- Solana has seen a total of 8.75 billion USDC since 1 January.

- Has the Sol influenced?

Solana [SOL] Beginning February with a market capitalization above $ 100 billion, but at the time of the press, to $ 72 billion has fallen.

Persistent pressure-side pressure has the demand, so that Sol is forced to support $ 140 in four months.

With 250 million USDC fresh beaten Can an increased liquidity on the network catalyze a recovery?

Solana’s liquidity voltage

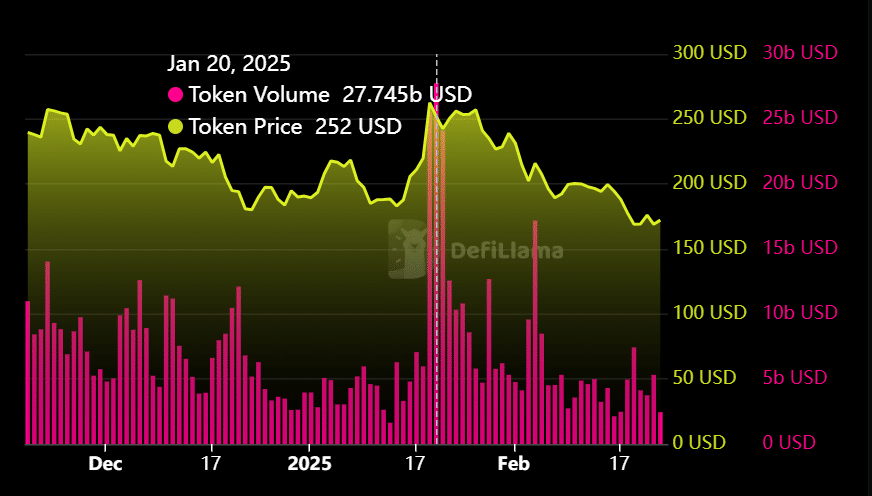

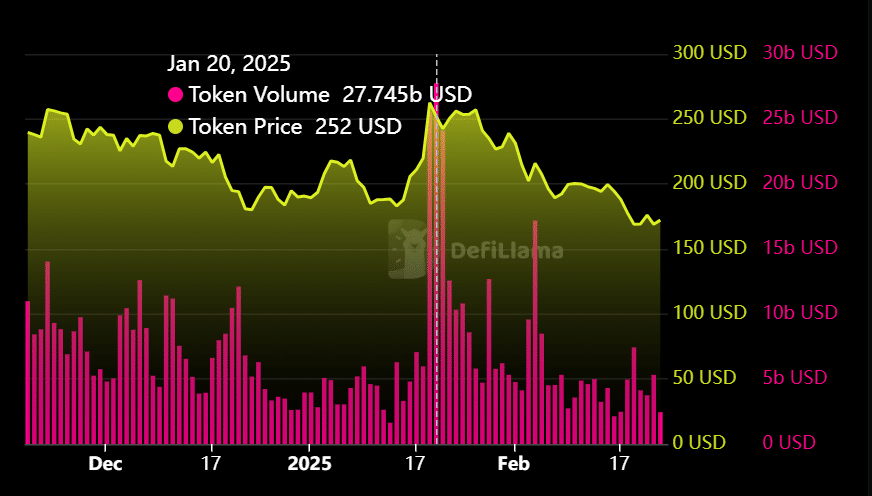

Since the new year, 8.75 billion USDC have been beaten on Solana, where the network volume is driven to a record high in $ 27,745 billion with the launch of the Trump Memecoin.

However, the volume has since been strongly withdrawn to just $ 1 billion, while it is based on Solana memecoins have losses with double digits.

Source: Defillama

This sharp decline suggests liquidity saturation, which may signal exhaustion in Sol’s recent rally.

With meme sector volume A fall of more than 50%, the recently beaten 250 million USDC can have a reduced impact, reducing Sol’s upward potential.

As surplus SOL-Liquidity floods the market in the midst of blading memecoin question and falling trade volume, the growing unbalanced acceptance of the supply of concern shouts that Solana can shift from a value of a long-term value to a speculative game in the short term.

Fundamentals versus speculation – Where is the future of SOL?

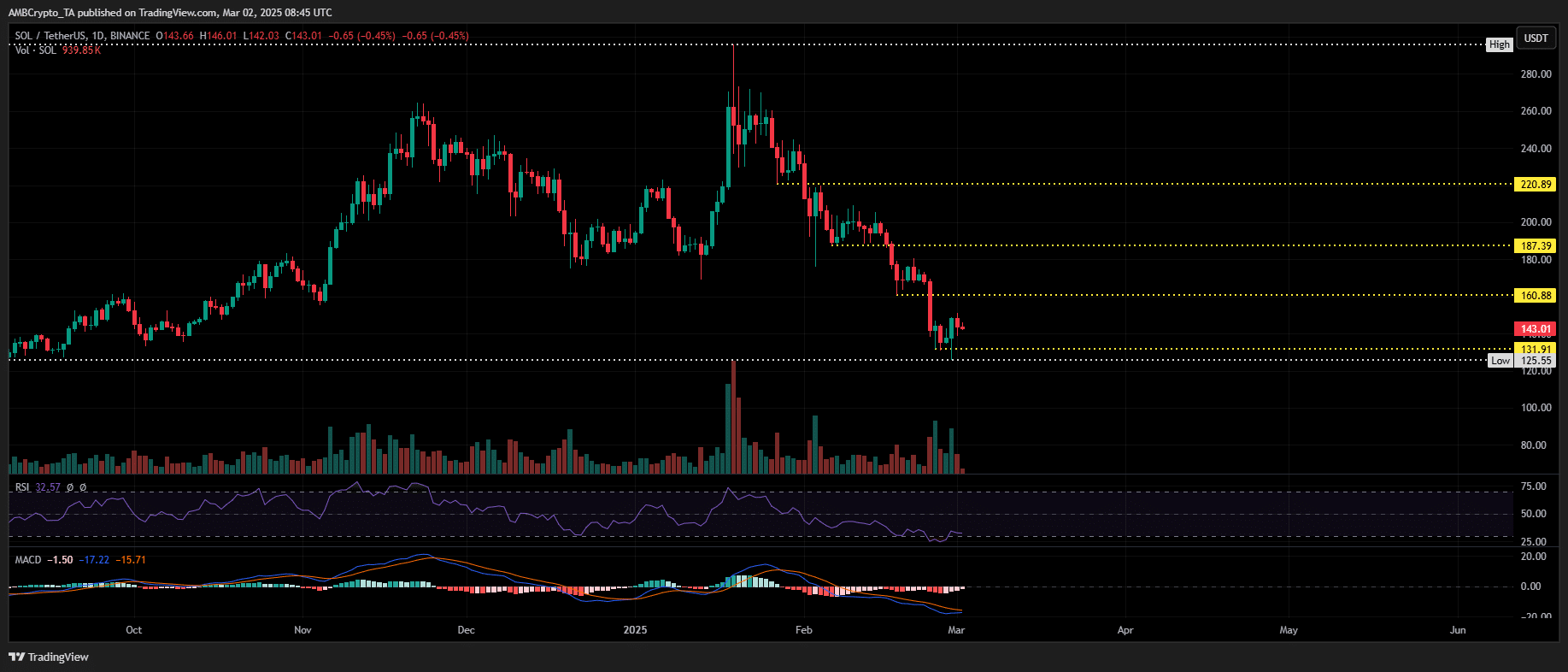

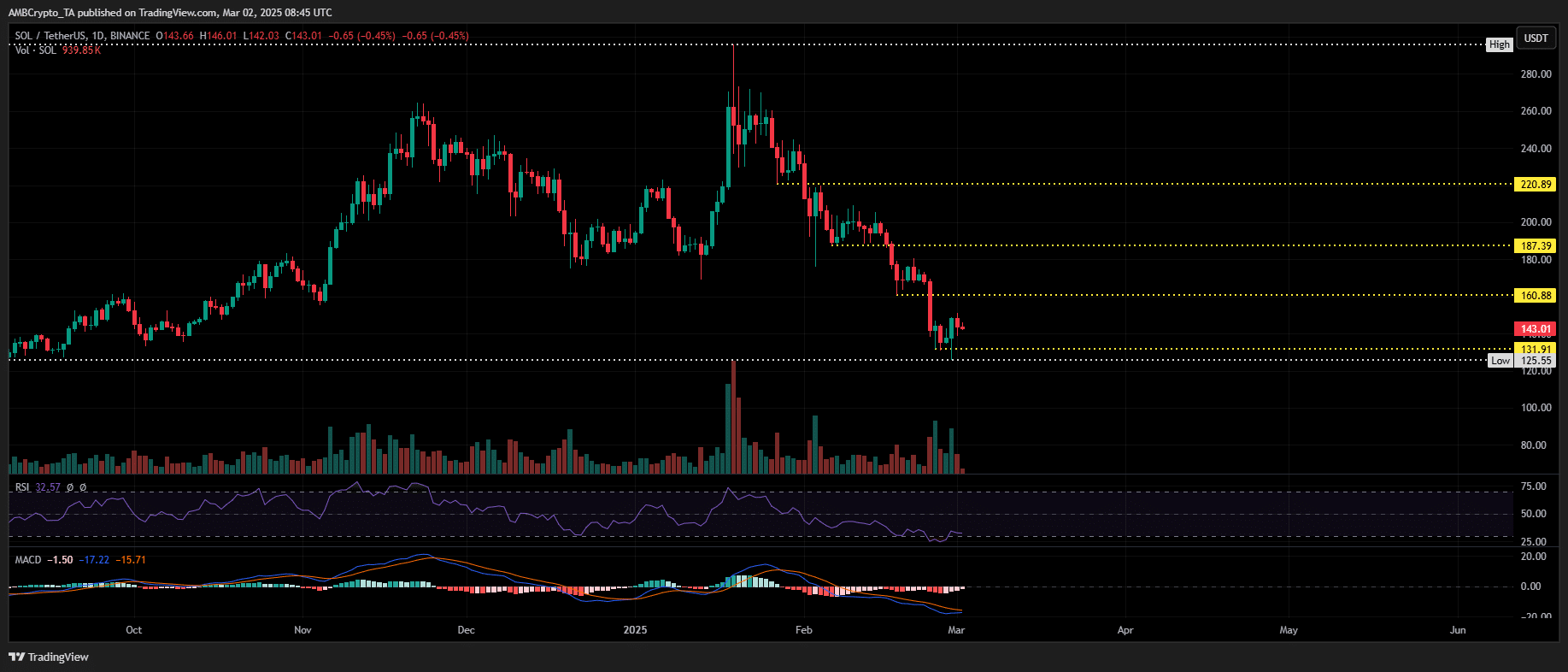

Since reaching his $ 295 ATH, Sol has remained in a persistent downward trend, so he has not provided strong support at important retracement levels – in contrast to his competitors.

In earlier Cycli, Sol broke important resistance levels in elections and “hype” driven by memecoin, but the absence of strong demand in Bearish circumstances now indicates a fragile market structure.

Source: TradingView (SOL/USDT)

Weak bid side liquidity continues to limit the bullishhabsorption of sales pressure, which means that the support level of $ 140 risk runs.

A short squeeze activated $ 2.37 million in liquidations, which suggests that the recent rally is largely speculative rather than fundamentally driven.

With the basic principles of Solana that do not show any significant improvement, the impact of the 250 million USDC remains negligible.

Instead of a liquidity -driven rebound, SOL is confronted with a higher chance of withdrawing to $ 125.