- Top Institutional Investors – Graycale, Fidelity and Ark Invest – have collected Bitcoin.

- The market could see a bullish put as soon as Bitcoin recovers the fiat base in the short term.

Bitcoin [BTC]Who has failed to establish a remarkable market movement in both directions, now seems to lean to the Bullish end.

The active has won 0.92% because the trust of the market is gradually being restored. Recent market promotion of whales and the potential of Bitcoin that regain the most important levels remain high.

Top investors give priority to BTC in the midst of minimal profits

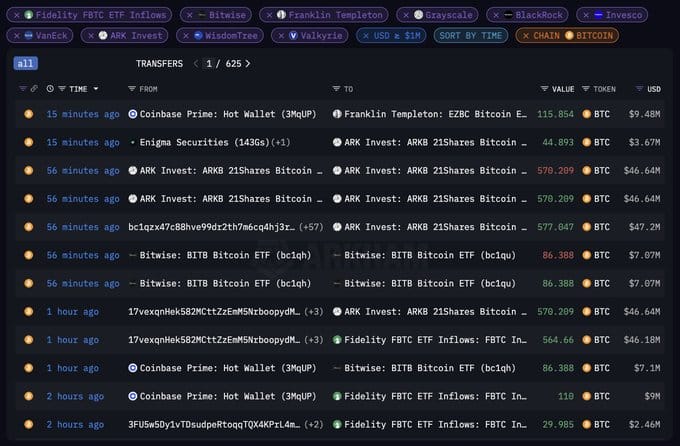

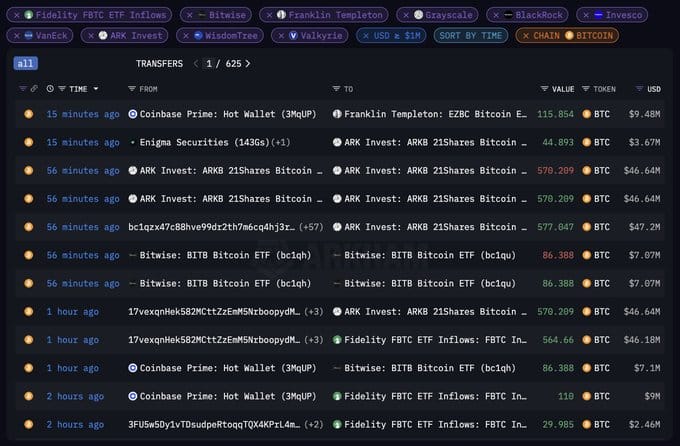

There has been a remarkable purchase of Bitcoin from top -institutional investors in the market for the past 24 hours, which contributes to their existing portfolios, despite market shift rates that have been implemented by President Trump.

According to a report from Arkham, Grayscale, Fidelity and Ark Invest are the most important investors involved in this trade. Institutional investors have purchased at least 2,099 BTC from the moment of press.

Source: Arkham Intelligence

When large investors who are known to stimulate liquidity on the market, choose to buy – especially when the market remains at lower levels – this means that a price rally can be, with the assets trending higher.

Are the bulls completely in on BTC’s rally?

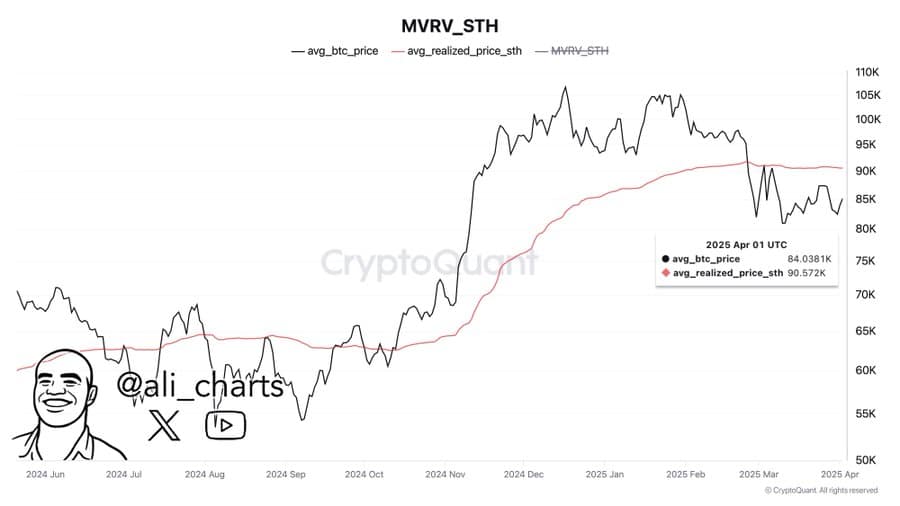

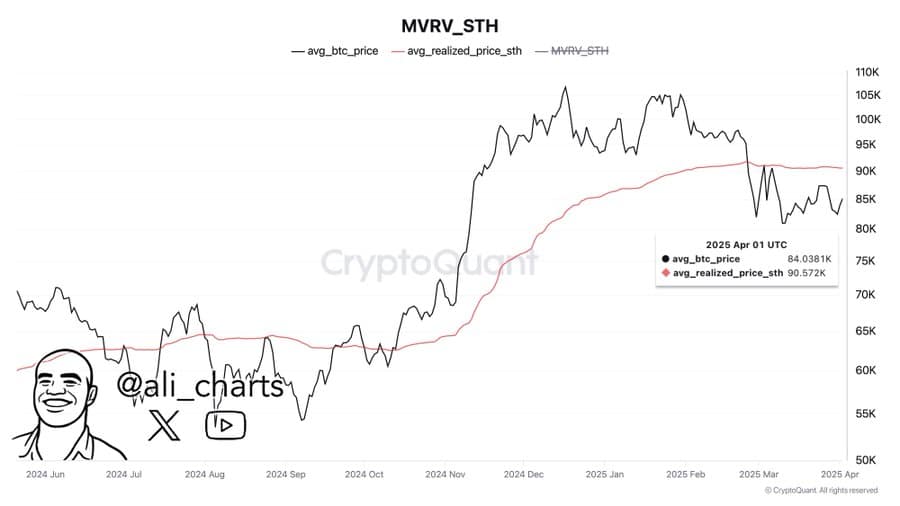

To confirm whether the bulls fully support a Bitcoin rally, Ambcrypto analyzed the realized price of the short-term holders-a historical reference point that is used to determine whether the market is bullish or bearish.

Source: Cryptuquant

Currently, the market value will remain realized by holders in the short term $ 90,570. This means that Bitcoin to resume his rally should recover this level.

As can be seen on the graph, Bitcoin tries to reclaim this level, with its current price at $ 84,580, pointing to the top.

Analysis of other important statistics suggests that the rally could come earlier than expected.

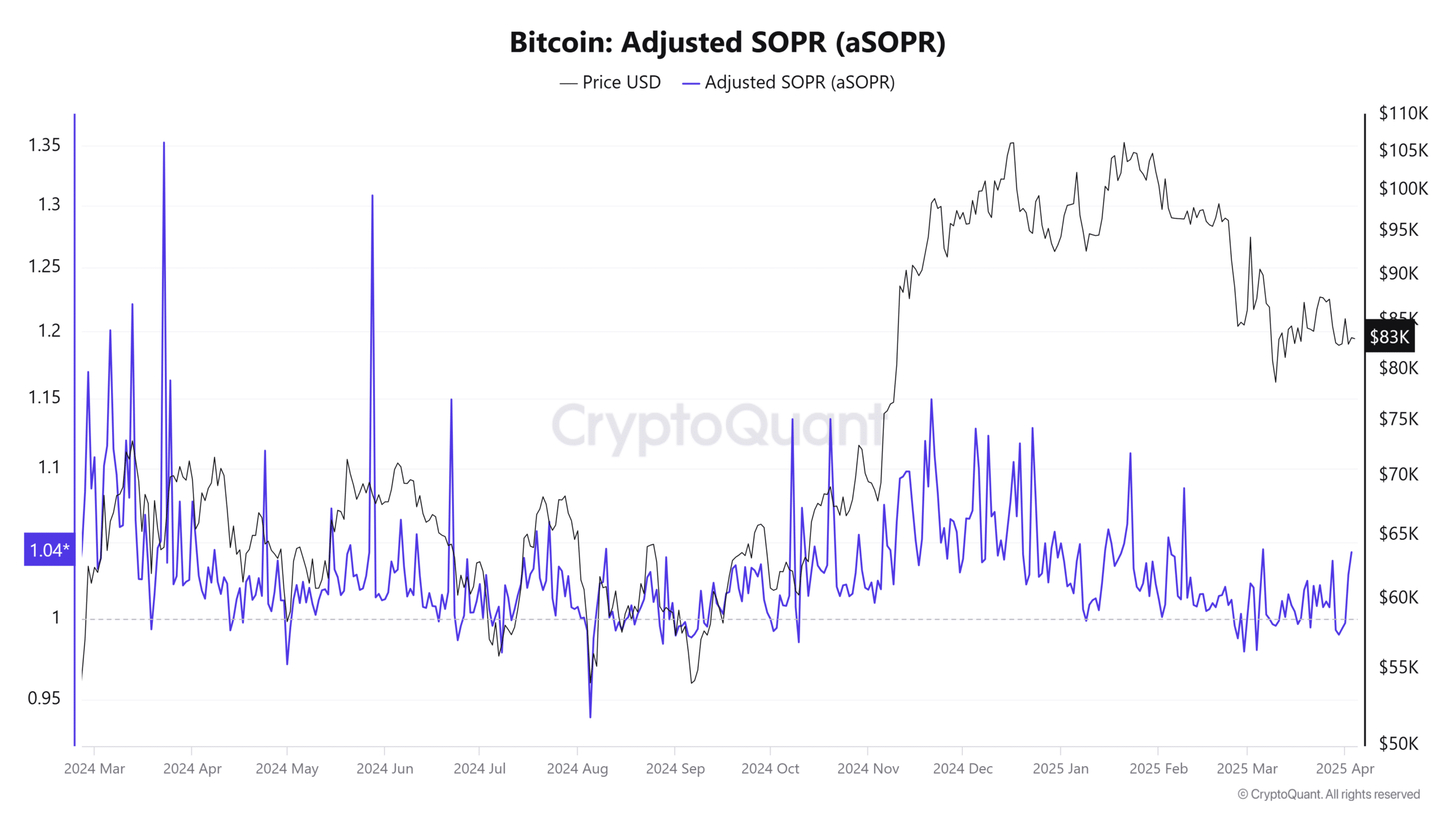

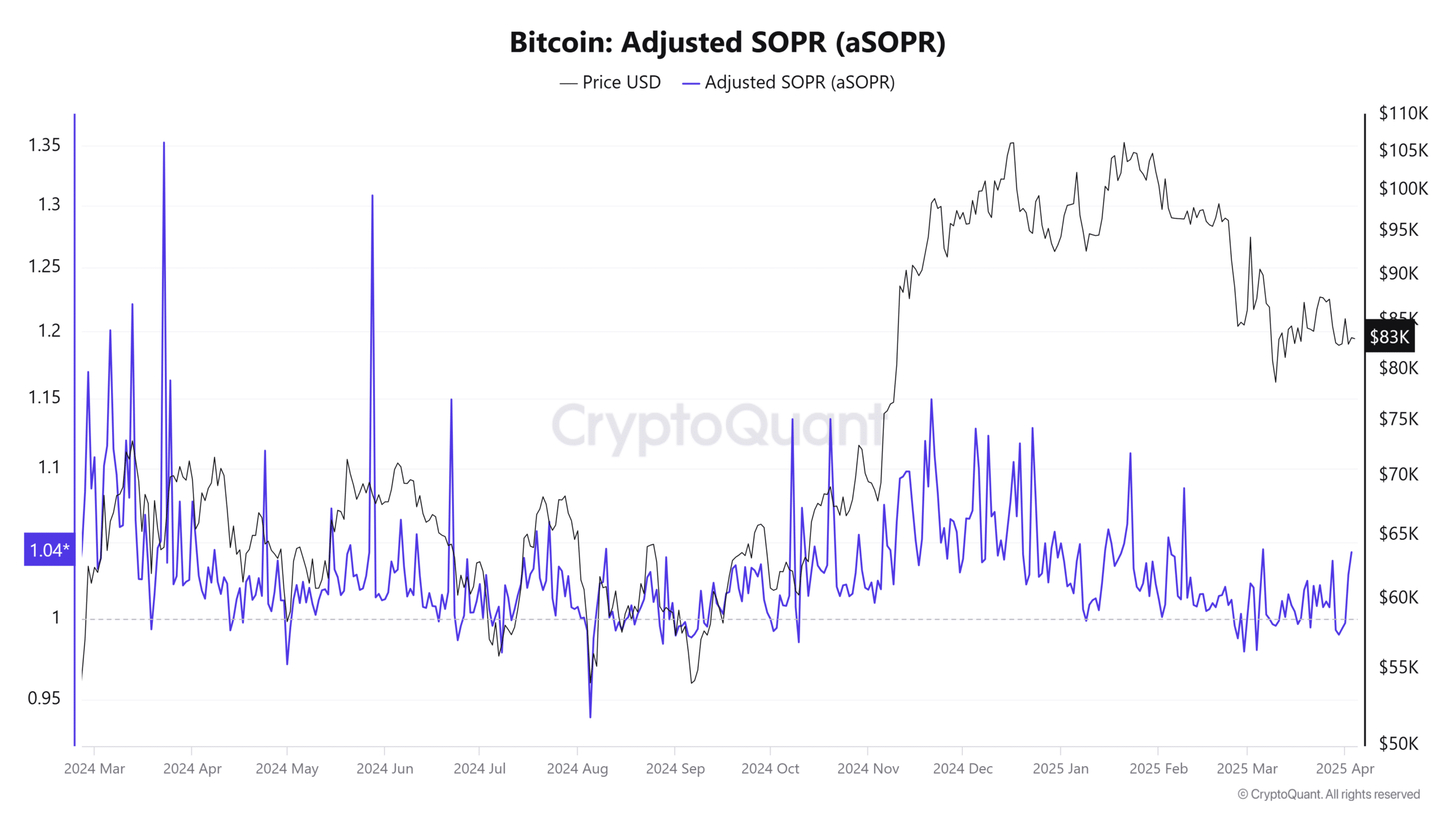

The custom issued output Winstratio (ASopr), which follows or sell investors with a profit or loss, shows that investors sell with a profit.

Source: Cryptuquant

Selling with profit implies that there can be a downward pressure on Bitcoin, because more tokens with limited demand are expected to be sold.

Analysis of Bitcoin’s net non -realized profit/loss (NUPL) – a metric used to determine the number of investors in profit or loss – means that only a small percentage is currently a profit.

The Bitcoin NUPL is slightly above 0, with a lecture of 0.4, indicating that only a small percentage of traders has a profit. This suggests that taking a profit could quickly slow down, so that the total market has little impact.

Source: Intotheblock

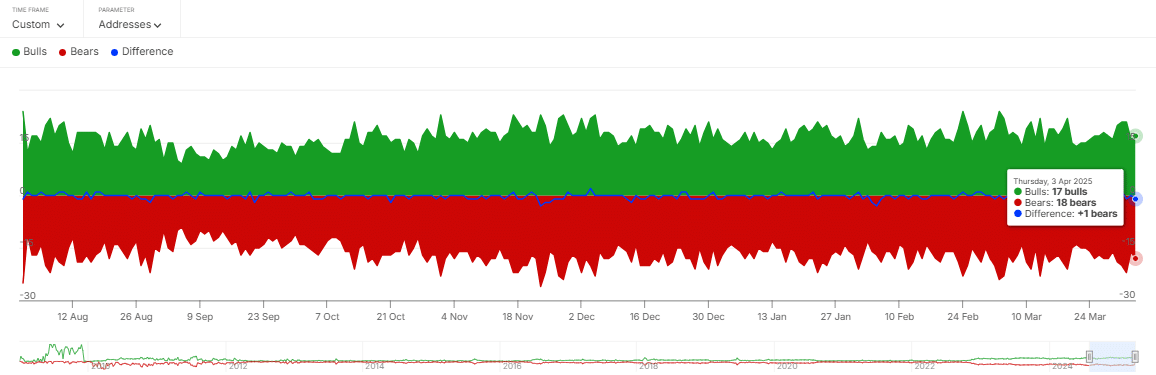

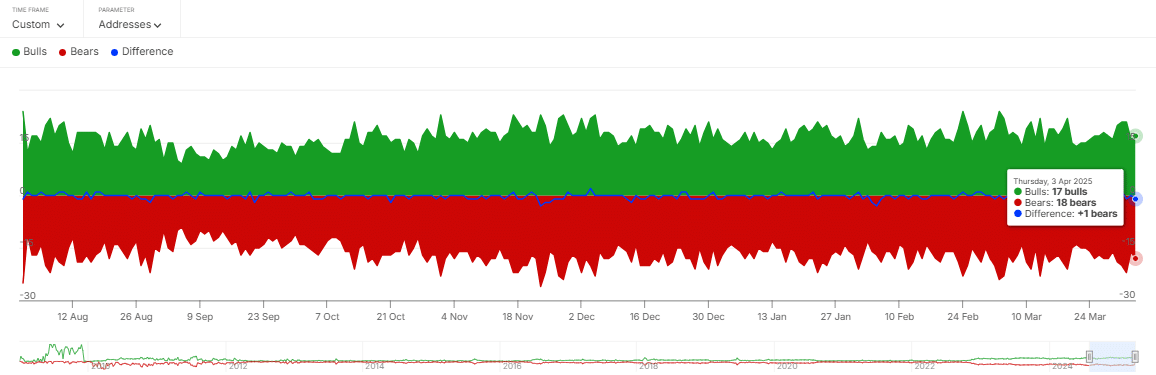

In addition, the Bull-Beer Ratio-a indicator used to determine the number of Bullish and Bearish and Bearish large investors in the market-that there are 17 bulls and 18 bears.

This minimum difference suggests that the bulls are approaching the bears, and it is only a matter of time before the market is in balance or the bulls catch up.

In general, analysis shows that the opportunities for a rally remain high, whereby the sales pressure gradually decreased. If this trend continues, it offers an opportunity for a big price drop as buying sentiment grows.