Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

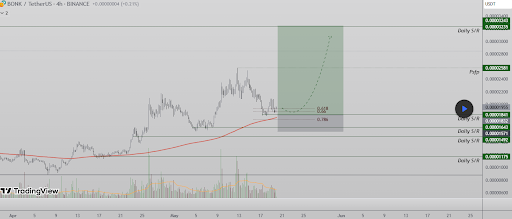

The Bonk price action has been back and forth in May and the cryptocurrency is now in essence where it started the month. Recent price promotion shows that token is trying to stabilize around 200 EMA after being rejected by the local high near the level of 0.00002581.

This rejection led to a measured withdrawal to $ 0.00001820. According to a technical Analysis on the TradingView platformThe Retrace seems to be a bullish continuation with a 77% corrective movement in view instead of indicating a bearish.

Bullish Market Structure is recorded for Bonk

The price racement of Bonk has brought it directly into a zone of serious technical importance. The core of this confluence lies the 200 EMA on the 4-hour period, which could be technically seen as the next support zone for the meme-mint that progresses. Moreover, the retracement votes out with the 0.618 Fibonacci level, which is often associated with bullish corrections. It also arrives at a daily support zone from around $ 0.00001832 to $ 0.00001841 and a resistance zone around $ 0.00002034.

Related lecture

Interestingly, this movement has led to a consolidation between these levels since 15 May, and according to the HandelsView analyst, the price structure suggests that buyers intervene to defend the trend. This in turn led to the formation of a higher layer.

From a volume position, every upward boost has shown an increasing volume since the first week of April. The recent decline, however, took place during the decreasing volume, by hintering depletion of sellers.

77% upward movement when Bonk breaks over resistance

Even with the current reach, Bonk is Still in a bullish setup tHat could send it to a new 2025 High and possibly to the current highest levels of all time. The important level to view now is the point of control (POC) resistance at around $ 0.00001955. This level earlier acted as the pivot point before the withdrawal and now serves as the threshold for bullish continuation.

Related lecture

A confirmed close to this region would probably cause a quick expansion movement in the direction of the next resistance cluster around $ 0.00002581, before the predicted price target of $ 0.00003243 would eventually reach, which would bring open $ 0.000035 close to his January 2025. As such, the projected target will translate into a 77% rally. The price target is also arrived at one Previous Swing High On January 15 and January 18.

At the time of writing, Bonk acts at $ 0.00001995, an increase of 1.6% in the last 24 hours. The reaction here, just above the POC resistance, will be an important decisive factor. As buyers succeed in maintaining pressure And secure a decisive outbreak, the stage can be set for a strong meeting in the upper resistance band and a retest of Bonk’s 2025 Swing High.

Featured image of Shutterstock, Graph of TradingView.com