- The whale activity is increasing as Sol is the most important support retest, which increases concerns about short -term corrections.

- Technicals point to recovery, but weak sentiment and low social buzz keep traders careful.

A great Solana [SOL] Whale has fueled new speculation after On Onstak and depositing of 71,448 SOL – WORTH about $ 8.54 million – to Binance.

This step comes in the midst of growing concerns about the increased sales pressure of large holders in the Solana network.

At the time of the press, Sol traded at $ 107.32, which reflects a fall of 1.08% in the last 24 hours.

In addition to this transaction, there have been more than 149,000 Sol unloaded Due to other large holders in the last 24 hours, with the sale between $ 102 and $ 108.

Interesting is that, despite this remarkable recording, the same whale still 568,000 SOL – observed at around $ 68 million – in striking contracts.

These movements on the chain still have questions about whether Solana is on its way to a short -term correction or whether whales are simply re -allocated for the next phase of the market promotion.

Sol Price Action Rebounds from Support

Sol recently bounced off a critical level of support near $ 103, which consistently followed as a demand zone during previous corrections.

This bounce has temporarily stabilized the price and received attention for key resistance levels at $ 120.43 and $ 143.84.

Break past these zones can inject a new momentum and indicate a short -term repair.

However, if Sol holds no more than $ 103 in the coming days, the sales pressure can speed up, so that the price is dragged back to double digits.

That is why bulls must maintain this level to prevent the market structure from being moved to a more bearish trend.

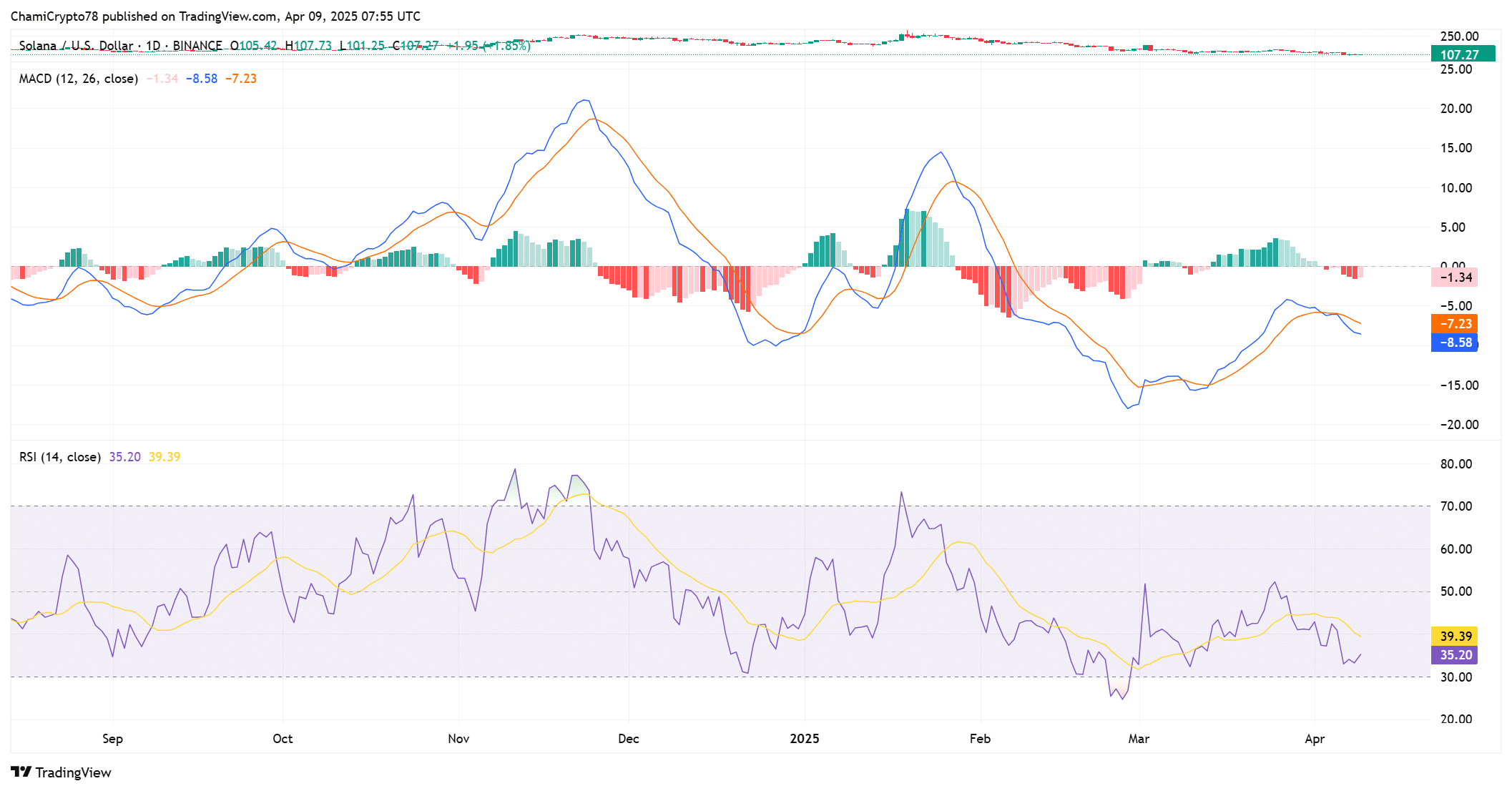

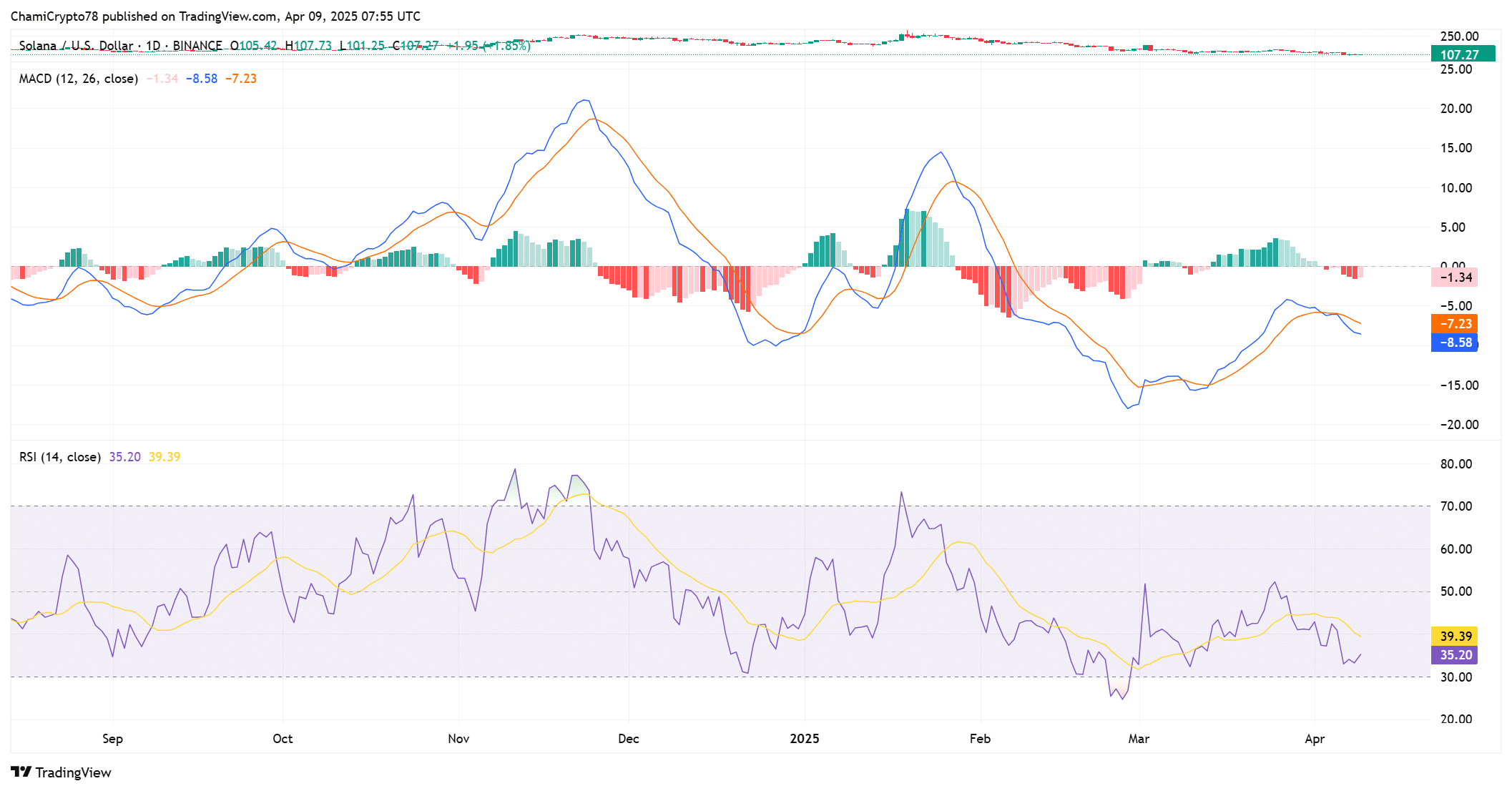

Source: TradingView

Traders remain careful

The total weighted sentiment from Solana was -0.178 at the time of the press, which reflects the prevailing caution on the market. Traders seemed uncertain about the direction of SOL, especially after large -scale sale by influential portfolios.

Although the price has shown temporary strength, sentiment remained fragile and very reactive for sudden changes in behavior in chains.

That is why every persistent rally will probably require a noticeable shift in the perception of the public and require renewed confidence in the basic principles of Solana.

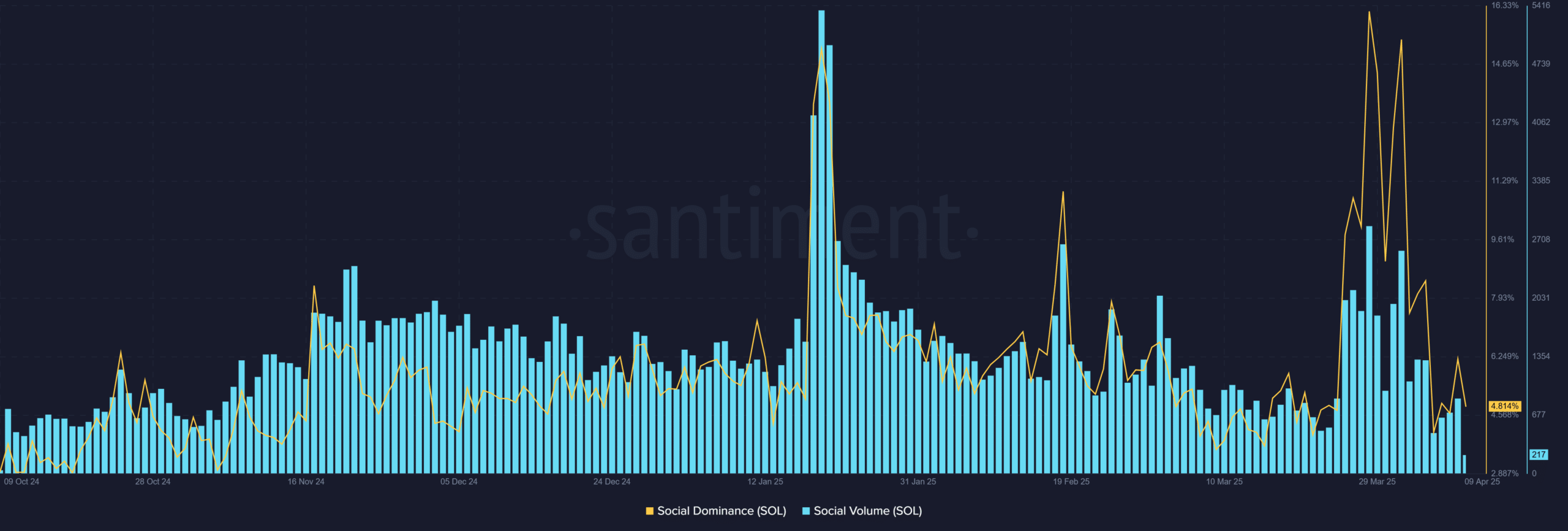

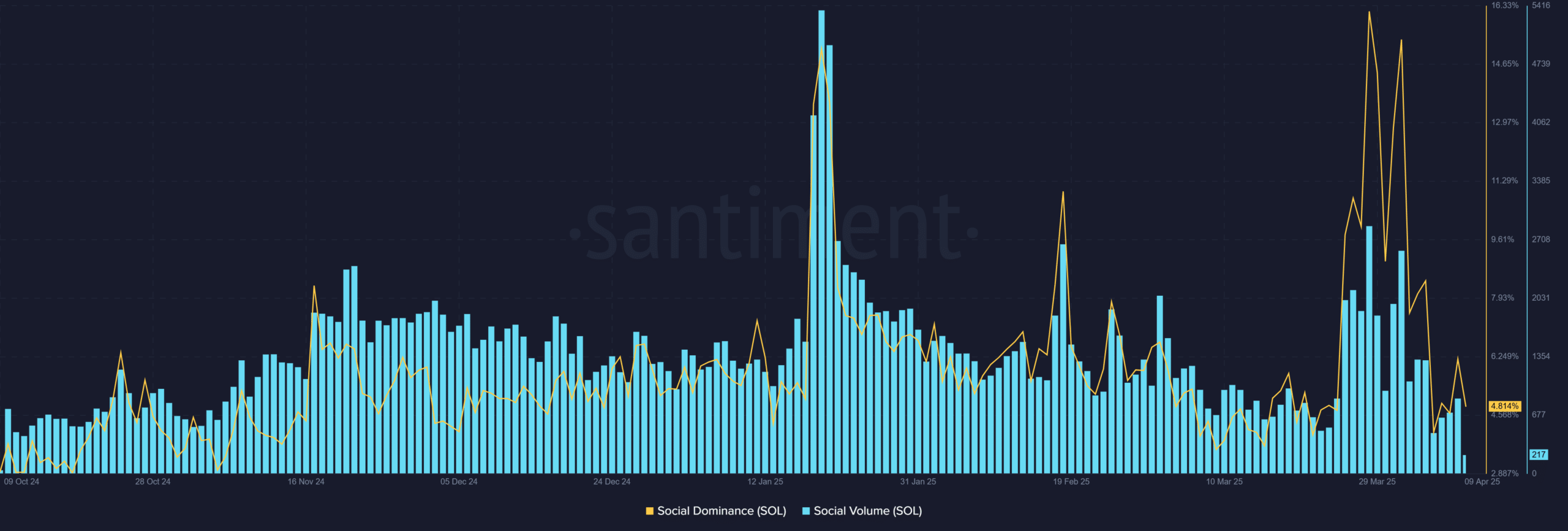

Source: Santiment

Momentum brewing?

The RSI of Solana floated around 35 at the time of writing, placed it close to the sold -over territory and signaled the potential for a price rebound.

Moreover, the MACD is approaching a crossover point, in which the signal line narrows – is considered in a momentum shift.

Although this does not guarantee a rally, it provides a technical basis for recovery as a volume of upward movement. Traders must follow these indicators closely on confirmation of a short trend domination.

Source: TradingView

Solana’s social buzz cools: can excitement return?

The social interest in Solana has fallen in particular, which reflects the uncertain attitude of the broader market. According to Current dataSocial volume has fallen to 217 entries, while social dominance has gone to 4.81%.

This decrease suggests that many retail traders have moved to the sidelines, probably wait for a stronger price action before they are committed.

However, social sentiment is often reactive and can change quickly. A decisive movement above $ 120 could restore the attention of the community and strengthen the Bullish Momentum, especially if it is supported by a broader market optimism.

Source: Santiment

Correction or just a recurrence for SOL?

The technical set-up suggests that Solana could see a short-term supported by RSI that was approaching levels and a potential MacD crossover.

However, caution is necessary if sentiment, whale activity and social involvement still bearish.

Although the current behavior on the chain is more like a strategic recontribution than on a complete output, traders must remain alert to volatility.

A confirmed movement above the resistance levels would strengthen the bullish case, but until that time the risk remains increased.