- Sonic whales have been selling it actively for weeks, which means that it is actively falling.

- Spot traders on the market start to prevent the movements of the whales when they change the story.

Sonic [S] Has been on a recession for a longer period of time, with a weekly loss of 27.11% if market participants become BEARISH.

The Bearish Golf seems to be intensified because it has been actively falling by 9.53%, with the increasing pressure from the whale. Ambcrypto has since discovered that spot traders can play a role in preventing further price decreases.

Whales keep selling Sonic

Large investors, also known as whales – who control a considerable amount of an active between 0.1% to 1% – remain S.

In the last 24 hours alone, IntotheLock registered that this cohort sold 8.66 million S tokens at the time worth $ 5.41 million, which contributed to the recent price decrease.

Source: Intotheblock

This current sale is a significant decrease in the 65.17 million S tokens that are sold on January 21, which suggests that whales can approach a point of exhaustion.

For now, however, there are even more bearish whales in the market than Bullish. In the past week there were 131 bears and 114 bulls on the market, which means that there are 6.94% more bears.

While whales continue to sell and be able to go on their way to exhaustion, Ambcrypto discovered that a squeeze of the supply could almost be in the area, because spot traders make their movement.

Spot traders against

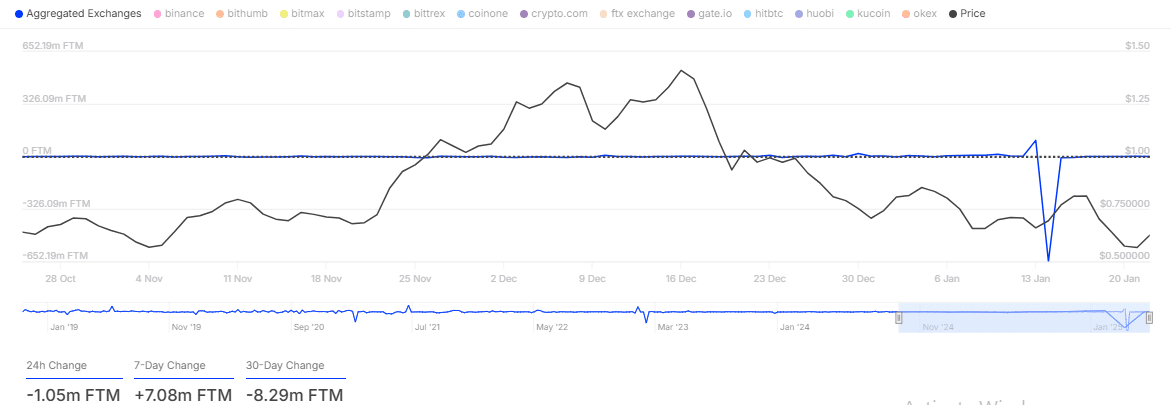

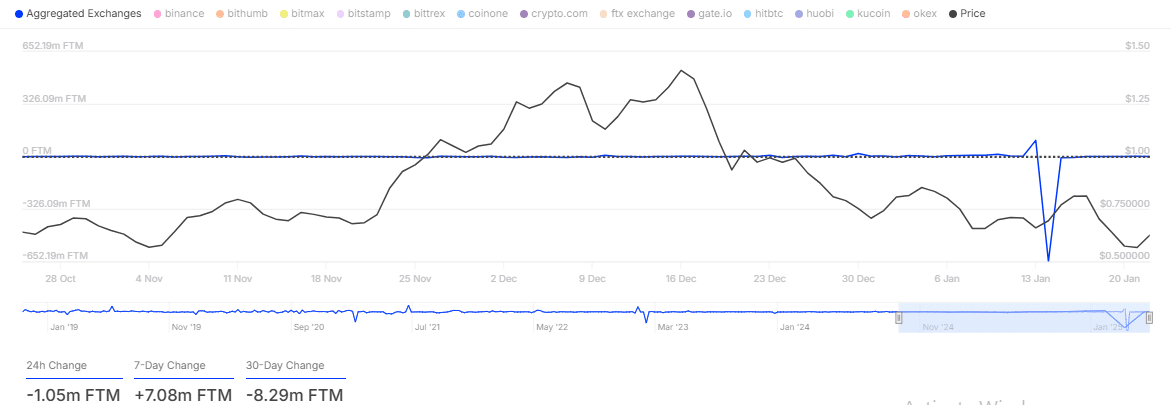

While whales keep selling, spot traders started to gradually reduce their ownership in stock markets in the last 24 hours.

The Exchange Netflow shows that a total of 1.05 million has been removed from Sonic from fairs. When this happens, this indicates that traders are willing to hold it actively for a longer period.

Source: Intotheblock

A movement like this tends to gradually cause an offer while the available sonic tokens start to reduce, may not match the demand.

This would depend on whether spot traders continue to move their participations to private portfolios, which changes the current weekly Netflow from a positive $ 7.08 million to a negative figure.

If this movement goes away from stock markets, and if the sale of whales finally touches peak output, it is likely that S could see a rebound to the top.

Gradual volume

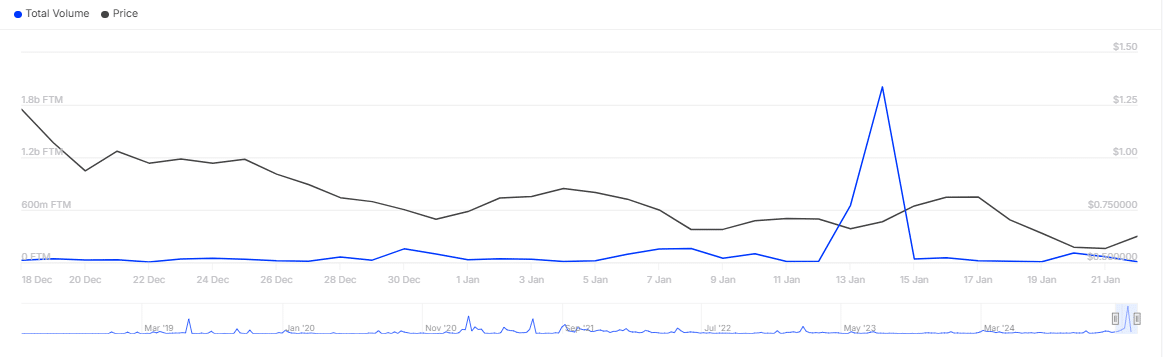

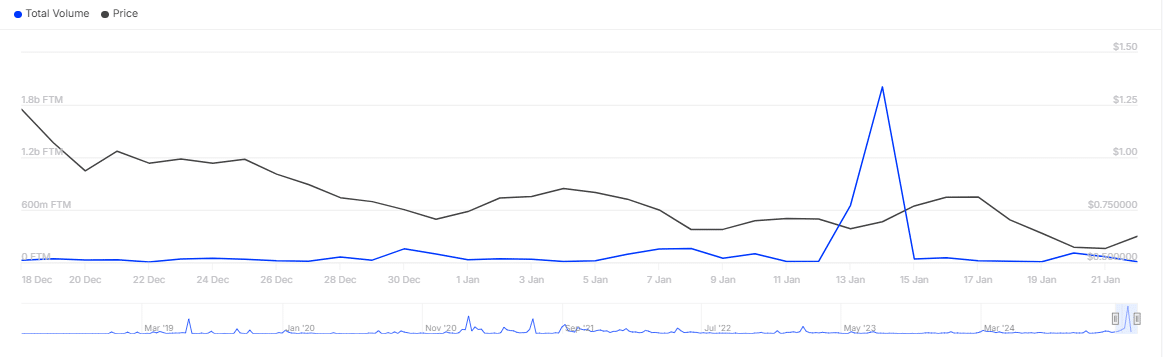

The total Sonic volume has continued to rise since 1 January, starting with an opening volume of approximately $ 890,000 and $ 15.47 million reached, according to Defillama.

Read Sonic’s [S] Price forecast 2025–2026

Usually the growing volume does not indicate a bullish or bearish scenario as a stand-alone metric. However, if the price direction changes, since sentiment may be shaking in favor of the bulls, then S could see a rapid increase.

This is because simultaneous growth in price and volume shows that there is a high omentum in the market, which leads the assets to a faster revival.