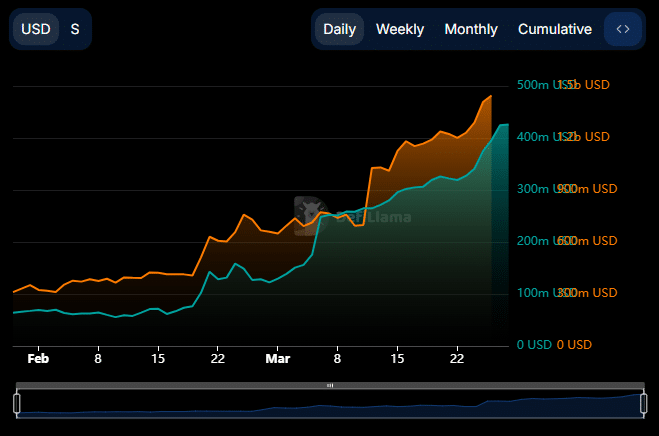

After the announcement, the liquidity inflow in the chain increased, with stablecoin -baldi and bridged TVL (total value locked) that remarkable increases.

At present, the total stablecoin volume that is processed on the Sonic chain has reached a record of $ 425.96 million, an increase of $ 28.41 million compared to its previous daily low point.

Source: Defillama

A peak in the Stablecoin demand on a chain often signals positive developments because market participants actively support activities. This can be buying and keeping of Sonic’s native token, s or depositing funds in protocols to earn rewards.

Similarly, the bridged total value (TVL) shows, with measuring the liquidity between chains, that $ 1,445 billion has flowed to Sonic’s protocols from other chains. This indicates a bullish sentiment, where participants would like to get in touch with the chain.

Optimism extends beyond the activity on the chain, since Ambcrypto reports that both spot and derivative traders also accept a bullish prospect.

Sonic: Spot and derivative traders are Bullish

Both ridiculous and derived traders position themselves for an S meeting.

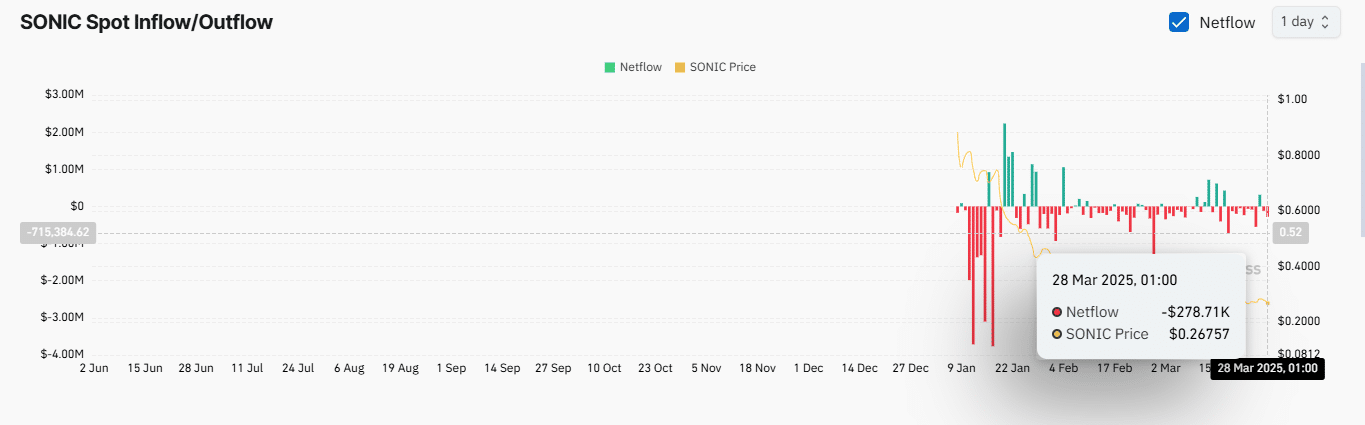

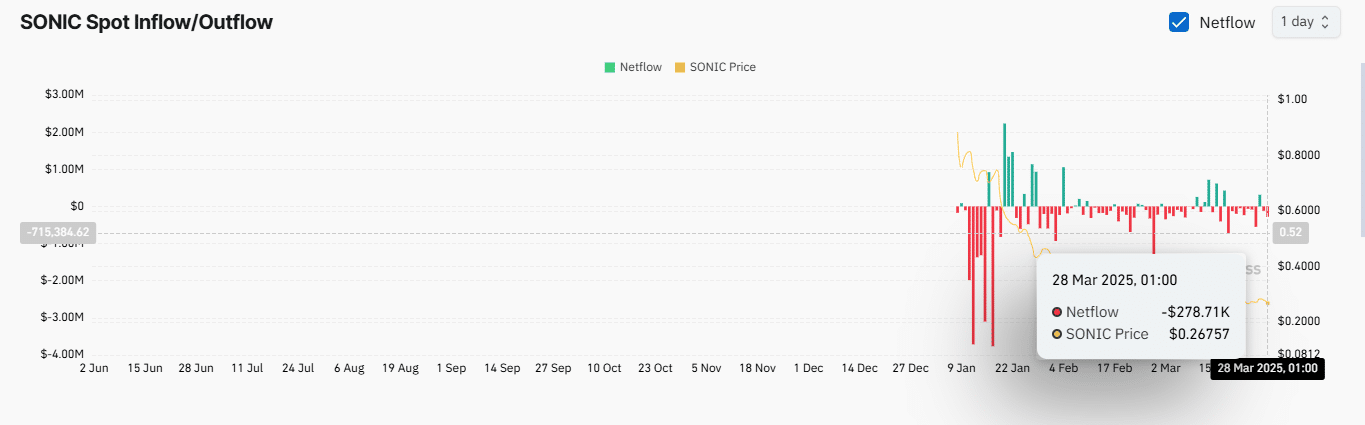

Source: Coinglass

At the time of the press, Spot traders have adjusted their expectations for the actively and only in the last 24 hours of S., traders have purchased more than $ 278,000 in S, so that the week a total purchase of $ 742,000 is concluded.

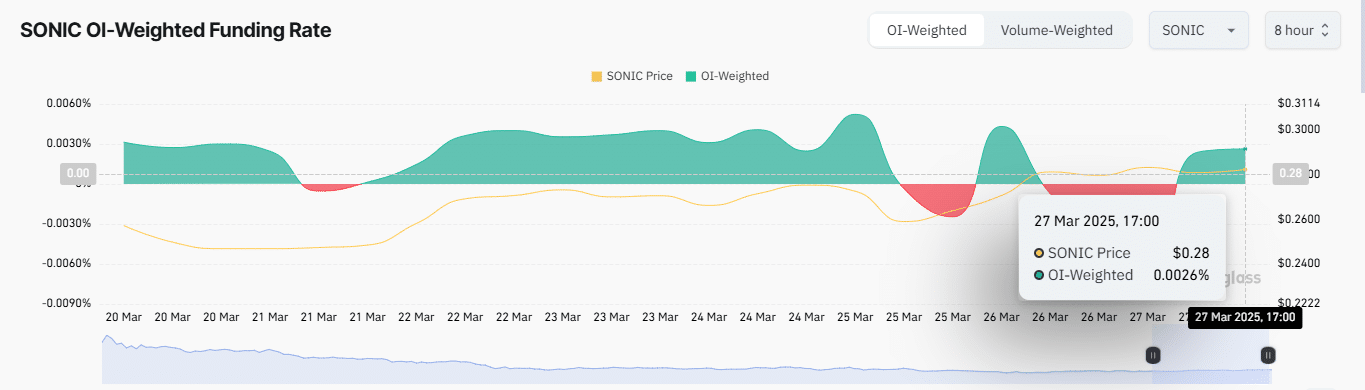

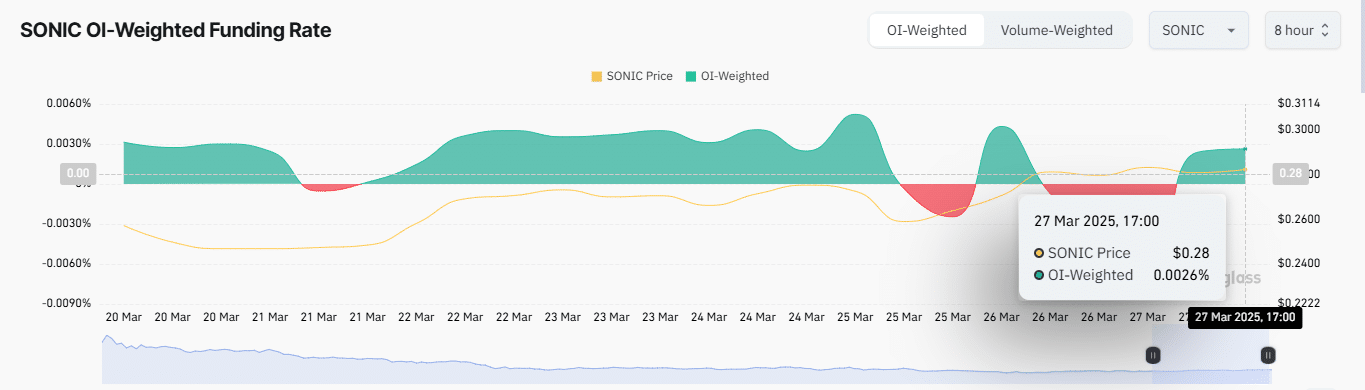

In the Derivatenmarkt, traders place long bets such as the open interest -funding financing percentage – an indicator that records market trends based on open interest and financing interest – has become positive.

Source: Coinglass

With a period of 0.0026%, this suggests that traders on the derivatives market are bullisher than Bearish. If this figure continues to rise, s could see a big markettrally.