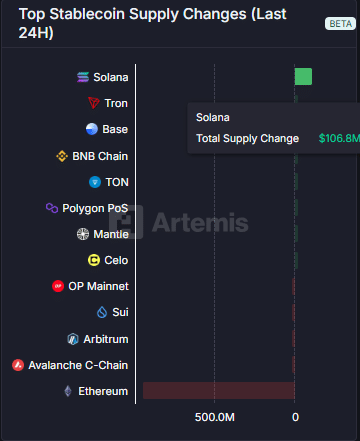

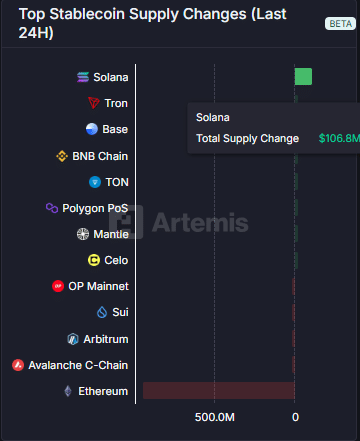

- Sol has set a remarkable share of the Stablecoin offer in the last 24 hours as the interest rate grows.

- The accumulation on the spot market has increased over the past five days, which indicates the increasing market interest in the active.

Despite his recent Bearish Trend in the past week and months, Solana [SOL] has remained relatively stable for the past 24 hours if the sentiment shifts and light drops by 1.05%.

The growth of the supply of Stablecoin and the accumulation of Sol investors are clear indications of a ruling bullish sentiment on the market.

Solana’s Stablecoin range and accumulation grow

There has been a remarkable increase in the total supply of Stablecoins on Solana in the last 24 hours. At the time of writing, $ 106.8 million to Stablecoins has been added to the network, indicating that the rising demand for SOL.

This could be for different purposes, including setting up in protocols or development activities.

Source: Artemis

Sentiments such as these tend to positively reflect on the price, whereby it actively gradually climbs higher. However, it would require more fundamental catalysts for a significant momentum rally.

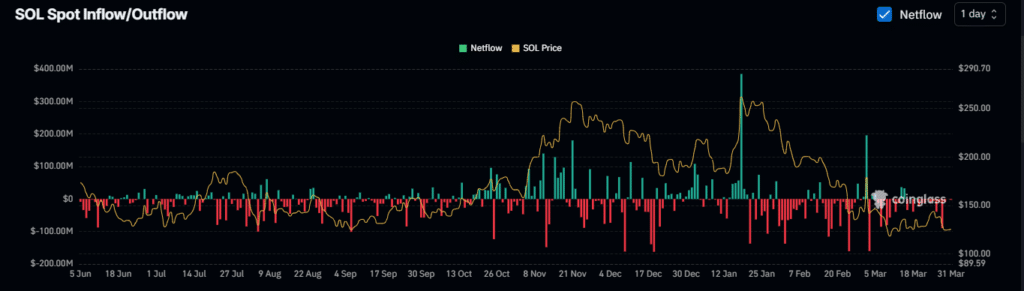

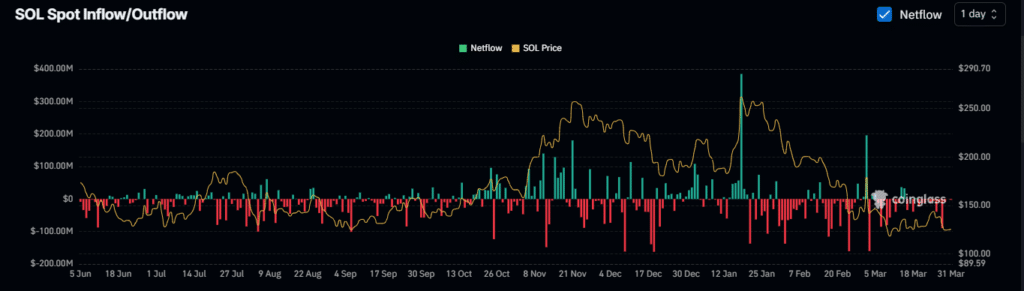

Spotmarkthandelers have steadily collected the SOL for the past five days. From now on these traders have bought more than $ 100 million in SOL, with the largest purchase on March 28, when $ 89 million was purchased.

Source: Coinglass

Spot traders have transferred their accumulated Sol to private portfolios, which indicates potential long -term preserves and the market facility is reduced.

The transaction activity has also increased, which indicates increased network involvement. Between March 24 and now the total transaction officers rose from 87.6 million to 92.7 million, which reflects a strong presence of trader.

Source: Artemis

Given the significant accumulation by spot traders and the relatively stable price range of SOL, trading activity seems to have a positive influence on price movements.

Long bets rise in futures and option markets

In the derivatives market, interest rates grow as indicators show that traders place long bets awaiting a rally.

The number of restless derivative contracts, known as Open Interest (OI), has increased on both futures and option markets.

At the time of writing, the OI in the Futuresmarkt has risen by 1.69%and reached up to $ 4.70 billion. Similarly, the OI in the option market has risen by 16.19%and climbs to $ 3.3 million.

This increase, combined with an increase of 21.15% of the total market trade volume to $ 11.25 billion, reflects the growing activity.

The data suggests that long traders control the momentum, anticipating an increase in the price of SOL.

Source: Coinglass

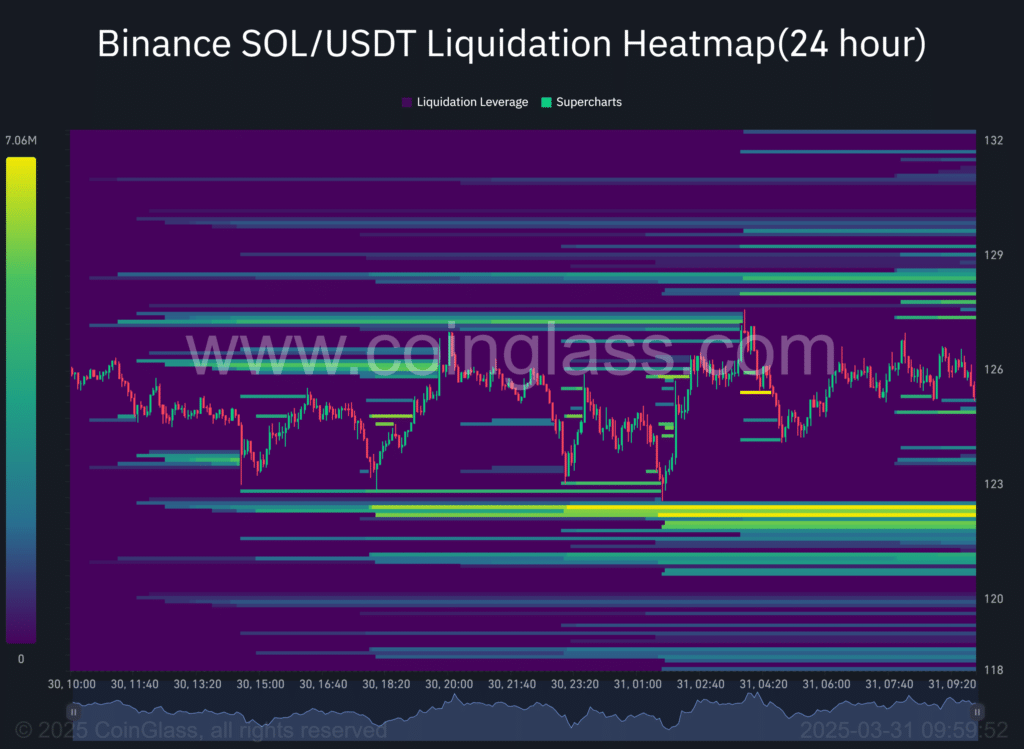

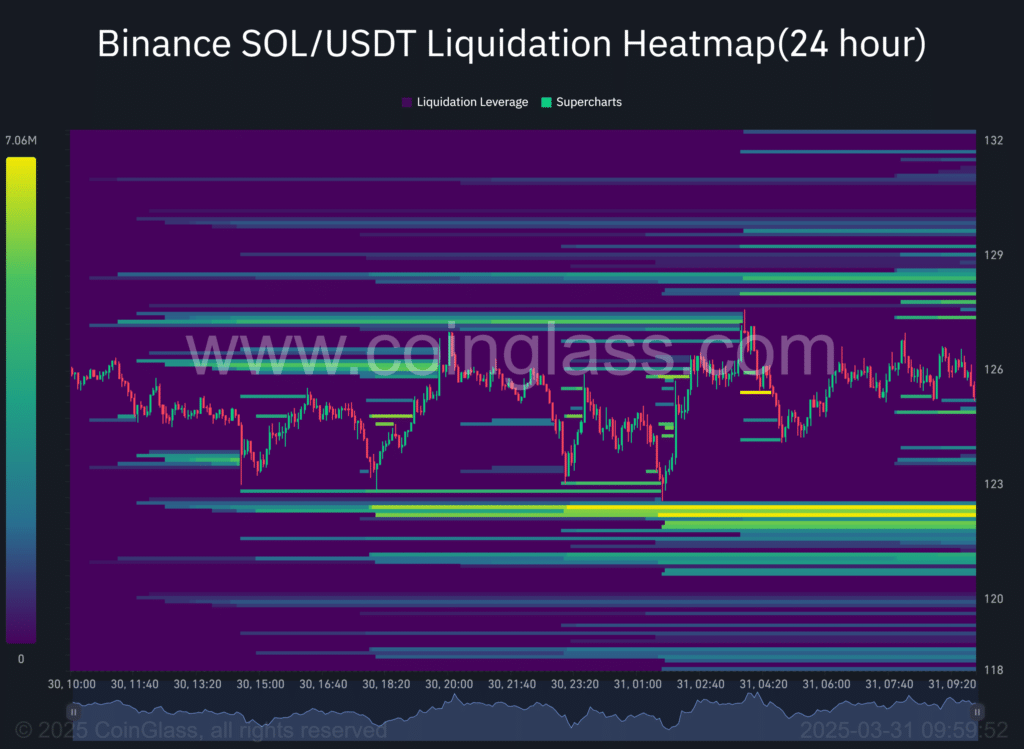

The liquidation heat map, which identifies areas of non -filled orders, indicates that a potential price movement could occur in both directions.

The marked sections of the graph in green and yellow suggest liquidity at these levels, which tend to attract price movements.

With the bullish market sentiment – in particular the growth of the stablecoin and the accumulation of the spot traders – Sol is likely to go up, with the potential to reclaim the $ 130 region.