- Whale inflow explored when investors shifted the focus of scarcity

- On-chain statistics supported bullish sentiment with strong profitability of holders and the most important price support zones

More than 22,000 BTC has flowed in Binance within a period of less than two weeks. The newest increase increased the exchanges Bitcoin [BTC] Reserves from 568.768 BTC on March 28 to 590,874 BTC before April 9.

Such a sharp increase in reserves reflects the growing investor activity, possibly caused by fears around macro -economic uncertainty and the imminent US Consumer Price Index (CPI) announcement.

Although some can interpret this inflow as a sign of potential sales pressure, others believe that strategic accumulation can be in preparation for market volatility.

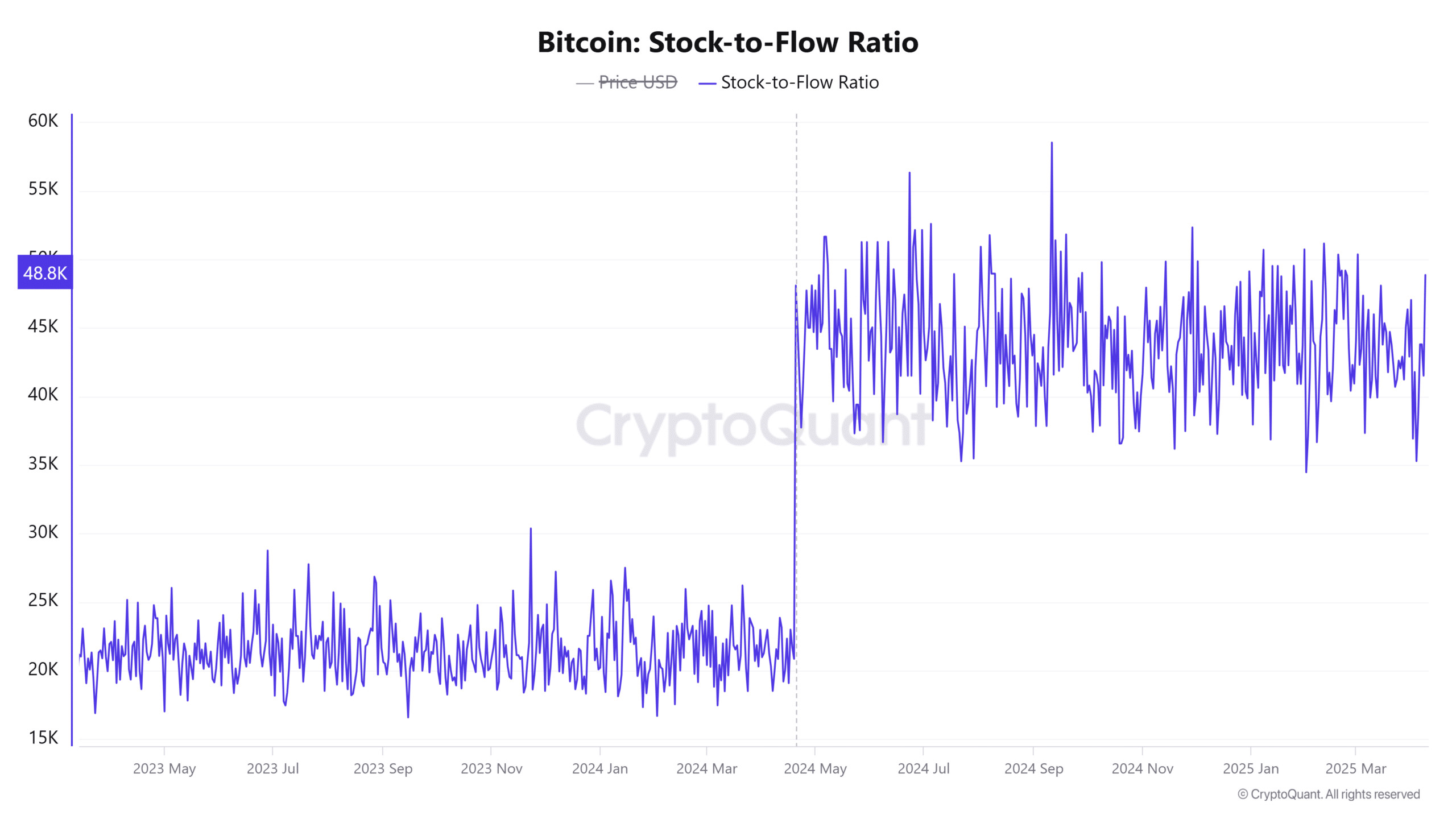

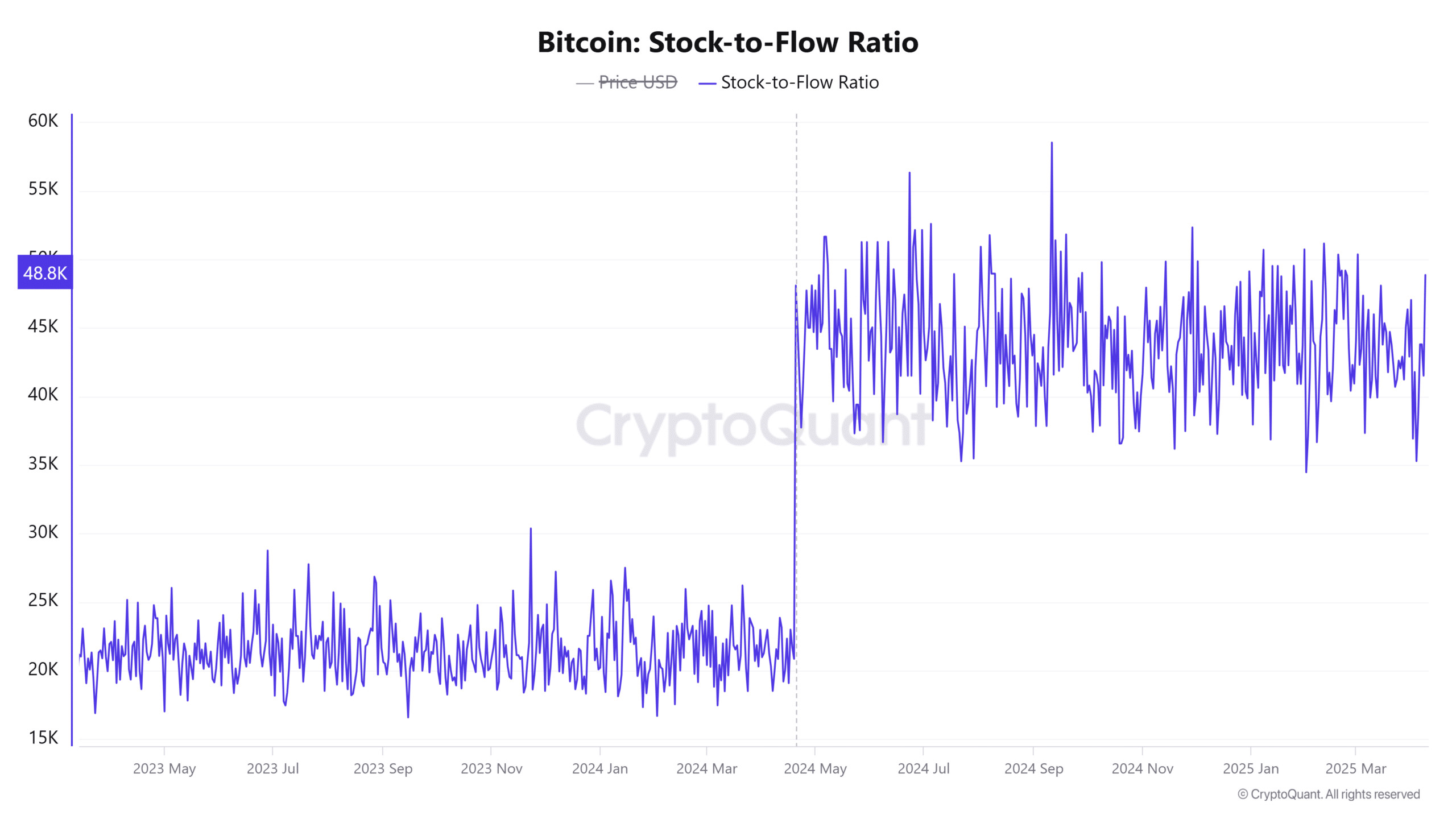

Stock-to-flow Ratio is sharp-scarcity lost its influence?

With the rising of the exchange reserves, another metric took a noticeable hit.

The ratio for stock-to-flow (S2F) dived in the last 24 hours with 16.66%. Here it is worth noting that this metric follows Bitcoin’s scarcity by comparing the delivery with mined coins.

The decline raised the time value of the press to around 1,0586 million – indicative of a reduced market emphasis on Bitcoin’s scarcity model.

While the S2F often matches long -term bullish trends, recent behavior underlined the focus that shifts to inflation and interest factors.

Source: Cryptuquant

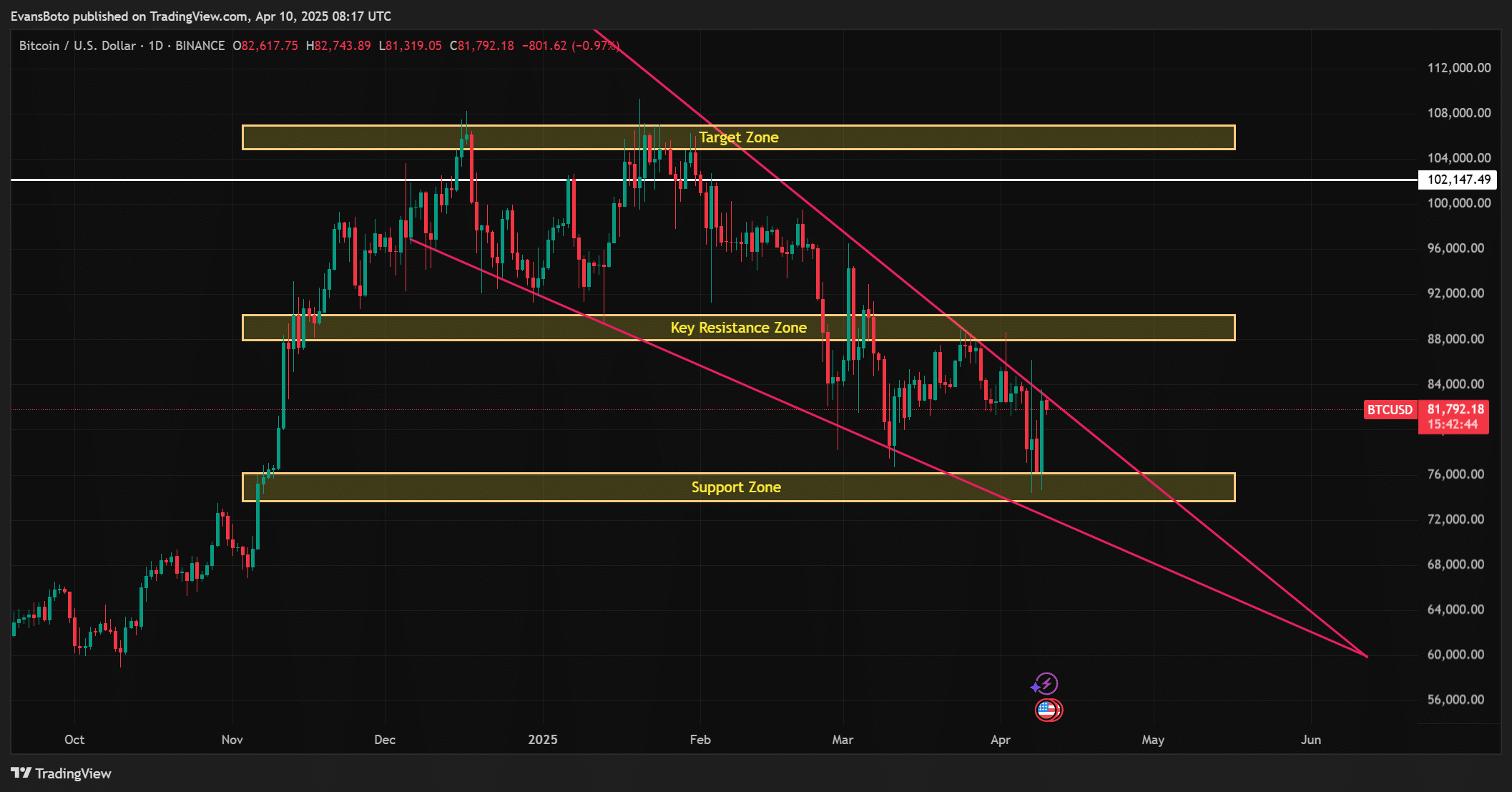

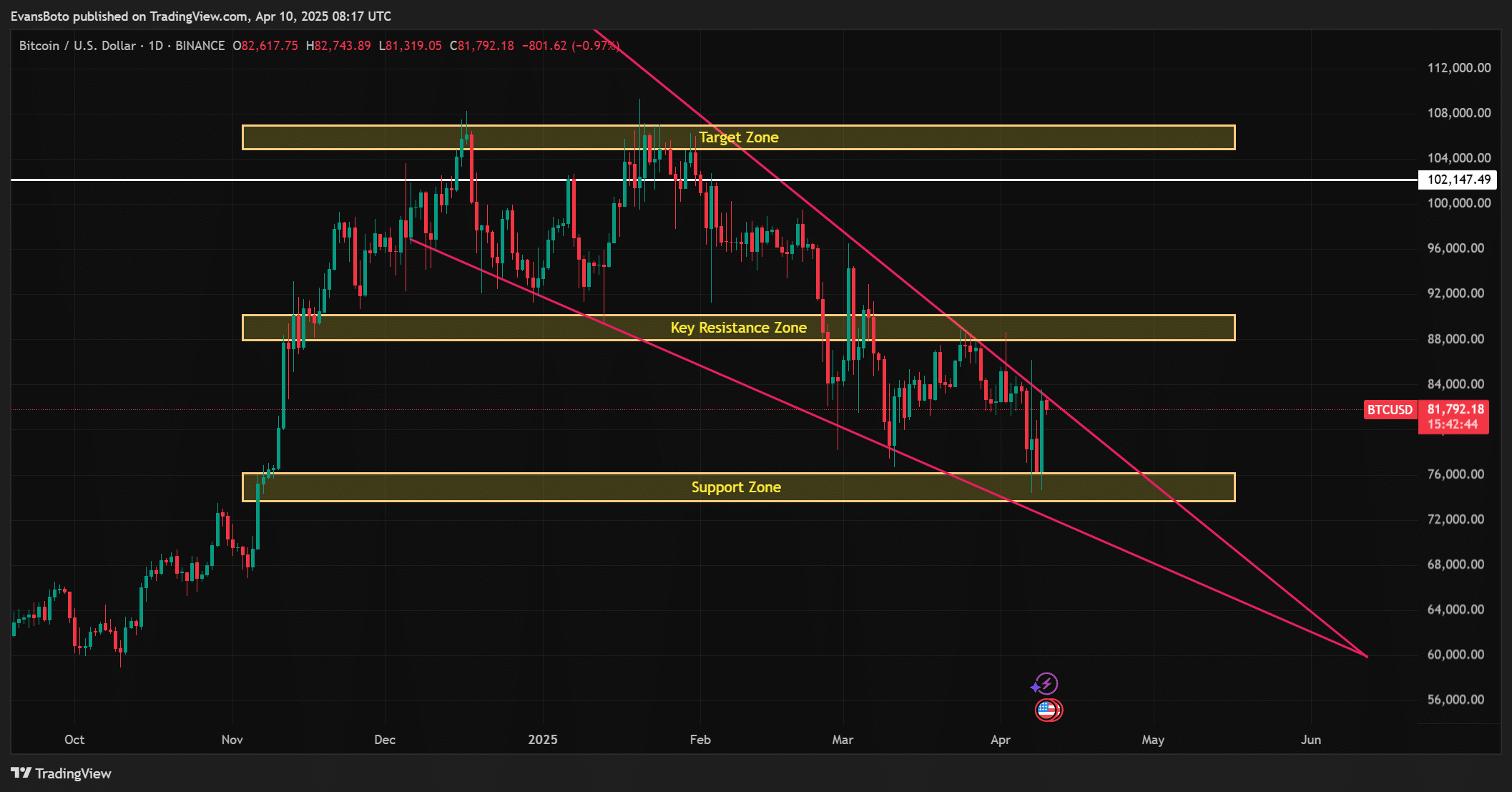

Bitcoin -price compresses under key resistance

At the time of writing, Bitcoin acted at $ 81,715.99, after a win of 5.57% in the last 24 hours.

Despite this recovery, however, the price remains trapped in a falling wig pattern. It even seemed to test a large resistance zone near $ 84,000. Although the support level has kept around $ 76,000, the narrowing pattern suggested that an outbreak can be imminent.

If the bulls succeed in pushing the upper limit, the purpose of $ 102,000 could come into play. However, not maintaining support can cause a decrease to $ 60,000. That is why this is a make-or-break zone for BTC.

Source: TradingView

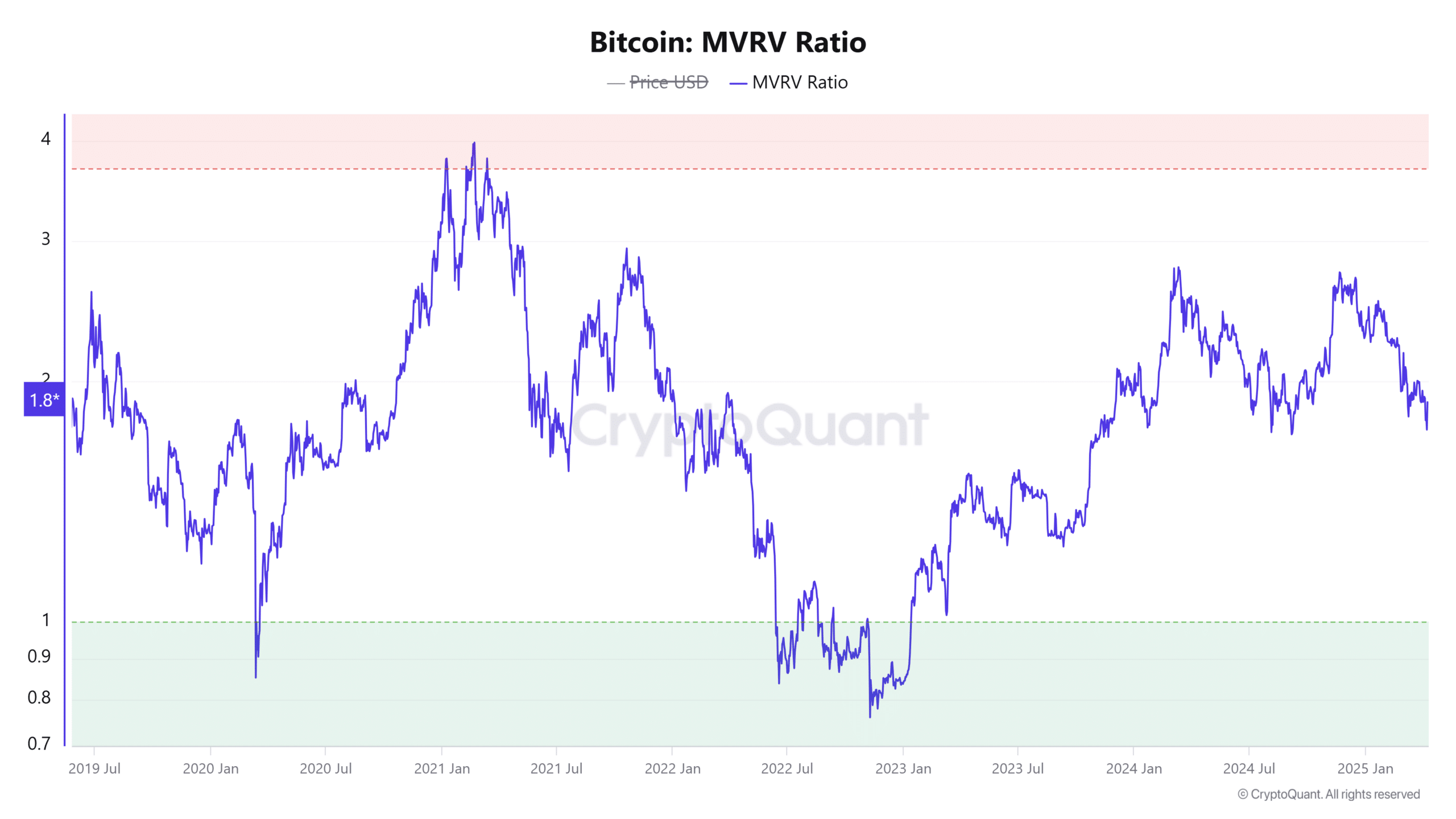

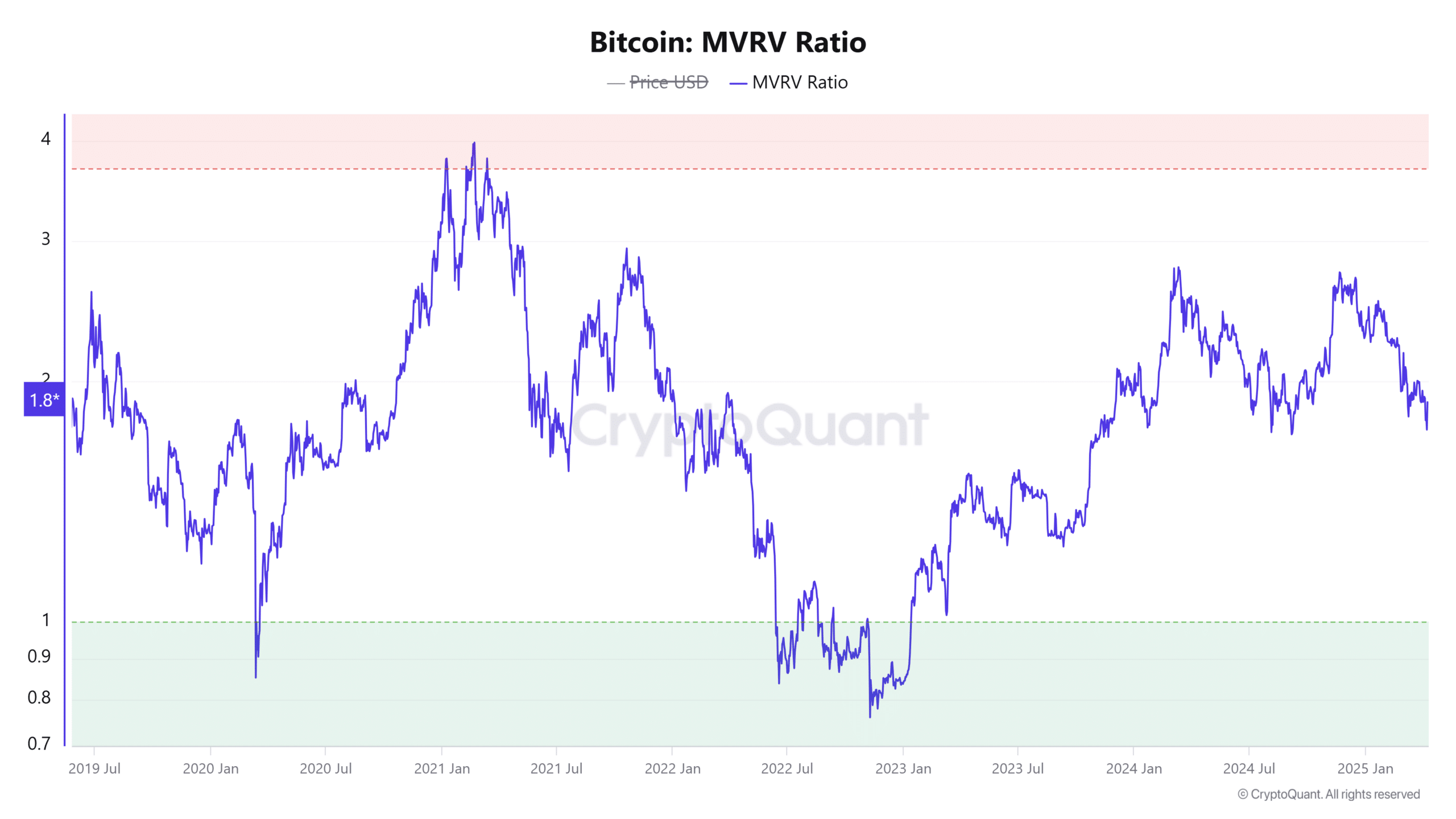

Bitcoin MVRV Ratio -Flimingen -Do investors still have faith in their positions?

By adding more context to the market mood, the MVRV ratio- which is meters or BTC is over or undervalued- was at 1.86, which reflects a 4.84% increase in the last 24 hours.

A ratio above 1 means that holders probably remain confident and hold, rather than selling with losses.

As the ratio climbs, the temptation is to lock up profits. This emphasizes the importance of following sentiment shifts in real time.

Source: Cryptuquant

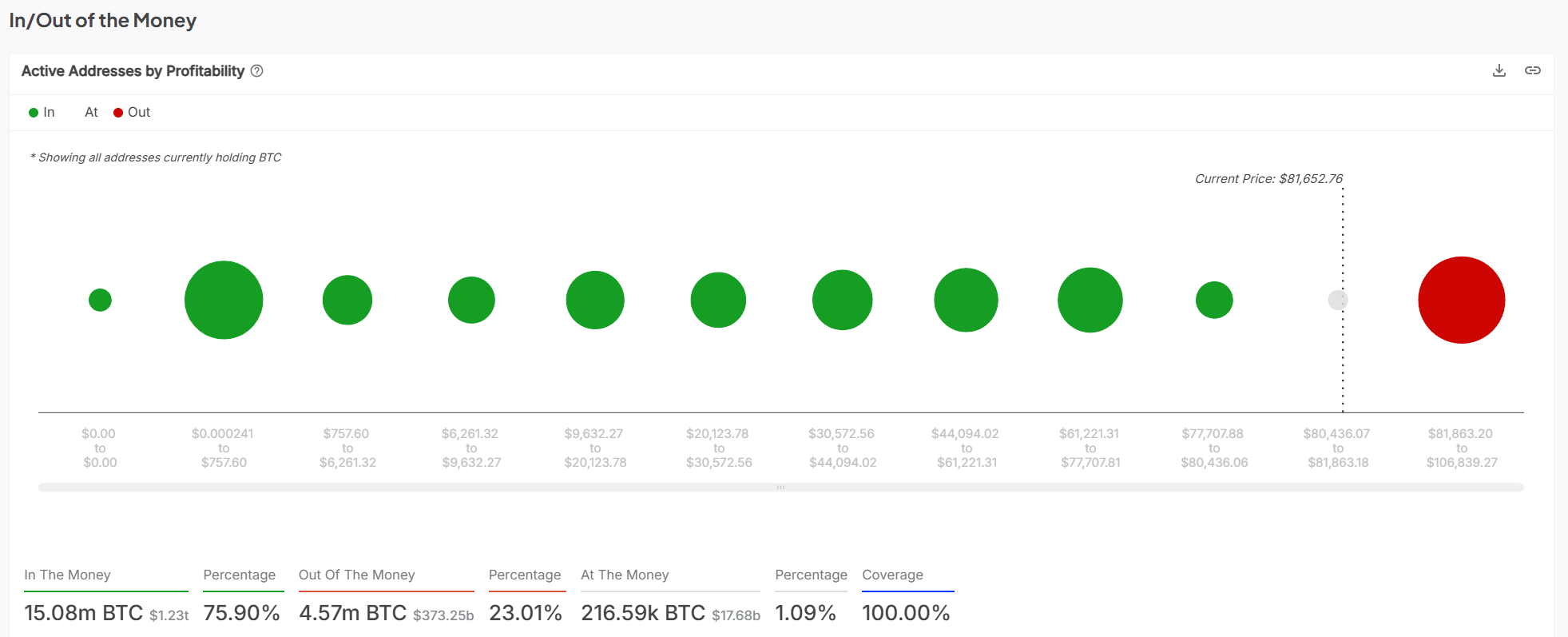

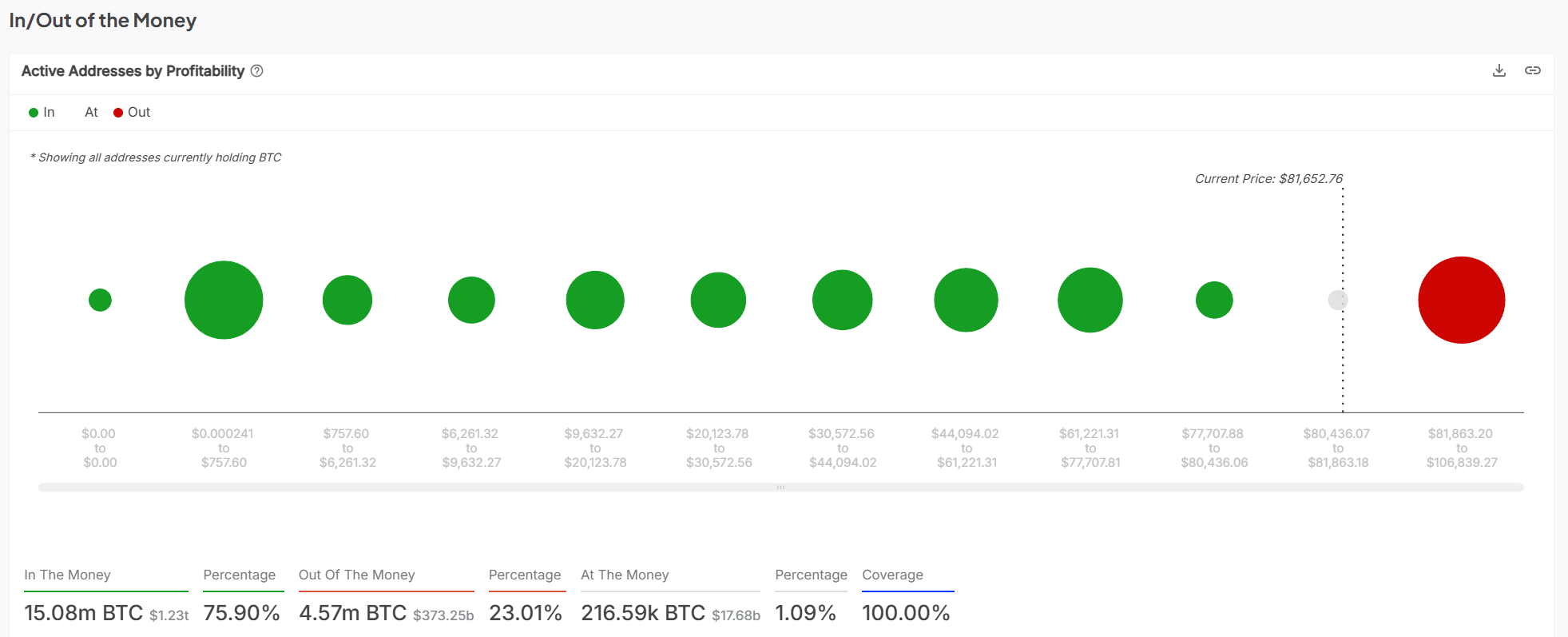

Most wallet still ‘in the money’, but for how long?

According to the last in/outside the money data, 75.90% of the BTC addresses have a profit, while only 23.01% are outside the money. This is a sign that the majority of the market participants remain well positioned. This can serve as a psychological pillow during pullbacks.

Moreover, the concentration of holders seemed to create a strong support zone just below the time price of the press, which may limit the disadvantage.

With a large cluster of addresses that also approaches break, any significant drop of panic can cause weak hands.

Source: Intotheblock

By putting together all the documents, the data seems to prefer strategic positioning over anxiety -driven outputs.

A majority of holders remains in profit, the MVRV ratio has supported a bullish prospect and the price still respects the most important support levels.

In short, whales are not bail, they bet. Their accumulation behavior hinted that smart money has been quietly set for the next step, and not fleeing.